Get the free Form 01- 339

Get, Create, Make and Sign form 01- 339

Editing form 01- 339 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 01- 339

How to fill out form 01- 339

Who needs form 01- 339?

A Comprehensive Guide to Form 01-339: Understanding, Completing, and Managing Tax Exemption Claims

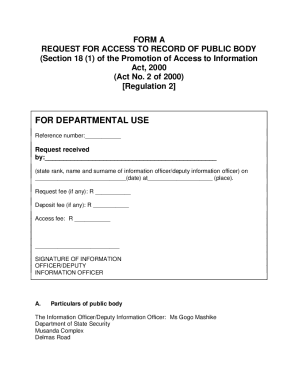

Overview of Form 01-339

Form 01-339 is a critical document for organizations seeking tax exemption in various contexts. It serves as a formal declaration that an entity qualifies for specific tax exemptions, which can significantly reduce operational costs and enhance funding capabilities. The form is often utilized by nonprofit organizations, governmental entities, and other qualifying groups to streamline their procurement processes and financial dealings.

Historically, Form 01-339 emerged from a need for clear guidelines and standardization in the claims for tax exemption. As regulatory frameworks have evolved, this form has become an essential tool in navigating tax compliance and ensuring eligibility for multiple levels of tax relief.

Who needs Form 01-339?

Eligible organizations and businesses looking to claim tax exemptions must use Form 01-339. Nonprofits, charities, educational institutions, and various government entities typically fall under the purview of this form. Recognizing which entities qualify is essential for ensuring compliance and maximizing financial benefits.

Key features of Form 01-339

One of the primary advantages of filing Form 01-339 lies in the diverse array of tax exemptions it encompasses. Individuals and organizations can benefit from broader exemptions specifically tailored for nonprofits and government entities. This means that by properly utilizing the form, organizations can significantly lessen their tax burdens and enhance their operational scopes.

Moreover, the benefits of using Form 01-339 extend beyond just financial savings. By simplifying procurement processes and reducing the time required for tax-related paperwork, organizations can focus their efforts on mission-driven activities rather than administrative tasks. This, in turn, fosters both efficiency and growth.

How to fill out Form 01-339

Completing Form 01-339 involves several key sections that must be meticulously filled out to ensure correct filing. Here's a step-by-step guide to help you navigate each section of the form effectively.

While filling out Form 01-339, it's vital to avoid common mistakes, such as incorrect identification numbers or failing to provide supporting documentation. Being thorough and double-checking each entry will contribute to successful processing.

Managing and updating Form 01-339

Proper management of Form 01-339 is crucial for long-term operational success. Keeping secure records is imperative to ensure that you can defend your tax-exempt status if questions arise later. Best practices dictate that you should also ensure consistent access to both physical and electronic copies of this form.

There are specific circumstances under which you must update or re-evaluate your Form 01-339. Major organizational changes, such as a shift in status, mission, or if new regulations come into effect, may necessitate a comprehensive review and, potentially, resubmission of the form.

The importance of compliance with Form 01-339

The legal implications surrounding claims of tax exemption can be serious. Misuse of Form 01-339 or failure to adhere to proper procedures can lead to penalties and revocation of tax-exempt status. Understanding the legal landscape is critical for organizations aiming to maintain compliance and governance.

Moreover, staying informed about regulatory changes ensures you remain compliant in the ever-evolving tax landscape. Regularly consulting resources such as government websites, professional tax consultants, and tax-related newsletters can aid in keeping track of important updates.

Interactive tools for Form 01-339 users

Utilizing interactive tools can streamline the process of filling out Form 01-339 significantly. Platforms like pdfFiller offer comprehensive document creation and editing tools that facilitate effortless collaboration and signing capabilities.

For instance, pdfFiller allows users to edit PDFs directly, ensuring that all information is up to date and accurately represented. Additionally, features such as document sharing and e-signatures are invaluable for teams working remotely or across different locations.

FAQs on using Form 01-339

Understanding the specifics about Form 01-339 can help users navigate their needs more efficiently. Here are some common questions that arise:

Examples and case studies

Real-world examples illustrate the effectiveness of Form 01-339. For instance, a nonprofit organization may file this form to secure an exemption on their purchases, which can lead to substantial savings over time. This case highlights the direct correlation between proper utilization of the form and enhanced organizational capacity.

In comparison, it's essential to recognize how Form 01-339 stands against alternatives such as state-specific forms or other tax exemptions. Identifying the nuances of each document helps organizations make informed decisions on which forms to utilize and when.

Ongoing support for Form 01-339 users

pdfFiller offers specialized services for users needing assistance with Form 01-339. The platform provides resources for document management, including templates and filing tips that adapt to users' unique requirements.

For additional support, pdfFiller's customer service team is readily accessible, offering expert guidance and answering any queries regarding document handling and database management. This kind of ongoing support is invaluable for organizations looking to ensure compliance and efficiency in their operations.

Final thoughts on navigating Form 01-339

Navigating Form 01-339 doesn’t need to be a daunting task. Continuous improvement in document management and leveraging technology can significantly enhance accuracy and efficiency for individuals and organizations alike. Embracing tools like pdfFiller simplifies these processes, leading to better outcomes and reduced stress levels.

Related topics and resources

In addition to Form 01-339, numerous other tax forms exist that serve distinct purposes. Exploring additional resources, like articles on effective tax compliance strategies, can bolster your understanding and assist you in managing your organizational duties effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 01- 339 from Google Drive?

How do I fill out the form 01- 339 form on my smartphone?

How do I edit form 01- 339 on an iOS device?

What is form 01- 339?

Who is required to file form 01- 339?

How to fill out form 01- 339?

What is the purpose of form 01- 339?

What information must be reported on form 01- 339?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.