Get the free Business Tax Application

Get, Create, Make and Sign business tax application

How to edit business tax application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business tax application

How to fill out business tax application

Who needs business tax application?

A comprehensive guide to the business tax application form

Understanding the business tax application form

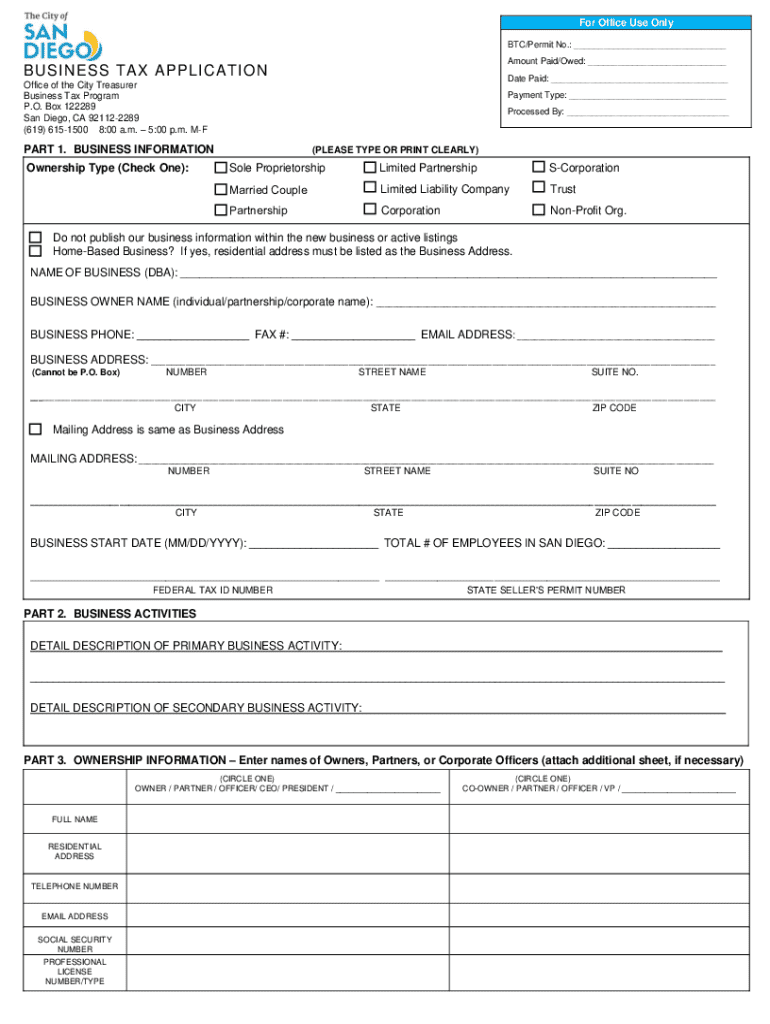

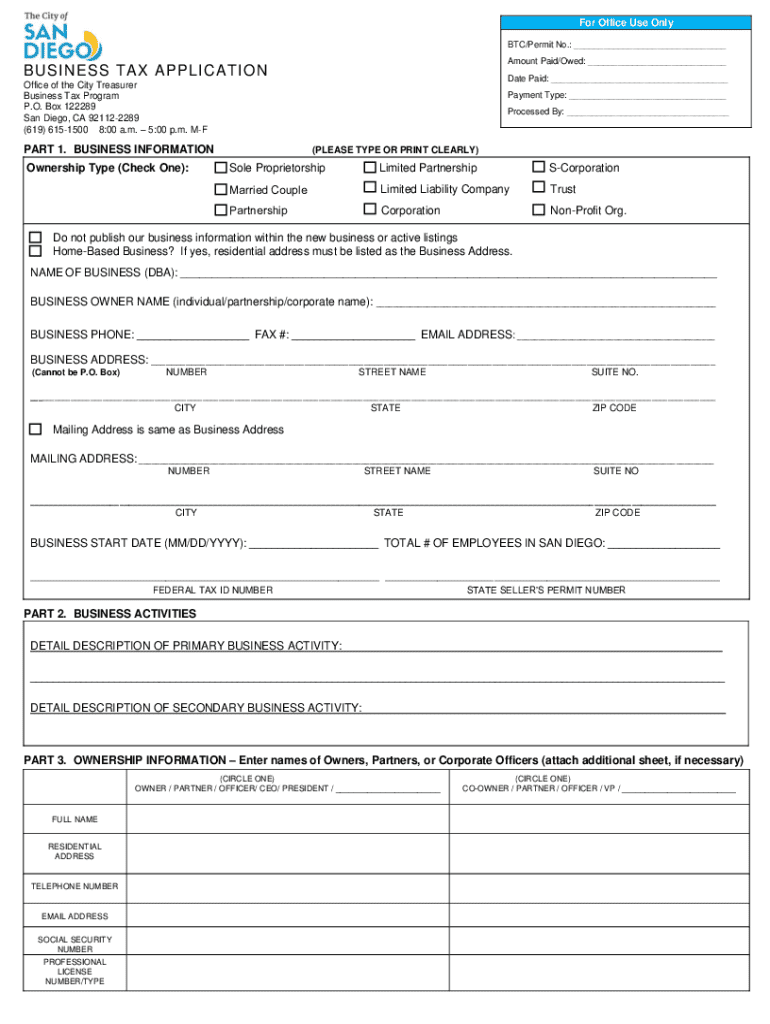

The business tax application form is a critical document used by various types of businesses to apply for necessary tax identification numbers, licenses, and classification. This form is integral to ensuring that businesses are compliant with local, state, and federal tax laws, facilitating accurate taxation and reporting. Accurately completing this form is paramount, as errors can lead to delays, possible fines, and complications with the business's tax status.

What can we help you find today?

Navigating the complexities of the business tax application can be daunting. To streamline your experience, we provide an interactive Q&A section where you can find answers to common questions, minimizing confusion and expediting your application process. Additionally, we offer immediate links to relevant resources or tools that you can utilize.

Eligibility criteria for filing a business tax application

Not every business needs to file a business tax application, but several specific types typically do. This includes sole proprietorships, partnerships, corporations, and non-profits. Each of these entities must complete the application to obtain relevant permits, licenses, or tax identification numbers as mandated by their local jurisdictions.

How to fill out the business tax application form

Completing a business tax application form requires careful attention to detail to ensure all information is accurate. Here's a step-by-step guide to assist you through the process.

Editing and signatures: Enhancing document management

Once you've completed your form, using pdfFiller for document editing can streamline your application process. pdfFiller provides a range of tools that allow you to edit forms easily, making it simple to correct any mistakes or update information directly on the document.

Submitting your business tax application

