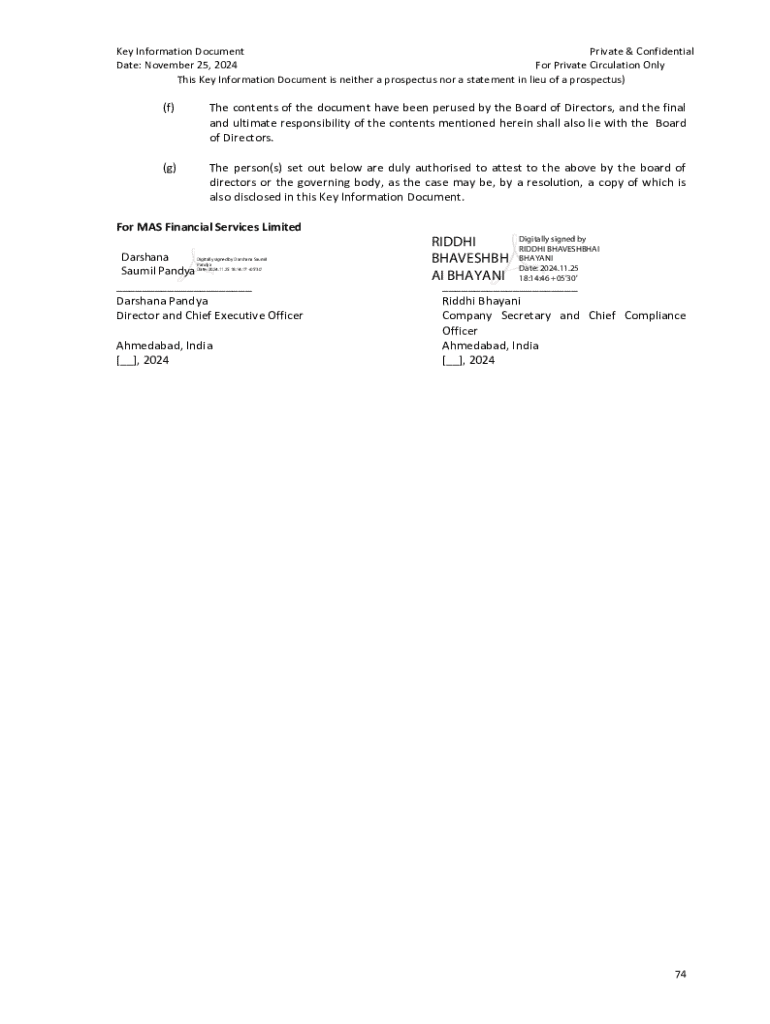

Get the free Key Information Document

Get, Create, Make and Sign key information document

How to edit key information document online

Uncompromising security for your PDF editing and eSignature needs

How to fill out key information document

How to fill out key information document

Who needs key information document?

A Comprehensive Guide to the Key Information Document Form

Understanding Key Information Documents (KIDs)

A Key Information Document (KID) is a standardized template designed to provide essential information about a financial product or service. It serves as a concise summary, allowing potential investors or users to grasp the key aspects of a product before making decisions. KIDs are particularly important in financial services, where clarity and transparency are crucial for stakeholders. These documents help demystify complex data, enabling individuals and teams to understand the financial implications and projected outcomes associated with investing in a particular product.

The importance of KIDs in document management cannot be overstated; they function as an essential tool ensuring compliance with regulatory requirements while also promoting informed decision-making among users. By summarizing critical details in one document, KIDs facilitate comparison between different offerings, thereby empowering consumers.

Required information for completing a KID

To complete a Key Information Document accurately, specific required information is necessary. This includes personal details, employment information, and income and taxation details. Each component provides a holistic view of the individual’s financial situation, which helps in tailoring the document effectively for the intended purpose.

Essential details explained

Personal information includes your name, address, and relevant identification numbers, all of which help ensure that all documentation is accurately attributed. Employment information provides context regarding your earning potential and job security, which is especially important for potential lenders or investors assessing risk factors.

Income and taxation details need careful documentation, as they play a critical role in calculating net income and understanding liabilities. Missing or incorrect data in this section can lead to significant misunderstandings in financial assessments or loan eligibility.

Hidden calculations in KIDs

When preparing KIDs, many individuals overlook the calculations that underlie the figures presented. Understanding how these figures are derived helps in validating the information being reported. Common pitfalls include miscalculating tax deductions or failing to include variable income sources, which may lead to providing an incomplete financial picture.

Filling out a Key Information Document

Completing a Key Information Document requires a systematic approach to ensure accuracy and completeness. Begin by gathering necessary documents such as your tax records, employment contracts, and identification to streamline the process. Once you have all the required documentation, you can start inputting data into the KID form.

