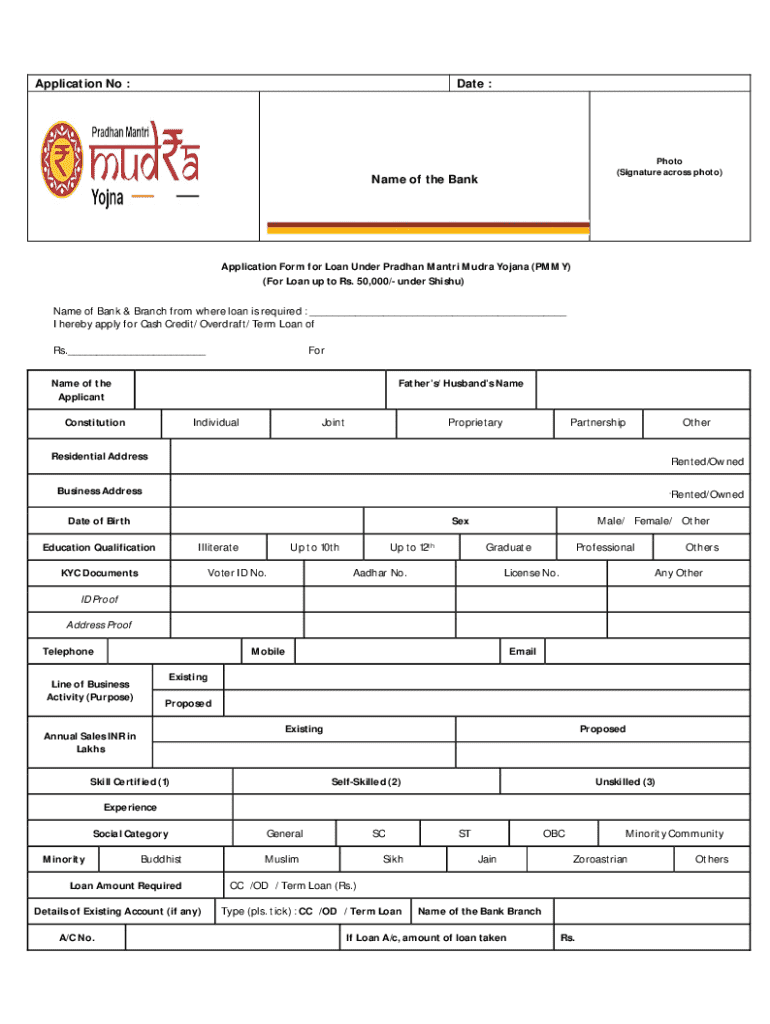

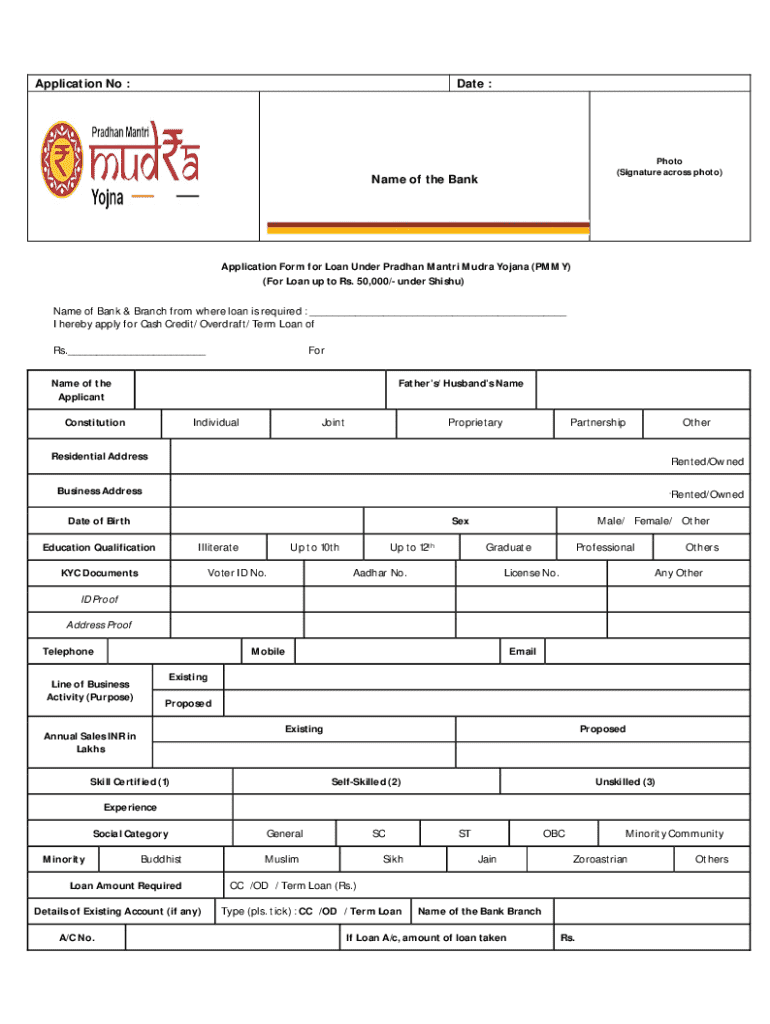

Get the free Application Form for Loan Under Pradhan Mantri Mudra Yojana (pmmy)

Get, Create, Make and Sign application form for loan

Editing application form for loan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application form for loan

How to fill out application form for loan

Who needs application form for loan?

