Comprehensive Guide to Limited Partnership Agreement Template Form

Understanding limited partnerships

A limited partnership is a partnership comprised of at least one general partner and one limited partner. This formation allows for different responsibilities and levels of involvement in the business, making it an appealing choice for many entrepreneurs.

Key features of this structure delineate responsibilities and protections clearly. General partners manage day-to-day operations and bear full liability for debts and obligations, while limited partners typically provide capital and receive limited liability protection against business debts.

General Partners vs. Limited Partners: Understand the primary distinctions between active and passive roles in the partnership.

Limited Liability Protection: Limited partners are shielded from personal liability beyond their investment in the partnership.

The advantages of forming a limited partnership include a flexible management structure that accommodates both active and passive partners, as well as pass-through taxation, ensuring profits are taxed at the partner's individual tax rates rather than at the corporate level.

What is a limited partnership agreement?

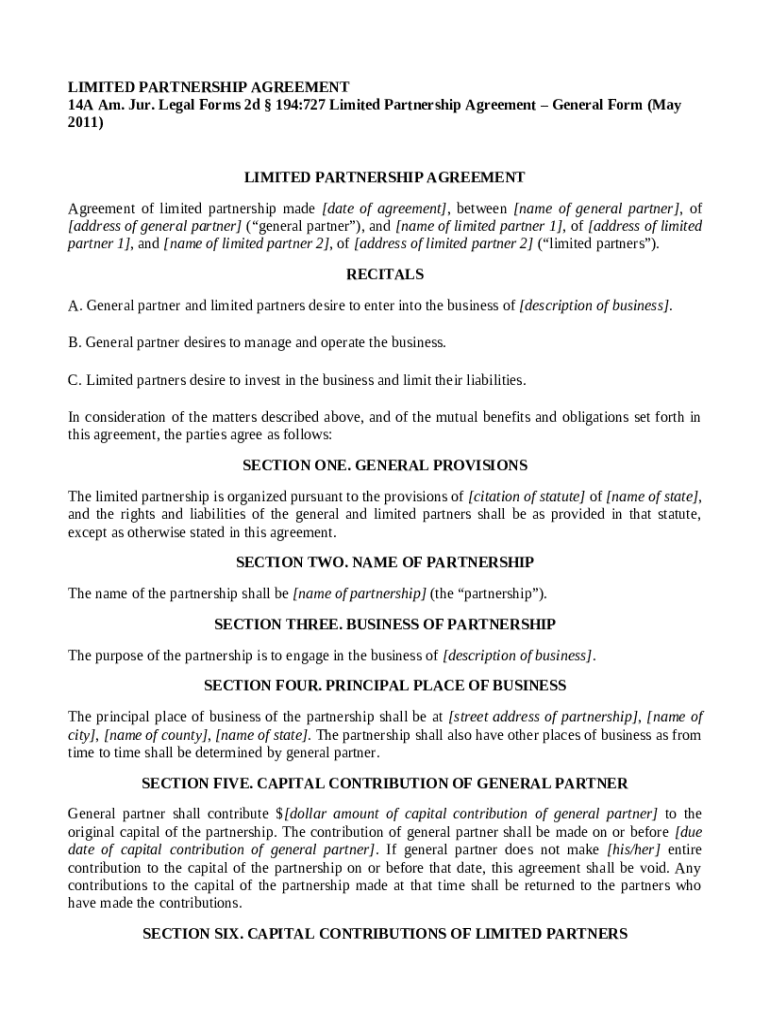

A limited partnership agreement is a formal document that outlines the terms of the partnership’s operation, including the roles and responsibilities of each partner. It serves as a contract that governs the relationships among partners and their individual rights.

The purpose of a limited partnership agreement includes clarifying each partner’s contributions, distributions, and obligations, thereby preventing disputes. It also ensures compliance with legal requirements for the partnership’s formation and ongoing operations.

Legal Requirements for Validity: Ensuring the agreement meets state laws can protect the partnership's interests.

Common Uses: This agreement becomes crucial in various business scenarios, ranging from investment funds to family businesses.

Essential components of a limited partnership agreement

An effective limited partnership agreement is detailed and tailored to fit the business's specific needs. Essential components often include several critical elements.

Name of the Partnership: The designated name under which the partnership operates.

Description of the Business: A brief outline of business operations and objectives.

Duration of the Partnership: Specifying whether it is set for a certain period or ongoing until dissolved.

