Get the free Certificate of Delinquency Sale Registration/affidavit Form

Get, Create, Make and Sign certificate of delinquency sale

How to edit certificate of delinquency sale online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of delinquency sale

How to fill out certificate of delinquency sale

Who needs certificate of delinquency sale?

A comprehensive guide to the certificate of delinquency sale form

Overview of certificate of delinquency

A certificate of delinquency is an official document issued by a governmental body confirming that property taxes have not been paid for a specific period. This certificate serves to notify property owners and potential buyers about outstanding tax obligations that can lead to a property tax lien if not settled. Understanding this process is crucial for effective property tax management, as it highlights the financial responsibilities and implications related to property ownership.

The certificate plays a key role in the taxation process by protecting the interests of municipalities while encouraging property owners to pay their taxes. Stakeholders involved in this process include local governments, tax collectors, property owners, and potential investors looking to purchase delinquent tax certificates as an investment strategy.

Understanding delinquent property tax

Delinquent property tax refers to taxes that have not been paid by their due date. It is a common issue faced by many property owners and can arise from various circumstances, including financial hardship, lack of awareness of payment deadlines, or disputes regarding assessed property values. The consequences of delinquency can be severe, ranging from penalties and interest fees added to the owed amount to the potential loss of the property itself through a tax lien sale.

When property taxes go unpaid, it not only affects property owners financially but also impacts the community at large. Local governments rely on tax revenue to fund essential services such as public education, infrastructure, and emergency services. As delinquent taxes accumulate, communities may face reduced funding and deteriorating services, negatively impacting the quality of life for residents.

Navigating the certificate of delinquency sale process

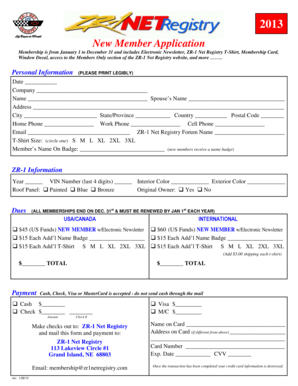

The sale process for certificates of delinquency typically follows a standardized procedure, beginning with the issuance of the certificate by the local tax authority. Once this certificate is issued, it becomes available for purchase by interested buyers in a public sale, often through auction. Buyers can acquire these certificates with the expectation of earning interest or recovering their investment through the eventual payment of the delinquent taxes by the property owners.

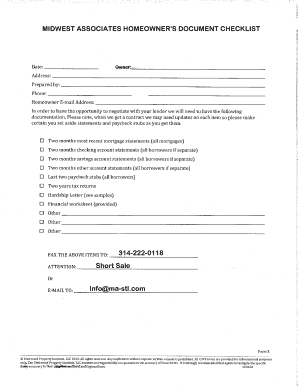

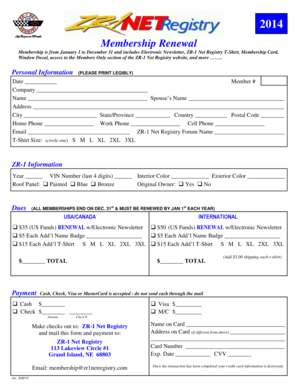

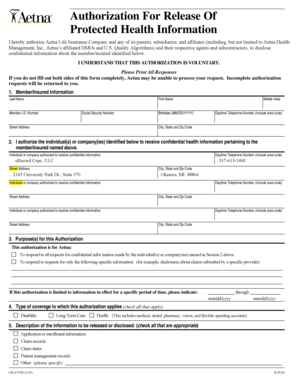

To participate in this sale, prospective buyers must meet certain eligibility criteria, which can vary by jurisdiction. Typically, interested parties are required to provide proof of their financial capacity to purchase these certificates. Furthermore, essential documentation like a completed certificate of delinquency sale form is necessary to formalize the transaction and to register as a bidder in the sale.

Steps to fill out the certificate of delinquency sale form

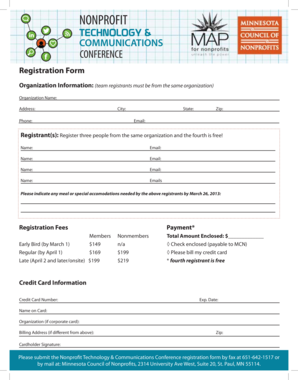

Filling out the certificate of delinquency sale form correctly is crucial for ensuring that your application is processed efficiently. The first step involves accessing the form on pdfFiller, which provides a user-friendly interface that makes document management a breeze. Simply navigate to the pdfFiller website, search for the certificate of delinquency sale form, and open it to begin.

