Get the free Details of Unclaimed/unpaid Dividend

Get, Create, Make and Sign details of unclaimedunpaid dividend

Editing details of unclaimedunpaid dividend online

Uncompromising security for your PDF editing and eSignature needs

How to fill out details of unclaimedunpaid dividend

How to fill out details of unclaimedunpaid dividend

Who needs details of unclaimedunpaid dividend?

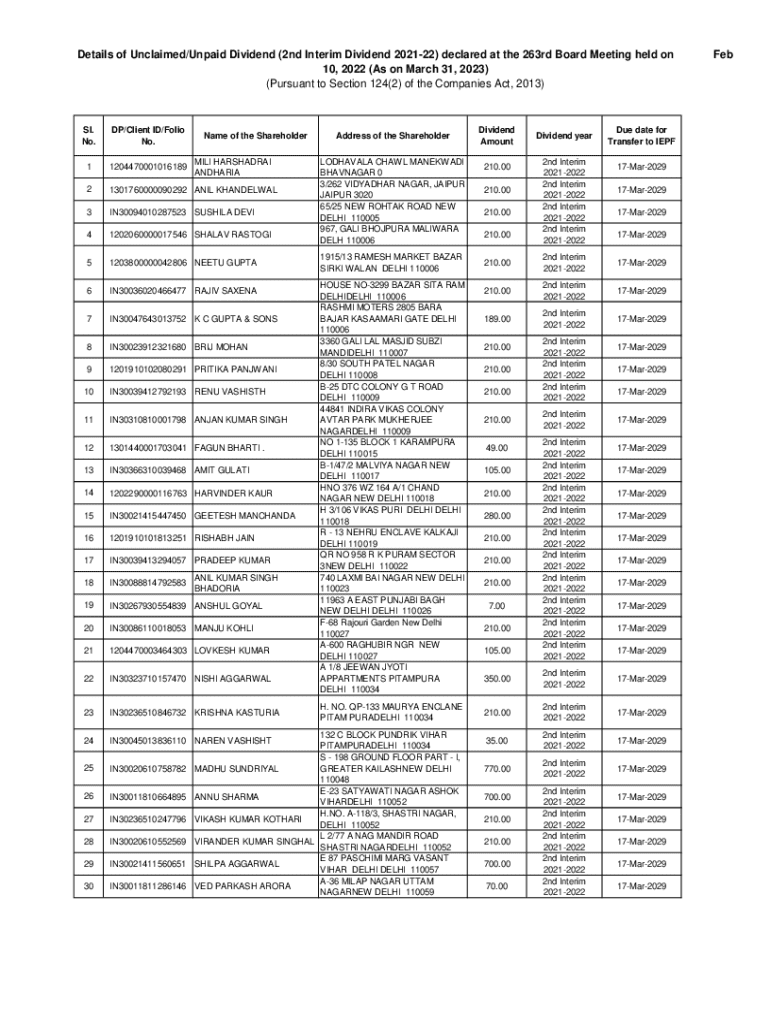

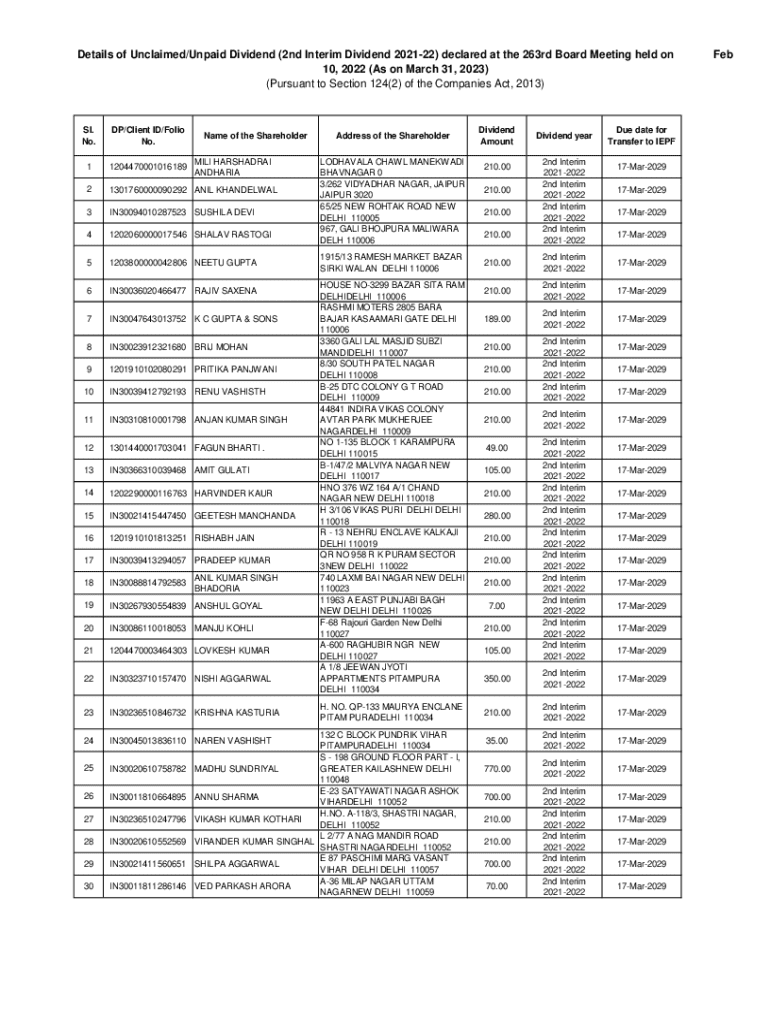

Details of Unclaimed Unpaid Dividend Form

Understanding unclaimed unpaid dividends

Unclaimed unpaid dividends arise when a company declares dividends to its shareholders, but those dividends remain unclaimed due to various reasons. These amounts may remain uncollected for extended periods, leading to unclaimed status. Not only do unclaimed dividends contribute to shareholder loss, but they also indicate possible communication lapses between the company and its stakeholders.

Claiming unpaid dividends is crucial because it ensures that shareholders receive all benefits they are entitled to. Companies have specific time frames in which unclaimed dividends must be addressed, and failure to claim could result in the funds becoming permanent revenue for the company. Common reasons for dividends remaining unclaimed include outdated contact information, lack of awareness about declared dividends, or the dissolution of relationships with brokers.

The unclaimed unpaid dividend process

The unclaimed unpaid dividend process begins with the company's declaration of a dividend and ends with the successful claiming of that dividend by shareholders. First, companies send notices to eligible shareholders, but these may not reach everyone due to incorrect addresses. Once shareholders realize they have unclaimed funds, they must navigate through the claims process, which typically includes submitting specific forms.

The primary stakeholders in this process include corporations, which are responsible for maintaining accurate records and notifying shareholders; the shareholders themselves, who must keep their contact details updated; and regulatory bodies that oversee these transactions to ensure compliance. Understanding the roles of each party can greatly assist in effectively claiming unpaid dividends.

Eligibility criteria for filing the unclaimed unpaid dividend form

To file the unclaimed unpaid dividend form, claimants must meet specific eligibility requirements. For individuals, basic eligibility often includes being a registered shareholder on the company’s books. For companies, eligibility may involve maintaining correct documentation related to shareholdings. The verification process plays a critical role in confirming the claimant's identity and entitlement to the dividends.