Contributions and Ownership Interests: Detailing how much capital each partner will contribute and their ownership share.

Management and Voting Rights: Outlining how decisions will be made and the voting power of each partner.

Profit Allocation and Distributions: Clarifying how profits are divided among partners.

Indemnification Clauses: Protecting partners from certain liabilities.

Partner Responsibilities: Specifying each partner's duties and expectations.

Admission and Withdrawal of Partners: Procedures for adding or removing partners.

Dissolution Procedures: Steps taken to dissolve the partnership if needed.

Step-by-step guide to creating your limited partnership agreement template

Creating a limited partnership agreement template begins with gathering necessary information about the partners and the business itself. Ensure you have accurate details on the general and limited partners, as well as a concise description of the business activities involved.

Gather Necessary Information: Start by collecting details about partners' identities and investment amounts.

Customize Your Template: Use a standard template but tailor it to accommodate specific needs and agreements.

Review Legal Compliance: Ensure your agreement is compliant with relevant state regulations.

Incorporate Additional Clauses: Consider including clauses like non-compete agreements or conflict resolution mechanisms.

Filling out and editing your limited partnership agreement

Using a user-friendly platform like pdfFiller, filling out and editing your limited partnership agreement becomes a straightforward process. Start by accessing the pdfFiller template form, which offers various tools for customization.

Accessing the pdfFiller Template Form: Locate the specific template designed for limited partnership agreements.

Interactive Tool Features for Editing: Enjoy features like text editing, adding signatures, and collaboration for real-time feedback from partners.

Saving and Sharing Your Agreement: Utilize options for cloud storage and secure sharing functionalities.

Signing and finalizing the agreement

The significance of signatures in legal documents cannot be overstated. eSigning features available on platforms like pdfFiller ensure that signing the agreement is not only easy but also secure.

Importance of Signatures in Legal Documents: Signatures signify agreement and acceptance of the terms outlined.

eSigning Features on pdfFiller: Use digital signatures to finalize documents legally.

Best Practices for Finalization: Consider notarization for added security, and ensure proper record-keeping of the agreement.

Managing your limited partnership agreement

Once the agreement is signed, managing it effectively is crucial. Regular updates and amendments may be necessary as partnerships evolve or business conditions change.

Regular Updates and Amendments: Keep the agreement current by reflecting changes in partnership roles or business strategies.

Monitoring Compliance with Agreement Terms: Ensure all partners adhere to the agreed-upon responsibilities.

Tools for Ongoing Document Management with pdfFiller: Utilize features like version control and searchable archives to stay organized.

Common mistakes to avoid in limited partnership agreements

Avoiding pitfalls when drafting a limited partnership agreement is essential to maintaining a healthy partnership. Several common mistakes can lead to complications down the line.

Omitting Key Details: Ensure all essential components are detailed to avoid misunderstandings.

Confusing Rights and Responsibilities: Clearly delineate each partner's rights to prevent disputes.

Failing to Adapt to Changing Circumstances: Regularly assess and adjust the agreement as necessary.

Potential pitfalls of limited partnerships

While limited partnerships offer many advantages, they are not without potential pitfalls. Understanding these challenges can better prepare partners for success.

General Partner Liability: General partners assume more risk since they are fully liable for partnership debts.

Regulatory Compliance Challenges: Partners must stay informed about relevant laws to avoid legal issues.

Understanding the Costs Involved: Partners should be aware of setup, operational, and dissolution costs to budget accordingly.

Resources for further assistance

Multiple resources can assist in navigating the complexities of forming and managing a limited partnership agreement. Utilizing services like pdfFiller can simplify document creation.

pdfFiller Support for Document Creation: Access various support options for troubleshooting and document management.

Accessing Legal Professionals for Consultations: Legal advice can help tailor the partnership agreements to specific needs.

Related Documents and Templates on pdfFiller: Explore additional templates to streamline other forms you may need.

Comparing limited partnership structures

When considering a business structure, it's vital to compare limited partnerships with other options like general partnerships. Each has its own pros and cons that align differently with business goals.

Limited Partnership vs. General Partnership: Limited partnerships offer limited liability to some partners, unlike general partnerships where all partners are fully liable.

Pros and Cons of Each Structure: Evaluate benefits like liability protection against the simplicity of formation in a general partnership.

Choosing the Right Structure for Your Business Needs: Assess your business goals, partner involvement, and risk tolerance when selecting a structure.