Get the free Corporate Account Opening Form

Get, Create, Make and Sign corporate account opening form

How to edit corporate account opening form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporate account opening form

How to fill out corporate account opening form

Who needs corporate account opening form?

Corporate Account Opening Form - How-to Guide

Understanding corporate account opening forms

A corporate account opening form is a critical document used by businesses to establish a banking relationship. It signifies the formal request by a corporation to open a financial account, allowing the organization to manage its cash flow, deposit revenue, and handle expenditures efficiently. The significance of these forms cannot be overstated; they serve as the first step towards establishing a reliable banking infrastructure tailored to the unique needs of businesses.

One crucial difference between personal and corporate accounts lies in the legal requirements and documentation needed. Personal accounts often require minimal validation such as personal identification, while corporate accounts demand comprehensive documentation reflecting the company's legal status, ownership structure, and operational scope. Corporate accounts are typically designed for various purposes including payroll management, investment, and daily operational expenses, providing numerous benefits like enhanced security, better record-keeping, and professional financial management.

Essential preparation before filling out the form

Before you begin filling out the corporate account opening form, thorough preparation is essential. Start by researching the requirements specific to the financial institution you're considering. Required documentation for corporations may include items such as Articles of Incorporation, a business license, and tax registration documents. Each bank and credit union has different eligibility criteria; therefore, it's crucial to ensure your business meets these prerequisites for the chosen account.

Choosing the right type of account is also vital. Different account types, such as checking, savings, or business credit accounts, cater to distinct financial needs. For instance, checking accounts are suitable for businesses that require regular transaction capabilities, while savings accounts may be ideal for companies that want to set aside funds for future investments. Your choice should be guided by your business goals, whether it involves expansion, investment needs, or efficient cash flow management.