Inputting data accurately is crucial—it’s best to double-check entries against source documents. After filling out the KID, review your information thoroughly to ensure that no details are omitted or inaccurately represented. Finalizing the document comes once you’ve validated all inputs against your original data and ensured that the KID reflects your true financial status.

For a smooth experience, consider the following tips for accurate data entry: always use up-to-date figures, maintain consistency in terminology, and keep your document neat and legible to avoid misinterpretations.

Employer deductions and PAYE illustrations

When filling out your KID, it's essential to account for employer deductions that directly impact your net income. Common deductions include national insurance contributions, pension contributions, and any other specific deductions dictated by your employment contract. Understanding these deductions can help paint a clearer picture of your financial obligations and net earnings.

Understanding PAYE (Pay As You Earn)

Pay As You Earn (PAYE) is a taxation system whereby your employer deducts income tax directly from your earnings before you receive your paycheck. To calculate your PAYE contributions accurately, you will need to take into account your tax code, as well as any additional allowances you may have.

Understanding how PAYE works is crucial for effective financial planning. Inaccuracies in this section could lead to unexpected tax liabilities at year-end. Consequently, maintaining accurate records and updating your employer with any changes in your financial situation is vital.

Assumptions in KID calculations

While filling out KIDs, various common assumptions are often made, which could lead to discrepancies. For example, it is typically assumed that income levels will remain stable over the next year, which may not be the case for everyone. Similarly, certain deductibles may be pre-determined based on average data for similar employment sectors.

Adjustments may also need to be made for specific circumstances such as changing employment types—freelancers may have less predictability in income compared to salaried employees. In this regard, being aware of variable trends and economic factors is crucial for realistic documentation.

Sharing your Key Information Document

Once your KID is complete, sharing this document securely is paramount to protect sensitive information. Utilize secure distribution methods, such as encrypted email or cloud storage options that meet industry compliance standards, to mitigate risks associated with unauthorized access.

For teams requiring collaboration, leveraging tools specifically designed for document sharing can enhance both access and security. Ensuring that team members have the most current version is also vital; utilize version control features offered by platforms like pdfFiller to track edits and manage documentation effectively.

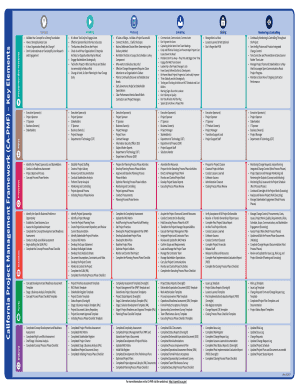

Additional tools and resources for KIDs

Utilizing interactive tools for creating and managing KIDs can significantly enhance both the efficiency and accuracy of documentation processes. Various platforms, including pdfFiller, offer functionalities that simplify the completion of forms while maintaining compliance and accuracy.

File formats and conversions for KIDs

Understanding the file formats compatible with KIDs is critical for seamless sharing. Common formats include PDF, DOCX, and XLSX, with PDF being widely used for its reliability and ease of sharing. pdfFiller's capabilities not only allow for easy editing but also support conversions between these formats to ensure flexibility.

Using pdfFiller features to enhance document experience

Navigating the Key Information Document process

The process of handling a Key Information Document can seem overwhelming, filled with various nuances and detailed requirements. Addressing frequently asked questions can alleviate concerns, while troubleshooting common issues can ensure a smoother experience for all parties involved.

Resources available for support

When in doubt, seeking advice from established resources can considerably ease the process. Industry-specific forums, online courses about financial documentation, and dedicated support teams for your chosen document management service can provide the additional insights needed to navigate complexities.

Exploring job opportunities related to KIDs

As knowledge about Key Information Documents becomes integral in various sectors, several job roles emphasize expertise in these areas. Positions requiring specialized knowledge of KIDs are on the rise, encompassing roles in finance, compliance, and administrative support.

Search jobs: Roles utilizing KIDs

Customizing your Key Information Document

Customization of your Key Information Document can significantly enhance its relevance and usefulness. Leveraging template options available on platforms like pdfFiller can streamline this process, offering pre-designed layouts tailored for various use cases.

Best practices for document personalization

When personalizing a KID, consider factors such as the audience and purpose of the document. Use a clear and professional tone while ensuring that content is accessible to its intended readers. Gaining feedback from peers can also help identify areas for improvement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my key information document directly from Gmail?

Can I create an electronic signature for signing my key information document in Gmail?

How can I edit key information document on a smartphone?

What is key information document?

Who is required to file key information document?

How to fill out key information document?

What is the purpose of key information document?

What information must be reported on key information document?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.