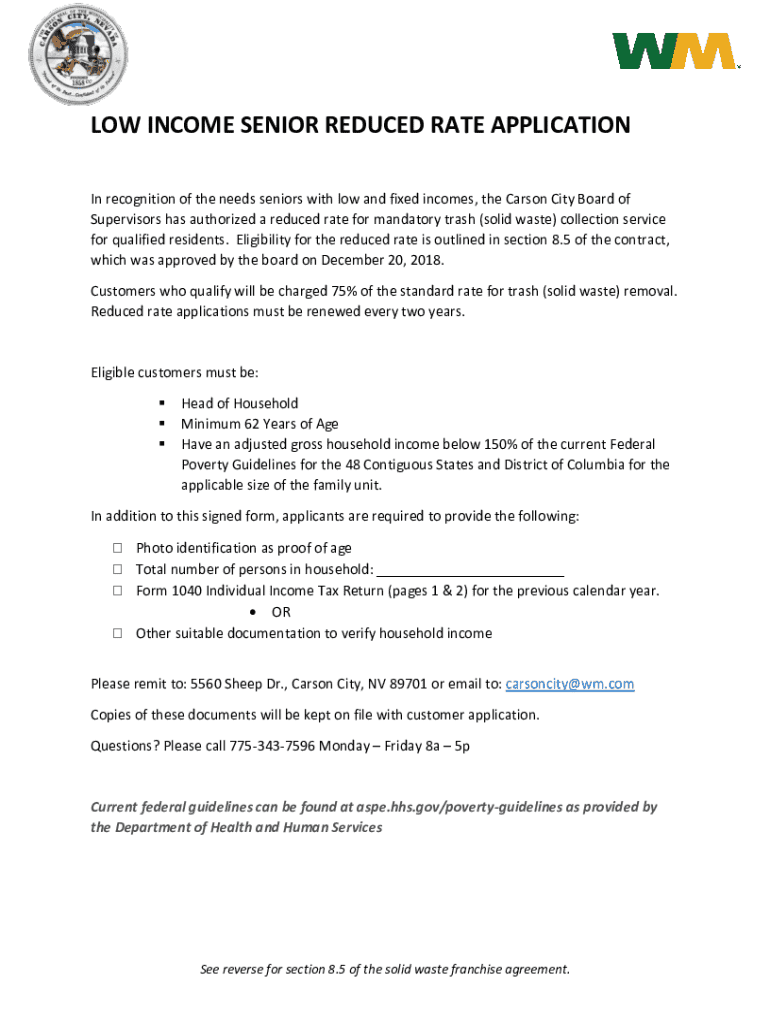

Get the free Low Income Senior Reduced Rate Application

Get, Create, Make and Sign low income senior reduced

How to edit low income senior reduced online

Uncompromising security for your PDF editing and eSignature needs

How to fill out low income senior reduced

How to fill out low income senior reduced

Who needs low income senior reduced?

