Get the free Cpf D103

Get, Create, Make and Sign cpf d103

How to edit cpf d103 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cpf d103

How to fill out cpf d103

Who needs cpf d103?

A Comprehensive Guide to the CPF D103 Form

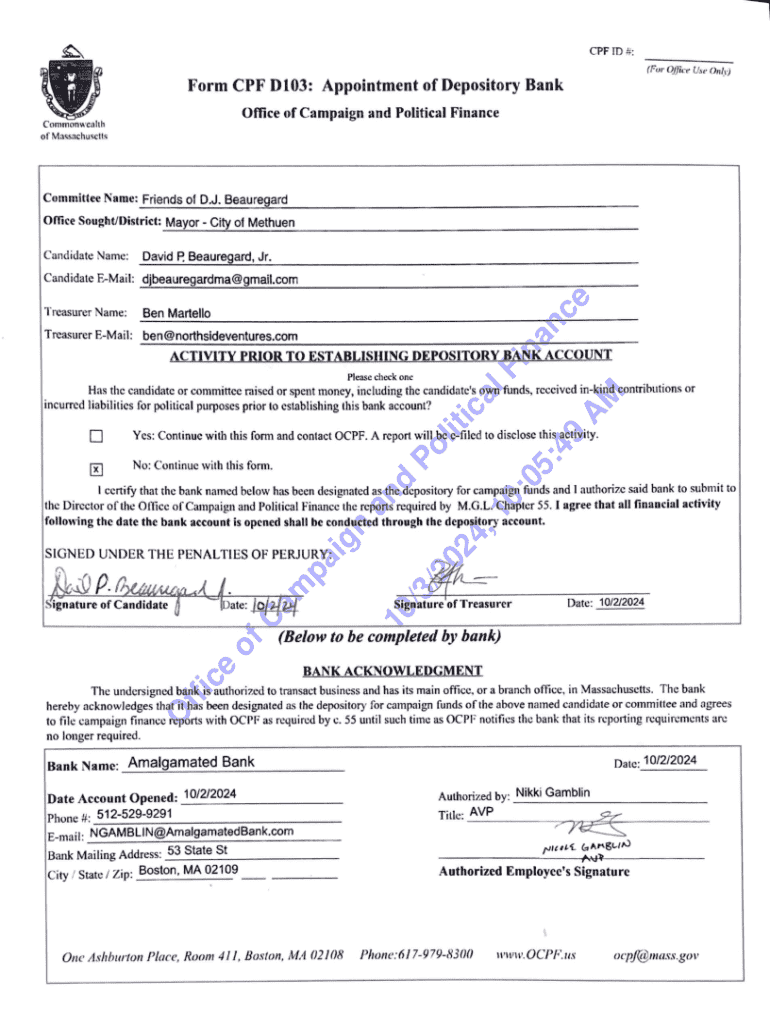

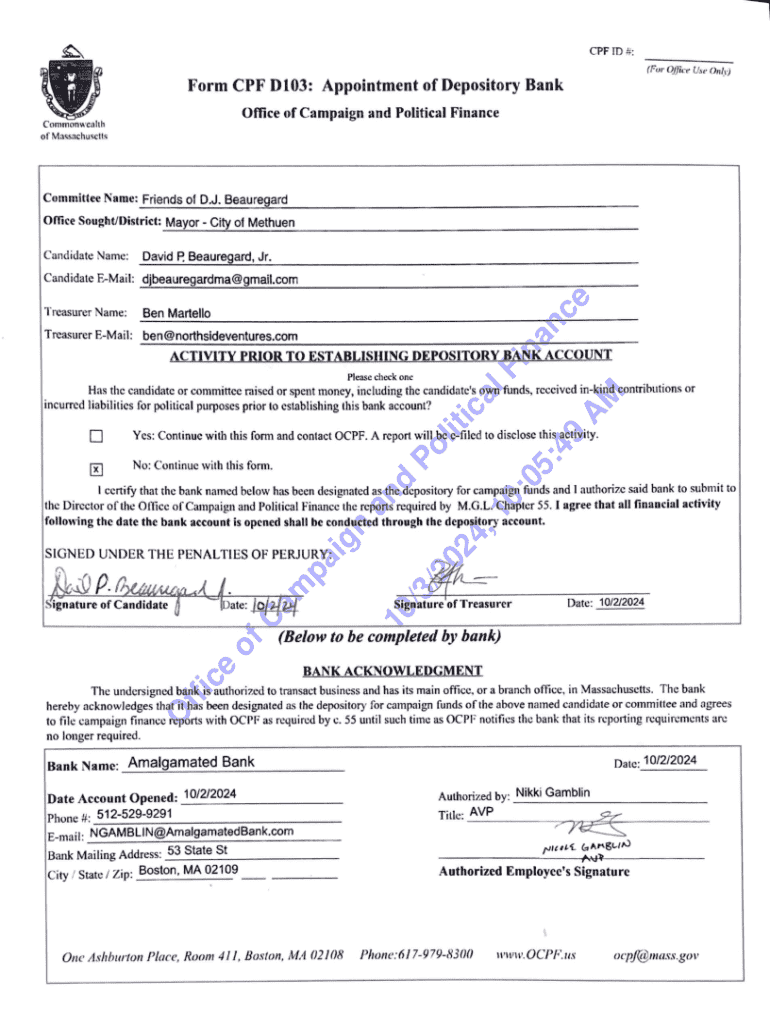

Understanding the CPF D103 form

The CPF D103 Form is a crucial document required for the Central Provident Fund (CPF) in Singapore. Designed to facilitate contributions from employers for their employees, this form is vital for compliance with CPF regulations. Properly filling it out ensures that both employees and employers meet their legal obligations regarding retirement savings.

