Get the free 941 for 2025

Get, Create, Make and Sign 941 for 2025

How to edit 941 for 2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 941 for 2025

How to fill out 941 for 2025

Who needs 941 for 2025?

Comprehensive Guide to IRS Form 941 for 2025

Understanding IRS Form 941: Employer's Quarterly Federal Tax Return

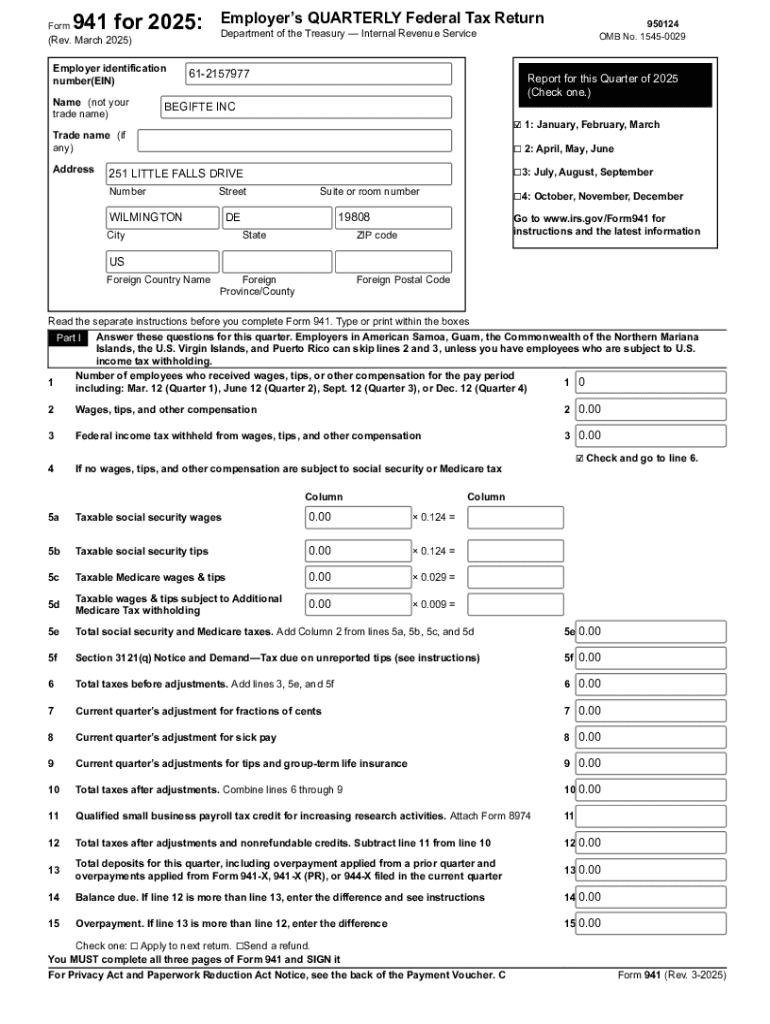

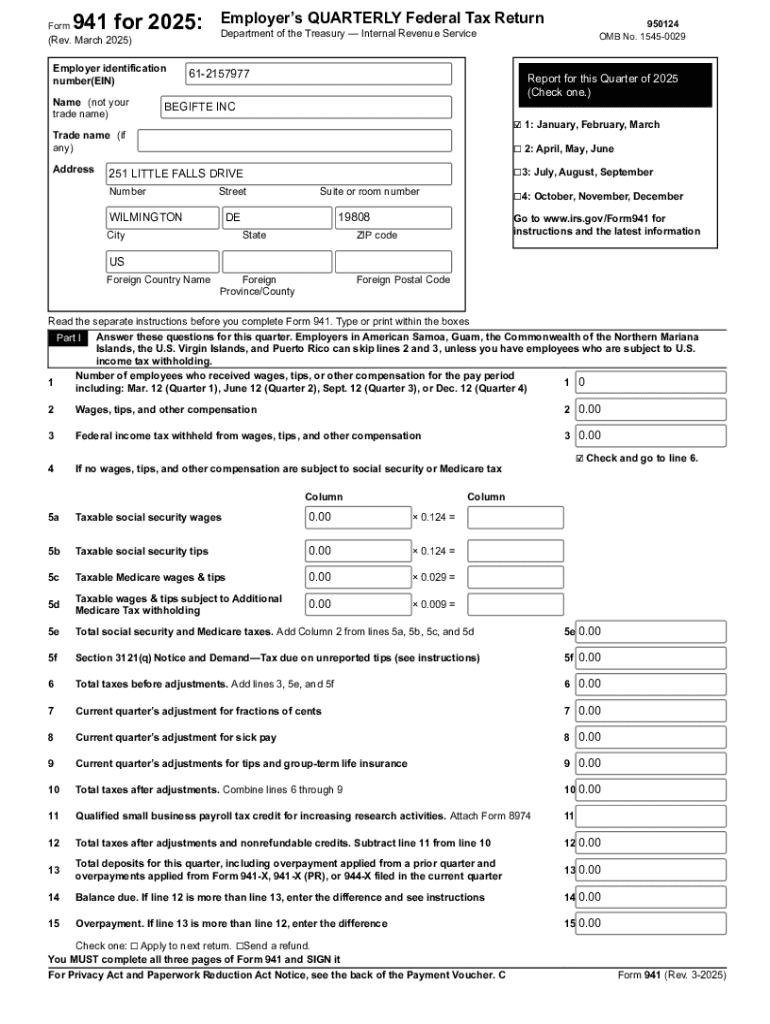

IRS Form 941 serves as the Employer's Quarterly Federal Tax Return, essential for employers who must report income taxes, Social Security, and Medicare taxes withheld from employees’ paychecks. The form ensures accurate calculation of payroll taxes owed to the federal government, thereby aiding in tax compliance and employer accountability. For 2025, updates and changes aim to simplify reporting requirements and reflect recent tax law adjustments.

