Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form: Comprehensive Guide

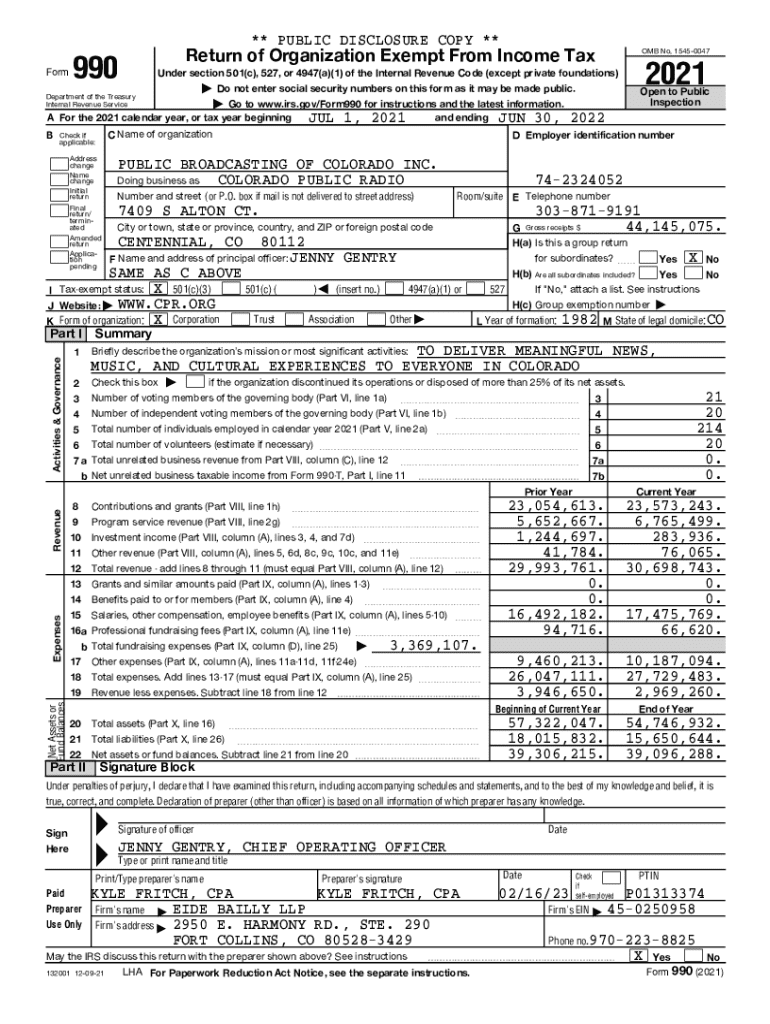

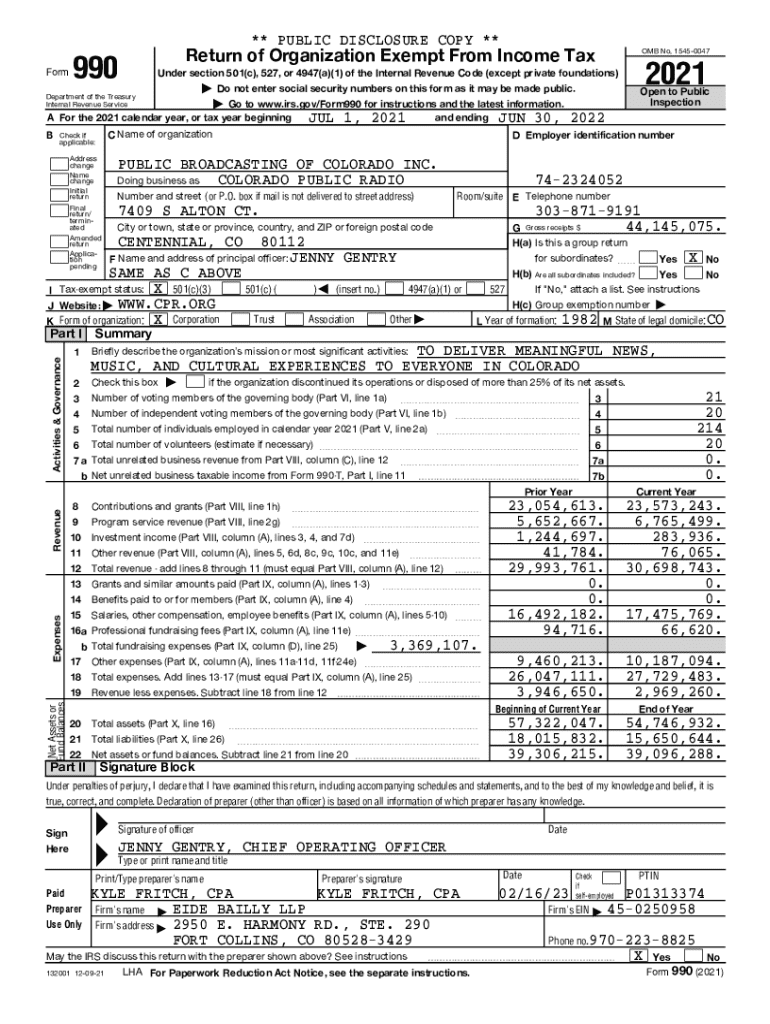

Understanding Form 990

Form 990, officially known as the Return of Organization Exempt From Income Tax, serves as a crucial financial reporting tool for tax-exempt organizations. This form is an annual requirement by the IRS and encompasses detailed information about the nonprofit's mission, finances, governance, and program effectiveness. Understanding this form is vital for both nonprofit executives and interested stakeholders like donors, as it enhances transparency and accountability.

The importance of Form 990 extends beyond mere compliance; it provides insights into an organization’s operational health and demonstrates its adherence to federal regulations. For nonprofits, this form is an invaluable asset that affects funding, donor trust, and overall legitimacy within the philanthropic community.

Who is required to file Form 990?

Organizations that are recognized as tax-exempt by the IRS, typically under section 501(c)(3) of the Internal Revenue Code, are mandated to file Form 990 if they meet specific thresholds regarding annual gross receipts and total assets. Generally, organizations with gross receipts over $200,000 or total assets exceeding $500,000 must file the full Form 990. Smaller nonprofits may qualify to file simpler forms alternatives like Form 990-EZ or Form 990-N.

However, certain classes of organizations are exempt from filing Form 990 altogether. For example, churches, integrated auxiliaries of churches, and certain state institutions typically do not have to submit this form. This exemption allows these organizations to focus on their missions without the burden of extensive reporting requirements.

Components of Form 990

Form 990 is structured into several sections, each capturing critical aspects of a nonprofit’s operations. Understanding these components can aid organizations in accurately completing the form and leveraging it for their benefit. The main parts include a summary of the organization's mission, financial data, governance, program services, and disclosures.

Overview of form structure

The structure of Form 990 can be broken down into the following key parts:

Preparing to fill out Form 990

Preparing to fill out Form 990 involves gathering crucial documents and data to ensure accuracy. Organizations will need a comprehensive collection of financial statements, including balance sheets, income statements, and IRS determination letters. Specifically, accurate financial records for the fiscal year, details of board meeting minutes, and reports on program activities are essential.

