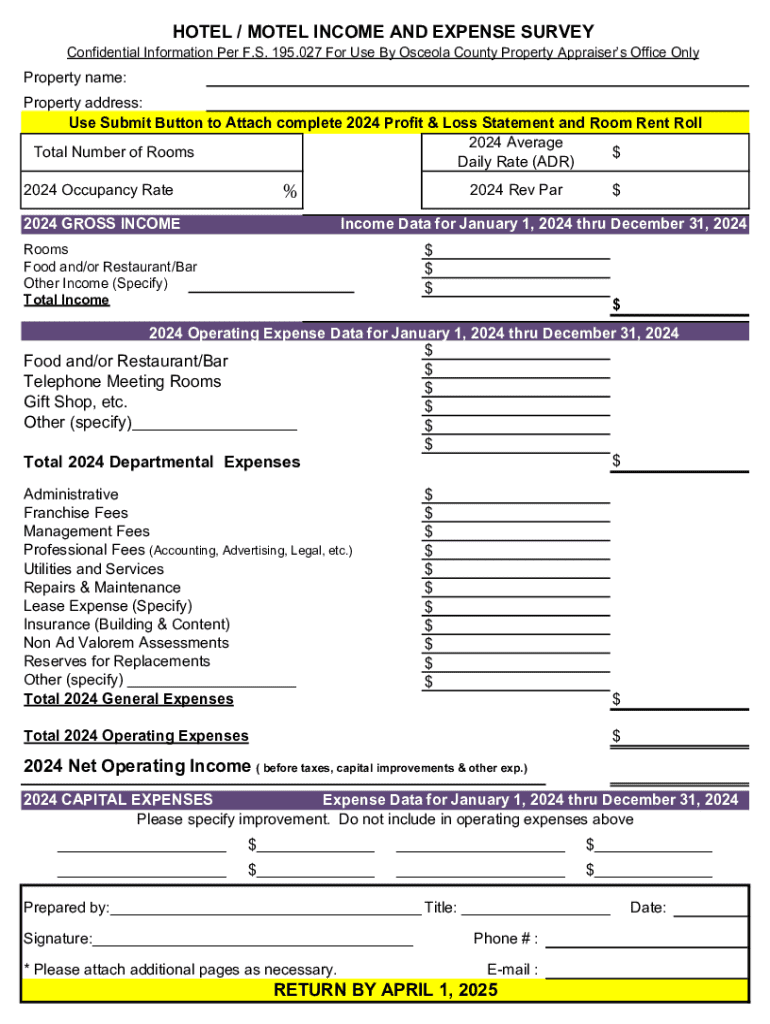

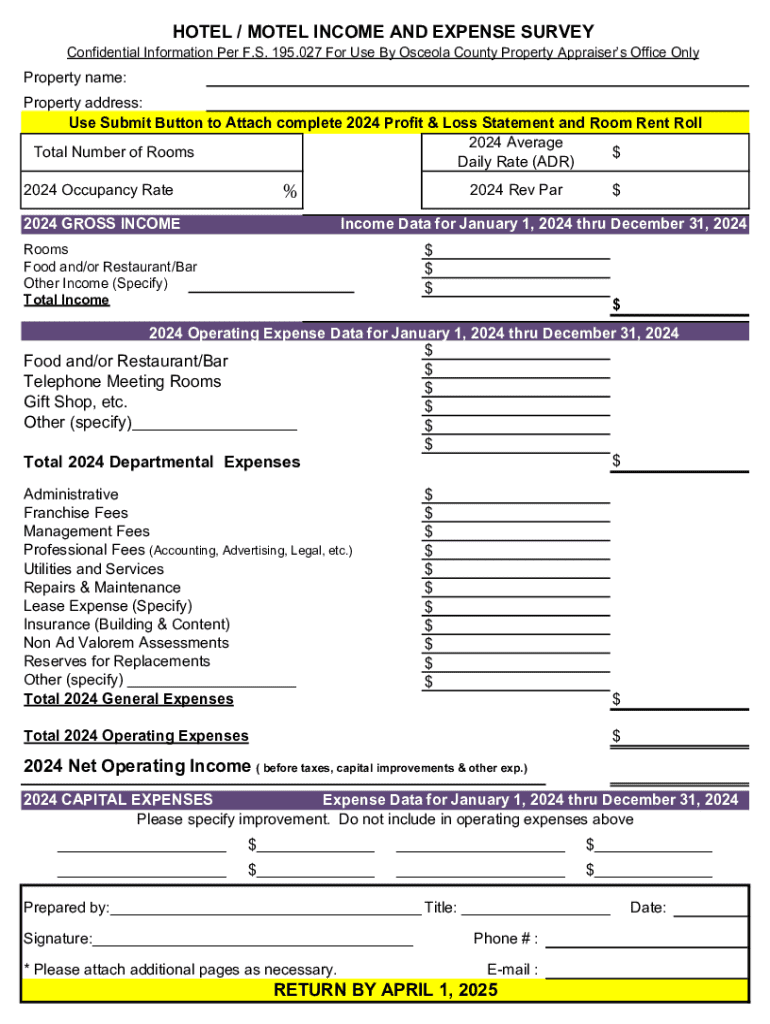

Get the free Hotel / Motel Income and Expense Survey

Get, Create, Make and Sign hotel motel income and

How to edit hotel motel income and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hotel motel income and

How to fill out hotel motel income and

Who needs hotel motel income and?

Understanding hotel motel income and form

Understanding hotel and motel income

Hotel and motel income encompasses various revenue streams generated from accommodating guests and offering additional services. This includes not only the revenue from room bookings but also from food and beverage sales, amenities like spas and gyms, and other ancillary services. By breaking down income into different categories, hotel operators can gain a clearer picture of their financial performance.

Accurate reporting of hotel motel income is crucial for several reasons. First, it ensures compliance with tax regulations, allowing businesses to avoid penalties and fines. Additionally, insightful financial reporting aids in effective financial planning, providing management with data necessary to make informed decisions. Strikingly, the hospitality sector is known for its many income sources, which can range from direct room revenue to less obvious avenues such as group bookings and event hosting.

