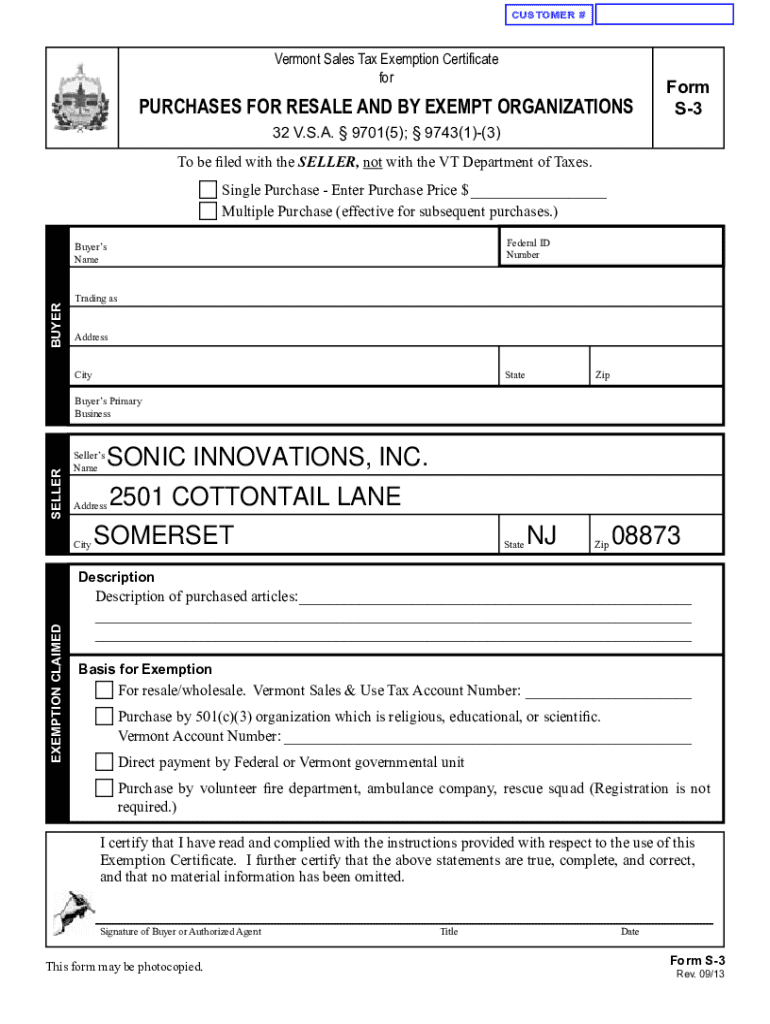

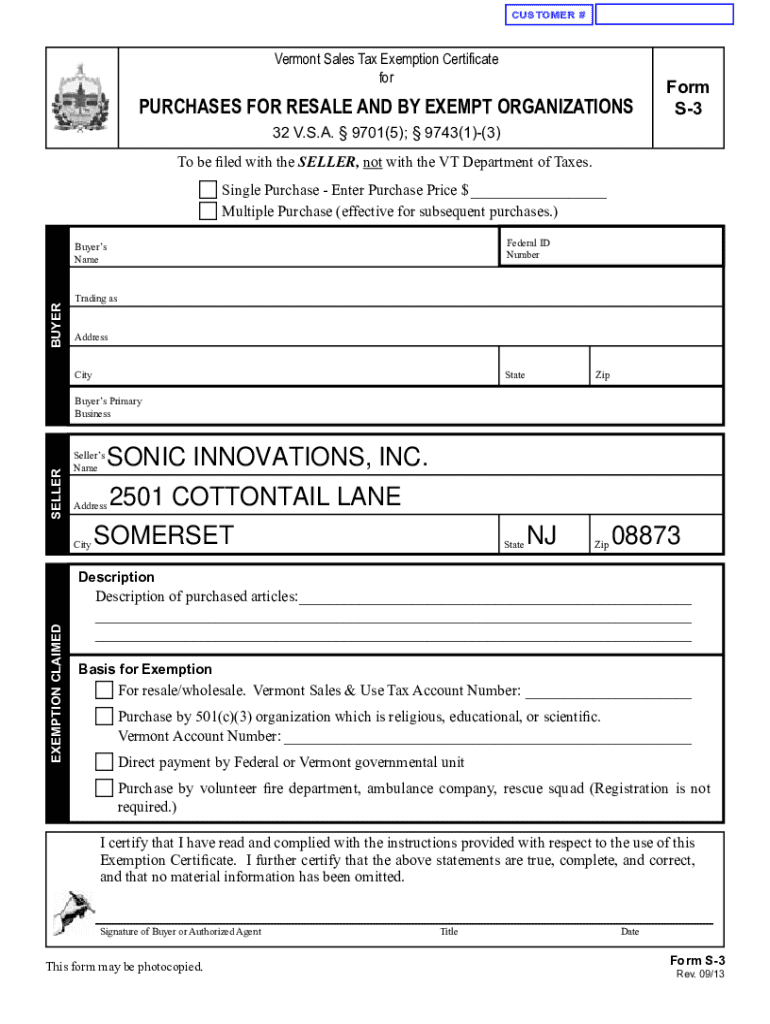

Get the free Vermont Sales Tax Exemption Certificate

Get, Create, Make and Sign vermont sales tax exemption

Editing vermont sales tax exemption online

Uncompromising security for your PDF editing and eSignature needs

How to fill out vermont sales tax exemption

How to fill out vermont sales tax exemption

Who needs vermont sales tax exemption?

Understanding the Vermont Sales Tax Exemption Form

Understanding Vermont sales tax exemption

In Vermont, the sales tax exemption allows qualified individuals and organizations to purchase certain goods and services without incurring sales tax. This exemption can significantly impact the financial decisions of both individuals and businesses, providing substantial savings on essential purchases. It helps in minimizing the overall expenditure, particularly for entities like non-profit organizations, government agencies, and certain industries engaged in specific activities.

The importance of the Vermont sales tax exemption cannot be overstated. For individuals, this exemption can offer substantial financial relief, especially when managing limited budgets. Businesses, on the other hand, can allocate these savings towards growth and operational costs, making this exemption a vital tool in their financial strategy.

Eligibility for Vermont sales tax exemption

Eligibility for obtaining a Vermont sales tax exemption is determined by specific criteria. Not all individuals and entities qualify; thus, understanding the qualifying criteria is essential. Generally, non-profit organizations, government agencies, and occasionally certain educational institutions may be eligible for the exemption. Furthermore, certain purchases related to manufacturing, agriculture, or healthcare can also qualify.

The criteria can differ for personal versus business exemptions. For instance, individuals purchasing goods for personal use may not qualify, while businesses engaged in operations that necessitate purchasing materials for production may be eligible. Understanding these nuances is crucial for ensuring compliance with state regulations.

Types of exemption certificates in Vermont

Vermont has various exemption certificates tailored to different circumstances. Understanding these types is crucial for correctly applying for an exemption. The primary categories include entity-based, use-based, and product-based exemption certificates, each designed to cater to specific needs.