Common challenges that arise during the preparation of Form 990 include ambiguities in financial reporting which can lead to misinterpretations and potential inaccuracies. One way to overcome these challenges is through cross-referencing multiple financial documents and, if needed, consulting accounting professionals to clarify doubts or discrepancies in reporting.

Filing requirements and deadlines

Filing Form 990 comes with specific deadlines that organizations must adhere to, depending on their fiscal year-end. Typically, the form is due on the 15th day of the 5th month after the end of an organization's fiscal year. For organizations with a fiscal year that ends on December 31, the deadline falls on May 15 of the following year. Extensions can be requested, allowing an additional six months to submit the form.

Organizations can file Form 990 electronically through the IRS's e-file platform, though paper submissions are also accepted. Fees may apply for late submissions or if an extension is needed, which could impose additional financial strain on the organization. It's vital to understand these deadlines and requirements to maintain compliance and protect the nonprofit's tax-exempt status.

Penalties for non-compliance

Non-compliance with Form 990 filing requirements can result in severe penalties. Organizations that fail to file Form 990 for three consecutive years risk losing their tax-exempt status, significantly impacting their funding and reputation. The IRS imposes fines for late filings, which can amount to thousands of dollars depending on the organization’s gross receipts.

Beyond financial penalties, the consequences of non-compliance can hurt the nonprofit’s ability to attract donors and maintain credibility within the community. Many funders require up-to-date Form 990 filings as part of their due diligence before making grants. Thus, timely filing is essential not just for legal compliance, but for sustaining donor relationships and trust.

Public inspection regulations

Form 990 is not just a reporting document; it's also a tool for transparency as it is made available for public inspection. This requirement mandates that nonprofits present their Form 990 filings as part of their commitment to accountability, allowing donors and the public to review the organization’s financial health and program effectiveness.