Key forms for reporting hotel and motel income

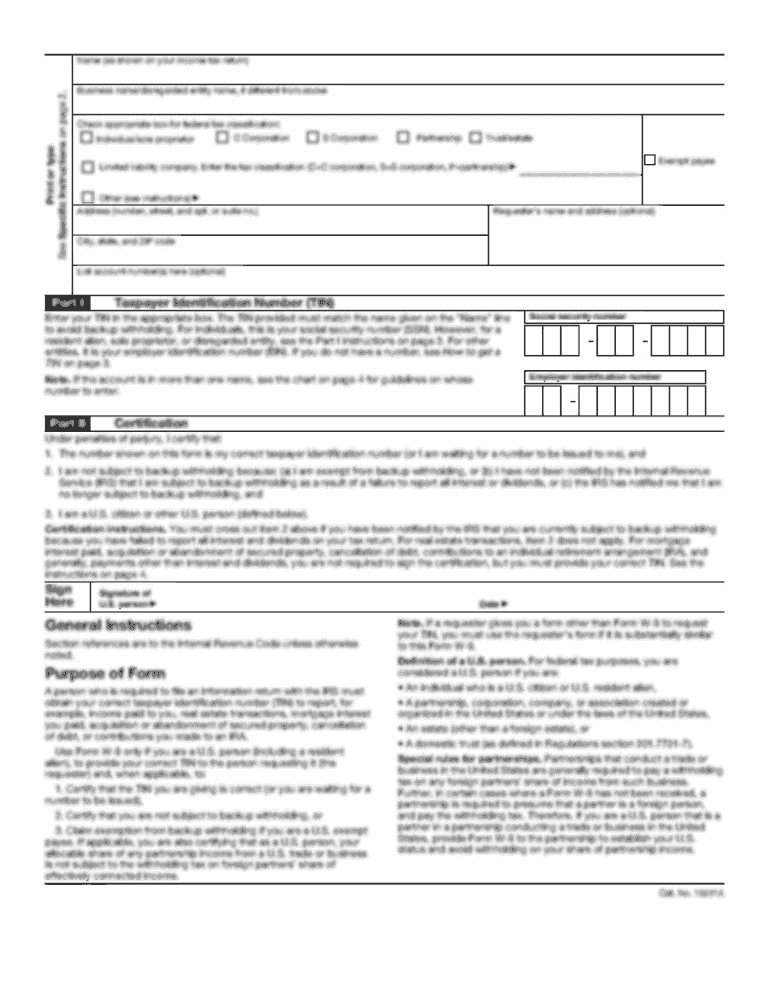

Reportings for hotel motel income necessitate specific forms that vary depending on jurisdiction. Primarily, IRS forms facilitate income verification for tax purposes, while various state-specific documents ensure compliance with regional regulations. Understanding these forms is pivotal for accurate financial reporting. For instance, IRS Form 1040 is often used alongside additional schedules that capture business income and expenses.

Every hotel owner must be familiar with the most pertinent forms and their purposes. The right forms can streamline the income reporting process and underscore the financial health of the establishment. Addressing eligibility requirements leads to smoother interactions with tax agencies, thus ensuring businesses stay compliant and avoid unnecessary complications.

Step-by-step guide to completing the income form

Before one begins filling out the income form, gathering all relevant documentation is essential. This includes receipts from guests, invoices from suppliers, and bank statements that reflect overall revenue. Without these, the accuracy of the report can be jeopardized. Thus, readiness is key; the more organized the records, the smoother the reporting process becomes.

Completion of the income form should be systematic. Starting with personal information, then moving on to report hotel revenue, and concluding with additional income sources needs a clear strategy to avoid missed or erroneous entries. One common mistake is neglecting to report ancillary services, which could provide a misleading picture of total revenue. As a best practice, employing a methodical review and verification process before submission can significantly enhance accuracy.

Tools and resources for managing hotel and motel income

Adopting document management solutions greatly benefits hotel and motel management by creating a fluid approach to handling various forms and reports. Platforms like pdfFiller offer cloud-based solutions ideal for ensuring documents are accessible from anywhere, facilitating teamwork needed for effective financial management.

An added benefit of using solutions like pdfFiller is their comprehensive tools for enhancing document workflows. Users can edit existing PDFs, eSign documents, and collaborate on files seamlessly. These capabilities also assist in maintaining historical documents, improving overall management efficiency.

Best practices for managing and reporting income