Entity-based exemption certificates are issued to recognized organizations, allowing them to purchase eligible goods without sales tax. Use-based certificates, on the other hand, are for specific consumption purposes, while product-based certificates are designated for particular products such as agricultural supplies or manufacturing materials. There are also specialized exemptions for agricultural activities, forestry, and certain energy sources like fuel.

Obtaining the Vermont sales tax exemption form

Acquiring the Vermont sales tax exemption form is straightforward. It can typically be accessed from the Vermont Department of Taxes website or other official state resources. The key to a smooth application process is knowing where to find the form, how to download it, and what to do next.

To access the form, visit the Vermont Department of Taxes' official website, where you will find a directory for tax exemption forms. Download the appropriate form as a PDF, ensuring that you have the most up-to-date version. Once downloaded, print out enough copies for your needs or save them for future use. It's advisable to keep an electronic copy on hand for easy access.

Filling out the Vermont sales tax exemption form

Filling out the Vermont sales tax exemption form correctly is essential for ensuring the approval and validity of your exemption. Pay close attention to the required information fields. Common areas that need to be filled out include customer details, the legal name and address of the entity requesting the exemption, and a clear description of the goods or services being purchased.

One common mistake to avoid includes failing to provide adequate descriptions of the goods or services. This can lead to confusion and potential rejection of the exemption. Additionally, ensure that all fields are completed accurately, as missing information can also hinder the process. Reviewing the completed form before submission can prevent unnecessary delays.

Submitting the Vermont sales tax exemption form

Submitting the completed Vermont sales tax exemption form is a crucial next step in the process. Once you have filled out the form and reviewed it for accuracy, you'll need to know where to send it. Typically, you would send it to the vendor or the seller from whom you are making the purchase, not directly to the state tax authority.

