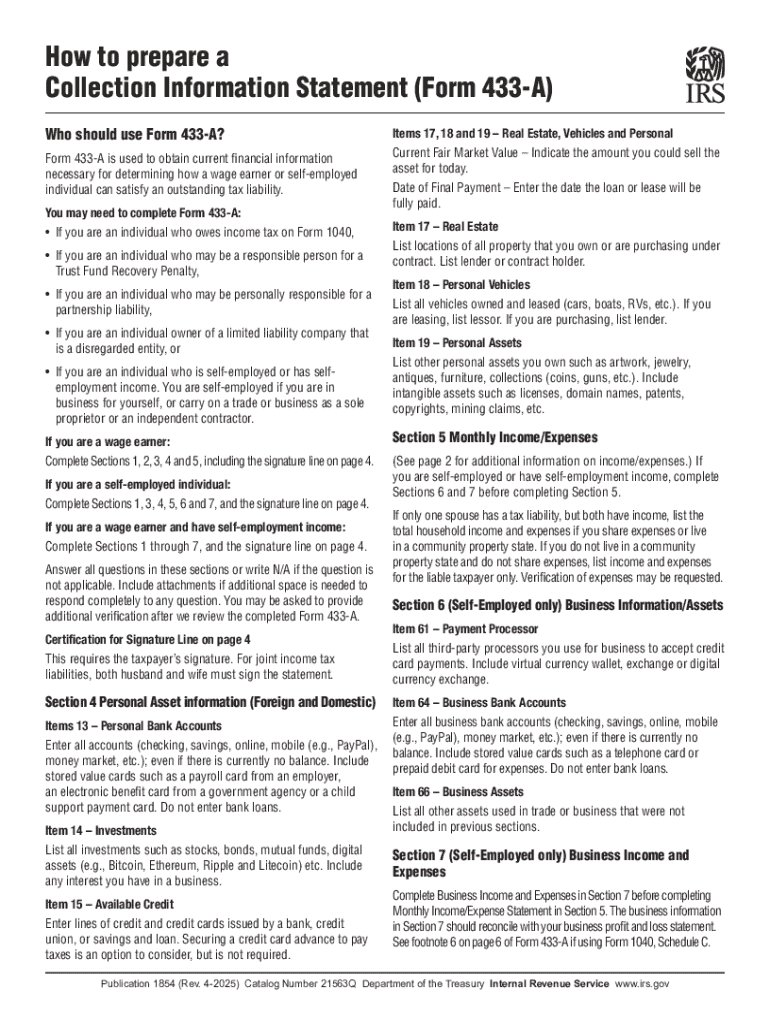

IRS Publication 1854 2025-2026 free printable template

Get, Create, Make and Sign IRS Publication 1854

How to edit IRS Publication 1854 online

Uncompromising security for your PDF editing and eSignature needs

IRS Publication 1854 Form Versions

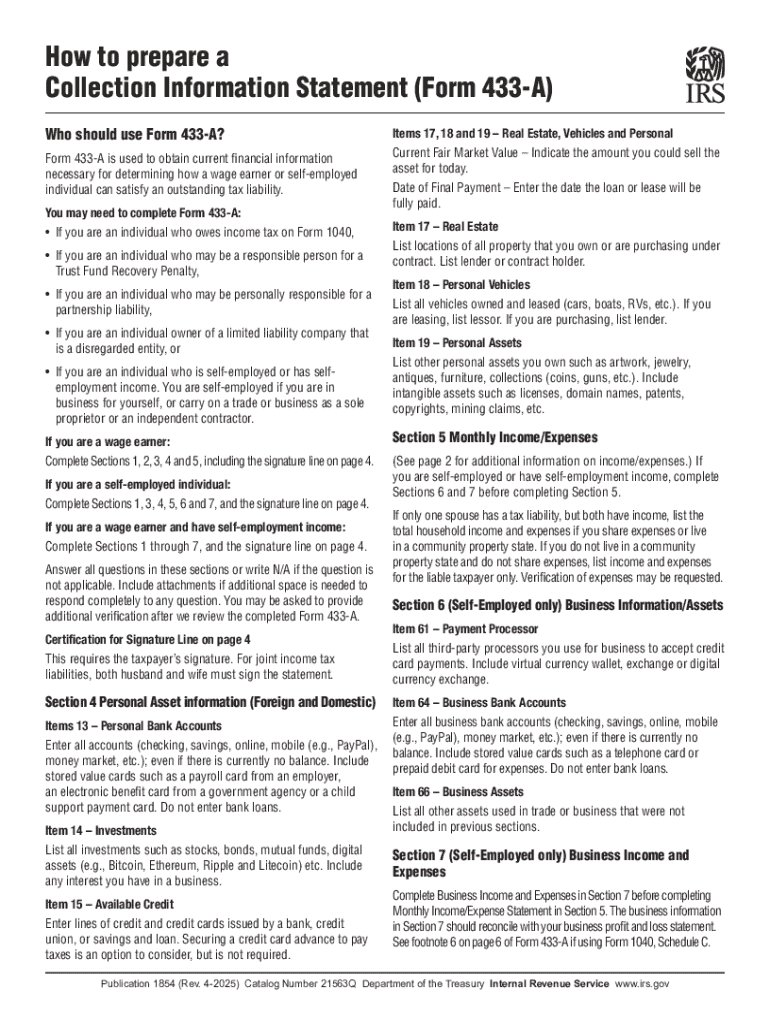

How to fill out IRS Publication 1854

How to fill out collection information statement form

Who needs collection information statement form?

Your Ultimate Guide to the Collection Information Statement Form

Overview of the Collection Information Statement Form

A Collection Information Statement (CIS) is a critical document used primarily during debt resolution processes, detailing comprehensive financial information of individuals facing collections. This form serves the dual purpose of offering a clear snapshot of one's financial situation to creditors or debt resolution agencies and helping individuals develop a viable repayment plan. Accurately completing the CIS is essential for successful negotiations with creditors, making it an indispensable element in financial management.

Understanding who requires this form is equally important. Those grappling with personal debts, such as credit card balances, medical bills, or loans, should be well-acquainted with the CIS. Additionally, financial advisors and agencies involved in debt resolution rely on this data-heavy form to assess their clients' situations effectively. Thus, the CIS is foundational in the landscape of personal finance.

Key components of the Collection Information Statement Form

The Collection Information Statement Form is structured to capture detailed information across several segments, ensuring a holistic view of the individual’s financial standing. The first section focuses on personal information, which includes essential details like full name, address, contact information, and Social Security number. Providing this information accurately is paramount, as any discrepancies can lead to complications in debt discussions.

