Get the free Form 5500

Get, Create, Make and Sign form 5500

Editing form 5500 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 5500

How to fill out form 5500

Who needs form 5500?

Comprehensive Guide to Form 5500: Understanding, Filing, and Managing Employee Benefits Reporting

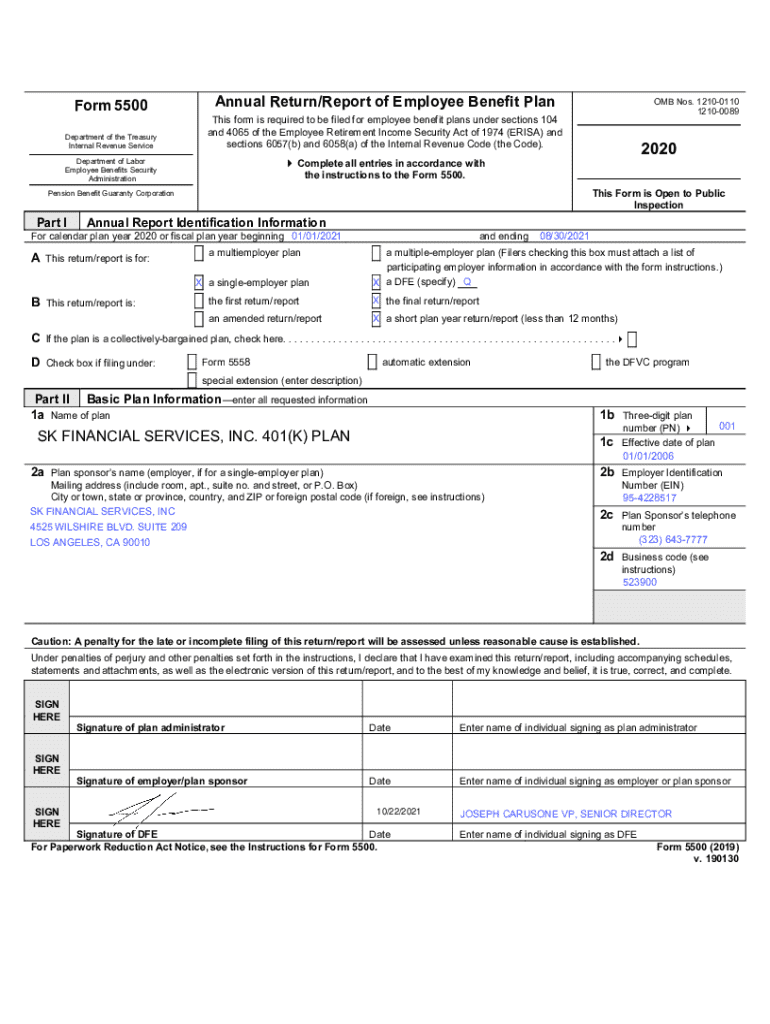

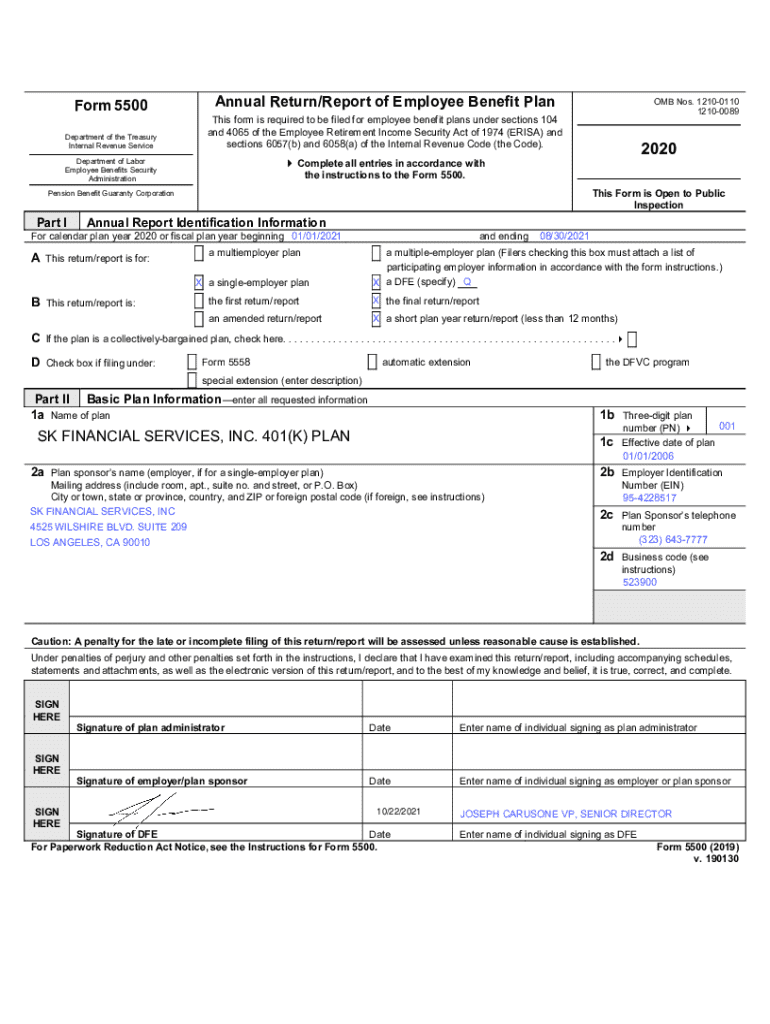

Understanding Form 5500

Form 5500 is a vital document required by the Employee Retirement Income Security Act (ERISA) for employee benefit plans, ensuring that organizations provide transparency regarding their benefit offerings. The primary purpose of this form is to collect information about the plan's financial condition, investments, and operations. Its importance lies in safeguarding employees’ rights and benefits by ensuring that plans are compliant with regulatory standards.