It is essential to ensure that vendors accepting the exemption certificate do so in ‘good faith.’ This means that they should reasonably believe that the transaction qualifies for the exemption. Businesses that accept exemption certificates must retain them in their records for audit purposes, ensuring compliance with state regulations.

Managing sales tax exemptions

Effectively managing sales tax exemptions is vital for both individuals and businesses. This involves keeping accurate records of exempt sales, tracking and auditing these transactions periodically, and ensuring compliance with all state regulations. Regular audits will help in identifying any discrepancies and addressing them promptly.

The need to amend or update an exemption certificate can arise due to changes in organizational status or purchasing needs. Keeping the exemption updated is essential to avoid potential penalties. It’s also important to retain all documentation related to exempt purchases for a specific period, as determined by the Vermont Department of Taxes, especially in the case of tax audits.

Multiple purchase exemption certificates

Vermont offers multiple purchase exemption certificates for entities that anticipate multiple exempt purchases over a specific time frame. This is particularly beneficial for businesses requiring various items that qualify for exemption. To successfully complete a multiple purchase exemption certificate, detailed descriptions of all anticipated purchases must be included.

It’s vital to remember that separate certificates may be necessary for different types of exempt equipment or products. This ensures that each transaction is properly documented and complies with state requirements, avoiding potential issues during audits or reviews.

Specialized exemptions in Vermont

Certain specific exemptions exist in Vermont, notably for items like advanced wood boilers. These specialized exemptions have particular criteria that must be met, such as standards pertaining to heating value or efficiency. Understanding these criteria is essential for entities seeking exemptions in the sustainable energy sector.

Other examples of specialized exemptions include agricultural fertilizers and pesticides, often requiring specific documentation to qualify. Familiarizing yourself with these unique rules and requirements can better position you to take advantage of available savings while remaining compliant with state laws.

Frequently asked questions (FAQs)

A common question among those navigating the Vermont sales tax exemption process is what happens if an exemption certificate is not available at the time of purchase. Without a valid certificate, buyers may be charged sales tax and will absorb that cost unless the exemption is duly applied for later. Furthermore, purchasers often inquire whether different types of exempt purchases can be combined on the same certificate, which generally isn't advised due to the specificity required by the state.

If a submitted exemption certificate is denied, it is crucial to understand the reasons behind the denial. Engaging directly with the vendor or the state tax authority can usually clarify issues, and adjustments can be made accordingly, allowing future certificates to be approved without complications.

Contact information for further assistance

For anyone seeking additional support with the Vermont sales tax exemption process, reaching out to the Vermont Department of Taxes is a valuable step. They can provide specific guidance concerning eligibility, documentation, and submission processes. Contacting the appropriate department directly is often the fastest way to obtain accurate information.

Additionally, various online resources exist, including help from platforms like pdfFiller, which provide templates and tools to assist individuals and businesses in managing exemption forms effectively.

Language access information

Vermont ensures that resources are available in multiple languages, allowing broader access for those who may not be fluent in English. This inclusiveness helps ensure that all eligible individuals can navigate the sales tax exemption process effectively. Language support can often be accessed through local community centers or specific state resources online.

For those requiring assistance in filling out the Vermont sales tax exemption form or needing additional resources in their preferred language, reaching out to local authorities or utilizing available online translation tools can be beneficial steps to take.

About pdfFiller’s services

pdfFiller provides comprehensive document management solutions, empowering users to seamlessly edit PDFs, e-sign, collaborate, and manage documents from its cloud-based platform. This capability streamlines the process of filling out and submitting forms like the Vermont sales tax exemption form, allowing users to handle their documentation efficiently and from anywhere.

Utilizing pdfFiller's platform offers numerous features, such as document templates tailored specifically for the Vermont sales tax exemption form, making it easier for users to navigate the requirements and ensure compliance. The access-from-anywhere feature ensures that all users have the necessary tools to manage their documents effectively, thus simplifying the overall exemption process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit vermont sales tax exemption in Chrome?

How can I edit vermont sales tax exemption on a smartphone?

Can I edit vermont sales tax exemption on an Android device?

What is vermont sales tax exemption?

Who is required to file vermont sales tax exemption?

How to fill out vermont sales tax exemption?

What is the purpose of vermont sales tax exemption?

What information must be reported on vermont sales tax exemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.