Who is required to file Form 941?

Filing Form 941 is mandatory for all employers who pay wages to employees subject to federal income tax withholding. Self-employed individuals who do not have employees are not required to file this form. Specific exceptions exist, such as for seasonal employers or those who close their businesses temporarily, with rules varying based on employment structure.

Employers must understand the importance of timely filing, especially when managing seasonal versus year-round employment. Each category comes with its own rules, influencing how and when Form 941 should be submitted.

Key dates for filing Form 941 in 2025

For 2025, Form 941 must be filed quarterly, with specific deadlines on which employers should take note. The first quarter’s deadline falls on April 30th, with subsequent deadlines for Q2, Q3, and Q4 occurring on July 31st, October 31st, and January 31st of the following year respectively. Employers also need to be mindful of federal holidays, as these can affect submission timelines.

Considering tax extensions, individuals can apply for an extension if complications arise, but it's essential to file Form 941 on time to prevent penalties.

Step-by-step instructions for completing Form 941

Accurate record-keeping is vital for completing Form 941. Essential documentation includes payroll records, employee data, and tax calculations. Completing the form involves entering your business information, such as the Employer Identification Number (EIN), name, and address, followed by employee counts and payroll data.

Employers must carefully calculate taxes withheld, including Social Security, Medicare, and federal income taxes. Resources like pdfFiller provide straightforward tools to assist with form completion and minimize errors.

Understanding Form 941-: Payment voucher

Form 941-V is the payment voucher that accompanies Form 941 submissions when making deposits for payroll taxes. Understanding and accurately completing this form is important to ensure timely payments are made and to avoid penalties associated with payment delays. It allows employers to specify the payment amount and helps in tracking payments in the IRS system, ensuring correct allocation.

Using tools like pdfFiller, employers can create and fill out the payment voucher easily, ensuring they follow the correct protocol for submitting payments.

Filing Form 941: Online vs. paper submission

When it comes to submitting Form 941, employers have the option to file online or via paper. The online filing route, particularly through platforms like pdfFiller, provides significant advantages such as real-time error checking and quick submission. Unlike traditional mail, online filing often leads to faster processing times.

Conversely, those choosing to file through traditional methods must ensure their forms are properly prepared and sent well in advance of deadlines. It's equally important to track your submission status, whether filed online or offline, to confirm acceptance by the IRS.

Common issues when filing Form 941

Employers may encounter various issues when filing Form 941, including rejection codes specified by the IRS. Understanding these codes can help in timely resolution and reduce confusion. If errors occur post-filing, employers can need to amend submitted forms using Form 941-X, which allows for accurate reporting of wages and tax calculations.

Addressing mistakes promptly is essential to avoid penalties and ensure compliance. Common issues include misreported employee counts and erroneous tax calculations, which can lead to larger problems down the line.

Frequently asked questions about Form 941

Employers often have several questions regarding Form 941, especially concerning deadlines. Missing a due date can result in penalties; hence, awareness of filing deadlines is crucial. The IRS imposes late filing penalties that accumulate over time, making on-time submission vital to avoid these financial repercussions.

Additionally, it's essential to understand the differences between Form 941 and other forms like Form 940 or W-2 to ensure compliance with all tax obligations.

Advanced considerations for businesses

Beyond the basics, employers must adopt effective payroll management strategies to ensure smooth operations. Tracking wages and taxes accurately is fundamental for compliance and financial health. Incentives such as tax credits and deductions may be available, and it’s incumbent upon employers to stay informed about potential benefits.

COVID-19 relief measures continue to impact tax computed through Form 941, leading to potential revisions of payroll obligations. Understanding these changes is vital to ensure compliance and optimize financial strategies.

Final checklist to ensure compliance with Form 941

Before submitting Form 941, employers should review critical compliance points. Essential considerations include ensuring that all required sections are complete, tax calculations are accurate, and supporting documentation is readily available. Tools such as pdfFiller assist users in streamlining this process, thereby enhancing user confidence and ensuring accuracy.

A succinct checklist can help facilitate a smoother filing process, emphasizing the importance of accuracy and timely submission.

Navigating IRS guidelines for 2025

Staying informed about updated IRS guidelines is critical for smooth tax filing. The IRS regularly updates procedures and regulations, thereby mandating continuous education for employers. By utilizing resources from pdfFiller, businesses can remain abreast of changes and avoid pitfalls related to tax compliance.

Understanding the latest changes for 2025 can facilitate improved filing practices and a more seamless compliance experience.

Exploring further resources and tools

For further education on completing Form 941, pdfFiller offers tutorials designed to guide users through every step. Employers can also benefit from the integration of pdfFiller with other payroll tools, providing a comprehensive solution to manage related forms and documents. Collaborative tools enable teams to work efficiently on document management, fostering interactions that streamline processes.

These resources help ensure all elements related to Form 941 filings are handled proficiently, making tax compliance easier.

Additional topics for enhanced understanding of Form 941

To round out knowledge on Form 941, it's beneficial to explore related payroll forms like Form 940 and W-2. Each document has its own requirements and guidelines, and understanding these can optimize overall payroll processes. Additionally, insights into employment taxes offer invaluable information that supports compliance and reflects the financial health of an organization.

Employers should also develop best practices for record keeping and documentation, as these are crucial for successful filing and potential audits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 941 for 2025 for eSignature?

How do I fill out 941 for 2025 using my mobile device?

Can I edit 941 for 2025 on an iOS device?

What is 941 for?

Who is required to file 941 for?

How to fill out 941 for?

What is the purpose of 941 for?

What information must be reported on 941 for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.