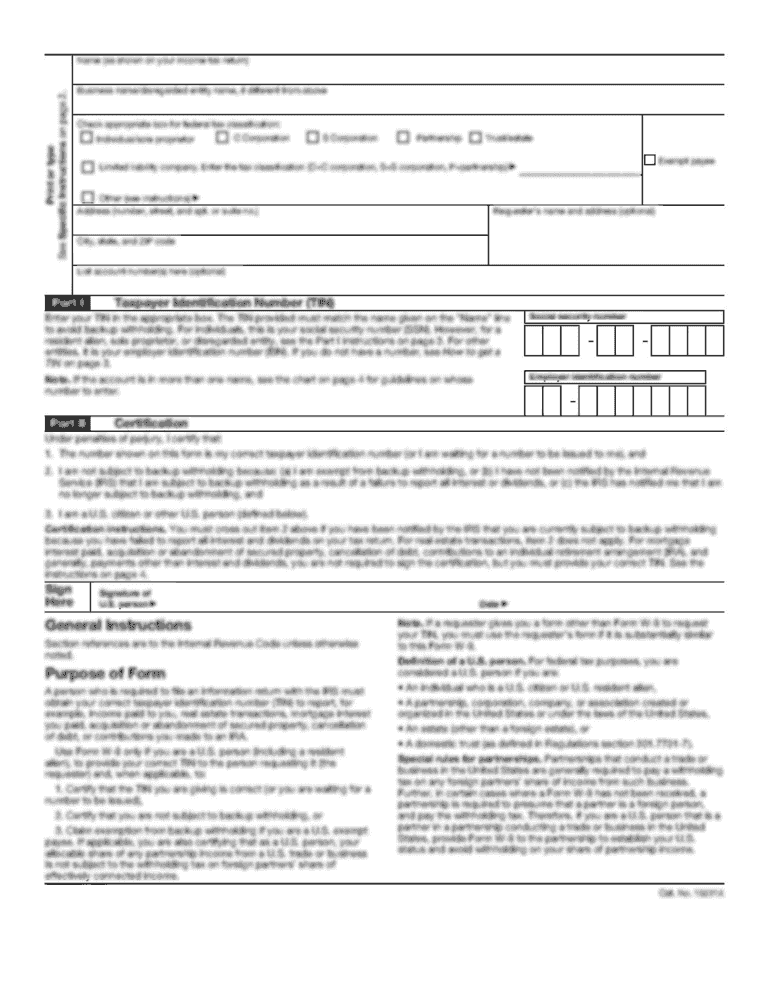

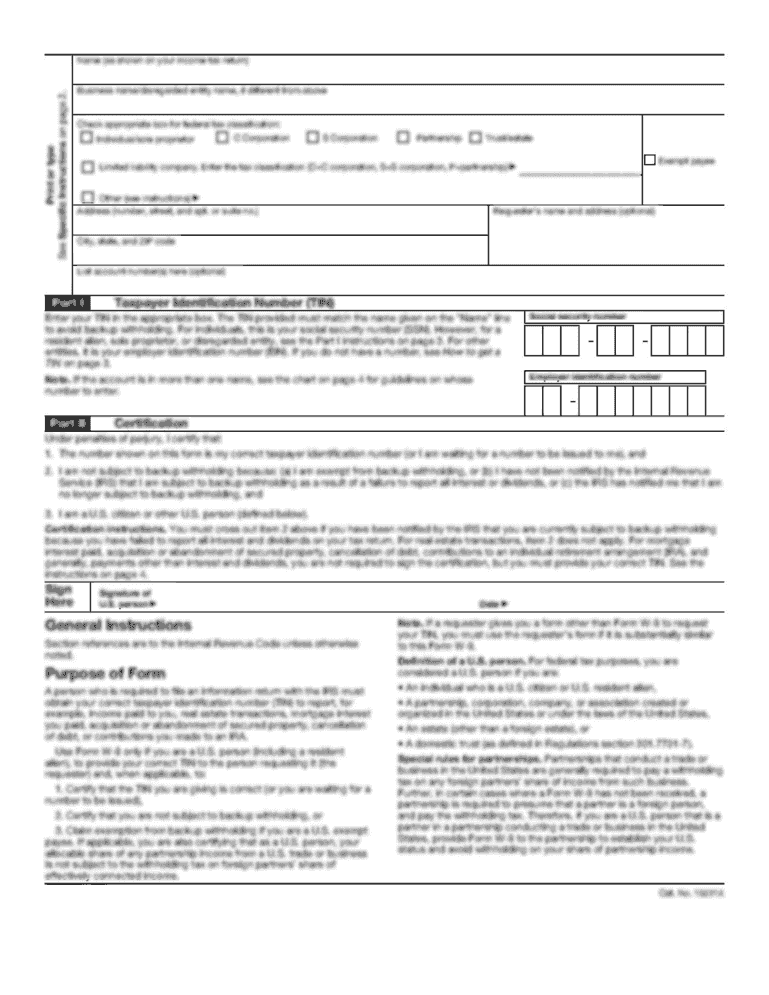

Documentation required includes share certificates, proof of identity, and any previous correspondence related to the dividend. These documents help establish the claimant's ownership of shares and their respective rights. Companies often require these details to ensure a secure and verified claim process.