To access Form 990 filings of other organizations, you can utilize resources such as the IRS website or various nonprofit watchdog websites, which compile this data for easy retrieval. This access aids potential donors in evaluating the organizations they are considering supporting, making it a critical component of charity evaluation.

Utilizing Form 990 for charity evaluation

Donors can glean valuable insights from Form 990, helping them to make informed decisions about their charitable contributions. By interpreting the data available in Form 990, prospective donors can assess a nonprofit's financial health, program efficiencies, and overall effectiveness in achieving its mission. This evaluation provides a clearer understanding of how funds are allocated, which is crucial for donor satisfaction.

Multiple tools and services are available to assist in evaluating nonprofits. Websites like Guidestar and Charity Navigator provide comprehensive analyses based on Form 990 data, highlighting key metrics that potential funders can assess to ensure their contributions align with their values and desired impact.

Variants of Form 990

Nonprofits may encounter different versions of Form 990 filed based on their size and financial status. The primary variants include Form 990-EZ, designed for smaller organizations with simpler operations, and Form 990-N, a postcard for the smallest nonprofits with gross receipts under $50,000. Choosing the appropriate form is vital to comply with IRS requirements and ensure accurate reporting.

For small organizations, navigating the complexities of these forms can be simplified by focusing on the streamlined requirements and ensuring that essential financial data is correctly presented. Each version has specific eligibility criteria, underscoring the importance of understanding the organization's financial position before deciding on the filing form.

Filing modalities

Nonprofits have the option of filing Form 990 through paper submissions or electronically. Electronic filing is increasingly preferred for its advantages, including reduced processing times, immediate acknowledgment from the IRS upon submission, and a lower risk of errors due to built-in checks in e-filing platforms.

To successfully e-file Form 990, organizations must follow a step-by-step process that includes selecting an authorized e-filing platform, ensuring all required forms and documentation are prepared, and carefully reviewing the information before submission. By adopting electronic filing through services like pdfFiller, organizations can streamline their filing process and enhance compliance with IRS regulations.

History and evolution of Form 990

Understanding the history of Form 990 offers valuable context. Introduced in 1943, the purpose of this form was to allow the IRS to track nonprofit organizations and ensure they were operating within the boundaries of tax-exempt status. Over the years, the form has evolved significantly, adapting to changes in the financial landscape and increasing demand for transparency within the nonprofit sector.

Recent updates have aimed to refine reporting requirements, particularly in the areas of governance and compensation, making it easier to evaluate nonprofit performance. This evolution reflects growing public interest in accountability and the need for nonprofits to provide transparent insights into their operations and funding.

Expertise and collaboration

Employing tools like pdfFiller enhances the effectiveness of document management for Form 990. This platform offers users the ability to efficiently fill out, save, and electronically sign their forms while maintaining compliance with IRS requirements. Its user-friendly interface simplifies the completion process, allowing nonprofits to focus on mission-centric activities rather than administrative burdens.

Moreover, when preparing Form 990 as a team, collaboration tools can streamline the process of reviewing and editing documents. Utilizing pdfFiller's collaborative features allows multiple team members to work on the form simultaneously, ensuring that all necessary data is included and accurate before submission.

Additional compliance considerations

Managing fiduciary reporting responsibilities is an essential part of completing Form 990 compliance. Board members and top executives must understand their legal obligations to ensure the organization adheres to state and federal regulations. This understanding is necessary to avoid potential legal liabilities and protect the nonprofit’s tax-exempt status.

Furthermore, organizations should prepare for the possibility of IRS audits related to Form 990 filings. Being proactive in maintaining accurate records and having a systematic approach to compliance can alleviate stress during potential reviews. Establishing a compliance plan that includes periodic internal audits may bolster an organization’s preparedness for external scrutiny.

Related forms and filings

Nonprofits may need to be aware of other relevant IRS forms that complement Form 990 filings. Related documents include Form 990-T, used to report unrelated business income; Form 1023 for tax-exempt status applications, and Form 8872 for political organizations to report contributions. Understanding these related forms can further enhance an organization's compliance framework.

For further reading, nonprofits should consult IRS guidelines to stay updated on the latest regulatory shifts. Resources like the IRS website and nonprofit advocacy organizations provide a wealth of information to guide organizations in their compliance efforts, ensuring they remain informed and accountable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 990 directly from Gmail?

How can I modify form 990 without leaving Google Drive?

How do I edit form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.