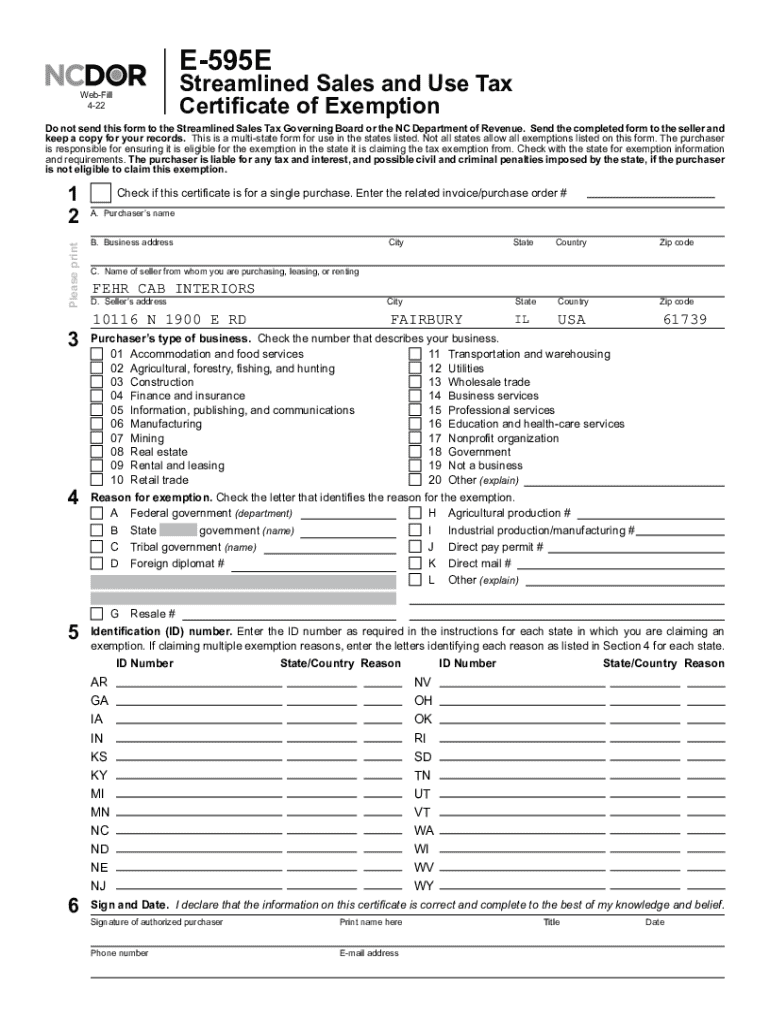

Get the free E-595e

Get, Create, Make and Sign e-595e

Editing e-595e online

Uncompromising security for your PDF editing and eSignature needs

How to fill out e-595e

How to fill out e-595e

Who needs e-595e?

Your Comprehensive Guide to the e-595e Form

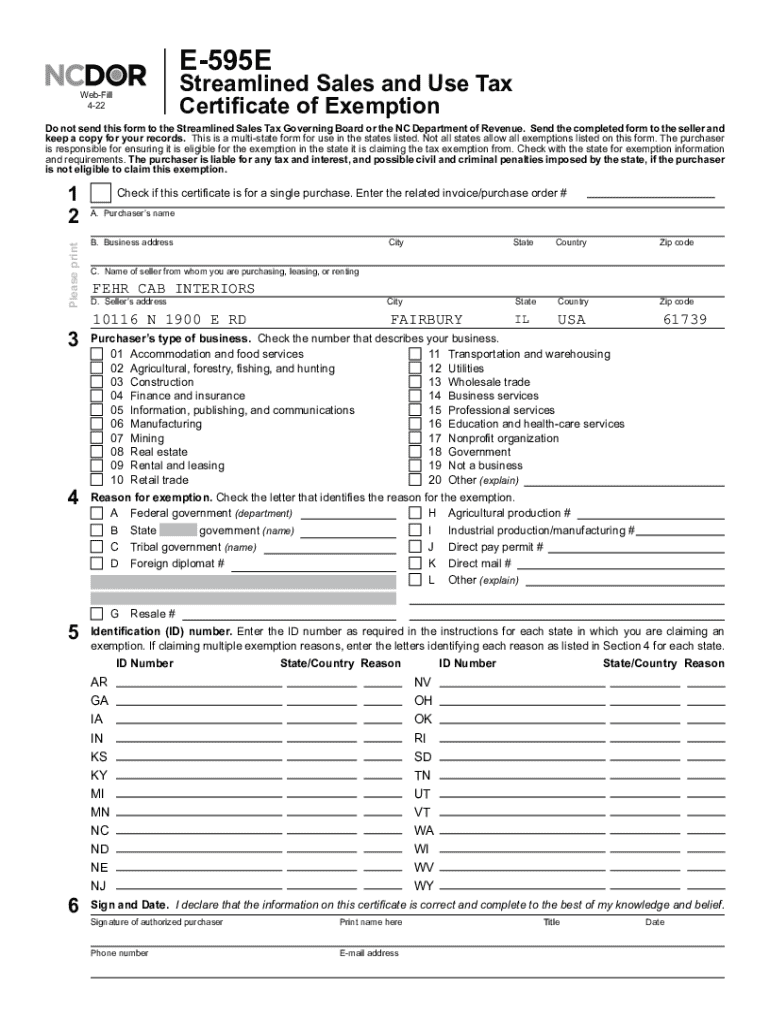

Understanding the e-595e Form

The e-595e form is specifically designed for individuals and businesses seeking an exemption from New Jersey Sales Tax for certain types of purchases. It allows eligible entities to avoid paying sales tax when acquiring property and services essential for their operations. This exemption plays a critical role in reducing the financial burden of taxes on qualifying purchases.

