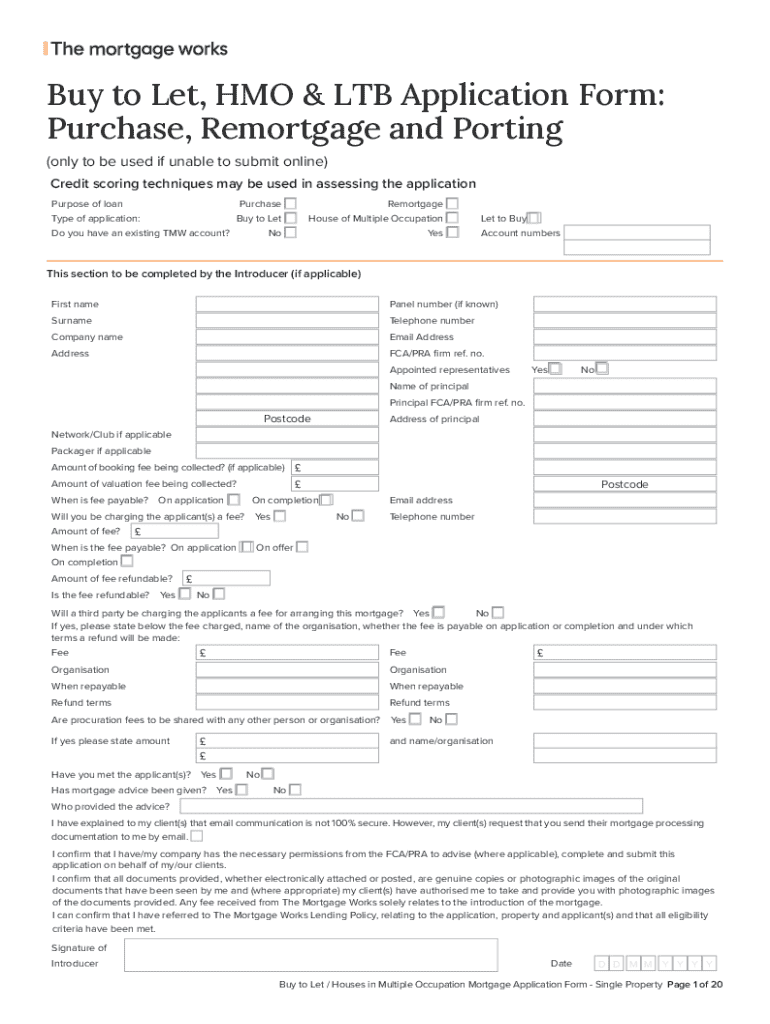

Get the free Buy to Let, Hmo & Ltb Application Form

Get, Create, Make and Sign buy to let hmo

How to edit buy to let hmo online

Uncompromising security for your PDF editing and eSignature needs

How to fill out buy to let hmo

How to fill out buy to let hmo

Who needs buy to let hmo?

Understanding and Managing the Buy to Let HMO Form

Understanding buy to let HMOs

Houses in Multiple Occupation (HMOs) are residential properties where at least three tenants live, forming more than one household and sharing facilities like kitchens and bathrooms. This arrangement differs substantially from standard buy-to-let properties, which are typically rented to a single household. Understanding this distinction is crucial for prospective landlords, particularly those exploring the buy to let HMO form.

Investing in buy to let HMOs offers several advantages, including higher rental yields, increased demand in urban areas, and the appeal of catering to a variety of tenants looking for affordable shared living options. However, successful management requires compliance with specific regulations and attention to tenant needs.

The importance of the HMO form

The HMO licensing process is vital for landlords to ensure their properties meet safety and quality standards. Engaging in the buy to let HMO form process ensures landlords can legally operate their rental properties without fear of penalties. Legal requirements include fire safety measures, adequate amenities, and proper maintenance.

Failing to obtain an HMO license may lead to severe penalties, including hefty fines and increased scrutiny of property management practices. This could also result in losing rental income during the time it takes to rectify the lack of licensing.

