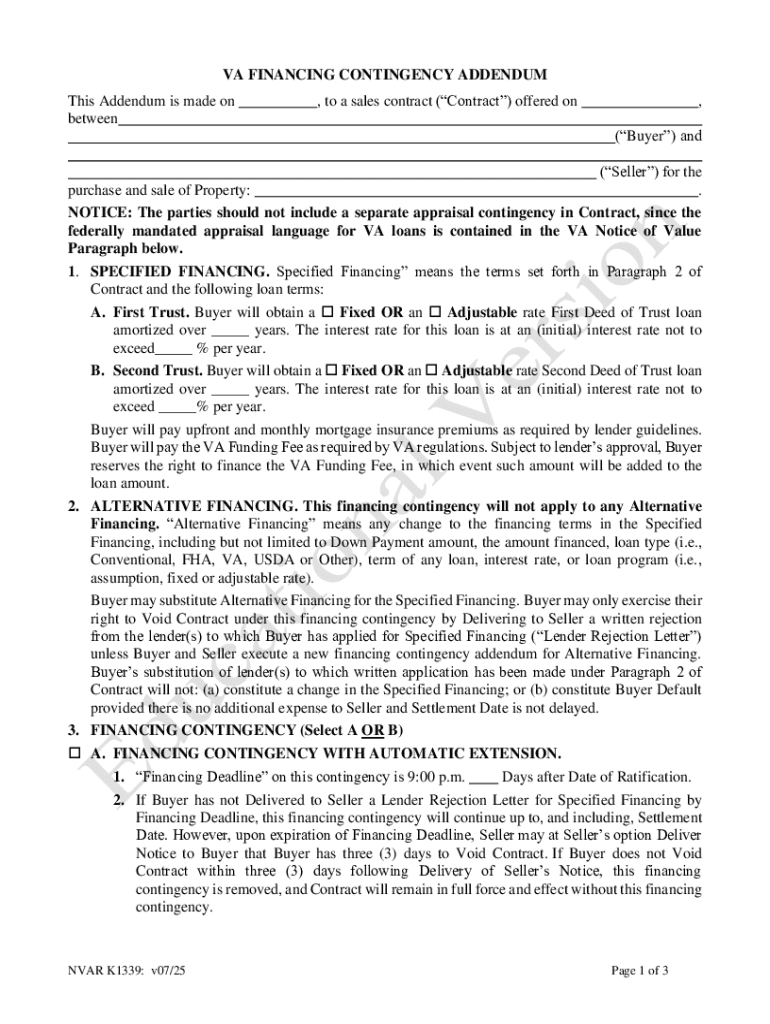

Get the free Va Financing Contingency Addendum

Get, Create, Make and Sign va financing contingency addendum

How to edit va financing contingency addendum online

Uncompromising security for your PDF editing and eSignature needs

How to fill out va financing contingency addendum

How to fill out va financing contingency addendum

Who needs va financing contingency addendum?

Understanding the VA Financing Contingency Addendum Form

Understanding the VA financing contingency addendum

The VA financing contingency addendum form is a crucial document in the home-buying process for veterans and active-duty service members utilizing VA loans. It provides a layer of protection for the buyer, ensuring they can secure necessary financing to purchase the property without penalty if the loan fails to be approved. This specific addendum plays a vital role in making the home-buying process smoother and more secure for veterans.

Understanding the importance of this addendum cannot be understated, as it facilitates a legally-binding agreement between the buyer and seller concerning the terms of financing. When properly executed, it helps both parties understand their rights and obligations, making it an essential tool in any real estate transaction involving VA financing.

Key components of the VA financing contingency addendum

The VA financing contingency addendum typically comprises several critical components that outline the terms of the financing and conditions under which the buyer can retain their deposit if the loan is not secured. Understanding these components is essential for both buyers and sellers to navigate financing smoothly.

Key sections include buyer and seller information, loan details, and specific contingency conditions. The addendum should detail the expectations and obligations of both parties related to the loan approval process, safeguarding genuine interests and ensuring transparency.

