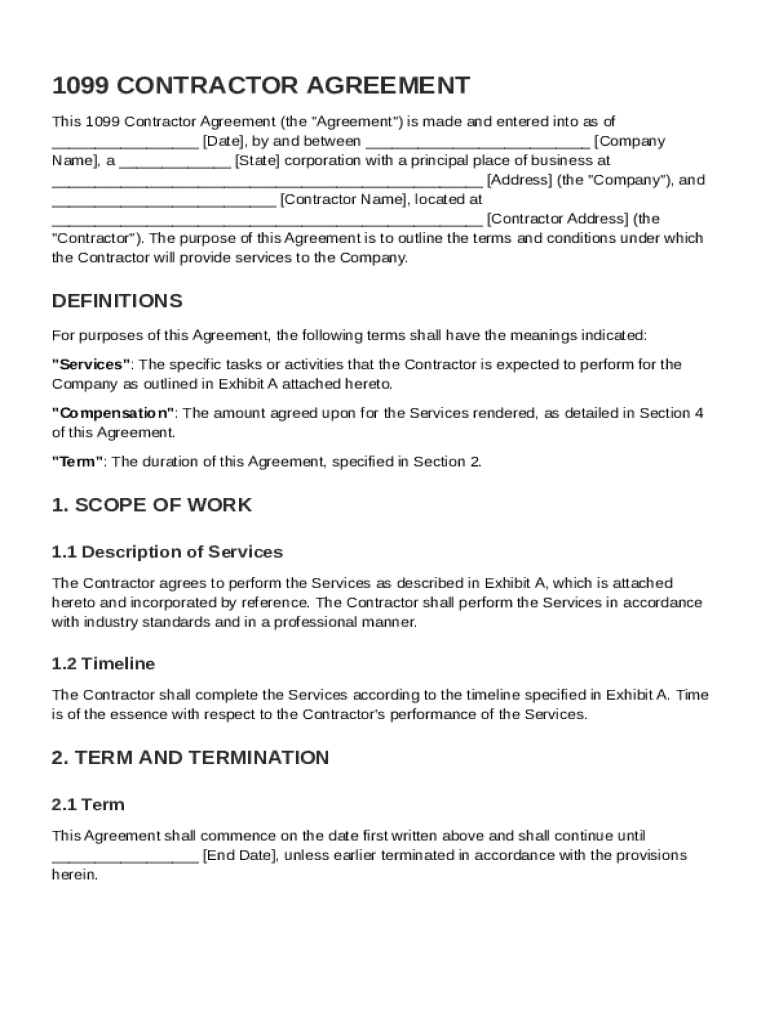

Get the free 1099 Contractor Agreement Template

Show details

This document outlines the terms and conditions under which a Contractor will provide services to a Company, including details on scope of work, compensation, confidentiality, and intellectual property

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is 1099 contractor agreement template

A 1099 contractor agreement template is a document that outlines the terms and conditions of work between a company and an independent contractor.

pdfFiller scores top ratings on review platforms

Amazing UI and easy to navigate.

Amazing UI and easy to navigate.

great service

great service

Service representatives are courteous…

Service representatives are courteous and professional, fixed my payment issue immediately - just waiting on the refund to come through.

Great for easy PDF edits.

Great for easy PDF edits.

ADMINISTRACION

ALL GOOD ALL ITS FINE AND OK

thank you so muchh

thank you so muchh

Who needs 1099 contractor agreement template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to 1099 Contractor Agreement Template

What is the purpose of a 1099 contractor agreement?

A 1099 contractor agreement serves to outline the terms between a business and an independent contractor. It is significant because it clarifies the expectations, responsibilities, and rights of both parties while establishing a legal framework for their working relationship.

This agreement is crucial for compliance with IRS regulations, as it helps delineate the difference between employees and independent contractors, thereby influencing tax reporting and liability considerations.

What are the key components of a 1099 contractor agreement?

-

Clearly state the names and contact information of both the contractor and the hiring business.

-

Detail the specific services or tasks the contractor will be performing, ensuring clarity in expectations.

-

Outline the payment structure, including rates, payment timelines, and any other financial terms.

-

Specify the duration of the contract, including start and end dates, as well as any renewal terms.

How can you fill out the 1099 contractor agreement template?

Filling out a 1099 contractor agreement template involves several steps. Start by completing the identification section with the contractor’s and business’s details, followed by defining the scope of work and compensation.

Utilize interactive tools available on platforms like pdfFiller, which offer guides and assistance in accurately filling out each section of the form.

Be aware of common mistakes such as failing to include essential details or leaving fields blank, which could lead to miscommunication or legal issues down the line.

What are the different types of 1099 contractor agreements?

-

These agreements usually focus on specific project-based work without an ongoing employer-employee relationship.

-

This type refers to contractors brought on for limited periods to fulfill specific needs or projects.

-

Different sectors may have unique variations in contractor agreements, reflecting the nature of the services provided.

How can you manage and secure your 1099 contractor agreement?

Using a cloud-based platform like pdfFiller enhances the management of your 1099 contractor agreement. It allows for easy editing, secure storage, and electronic signing, minimizing the risks of data loss.

Additionally, features such as collaboration tools enable multiple team members to review and interact with the document seamlessly, ensuring that everyone is on the same page.

What compliance and legal considerations should you be aware of?

Each state has its own legal requirements regarding contractor agreements, making it crucial to understand local laws. Non-compliance could lead to significant fines or invalidation of the agreement.

The agreement directly impacts tax obligations for both parties. Therefore, proper classification and agreement terms are essential in avoiding potential disputes and ensuring compliance.

What should you know about the termination of the contractor agreement?

-

Clearly define conditions under which either party can terminate the agreement, as well as the required notice period.

-

Include detailed notice requirements for both termination for convenience and for cause.

-

Discuss how termination affects final compensation and any unfinished work obligations.

How to fill out the 1099 contractor agreement template

-

1.Open the 1099 contractor agreement template on pdfFiller.

-

2.Review the template to understand the required sections like contractor details and payment terms.

-

3.Fill in the contractor's full name and business address in the designated fields.

-

4.Specify the scope of work and deliverables clearly in the agreement section.

-

5.Enter the payment terms including hourly rate or flat fee and payment schedule.

-

6.Include any applicable terms regarding confidentiality and dispute resolution.

-

7.Review all filled information for accuracy, ensuring no sections are left incomplete.

-

8.Save the document once everything is correctly filled out.

-

9.Export the filled contract in the desired format (PDF, DOC) for printing or emailing.

-

10.If necessary, send the agreement to the contractor for review and signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.