Following the personal information is the financial information breakdown, where users must detail their assets, income sources, and monthly expenses. Accurately listing assets such as vehicles, real estate, and savings can shine a light on financial stability. The income section should reflect all revenue streams, including salaries, freelance income, or investments. The expenses list, on the other hand, must account for everything necessary for day-to-day living, allowing a straightforward calculation of disposable income.

Lastly, debts and obligations are entered, categorizing all liabilities and providing information about their current repayment status. Clearly documenting debts, including credit card balances, mortgages, and student loans, is essential for providing a complete picture of one's financial obligations, which can significantly affect any negotiations with creditors.

Step-by-step instructions for completing the form

Completing the Collection Information Statement Form can seem daunting at first, but breaking it down into manageable steps can help simplify the process. Start by gathering all necessary documentation, such as income statements, bank statements, records of your assets, and details of your debts. Having organized paperwork will streamline the filling process.

Once you have your documents ready, proceed to fill out your personal information accurately. Check each field carefully to avoid common mistakes like misspellings or incorrect figures, as these errors may delay processing. Next, detail your financial information, ensuring that all income sources and assets are correctly listed. When defining expenses, remember to include basic costs, such as housing, utilities, groceries, and any debt payments.

In the debts section, enumerate all obligations clearly, prioritizing based on urgency or creditor relationships. Make sure to note down repayment statuses for each debt accurately. After completing all sections, review your form thoroughly, using a checklist to verify that every piece of information is correct. Double-checking your entries is crucial, as minor inaccuracies can derail your financial management efforts.