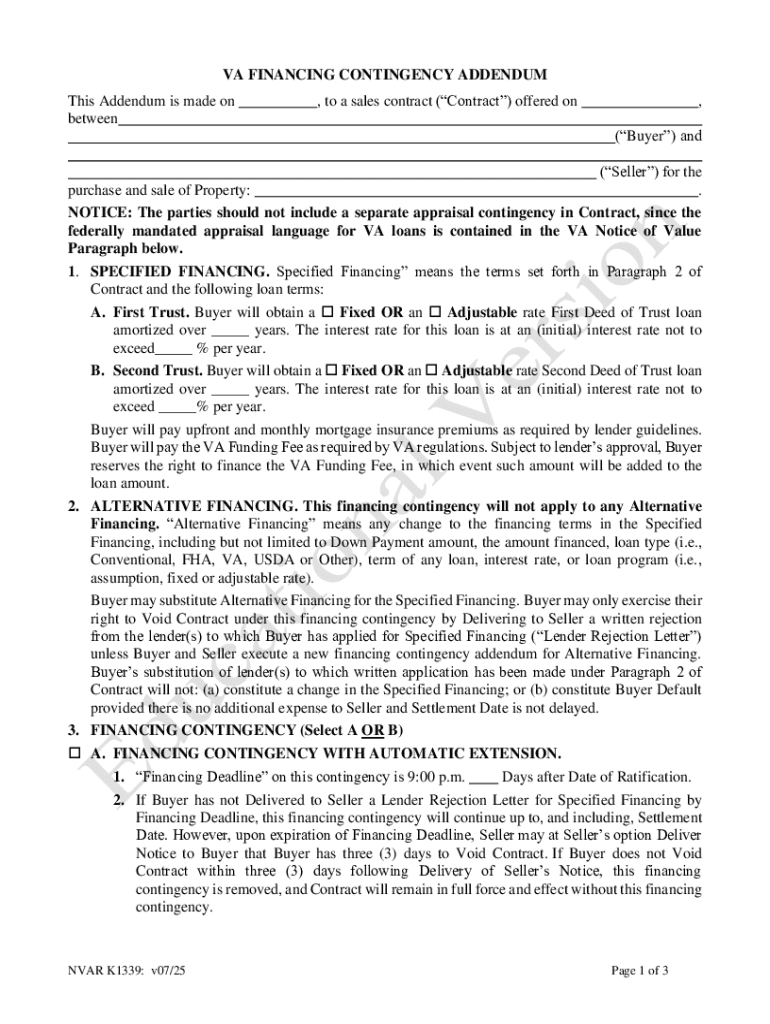

Step-by-step guide to completing the VA financing contingency addendum

Completing the VA financing contingency addendum is a straightforward process that requires careful attention to detail. Here’s a step-by-step guide to ensure all necessary information is accurately included.

Start by gathering the necessary information from both the buyer and seller. Key documentation for buyers may include evidence of VA eligibility, a pre-approval letter, and proof of income. Sellers need to provide details concerning the property and any outstanding financial obligations tied to it.

Editing and managing your VA financing contingency addendum

Once the VA financing contingency addendum is filled out, you may need to edit or manage the document. This can be vital for addressing any changes or updates required after the initial agreement.

Utilizing tools like pdfFiller simplifies this process by offering various features to collaboratively edit and manage documents. For example, stakeholders such as real estate agents can be involved by sharing the document and adhering to tracked changes to maintain clarity and consensus.

Common issues and solutions related to VA financing contingency

Despite its utility, the VA financing contingency addendum may present challenges. Delays in loan approval, issues with appraisals, or misunderstandings regarding default conditions can arise, complicating the transaction.

Identifying common issues and having solutions in mind beforehand helps expedite the process. For example, establishing clear communication between buyers, sellers, and lenders ensures everyone is on the same page — providing updates and addressing potential concerns as they arise.

Frequently asked questions (FAQs) about VA financing contingency addendum

Buyers and sellers often have questions about the implications and execution of the VA financing contingency addendum. Addressing these inquiries ensures a better understanding of the process and can alleviate potential concerns.

Real-life scenarios: Success stories with VA financing contingency

Understanding practical applications of the VA financing contingency addendum can provide insight. Numerous buyers have successfully navigated their home purchase by leveraging this addendum, providing a safety net that allows them to make offers confidently.

For instance, one family was able to secure their dream home after their original financing fell through. Utilizing the contingency, they were able to retract their offer with no financial penalties, subsequently securing a new lender who approved them within the contingency timeframe. Such success stories demonstrate the efficacy of using the VA financing contingency addendum wisely.

Expert tips for successfully navigating the VA financing contingency process

To successfully navigate the VA financing contingency process, both buyers and sellers must consider best practices and expert recommendations. Equipping oneself with knowledge is key to a smoother transaction.

For buyers, it may be beneficial to maintain open lines of communication with lenders and to have all necessary documentation prepared in advance. Sellers, on the other hand, should ensure they understand appraised values and have contingency clauses clearly defined and agreed upon in writing.

Innovations in document management with pdfFiller

In an increasingly digital world, managing documents effectively can significantly enhance the efficiency of real estate transactions. pdfFiller stands out with its innovative features that assist users in editing, signing, and managing documents seamlessly.

With functionalities like cloud storage, version tracking, and collaborative tools, pdfFiller empowers users to engage in a comprehensive document management experience. Testimonials frequently highlight the streamlined processes enabled by pdfFiller, proving valuable for buyers and sellers alike.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit va financing contingency addendum in Chrome?

How can I edit va financing contingency addendum on a smartphone?

How do I fill out va financing contingency addendum on an Android device?

What is va financing contingency addendum?

Who is required to file va financing contingency addendum?

How to fill out va financing contingency addendum?

What is the purpose of va financing contingency addendum?

What information must be reported on va financing contingency addendum?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.