Application form for loan form: A comprehensive guide to navigating your loan application

Understanding the loan application process

A loan application form is a critical document that individuals and businesses submit to obtain financing from lenders. It serves as the foundational step in the loan application process, requiring detailed personal and financial information to assess eligibility. Filling out the loan application correctly is paramount, as inaccuracies or omissions can lead to delays in processing or even rejection of the application.

Different types of loans, including personal loans, mortgages, and commercial loans, necessitate the completion of specific application forms. Understanding the nuances of each application is essential for applicants to secure the financing they need.

Who needs to fill out a loan application form?

Various entities require a loan application form. Individuals seeking personal loans typically complete this form to finance purchases such as a vehicle or home renovations. Businesses applying for commercial loans also fill out these applications to secure capital for expansion, inventory, or equipment. Additionally, homebuyers must complete a specialized loan application form when applying for mortgages to purchase residential properties.

Understanding who needs to fill out a loan application form helps tailor the application process and gather necessary documentation specific to each group's financial needs.

Key information required in a loan application form

Filling out a loan application form involves providing crucial information about your identity and finances. Applicants must include personal information, such as their full name, contact information, Social Security number, and date of birth, which help the lender verify identity and assess creditworthiness.

Beyond personal identifiers, financial information plays a significant role. This includes detailing income sources and amounts, employment history, and any existing debts and assets. Lenders use this information to evaluate the applicant's ability to repay the loan, determining the risk associated with the loan.

Step-by-step guide to completing your loan application form

Completing your loan application form accurately is crucial for a smooth application process. Here’s a step-by-step guide to help you.

Interactive tools for your loan application process

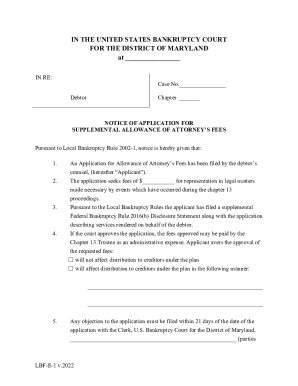

Utilizing interactive tools can greatly enhance your loan application experience. Platforms like pdfFiller offer form-filling tools that make the submission process straightforward and efficient.

The benefits of electronic signatures cannot be understated in the loan application process, as they facilitate speed and security while eliminating the need for physical paperwork. Additionally, pdfFiller allows collaboration with others, enabling teams to work together on loan applications seamlessly.

Managing your loan application post-submission

After submitting your loan application form, it’s essential to understand what happens next. Loan processing involves the lender reviewing your application, conducting a credit check, and verifying your provided information.

Tracking your loan application status is vital, and tools like pdfFiller help streamline this process, providing updates directly through their platform. Understanding the loan approval process will also help set your expectations regarding the timeline and any potential follow-up actions required.

Frequently asked questions about loan application forms

Many applicants have questions that arise during the loan application process. A common query is how long it takes to process a loan application; this can vary based on lender and application complexity but typically ranges from a few days to several weeks.

Another frequent concern is what to do if your loan application gets rejected. Applicants should consider reviewing feedback from the lender, enhancing their credit profile, or seeking alternative financing. Finally, modifying your loan application after submission is generally not advisable, as changes can complicate processing.

Common pitfalls in filling out loan application forms

Several pitfalls can occur when filling out your loan application form. One significant issue is providing incomplete information, which can delay processing or lead to outright denial.

Additionally, misunderstanding financial jargon can cause errors. Misinterpreting terms could lead to inaccuracies, which are critical on a loan application. Lastly, failing to attach required documentation, such as income verification or identification papers, can severely hinder your application progress.

Using pdfFiller to simplify your loan application experience

Leveraging a cloud-based document platform like pdfFiller provides several advantages when managing your loan application. This platform allows users to edit PDFs, eSign documents, and collaborate on forms without the hassle of physical paperwork.

Moreover, pdfFiller enhances collaboration and efficiency among teams, ensuring that everyone involved in the loan application can access the most up-to-date documents. The ability to securely store and access your loan applications from anywhere is invaluable in today’s fast-paced financial environment.

Next steps after submitting your loan application

Once you have submitted your loan application, it’s important to prepare for potential discussions with lenders regarding your application. Familiarize yourself with the key points of your application and be ready to explain your financial situation.

During loan processing, understanding what to expect can help mitigate stress. Be prepared for questions about your financial history, and know that it may take some time for the process to be completed. Utilize resources for comprehending loan terms and agreements to empower yourself in discussions with lenders.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in application form for loan without leaving Chrome?

Can I create an electronic signature for signing my application form for loan in Gmail?

Can I edit application form for loan on an Android device?

What is application form for loan?

Who is required to file application form for loan?

How to fill out application form for loan?

What is the purpose of application form for loan?

What information must be reported on application form for loan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.