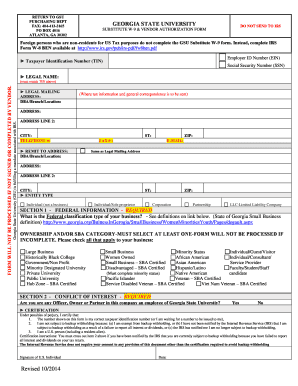

Georgia State University Substitute W-9 & Vendor Authorization Form 2024-2026 free printable template

Get, Create, Make and Sign Georgia State University Substitute W-9 Vendor

How to edit Georgia State University Substitute W-9 Vendor online

Uncompromising security for your PDF editing and eSignature needs

Georgia State University Substitute W-9 & Vendor Authorization Form Form Versions

How to fill out Georgia State University Substitute W-9 Vendor

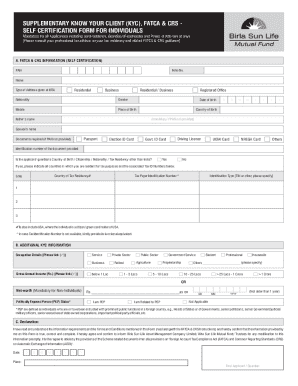

How to fill out taxpayer identification number tin

Who needs taxpayer identification number tin?

Taxpayer Identification Number (TIN) Form: A Comprehensive Guide

Understanding taxpayer identification numbers (TIN)

A Taxpayer Identification Number (TIN) is a unique identifier used by the Internal Revenue Service (IRS) to track individuals and businesses for tax purposes. Having a TIN is crucial for anyone who earns an income or needs to file tax returns in the United States. The IRS utilizes this number to verify taxpayers and ensure compliance with tax laws.

The importance of a TIN cannot be overstated, as it is essential for individuals and businesses alike to fulfill their tax obligations, apply for loans, and engage in various financial transactions. Without a valid TIN, filing taxes can become a complex and problematic process.

Getting started with TIN forms

The TIN form serves various purposes, from facilitating tax reporting to enabling individuals and businesses to comply with financial regulations. Knowing who needs a TIN is critical. Generally, anyone who earns income, engages in business activity, or needs to file a U.S. tax return must obtain a TIN.

The application process for obtaining a TIN can vary, depending on the type of TIN required. Individuals seeking an SSN typically do so through the Social Security Administration, while businesses apply for an EIN through the IRS. For non-residential aliens, the ITIN is requested using Form W-7. Each process has specific documentation requirements and associated timelines.

How to complete the TIN form

Completing the TIN form correctly is vital to avoid delays in processing. Follow this step-by-step guide to ensure accuracy.

TIN application process

Applying for a TIN can be done either online or via physical form submission, depending on the type of TIN you need. The online application process is the most efficient and streamlined way to receive your TIN promptly.

For instance, to apply for an EIN online, you must visit the IRS website, complete the online application, and submit it. The response is almost immediate, allowing businesses to receive their EIN the same day, provided all information is accurate.

Conversely, the physical submission process for an ITIN may involve mailing Form W-7 to the IRS with additional documentation. The processing times for physical submissions can take up to six weeks, depending on the time of year and the volume of applications.

Checking the status of your TIN application

Once you've submitted your TIN application, checking its status is straightforward. The IRS provides an online portal where applicants can verify the status of their application. By entering the required information, you can see if your TIN has been issued or if additional actions are necessary.

If you cannot check your status online or have specific inquiries, contacting the IRS directly is your next step. Make sure to have your application details on hand to facilitate the inquiry.

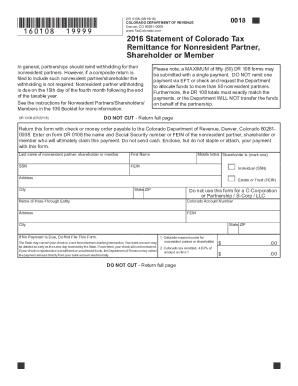

TIN by country: variations and requirements

Different countries may have their specific requirements and formats for taxpayer identification numbers. While TIN is standard in the U.S., other nations use various identification systems to track tax compliance.

For instance, in Canada, the Social Insurance Number (SIN) serves as the primary identifier, while in the U.K., National Insurance Numbers play a similar role. Understanding the nuances of TINs in other countries is essential for expatriates and international companies, as it affects compliance and tax status across borders.

Best practices for TIN management

Managing your TIN is crucial for maintaining your tax compliance and identity protection. Here are some best practices to follow.

Common challenges and limitations

While obtaining and managing your TIN is essential, several challenges may arise during the process. One common issue is TIN verification, where discrepancies between provided information and existing records can delay processing.

Moreover, TIN holders carry legal responsibilities that include filing accurate tax returns and reporting income appropriately. Failure to comply can lead to penalties or even criminal charges, reinforcing the importance of understanding your obligations regarding your TIN.

FAQs about taxpayer identification numbers

Common questions regarding TIN often arise related to security and usage. For instance, if your TIN is lost or stolen, immediately report it to the IRS and monitor your financial accounts for suspicious activity. You may need to request a replacement TIN.

Additionally, while TINs are primarily used for tax purposes, they may also be required for other activities, such as applying for certain government benefits. Regularly reviewing your TIN for accuracy is advisable to ensure your financial information remains secure and compliant.

Additional guidance and resources

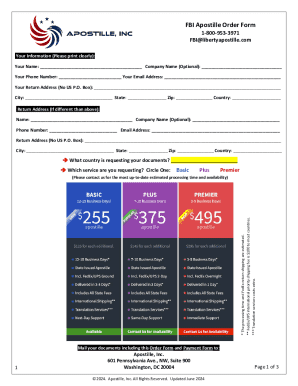

Maximizing your efficiency in managing your TIN can be significantly aided by utilizing helpful tools and resources. The IRS website offers essential guidelines and downloadable forms needed for TIN application and verification.

Moreover, consider leveraging platforms like pdfFiller, which empower users to effortlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform. This ensures seamless document management and reduces errors in form submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete Georgia State University Substitute W-9 Vendor online?

Can I sign the Georgia State University Substitute W-9 Vendor electronically in Chrome?

How do I complete Georgia State University Substitute W-9 Vendor on an iOS device?

What is taxpayer identification number tin?

Who is required to file taxpayer identification number tin?

How to fill out taxpayer identification number tin?

What is the purpose of taxpayer identification number tin?

What information must be reported on taxpayer identification number tin?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.