Understanding who needs to use the e-595e form is crucial. It is primarily aimed at nonprofit organizations, government entities, and certain types of businesses engaged in specific activities that are deemed exempt. If you fall into one of these categories, completing the e-595e form can streamline your purchasing process and potentially save you considerable amounts in sales tax.

Preparing to fill out the e-595e form

Before diving into the completion of the e-595e form, it is essential to gather all required information and documents. Mandatory data points include your organization’s name, address, tax identification number, and a clear description of the items or services you are purchasing. Additionally, supporting documents—like proof of your exempt status—should be ready to accompany the form.

To enhance your experience while filling out the e-595e form, consider setting up a pdfFiller account. This platform offers unique benefits, such as easy access to the form, editing features, and eSigning capabilities. Registering for an account is a seamless process, allowing you to create your profile, which will facilitate your document management significantly.

Step-by-step guide to filling out the e-595e form

Accessing the e-595e form through pdfFiller is straightforward. Simply navigate to the pdfFiller website, search for the e-595e form in their form library, and open it through your account dashboard. Alternatively, you can also acquire the form directly from the New Jersey Division of Taxation's website if you prefer to work offline.

As you start filling out the form, each section requires careful attention. For Section 1, ensure that you accurately enter your personal and organizational information. Common mistakes include typos in the tax ID or missing contact details, which can delay the processing of your form.

In Section 2, presenting your financial information requires precision. Avoid rounding numbers or making estimations; instead, provide exact amounts based on your purchases. For Section 3, be diligent in understanding the signature requirements, as pdfFiller allows for easy digital signing to finalize your form efficiently.

Reviewing your completed e-595e form

After completing the e-595e form, it's critical to review it thoroughly. Employ a checklist to ensure there are no errors or omissions. pdfFiller offers useful review tools that highlight any fields that need attention, ensuring that your submission is as accurate as possible.

Utilize features such as spell check and format checks provided by pdfFiller to catch mistakes you might have overlooked. A meticulous review reduces the likelihood of delays or rejections once your form is submitted.

Editing and modifying the e-595e form

Changes sometimes become necessary after you have initially completed the e-595e form. In pdfFiller, editing your form is a user-friendly process. Simply return to your saved form, and use the editing options to amend any information or add new sections as needed.

Moreover, it's worth noting that tracking changes is essential for maintaining the integrity of your document. pdfFiller provides version history that allows you to revert back to previous drafts if necessary, ensuring you always have access to the correct information.

Submitting the e-595e form

The e-595e form can be submitted electronically through pdfFiller, or you can choose to print and mail it. Electronic submissions are generally faster and provide instant confirmation of receipt, while paper submissions may take longer to process but might be preferred by some users.

Regardless of your chosen method, confirming the successful transmission of your form is crucial. If submitted electronically, check your email for a confirmation notice. If mailing, consider sending it via registered mail for proof of dispatch.

Managing your e-595e form with pdfFiller

Organizing your forms efficiently within pdfFiller can vastly improve your document management experience. Using folders and tags allows you to categorize your e-595e form alongside other relevant documents, making it easier to find when needed and enhancing your workflow.

Furthermore, pdfFiller supports collaboration among team members, with options for sharing forms and real-time editing features. This can be particularly beneficial for organizations where multiple stakeholders need to review and approve forms before submission.

Troubleshooting common issues with the e-595e form

Throughout the form-filling and submission process, you might encounter common issues such as unresponsive fields, technical glitches, or questions about compliance. These hurdles can be frustrating, but many can be resolved quickly with the right resources. pdfFiller has a robust support system in place, including tutorials, FAQs, and live chat options to assist users at any point during the process.

Engaging with community forums and user networks can also provide insights into common challenges encountered by fellow users. Whether you're unsure about a specific section of the form or need assistance troubleshooting a technical issue, collaborative platforms often yield helpful advice and shared experiences.

Advanced tips for efficient form management

To enhance your efficiency while handling forms, consider adopting best practices for completion and management. Incorporate strategic time-saving techniques, such as using templates for frequently used forms and ensuring your information is up to date to avoid repetitive data entry.

Leveraging pdfFiller's features can substantially streamline your workflows. The integration of templates, along with pre-filled fields, can significantly reduce the hassle tied to form completion, making what is often a tedious process much more manageable. Always keep an eye out for updates within pdfFiller that may offer improved functionalities.

Conclusion on utilizing pdfFiller for the e-595e form

Utilizing pdfFiller for completing and managing the e-595e form not only simplifies the process but also enhances accuracy and compliance. The platform’s comprehensive tools empower users to take full advantage of their document creation experience, from editing to eSigning.

By following the outlined steps and leveraging the capabilities of pdfFiller, individuals and teams can ensure that their submissions are handled efficiently and effectively. Embrace these resources today and experience how easy managing your e-595e form can be.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get e-595e?

Can I create an eSignature for the e-595e in Gmail?

How do I edit e-595e straight from my smartphone?

What is e-595e?

Who is required to file e-595e?

How to fill out e-595e?

What is the purpose of e-595e?

What information must be reported on e-595e?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.