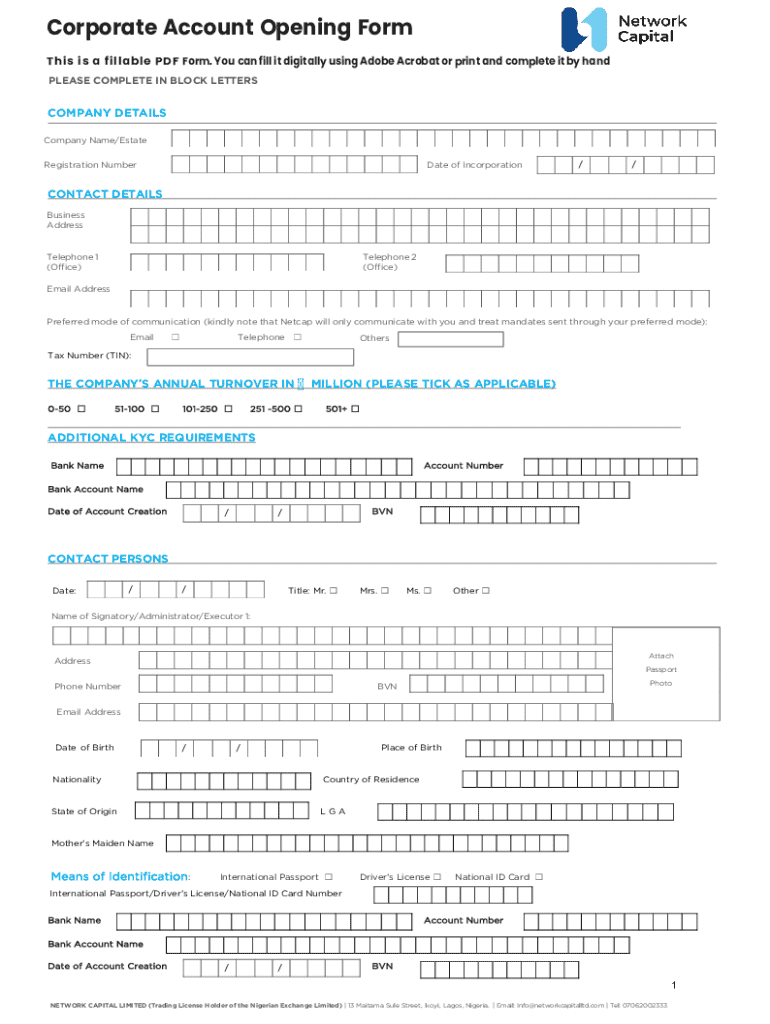

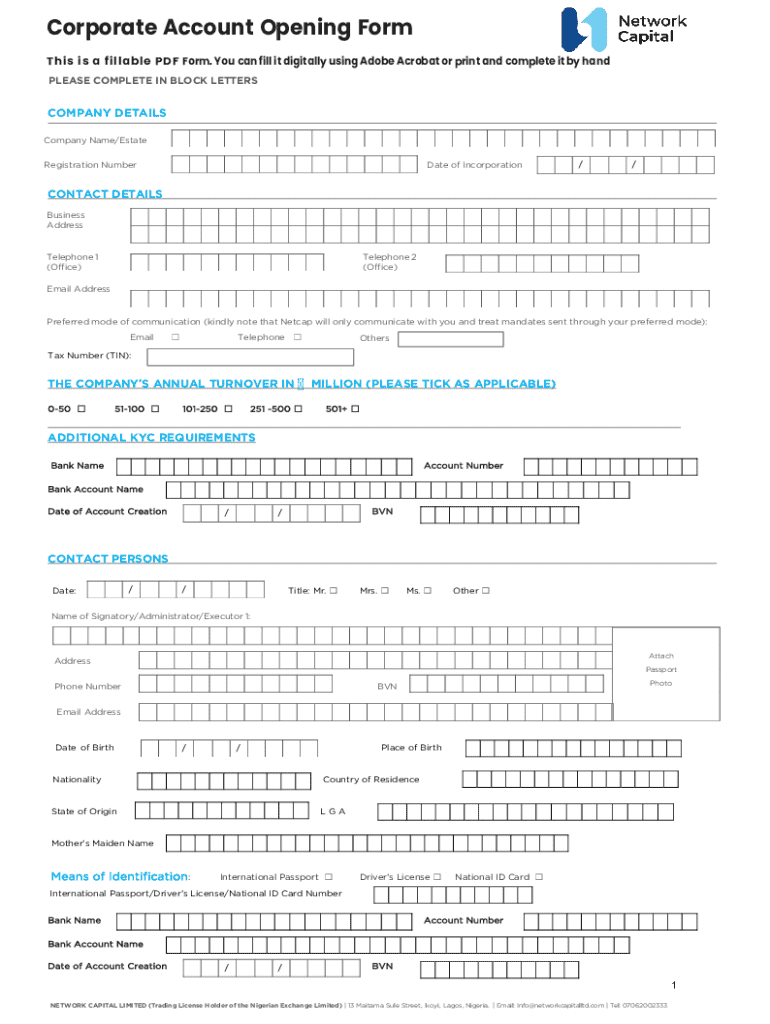

Components of a corporate account opening form

Understanding the components of a corporate account opening form is crucial for accurate completion. Typically, these forms include several key sections. The first is the 'Basic Company Information' section, where you will provide the legal name, registration number, and address of your business. The 'Business Structure Details' section follows, which outlines the entity type whether it's an LLC, corporation, or partnership. This is essential for the bank to understand your organization's legal stature.

Ownership Information is another critical section, which requires details about shareholders and directors to ensure transparency. Moreover, tax identification numbers are vital for regulatory compliance. Additional sections may include information on authorized signatories, who have the authority to operate the account, and contact information for business correspondence. Each of these components must be filled out with attention to detail to facilitate the account opening process without delays.

Step-by-step guide for completing the corporate account opening form

Completing the corporate account opening form can seem daunting, but following a structured approach can simplify the process. Start by gathering necessary documentation and information. Common documents to collect include the Articles of Incorporation, Operating Agreements, business licenses, and identification of the authorized signatories. Having these on hand ensures you have all the required information for accurate completion.

Next, fill out the form accurately. Clarity and completeness in your entries are key. Avoid abbreviations and ensure names are spelled correctly to prevent any issues later on. After submitting, take a moment to review the form for errors or missing information, as this is a crucial step before submission. Finally, submit the form via your chosen method, whether online, in-person, or by mail, based on the bank's options.

