Get the free Marks-roos Yearly Fiscal Status Report

Get, Create, Make and Sign marks-roos yearly fiscal status

Editing marks-roos yearly fiscal status online

Uncompromising security for your PDF editing and eSignature needs

How to fill out marks-roos yearly fiscal status

How to fill out marks-roos yearly fiscal status

Who needs marks-roos yearly fiscal status?

Comprehensive Guide to the Marks-Roos Yearly Fiscal Status Form

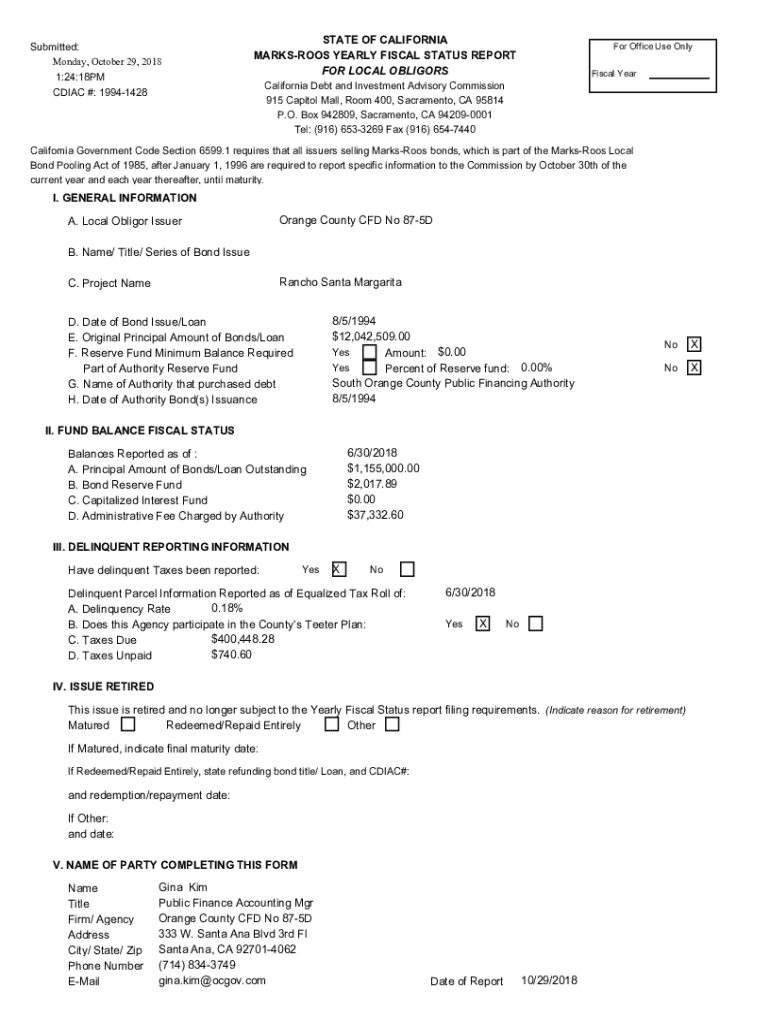

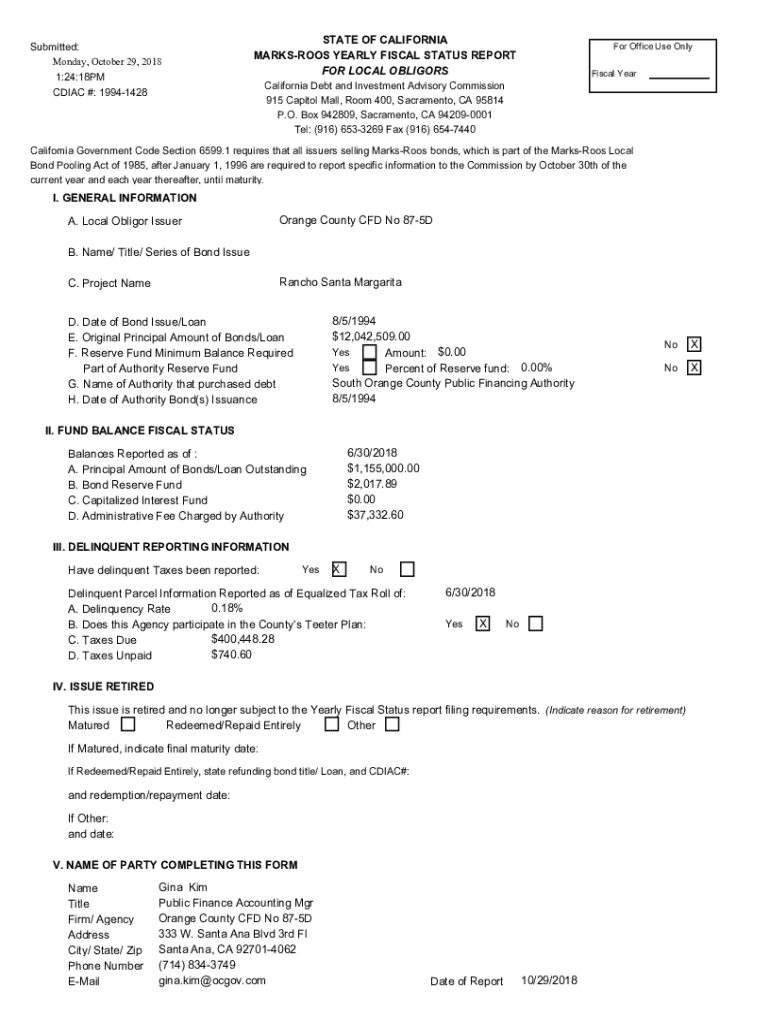

Overview of the Marks-Roos Yearly Fiscal Status Form

The Marks-Roos Yearly Fiscal Status Form plays a pivotal role in California's governmental financial framework. Designed primarily for local agencies, the form captures essential financial data that informs the decision-making processes of various public entities. By mandating transparency and accountability, it not only helps in fostering trust within communities but also ensures that agencies maintain fiscal responsibility.

The significance of the Marks-Roos form extends beyond mere compliance; it serves as a critical tool for assessing the economic health of local jurisdictions. The timely completion of this form provides insight into how agencies are managing their resources, ultimately affecting public service delivery.

Deadlines for submission are crucial; agencies must submit their forms by established due dates each year to remain compliant. Typically, these deadlines align with fiscal year-end practices, and compliance can vary by agency type, necessitating vigilance from local officials.

Understanding the components of the form

The Marks-Roos Yearly Fiscal Status Form comprises several key sections that require specific information to provide a complete financial overview. One of the primary sections includes financial information, where agencies must report on their revenues, expenses, and overall financial health. Being accurate in this section is paramount, as the data is used for statewide assessments.

Moreover, precise agency information is crucial. This section typically requires agencies to include their legal name, operating address, and contact details. Inaccuracies can cause delays and may result in penalties, making it essential for agencies to verify these details thoroughly.

The budget reports section demands careful attention to detail, as these reports serve as financial blueprints for agency operations. They reflect past performance and set expectations for future funding, thus directly influencing resource allocation.

Preparing to complete the Marks-Roos form

Preparation is key when it comes to completing the Marks-Roos Yearly Fiscal Status Form. Gathering all required documents in advance can streamline the submission process, ensuring accuracy and timeliness. Agencies should compile financial statements, previous fiscal reports, and budget forecasts—documents that often form the basis for the data entered in the form.

It's equally important to engage relevant stakeholders during the preparation phase. This not only encourages collaborative accuracy but also facilitates a shared understanding of the form's importance among team members. Fostering a team approach enhances the preparation process and reduces the likelihood of errors.