Filling the CPF D103 Form correctly is important not only for legal compliance but also for ensuring that employees receive their rightful entitlement. It serves as an official record of contributions, and inaccuracies can lead to discrepancies in an employee’s CPF account. This form is often used during the hiring phase of new employees or when adjustment in contributions is needed due to changes in salary.

Key features of the CPF D103 form

The CPF D103 Form is divided into various sections, each vital for gathering specific information. The main sections include details about the employer, the employee, and the contributions. Each segment asks for different types of information, such as the name, address, and registration numbers related to both parties. A comprehensive breakdown helps users understand what’s mandatory to fill out.

Common mistakes while completing the CPF D103 Form include incorrect employee names, missing identification numbers, and calculation errors in the CPF contributions. To help mitigate these issues, users should double-check all entries against official documents and verify numerical entries carefully.

Step-by-step guide to filling out the CPF D103 form

Before starting, gather essential documents, such as identification cards, proof of employment, and salary details. This information will streamline the process and ensure accuracy. Once you have everything ready, you can access the CPF D103 Form. It is available online on the CPF website, and also for download or in-person requests at CPF service centers.

Filling out your details involves entering accurate personal information, including your name, NRIC, and other vital data. Make sure you check for any forms of discrepancies by comparing it with the documents you’ve gathered. After filling out the required details, reviewing the entries is crucial. Use a checklist to confirm that all sections are complete and accurate before submission.

Editing and modifying the CPF D103 form

Editing the CPF D103 Form is made easy with tools like pdfFiller. After uploading your PDF to the platform, you can directly edit text fields, add notes, or include supplementary documents as needed. This flexibility allows for quick modifications without the hassle of redrafting the entire form.

When adding additional information, such as supporting documents, make sure they’re organized and relevant to the entries on your form. Clearly label any supplementary evidence to ensure completeness in your submission.

Signing and submitting the CPF D103 form

To electronically sign the CPF D103 Form, pdfFiller offers an easy-to-use digital signature feature. Ensure your signature process is secure to avoid any unauthorized use of your document. Following your eSign, it's important to select the right submission channel; this could involve online submissions, mailing to designated CPF addresses, or dropping off in person at CPF service centers.

Keep track of deadlines when submitting the form. Missing a submission can lead to penalties or complications in the CPF contributions and benefits.

Managing your CPF D103 form with pdfFiller

Storing your completed CPF D103 Form securely is critical. With pdfFiller, you can save your document in a cloud-based environment, ensuring easy access from anywhere, and providing peace of mind regarding document safety. Additionally, collaborating with team members on the form is simple, as pdfFiller allows seamless sharing with advisors or colleagues.

Tracking the submission status is vital to ensure that your document has been received and processed. PdfFiller provides features to monitor your submission progress, making it easier to follow up if necessary.

Troubleshooting common issues

Common issues during the completion of the CPF D103 Form may include error messages relating to information entry. Errors like mismatch of identification numbers or discrepancies in contribution amounts need to be addressed immediately. If you encounter problems, revise your entries carefully.

For assistance, the CPF Board has dedicated support channels. It's advisable to reach out to them via their official helpline or email support for speedier resolution of any issues.

Best practices for using the CPF D103 form

Staying organized with your documentation reduces the likelihood of errors during the process. Keep all relevant paperwork tidy and accessible, ensuring you have the right documents readily available when it’s time to fill out your CPF D103 Form. Regular updates to your form also help maintain compliance with current regulations.

Adopting these best practices ensures a smoother process whenever filling out paperwork related to CPF contributions, thereby increasing the likelihood of maintaining employee satisfaction.

Alternatives to the CPF D103 form

There may be instances where using alternative forms is more appropriate, such as for different employee types or specific adjustments. Understanding when to use these alternatives can save time and effort.

Other related forms, such as the CPF D1 Form for employers wishing to apply for exemptions, or the D5 Form for working with CIF contributions, serve functions that may, in particular cases, align better with user needs.

Leveraging pdfFiller beyond the CPF D103 form

PdfFiller provides valuable features that extend beyond the CPF D103 Form, supporting an array of document types and processes. Its user-friendly interface makes it a robust tool for creating, editing, signing, and sharing any number of documents within the platform.

Additionally, pdfFiller offers resources to help users refine their document management skills, ensuring that your documentation processes are efficient, compliant, and conducive to productivity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my cpf d103 in Gmail?

Can I edit cpf d103 on an iOS device?

How do I edit cpf d103 on an Android device?

What is cpf d103?

Who is required to file cpf d103?

How to fill out cpf d103?

What is the purpose of cpf d103?

What information must be reported on cpf d103?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.