Editing and customizing your corporate account opening form

Using online tools like pdfFiller offers immense advantages when editing corporate account opening forms. With various features, you can add or remove fields based on your organization's specific needs. Incorporating your company's branding, such as logos or color schemes, helps to create an identity that resonates with your business ethos. Moreover, pdfFiller allows you to collaborate with team members during form preparation, making it easier to collect feedback with sharing and commenting options.

eSigning your corporate account opening form

eSigning your corporate account opening form is a convenient way to authenticate the document digitally. Understanding the details of electronic signatures is essential before proceeding. Using a platform like pdfFiller, you can follow a step-by-step process to eSign your documents, ensuring a streamlined transition from drafting to submission. Verifying the security of signatures is crucial; pdfFiller provides encryption options to safeguard your documents and maintain confidentiality.

Managing your corporate account after opening

After opening your corporate account, it's essential to understand what to expect. First, you will gain access to the bank's online platform, allowing you to monitor account activity in real time. This is critical for tracking expenditures and ensuring that your company stays within budget. Being proactive about monitoring can also help identify any unusual transactions that may warrant further investigation.

Continued compliance is vital; corporate accounts often require annual documentation updates such as financial statements or changes in ownership. Regularly reviewing and updating your documents helps maintain good standing with the bank and regulatory authorities, minimizing risks related to penalties or account issues.

Troubleshooting common issues during the opening process

While completing a corporate account opening form, you may encounter common issues that can hinder the process. One frequent reason for form rejection is incomplete documentation. Banks require all aspects of the form to be filled out fully and correctly. Additionally, mismatched information, such as discrepancies between the business name on the form and the name registered with the authorities, can cause delays.

To overcome these challenges, carefully read the bank's instructions prior to submission. If difficulties arise, don't hesitate to contact customer support for clarification or assistance. This proactive approach can save you valuable time and ensure a smoother application process.

Interactive tools and resources on pdfFiller for corporate account management

pdfFiller offers a range of interactive tools that can greatly assist in managing corporate documentation. For instance, users can access templates for recurrent forms and documentation that streamline the creation process. These templates are specially designed to cater to various business needs, which is invaluable for efficiency.

Moreover, analytics tools available on pdfFiller allow users to track submissions and edits. This level of transparency ensures that you can monitor the progress of your documents efficiently, making it easier to manage time-sensitive submissions and maintain good standing with financial institutions.

Keeping your corporate documentation compliant

Regulatory compliance is a significant aspect of maintaining a corporate account. A failure to adhere to legal obligations can lead to penalties or account restrictions. Thus, staying informed on your compliance requirements is essential for the long-term sustainability of your business. Regular audits of your corporate documentation can help you ensure everything is up to date.

pdfFiller includes features that aid in compliance by allowing you to manage and store all relevant documents securely within one platform. By regularly utilizing these tools, you can maintain an organized repository of necessary documents that comply with regulatory standards.

FAQs on corporate account opening forms

Navigating the corporate account opening process can raise several questions. For instance, one of the most common inquiries is, 'How long does it take to open a corporate account?' Typically, the duration varies based on the bank's processing time and whether you have all required documentation ready, but expect anywhere from a few days to a couple of weeks.

Another frequent concern is regarding lost corporate documents. It's crucial to know the steps to take if your important paperwork is misplaced, such as contacting your corporate service provider or legal advisor for assistance. Additionally, many people wonder, 'Can I change my account type later?' Most banks allow you to upgrade or switch your account type as necessary, but understanding specific processes ahead of time can streamline any future transitions.

Final thoughts on the corporate account opening process

In conclusion, the corporate account opening process necessitates thorough preparation and precise completion of the required forms. As the process is often the gateway to unlocking the financial resources essential for your business's growth, taking measured steps can lead to a successful account opening experience. Remember, pdfFiller's toolset empowers you to manage documents seamlessly, ensuring you have everything you need to navigate the complexities of corporate banking with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send corporate account opening form to be eSigned by others?

How do I execute corporate account opening form online?

How do I make changes in corporate account opening form?

What is corporate account opening form?

Who is required to file corporate account opening form?

How to fill out corporate account opening form?

What is the purpose of corporate account opening form?

What information must be reported on corporate account opening form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.