There are several types of Form 5500 that cater to different plans and requirements. The standard Form 5500 is typically used for larger plans, while smaller plans can use the simplified version, Form 5500-SF. Additionally, Form 5500-EZ is available for one-participant retirement plans. Understanding which form is applicable is crucial for compliance.

Organizations required to file Form 5500 include employers offering welfare benefit plans, pension plans, and certain employee stock ownership plans (ESOPs). However, there are exemptions for businesses with fewer than 100 employees, or certain plans that meet specific criteria, which allows them to forgo filing.

Filing requirements and deadlines

Filing Form 5500 necessitates gathering precise credentials and information regarding your employee benefit plan. This includes information on the plan's financial status, the number of participants, and benefit offerings. Organizations must ensure that they have complete and accurate data before filing, as mistakes can lead to penalties.

Understanding filing deadlines is crucial for compliance. Generally, the due date for filing Form 5500 is the last day of the seventh month after the plan year ends. For calendar-year plans, this means July 31. However, extensions can be obtained through Form 5558, which allows for an additional 2½ months for submission.

Late filings can result in substantial financial penalties, starting from $1,100 per day until the issue is rectified. To avoid heavier fines, plans can participate in the Delinquent Filer Voluntary Compliance Program (DFVCP), which allows late filings with reduced penalties if filed appropriately.

Preparing for Form 5500 filing

To effectively prepare for Form 5500 filing, organizations must begin by gathering all necessary information. This includes the detail of employee benefit plans, financial statements, and any additional schedules or attachments required. Clear organization of documents will streamline the filing process.

Creating a Department of Labor (DOL) account is essential for electronic filing. To set up your account, visit the DOL's EFAST2 website, where you'll need to provide an Employer Identification Number (EIN) and other relevant information to register and begin the submission process.

Choosing the correct form is critical; determine whether you need the standard Form 5500, 5500-SF, or 5500-EZ based on the number of participants in your plan. It's also important to understand how tax and payroll considerations intersect with this reporting requirement, ensuring compliance on all fronts.

The filing process for Form 5500

The process of filing Form 5500 can be straightforward if approached systematically. Start by completing your designated Form, ensuring all required information is filled out accurately. This includes relevant schedules and disclosures related to fees, investments, and operations.

Proofreading your submission is a vital step before final submission to prevent errors that could delay processing. Remember to submit your Form before the due date to avoid penalties.

Common errors to avoid during filing include not including all required schedules, incorrect EINs, missing signatures, and failing to check the number of participants. Additionally, if you're filing for a wrap plan, ensure that you understand the implications of reporting on each participant effectively.

After filing Form 5500

Post-filing, it's essential to check the status of your submission. You can track your filing through the Department of Labor’s EFAST2 system, where you can confirm if your Form has been accepted or if there are any issues that need addressing.

Handling amendments and corrections can be necessary if inaccuracies are found after submission. Amendments are filed using the same Form 5500 by marking it as an amended return on top. Additionally, be aware of common rejection reasons, such as missing signatures or discrepancies in data.

Frequently asked questions about Form 5500

A common query relates to whether Form 5500 is only for employee benefit plans. The short answer is no; while it is primarily used for these plans, it also applies to certain welfare plans, indicating any organization managing retirement plans must be aware of its requirements.

What should you do if you miss the deadline? Organizations can file late; however, it's advisable to utilize the DFVCP to mitigate penalties. If you find that you have made a duplicate filing, promptly correct the issue by contacting the DOL to clarify.

Enhancing employee benefits reporting

Enhancing the employee benefits reporting process involves effective communication strategies during open enrollment seasons. Articulating the value of benefits available can foster greater participation and understanding among employees.

Additionally, offering diverse and robust benefits packages can improve employee satisfaction and retention. Engaging employees in benefits planning encourages them to think about retirement and future planning, resulting in a more considerate workforce.

Leveraging technology for document management, such as pdfFiller, can streamline the creation, editing, and management of Form 5500. This cloud-based platform allows teams to work collaboratively, ensuring that everyone has access to the same documents and can make real-time edits easily.

Resources for assistance

When it comes to seeking help for filing Form 5500, consulting with professionals or legal advisors experienced in employee benefits can provide invaluable guidance. Utilizing resources like pdfFiller also facilitates document management, enabling easy access and revision of forms as needed.

For those looking to expand their knowledge, recommended topics for further learning encompass ERISA regulations, employee benefit planning, and guidelines on healthy benefit practices within organizations. Equipping oneself with the right tools and knowledge can simplify the filing process and ensure compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 5500?

How can I edit form 5500 on a smartphone?

How do I fill out form 5500 using my mobile device?

What is form 5500?

Who is required to file form 5500?

How to fill out form 5500?

What is the purpose of form 5500?

What information must be reported on form 5500?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.