Steps to complete the buy to let HMO form

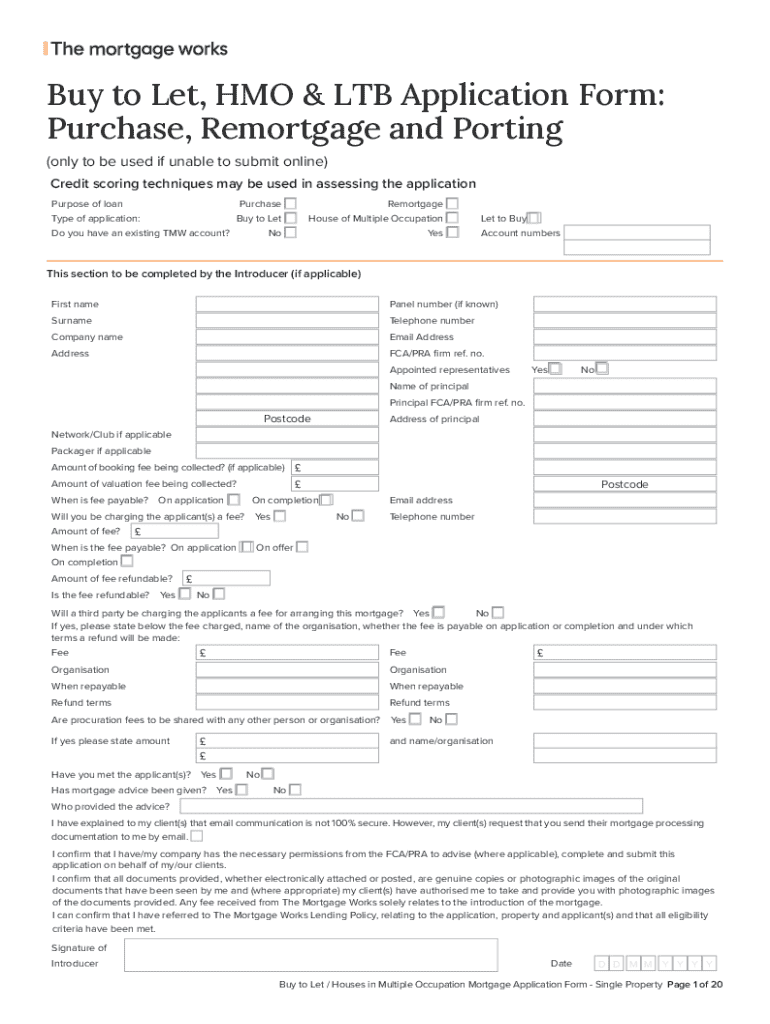

Completing the buy to let HMO form requires careful preparation. The first step involves gathering necessary information, including property details such as the address, the type of dwelling, and occupancy configurations. Landlords must also provide personal details, including contact information, along with financial data related to the buy-to-let mortgage.

After gathering all the necessary information, landlords must fill out the required sections of the HMO form. Each section is mandatory and requires accurate data entry to avoid delays in processing.

Reviewing and verifying the information before submission is critical. Create a checklist of the essential items, and beware of common pitfalls, such as incorrect or incomplete information that can lead to rejections.

Managing your HMO license application

Once the buy to let HMO form is completed, landlords can submit their application either online, possibly through platforms like pdfFiller, or using alternative methods such as mail or in-person visits to the local council office.

Landlords should be prepared for a typical processing time of 4-8 weeks for HMO applications. Monitoring the status of the application is important, especially if it is delayed or rejected. In case of rejection, landlords should seek feedback on necessary amendments and reapply.

After submission: Keeping your HMO license active

Maintaining an active HMO license involves adhering to ongoing compliance requirements. Regular inspections of the property, adherence to safety regulations, and timely updates to any changes in tenancy are just a few key responsibilities of an HMO landlord.

Landlords must also be aware of the frequency of license renewal. Depending on local regulations, some areas may require a renewal every five years, while others may have different timelines or conditions for review.

Best practices for HMO management

Setting clear tenant criteria is essential in HMO rentals to ensure each potential tenant aligns with the property’s demands and each other. This may involve background checks, credit checks, and verifying employment for a harmonious living environment.

Regular property inspections are vital to identify and resolve any issues before they escalate, including repairs and maintenance. Additionally, actively managing tenant relationships and being responsive to their concerns fosters a positive atmosphere, encouraging tenancy longevity and reducing vacancy rates.

Financial considerations for HMO landlords

Understanding the financial implications of managing an HMO is crucial. Costs can include maintenance, utility bills, and compliance expenditures, all of which can add up significantly. Therefore, conducting a thorough rental income analysis is vital to assess profitability.

Additionally, landlords should familiarize themselves with tax implications associated with renting an HMO, as there are specific rules around deductibles and income reporting specific to shared properties.

Frequently asked questions (FAQs)

Landlords often have many questions concerning the specifics of HMOs. A common query is the difference between a small HMO and a large HMO. Small HMOs typically refer to properties accommodating up to six tenants, while large HMOs involve larger properties that house more than six. Both categories require different licensing considerations and compliance.

Tools and resources for HMO landlords

Using pdfFiller offers various interactive tools specifically designed for document creation and management. Landlords can quickly fill out, edit, and manage their buy to let HMO form seamlessly, ensuring compliance and thorough documentation.

In addition, resources such as local government websites provide essential information on HMO regulations, safety standards, and compliance requirements tailored to each locality, ensuring landlords stay informed.

Additional considerations for potential HMO investors

Evaluating current market trends is essential for potential investors considering buy to let HMOs. Urban areas with high demand for rental properties are often ideal locations for investment. Factors such as proximity to public transport, universities, and business districts can influence the attractiveness of potential HMO properties.

In conclusion, mastering the buy to let HMO form is a critical step for landlords seeking to thrive in the rental market. The alignment of proper documentation, ongoing compliance, and effective management strategies will ultimately determine success in this sector.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get buy to let hmo?

Can I sign the buy to let hmo electronically in Chrome?

How do I fill out buy to let hmo on an Android device?

What is buy to let hmo?

Who is required to file buy to let hmo?

How to fill out buy to let hmo?

What is the purpose of buy to let hmo?

What information must be reported on buy to let hmo?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.