Once your business tax application form is completed and signed, it’s time for submission. pdfFiller offers convenient online submission directly through its platform. However, traditional methods such as printing and mailing the application are also available if preferred.

Managing your business tax documents

Efficient management of your business tax documents is crucial for organization and compliance. Utilizing pdfFiller’s cloud-based platform, businesses can store their documents securely and retrieve them as needed.

Common pitfalls and how to avoid them

Filing a business tax application can be fraught with challenges, many of which stem from simple errors. To make the process smoother, it's crucial to be aware of common pitfalls that could negatively impact your application.

Still unsure if you should apply?

If you're contemplating whether or not to file a business tax application, consider various factors, such as your business structure, revenue projections, and legal requirements in your jurisdiction. In many cases, seeking guidance from tax professionals can provide clarity and insight into whether filing is necessary for your particular situation.

Need more help?

For those who desire assistance or clarification regarding the business tax application form, pdfFiller offers robust customer support options. Explore our real-time assistance contacts, possibility of accessing tutorials, and help articles specifically tailored to your form-related queries.

FAQ: Business tax application form

This section compiles common questions and answers about the business tax application form to clarify any uncertainties you may have. For more in-depth information or specific issues, we provide quick links to relevant sections that address your inquiries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send business tax application for eSignature?

Can I create an eSignature for the business tax application in Gmail?

How do I fill out business tax application on an Android device?

What is business tax application?

Who is required to file business tax application?

How to fill out business tax application?

What is the purpose of business tax application?

What information must be reported on business tax application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.