Establishing regular documentation practices can lead to improved accuracy and efficiency for hotel and motel income tracking. Implementing daily, weekly, and monthly processes to document transactions will ensure financial records are always up to date. This approach not only streamlines year-end reporting but allows for mid-year adjustments as necessary, mitigating any surprises during tax season.

Integrating financial software with reporting capabilities further enhances the process. This type of software helps streamline reports and reduces the manual workload required for accurate income reporting. Moreover, performing regular audits and compliance checks can provide peace of mind, ensuring adherence to all tax regulations pertinent to the hospitality sector.

Troubleshooting common challenges

Inconsistencies in income reports can pose significant challenges for hotel and motel owners. Identifying discrepancies can be tricky and often requires a thorough audit trail that accounts for every revenue source. A helpful strategy is to reconcile reports against bank statements regularly, allowing for the immediate identification of any significant variances that need addressing.

Moreover, staying informed about tax regulations is paramount, especially as changes in tax laws can impact reporting requirements and obligations. Keeping abreast of updates in the hospitality sector can save time and prevent legal issues. For more complex situations, seeking professional guidance from financial advisors or accountants can ensure compliance and provide clarity on ambiguous tax rules.

FAQs about reporting hotel and motel income

In the realm of hotel and motel income reporting, questions frequently arise. For instance, many owners wonder what to do if they receive a tax notice. It’s vital to address notices promptly and consult with a tax professional to ensure proper response and compliance. Additionally, understanding how to deal with losses or damages to all the properties, and when income should be reported, is crucial to maintaining accurate records.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send hotel motel income and to be eSigned by others?

Can I create an electronic signature for signing my hotel motel income and in Gmail?

Can I edit hotel motel income and on an Android device?

What is hotel motel income?

Who is required to file hotel motel income?

How to fill out hotel motel income?

What is the purpose of hotel motel income?

What information must be reported on hotel motel income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.