Get the free Cost Accounting Standards Board Disclosure Statement for Educational Institutions

Get, Create, Make and Sign cost accounting standards board

Editing cost accounting standards board online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cost accounting standards board

How to fill out cost accounting standards board

Who needs cost accounting standards board?

Understanding Cost Accounting Standards Board (CASB) Forms

Overview of Cost Accounting Standards Board (CASB) forms

The Cost Accounting Standards Board (CASB) plays a pivotal role in federal contracting by establishing cost accounting standards that ensure consistency and transparency. CASB forms are essential tools for contractors to demonstrate compliance with these standards and maintain accountability in their financial practices.

Adhering to cost accounting standards is significant as it affects contract pricing, competitive positioning, and overall business integrity. By rigorously following these standards, contractors can minimize disputes with federal agencies and bolster their reputations.

Understanding the cost accounting standards

Diving deeper into the cost accounting standards, several key standards stand out. CAS 401 mandates consistency in estimating, accumulating, and reporting costs. This principle ensures contractors maintain a systematic approach to cost management and reporting, which is crucial for both operational integrity and compliance.

CAS 402 stipulates the need for consistency in allocating costs incurred for the same purpose, thereby preventing discrepancies between reported and actual costs. Another critical standard, CAS 403, deals with accounting for unallowable costs, which helps contractors understand which expenses cannot be billed to federal contracts.

For contractors, adhering to CAS can influence not just profitability but their overall compliance status. However, it’s important to note that challenges such as understanding the complexities of these standards or data management issues often hinder the implementation process.

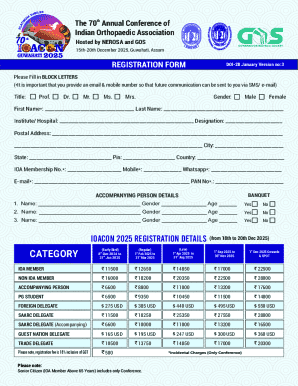

Detailed guide on completing the CASB form

Completing a CASB form doesn't have to be a daunting challenge. Here’s a step-by-step guide to effectively filling out the CASB form.

For instance, be sure you are clear on what constitutes a 'cost pool' and how to apply relevant allocation bases. Completing each section accurately is key to complying with federal requirements.

Interactive tools for form completion

pdfFiller provides a range of interactive tools to help with CASB form completion. The platform offers features that simplify the form-filling process, enabling users to focus on accuracy and compliance.

By utilizing pdfFiller's functionalities, users can quickly navigate complex forms and avoid unnecessary errors. From auto-population of fields to intuitive layout design, the platform enhances the overall efficiency of filling out CASB forms.

Editing and customizing CASB forms on pdfFiller

Editing your CASB form is straightforward with pdfFiller’s robust editing tools. Users can seamlessly annotate, add comments, or insert additional sections directly within the platform.

Maintaining version control is particularly essential in environments where multiple stakeholders may have access to the form. Thus, having clear documentation on revisions will help enforce accountability.

E-signing and document management

Obtaining e-signatures for CASB forms through pdfFiller is a simple but vital process that enhances compliance and expedites workflows. Following these steps can ensure smoother approval processes.

With real-time collaboration features, team members can review, comment, and finalize forms simultaneously, reducing delays and fostering a productive environment.

Compliance and record keeping for CASB forms

Ensuring compliance with CASB forms involves thorough record-keeping practices. Best practices to maintain compliance include regular audits and a clear compilation of regulatory requirements.

Utilizing pdfFiller's platform simplifies document retrieval and management, allowing contractors to locate past forms and relevant data efficiently, aiding in future compliance efforts.

Frequently asked questions (FAQs)

Contractors often have concerns regarding CASB forms, especially when errors occur. Knowing how to handle these situations is crucial for maintaining compliance.

Accessing customer support through pdfFiller can also alleviate concerns by providing timely guidance on handling CASB form-related issues.

Tailoring pdfFiller for your team’s needs

pdfFiller equips teams with features that promote collaboration and streamline processes. Teams can benefit from collaborative tools that allow for shared access and custom workflows for submission and approval of CASB forms.

Furthermore, leveraging feedback features within pdfFiller encourages continuous improvement, as firms can adapt workflows based on user experiences and outcomes.

Testimonials and case studies

Real-world experiences give context to the effectiveness of pdfFiller for CASB forms. Numerous teams have shared success stories where utilizing pdfFiller significantly enhanced their efficiency and compliance rates.

By streamlining form management, organizations have reported reduced processing times and fewer compliance-related disputes, showcasing the platform's positive impacts.

Next steps: Streamlining your document management

Exploring additional features of pdfFiller can further enhance document management processes. From integrating other forms to setting up personalized workflows, the platform caters to diverse organizational needs.

Setting up an account on pdfFiller is straightforward, allowing you to access a multitude of document tools efficiently. Initiate the sign-up process and enjoy a user-friendly setup that aligns with your specific requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my cost accounting standards board in Gmail?

How can I fill out cost accounting standards board on an iOS device?

Can I edit cost accounting standards board on an Android device?

What is cost accounting standards board?

Who is required to file cost accounting standards board?

How to fill out cost accounting standards board?

What is the purpose of cost accounting standards board?

What information must be reported on cost accounting standards board?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.