Next, you’ll need to input your personal information in the essential fields provided, including your name, address, and contact information. Ensure that all data entered is accurate to prevent your application from being delayed. Following that, you’ll detail the specific property information, which includes identifying aspects such as the parcel number and the owner’s name to link the certificate clearly with its respective property.

Finally, once all information has been accurately filled, you will utilize the eSigning features of pdfFiller to sign and submit your form electronically. This feature simplifies the submission process, allowing you to manage confirmation and tracking of your application effortlessly, thus ensuring a streamlined experience.

Tax sale registration

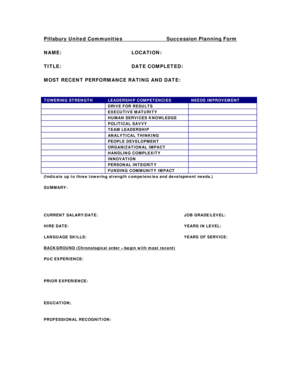

Registering for a tax sale is a key step in purchasing certificates of delinquency. Each locality typically has specific deadlines for registration that must be adhered to. It is vital to submit your application ahead of these deadlines to avoid missing the opportunity to bid on available certificates. Often, early registration might also provide participants with more options as they prepare for the auction.

Additionally, potential registrants must be aware of any registration fees that apply. These fees can vary by jurisdiction, so it’s essential to check the specific costs involved in your locale. Accepted payment methods can also differ, so ensure that you have the proper forms of payment ready to facilitate a smooth registration process when submitting your application.

Understanding the value of certificates of delinquency

Certificates of delinquency come in different types and values based on the duration and circumstances of the outstanding taxes. Short-term certificates typically arise from more recent tax delinquencies, while long-term certificates can represent older debts. Understanding the differences between prior year and current year certificates is also crucial, as it relates directly to potential interest and investment returns.

Legislation can significantly impact the operation and value of certificates of delinquency. Various statutes govern the sale of these certificates, including the interest rates that can be charged, the redemption periods for property owners, and other vital legal considerations that affect both buyers and sellers in this marketplace.

Acquiring delinquency certificates

The market for buying certificates of delinquency can vary significantly, depending on local real estate conditions and the specific tax policies in place. When purchasing certificates, it is prudent to approach the investment with thorough research to understand the underlying values of the properties linked to the certificates being offered.

However, it is critical to recognize the associated risks and considerations when investing in delinquent tax certificates. Investors should be wary of properties that might have deeper financial or legal issues, which could affect their ability to collect on the certificates purchased.

Payment options for delinquent tax bills

When faced with delinquent tax bills, property owners should be informed about the various available methods for settling these obligations. Payment methods can include direct pay, installment plans, or even negotiation with local tax authorities to establish a payment arrangement.

Each method presents its pros and cons, and property owners should weigh their financial situations carefully when deciding on a payment option.

Managing your certificate of delinquency

Once you have purchased a certificate of delinquency, certain responsibilities arise that require careful management. Buyers must remain informed about the delinquent taxes associated with the property and ensure they stay current on any updates or notifications regarding the status of the certificate.

Being proactive in managing your certificate is key to ensuring you maximize your investment potential and mitigate risks effectively.

Key contacts and resources

Understanding whom to contact in the case of inquiries, disputes, or further information about certificates of delinquency is crucial for all stakeholders involved. Local government offices handling tax assessments and tax sales serve as primary resources for guidance.

Utilizing these contacts and online tools strengthens your knowledge and capabilities regarding tax delinquency management.

Enhancing document management with pdfFiller

pdfFiller empowers individuals and teams with tools that significantly streamline document creation, signing, and management processes. Within the platform, users can not only fill out the certificate of delinquency sale form, but also edit PDFs, eSign documents, and collaborate effectively with team members.

The diverse features available within pdfFiller emphasize security and organization, allowing users to manage sensitive information easily and securely. Ensuring document integrity is paramount, particularly when handling legal forms like the certificate of delinquency sale form. Utilizing these capabilities can enhance efficiency and provide peace of mind throughout the document management process.

Frequently asked questions (FAQs)

As more individuals and teams navigate the certificate of delinquency sale form, common questions often arise regarding its completion and overall process. It can be beneficial for new users to familiarize themselves with FAQs to streamline their experience and avoid common pitfalls encountered by others.

Addressing these questions can build confidence as you navigate the often-complex world of property taxes and delinquency certificates.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my certificate of delinquency sale directly from Gmail?

How do I execute certificate of delinquency sale online?

How do I edit certificate of delinquency sale in Chrome?

What is certificate of delinquency sale?

Who is required to file certificate of delinquency sale?

How to fill out certificate of delinquency sale?

What is the purpose of certificate of delinquency sale?

What information must be reported on certificate of delinquency sale?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.