Editing and managing your Collection Information Statement Form

One of the significant advantages of using the pdfFiller platform is its tools for editing your Collection Information Statement Form effortlessly. Users can alter fields, update figures, or make changes to personal details using intuitive editing options. This flexibility is particularly beneficial when your financial situation evolves over time, ensuring your CIS remains accurate and relevant.

After editing, it’s crucial to save and store your completed form securely. Leveraging the benefits of cloud storage allows for access from any device, ensuring that you can retrieve your information whenever necessary. This feature is especially handy if you need to provide updates to creditors or financial advisors, making document management simple and efficient.

eSigning and submitting your form

Once your Collection Information Statement is complete, the next significant step is eSigning the document. With pdfFiller, this process is straightforward. The platform provides a step-by-step guide to electronically sign your CIS, ensuring that your signature is valid and legally recognized. Electronic signatures offer convenience but also come with legal implications; hence it’s essential to understand the laws governing eSignatures in your jurisdiction.

After signing, you’ll need to submit your form. This can typically be done through various channels, like email or direct upload to financial institutions. Understanding submission methods relevant to your creditors or advisors is essential for ensuring that your form reaches the right hands promptly. Once submitted, don’t forget to handle any responses with diligence and follow-up; clear communication can be key to effectively managing your debt.

Frequently asked questions about the Collection Information Statement Form

As with many financial documents, questions often arise while filling out the Collection Information Statement Form. Common queries include who to reach out to for help if you encounter issues while completing the form. Many financial professionals or debt resolution services can provide guidance. Additionally, it’s crucial to understand how often the CIS should be updated; typically, significant changes in your financial situation warrant a review and resubmission.

Another common concern revolves around mistakes made on the form. If you realize you've made an error post-submission, contact your creditor or financial advisor immediately for correction protocols. Lastly, it’s wise to know when to consult a financial advisor — situations involving complex debt or negotiating with multiple creditors often benefit from expert advice.

Additional support and resources

Should you need assistance while navigating the process of filling out your Collection Information Statement Form, there are multiple avenues of support available. Reaching out to financial institutions or debt service providers can yield valuable insights. Moreover, pdfFiller offers a range of resources aimed at helping users effectively manage their documents, from tips on filling out forms to deeper insights into financial management.

Utilizing interactive tools available on pdfFiller can enhance your management of the Collection Information Statement. Collaborating with team members or financial advisors simplifies sharing and obtaining feedback on your documents, allowing for a more streamlined process when addressing debt.

Real-life scenarios and use cases

Examining real-life scenarios can provide deeper insights into the practical application of the Collection Information Statement Form. Take Case Study 1, which illustrates an individual managing personal debt. For instance, a person facing multiple credit card bills might use the CIS to display their financial picture to creditors, enabling them to negotiate lower payments or favorable terms.

In Case Study 2, a financial advisor assists a client in organizing their CIS to effectively advocate for them to creditors. This proactive stance often results in better outcomes for individuals seeking to regain control over their financial situations. Insights from professionals indicate that an accurately completed CIS not only aids in negotiations but also provides clarity for individuals, fostering a deeper understanding of their finances.

Conclusion of the Collection Information Statement Form insights

In summary, the Collection Information Statement Form is a vital tool for individuals navigating the complexities of debt management. Accurate completion of this form can make the difference between successful financial negotiations and continued struggles. Using platforms like pdfFiller enables a seamless experience in editing, signing, and managing your CIS, ensuring you have the necessary tools for effective financial management. By staying organized and informed, you can tackle your financial challenges head-on and work toward a more manageable future.

People Also Ask about

What is the difference between IRS Form 433 A and 433 F?

What is Form 433 B used for?

What are the IRS allowable expenses for 433?

What is the purpose of Form 433 F?

What is form 433-B?

Which form 433 should I use?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit IRS Publication 1854 online?

How do I edit IRS Publication 1854 in Chrome?

How do I edit IRS Publication 1854 on an iOS device?

What is collection information statement form?

Who is required to file collection information statement form?

How to fill out collection information statement form?

What is the purpose of collection information statement form?

What information must be reported on collection information statement form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.