Organizing data in a clear format before starting the form helps prevent last-minute confusion and ensures that each piece of information can be allocated efficiently into the correct section.

Step-by-step instructions to complete the Marks-Roos form

Loading the Marks-Roos Yearly Fiscal Status Form is straightforward when leveraging pdfFiller. The initial step involves creating an account on their platform, which allows for efficient document management and submission tracking. Start by navigating to the pdfFiller website, and search for the Marks-Roos form template, ensuring you select the most up-to-date version.

Once the form is accessible, begin filling out the financial information section. Using pdfFiller's user-friendly tools can enhance accuracy in data entry, as they allow for easy calculations and adjustments.

It's vital to review all agency details meticulously before submission, as discrepancies can lead to delays or rejection by reviewing authorities. Furthermore, utilizing pdfFiller's eSignature feature can provide a formalized touch to your submission, seamlessly recording approval.

Editing and managing your Marks-Roos form with pdfFiller

One of the primary advantages of using pdfFiller is the ability to edit documents even after submission. If any alterations are necessary post-filing, the comprehensive editing tools offered by pdfFiller allow users to make changes easily without starting from scratch.

For teams working together, pdfFiller facilitates collaboration by allowing multiple users to review and make necessary revisions within the platform. This function promotes real-time updates and collective input, ensuring that everyone remains on the same page without complex email chains.

Maintaining prior versions of the Marks-Roos form is essential for reference, especially when scrutiny arises or comparative analysis is needed.

Common challenges and troubleshooting tips

Completing the Marks-Roos Yearly Fiscal Status Form may present a few challenges. Among the most common issues are rejections from reviewing authorities due to inaccuracies or missing data. Understanding typical reasons for rejection can help agencies avoid pitfalls and ensure smooth processing.

Resolving input errors involves a combination of careful review and an understanding of the terminology used throughout the form. pdfFiller provides avenues for customer support, which proves beneficial when specific issues arise, offering users access to specialized assistance.

Proactive measures can mitigate these challenges and enhance compliance with the Marks-Roos form requirements.

Best practices for filing the Marks-Roos Yearly Fiscal Status Form

Filing the Marks-Roos Yearly Fiscal Status Form effectively hinges on adherence to best practices. First and foremost is the importance of timeliness; completing the form well in advance of deadlines can alleviate stress and facilitate thorough review. Additionally, prioritizing accuracy is essential; double-checking figures and ensuring all required information is included can prevent unnecessary issues.

Being informed about changes in reporting requirements can give agencies a significant edge in preparation. Regularly reviewing guidelines and updates can ensure that agencies remain compliant with the latest regulations, thus maintaining credibility and operational efficacy.

These best practices not only promote efficiency but also contribute to the overall financial integrity of local agencies, ensuring they serve their communities effectively.

Interactive tools for effective document management

pdfFiller's platform offers interactive features that enhance the overall document management experience. The use of templates allows agencies to customize their responses, creating a consistent and professional presentation each time they complete the Marks-Roos Yearly Fiscal Status Form. Customization options ensure that the unique needs of different local agencies are addressed effectively.

Additionally, the cloud accessibility feature provides users with the flexibility to manage documents from anywhere at any time. This feature is invaluable for teams working remotely or across multiple locations, allowing for continuous collaboration and access to necessary files without delay.

These features not only make the process more streamlined but also enhance communication and collaboration among team members, thereby facilitating smoother submissions of the Marks-Roos Yearly Fiscal Status Form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my marks-roos yearly fiscal status directly from Gmail?

How do I execute marks-roos yearly fiscal status online?

How can I fill out marks-roos yearly fiscal status on an iOS device?

What is marks-roos yearly fiscal status?

Who is required to file marks-roos yearly fiscal status?

How to fill out marks-roos yearly fiscal status?

What is the purpose of marks-roos yearly fiscal status?

What information must be reported on marks-roos yearly fiscal status?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.