Low Income Senior Reduced Form: A Comprehensive Guide

Understanding the low income senior reduced form

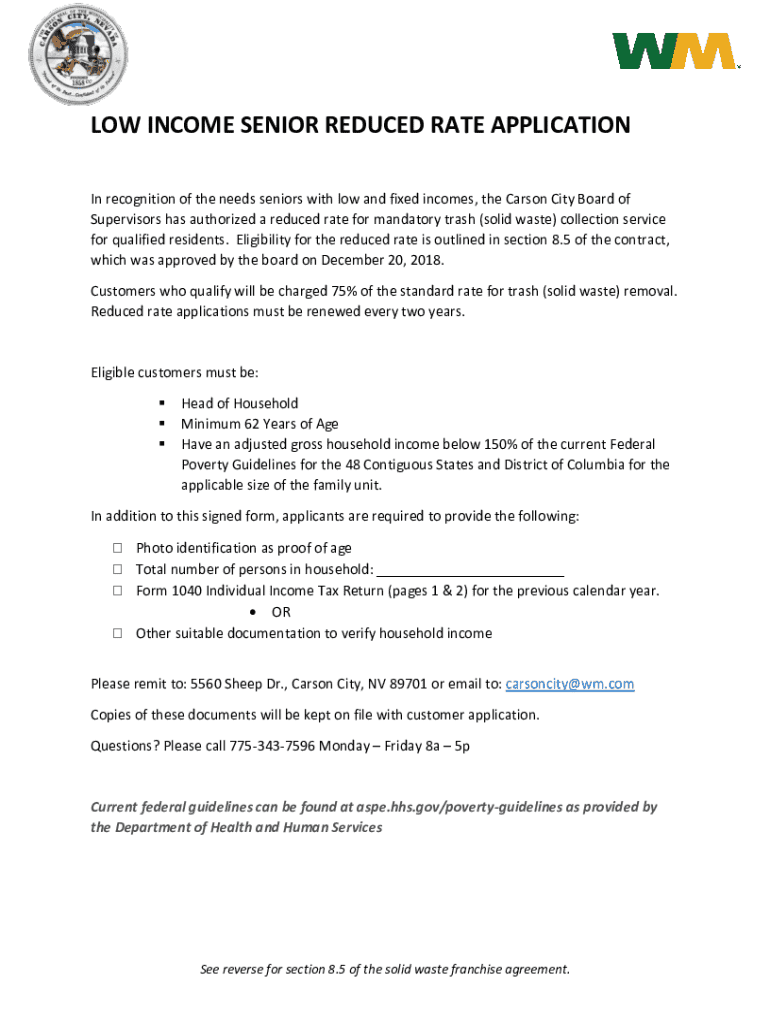

The low income senior reduced form is a crucial document designed to assist eligible seniors in securing financial relief and other social benefits. It acts as an application for various forms of aid that are available to seniors facing financial hardships. Completing this form can significantly ease the financial burden on low-income seniors, providing them with essential reductions in taxes and access to several benefit programs.

For many seniors, particularly those living on fixed incomes, the low income senior reduced form serves not only as a financial tool but also as a crucial resource for maintaining their quality of life. By identifying and addressing key eligibility criteria and benefits, this form becomes an invaluable asset for elderly individuals aiming to manage their financial affairs more effectively.

Eligibility criteria

To qualify for the low income senior reduced form, applicants must meet specific eligibility criteria. The primary condition is age; most states require applicants to be at least 65 years old. However, some regions may extend eligibility to younger individuals who are disabled or have specific health conditions.

Income limits play a significant role in the eligibility determination. Generally, these limits are tied to the federal poverty level and may vary by state. Additionally, applicants often need to demonstrate residency in the country or state where they are applying. Other essential qualifications may include providing proof of assets and confirming that the applicant does not own excessive property that could affect eligibility.

Benefits of the low income senior reduced form

The low income senior reduced form offers numerous financial benefits that can be instrumental in alleviating the economic pressures faced by many seniors. A primary advantage involves potential tax reductions and exemptions. By filing the form, eligible seniors can receive significant relief on their property taxes and other local taxes, enabling them to allocate more of their scarce resources toward essential living expenses.

Beyond financial implications, the social benefits provided through the low income senior reduced form are remarkable. Filling out this form can grant seniors access to additional support programs that provide food, healthcare, and transportation assistance. Community resources available to seniors, such as local non-profit organizations and state programs, often rely on applicants’ completion of this form to gauge qualifications for various aids.

Preparing to complete the form

Before filling out the low income senior reduced form, it’s essential to gather the necessary documentation. This will streamline the application process and ensure that you have everything required to qualify. Proof of income is paramount; this may include recent tax returns, pay stubs, or benefit statements from Social Security or other programs. Additionally, identification documents like a government-issued ID and proof of residency, such as utility bills or rental agreements, are mandatory.

Equipped with these documents, seniors can better navigate key terms present in the low income senior reduced form. Familiarizing oneself with the definitions of specific terms used—like ‘household income’ or ‘assets’—can help prevent misunderstandings and ensure that the application is filled out correctly. Understanding the jargon empowers seniors to present their situation accurately.