Details of the unclaimed unpaid dividend form

The unclaimed unpaid dividend form is structured to collect key information from the claimants. The Personal Information section typically requests the claimant's name, contact details, and shareholder identification. Accurate completion of the Dividend Details section is imperative; shareholders must include the specific dividend amounts, dates of declaration, and any reference numbers associated with their claims.

Every claim also needs supporting documents, which are often required attachments. Common mistakes when filling out the form include incomplete information, missing documents, and failure to sign the form. Taking care to review all entries thoroughly can avert simple errors that lead to delays in the claim process.

Instructions for submitting the unclaimed unpaid dividend form

Submitting the unclaimed unpaid dividend form is an organized process. First, gather all the necessary documents, including identification proofs and share certificates. Second, accurately fill out the form, ensuring each section is complete. Finally, it is crucial to know where to submit the form, whether through online submission platforms or physically at designated corporate offices.

Specific submission guidelines may vary by company, so verifying their requirements is important. Typically, the timeline for processing claims can vary, but claimants should expect a response within a few weeks to a few months, depending on the complexity and volume of claims received.

Tools and resources available with pdfFiller

pdfFiller offers innovative solutions for simplifying the form filling process related to unclaimed unpaid dividends. With interactive form-filling capabilities, users can easily complete their unclaimed unpaid dividend forms online, eliminating the need for paperwork. The platform also provides editing features that allow users to adjust entries as needed prior to submission, ensuring accuracy in all required fields.

Additionally, eSign options streamline the submission process, allowing users to securely sign documents online. Document management features, such as storage, retrieval, and collaboration tools for sharing forms within teams, make pdfFiller an invaluable resource for those navigating these processes. This enhances efficiency and keeps all involved parties informed.

Frequently asked questions about unclaimed unpaid dividends

One common inquiry revolves around what happens if a claim is denied. In such cases, it's essential to review the reasons for denial and potentially rectify any discrepancies noted by the processing team. Another popular question pertains to the timeframe for claiming dividends; shareholders typically have a specific time period, often ranging from a few years after declaration, to initiate their claims.

To follow up on a submitted claim, claimants can contact the corporate office or the relevant regulatory body handling such claims for updates. Educational resources can be found through the company’s investor relations pages or dedicated governmental financial websites to assist shareholders in claiming their dividends effectively.

Real-world examples and testimonials

Case studies of successfully claimed dividends serve as valuable lessons for shareholders pursuing their claims. For example, a shareholder who diligently followed the claim process and utilized pdfFiller was able to recover thousands in unpaid dividends. Testimonials from users often highlight the easy-to-navigate online tools that made the form-filling process smooth, reducing time spent on administrative tasks.

Users often express satisfaction with the clarity of instructions and the support they received through pdfFiller's resources, empowering them to act quickly on their unclaimed dividends. These success stories illustrate just how beneficial streamlined resources can be in facilitating claim processes.

Next steps and continuous engagement

Proactive monitoring of dividend announcements is essential for shareholders. Using tools provided by pdfFiller, users can keep track of outstanding dividends and be notified when new dividends are declared. It's vital to maintain current contact information with share registrars to avoid future issues with unclaimed dividends.

Incorporating pdfFiller tools into regular document management practices ensures that all dividend-related correspondence is handled efficiently and effectively. This not only helps with managing unclaimed dividends but also cultivates better communication channels with companies issuing stock dividends.

Final thoughts on managing unclaimed dividends

Managing unclaimed dividends requires consistent diligence and an understanding of financial rights. By mastering the details of unclaimed unpaid dividend forms and leveraging effective tools from platforms like pdfFiller, shareholders can secure the financial benefits they deserve. Regularly checking for updates and keeping documentation in order can prevent loss of valuable dividends in the future.

This proactive approach not only assists in claiming dividends but also cultivates a more informed and engaged shareholder base. As companies work to streamline communication, shareholders who utilize modern document management practices will be best positioned to benefit from their investments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete details of unclaimedunpaid dividend online?

How do I edit details of unclaimedunpaid dividend in Chrome?

Can I sign the details of unclaimedunpaid dividend electronically in Chrome?

What is details of unclaimedunpaid dividend?

Who is required to file details of unclaimedunpaid dividend?

How to fill out details of unclaimedunpaid dividend?

What is the purpose of details of unclaimedunpaid dividend?

What information must be reported on details of unclaimedunpaid dividend?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.