Step-by-step guide to filling out the low income senior reduced form

Accessing the low income senior reduced form is the first step in the application process. The form is typically available through your state’s department of revenue website or local government offices. Many states provide downloadable PDFs and online options that allow for easier completion within a digital environment, perfectly aligning with the capabilities offered by pdfFiller.

Once you have the form, simply filling it out may seem straightforward, but attention to detail is paramount. Begin by accurately reporting personal information such as your name, address, and contact information. Ensure all details are correct to avoid delays. When reporting income, include all sources of income, including pensions, Social Security, or any part-time job earnings. Identifying household information is also crucial; list all members residing in your home and clarify their relationships. Finally, review the submission options available—either online or by mail—and adhere to any deadlines stipulated by your local government.

Common mistakes to avoid

Applying for the low income senior reduced form can be daunting, especially when it comes to ensuring accuracy. One common mistake is submitting incomplete applications. Missing information can lead to delays or even denial of benefits. It is essential to carefully review each section and ensure all data provided is complete before submission.

Another frequent error is misreporting income or not including all household members, which might affect eligibility. Seniors should take the time to calculate their total income accurately and include any additional resources that may fall under the reporting guidelines. Missing submission deadlines can also jeopardize the application, as some states have specific timelines for filing. Lastly, remember to provide all required documentation; failure to submit these with the form can lead to denial.

Managing your application status

Once you have submitted your low income senior reduced form, managing your application status becomes vital. Many applicants are unsure about how to follow up. To check the status, applicants can contact their local revenue department or the office where the form was submitted. Some states now offer online tracking options, allowing seniors to easily verify the current status of their applications from the comfort of their homes.

In the event that your application is denied, it is important to understand the reasons behind the decision. Typically, denial notices outline the specific factors that led to disqualification. Seniors should carefully review this information and explore the next steps, which may include appealing the decision or reapplying with corrected details to satisfy eligibility criteria.

Additional support for seniors

Support for seniors applying for the low income senior reduced form extends beyond filling out the paperwork. Numerous local assistance programs exist to help seniors throughout the application process. These may include community centers, senior advocacy groups, and non-profit organizations that provide guidance on how to fill out the form and gather the necessary documents. It’s beneficial to seek out these local resources, as they can offer personalized assistance tailored to seniors’ specific needs.

Utilizing a tool like pdfFiller can greatly enhance the experience of managing the low income senior reduced form. With its cloud-based platform, pdfFiller empowers users to easily edit, sign, and manage their documents online. The accessibility of cloud storage ensures that all forms, including the low income senior reduced form, are conveniently stored and retrievable from anywhere, easing anxiety about lost paperwork and providing a streamlined approach to managing these crucial documents.

Case studies and success stories

Several seniors have successfully navigated the low income senior reduced form, leading to substantial financial relief and access to crucial resources. For instance, one recipient from California reported that by filling out the form, she received significant reductions on her property taxes, resulting in thousands of dollars in savings that she could allocate toward her medical expenses. Such success stories highlight the genuine positive impact this form can have on the lives of seniors.

Moreover, testimonials from users of the low income senior reduced form underline the ease of use when accessing online resources and community assistance. Seniors appreciate the support from local non-profits that guided them through the application process, underscoring the collaborative efforts available to ensure beneficiaries can effectively navigate their financial challenges.

Frequently asked questions (FAQs)

As you consider applying for the low income senior reduced form, questions may arise about various aspects of the process. Common queries typically revolve around eligibility criteria, documentation requirements, and submission timelines. Many seniors wonder what to do if they encounter issues with the online application process or if they need to amend a submitted form.

For those seeking troubleshooting tips, it's crucial to contact local assistance resources. They often provide valuable insights regarding specific application concerns and can guide seniors through addressing them effectively. Engaging with community support networks ensures that any hurdles encountered during the application process are met with guidance and resourcefulness.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit low income senior reduced in Chrome?

Can I edit low income senior reduced on an iOS device?

How do I edit low income senior reduced on an Android device?

What is low income senior reduced?

Who is required to file low income senior reduced?

How to fill out low income senior reduced?

What is the purpose of low income senior reduced?

What information must be reported on low income senior reduced?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.