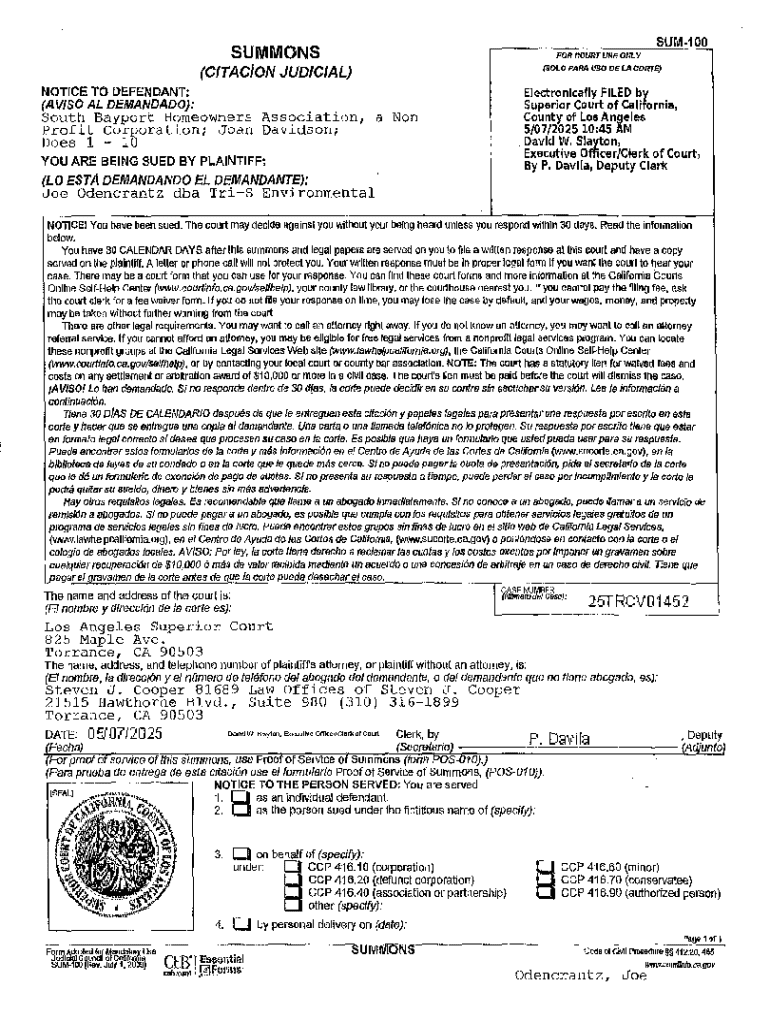

Get the free Sum-100

Get, Create, Make and Sign sum-100

Editing sum-100 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sum-100

How to fill out sum-100

Who needs sum-100?

Comprehensive Guide to the SUM-100 Form: Your Essential Resource

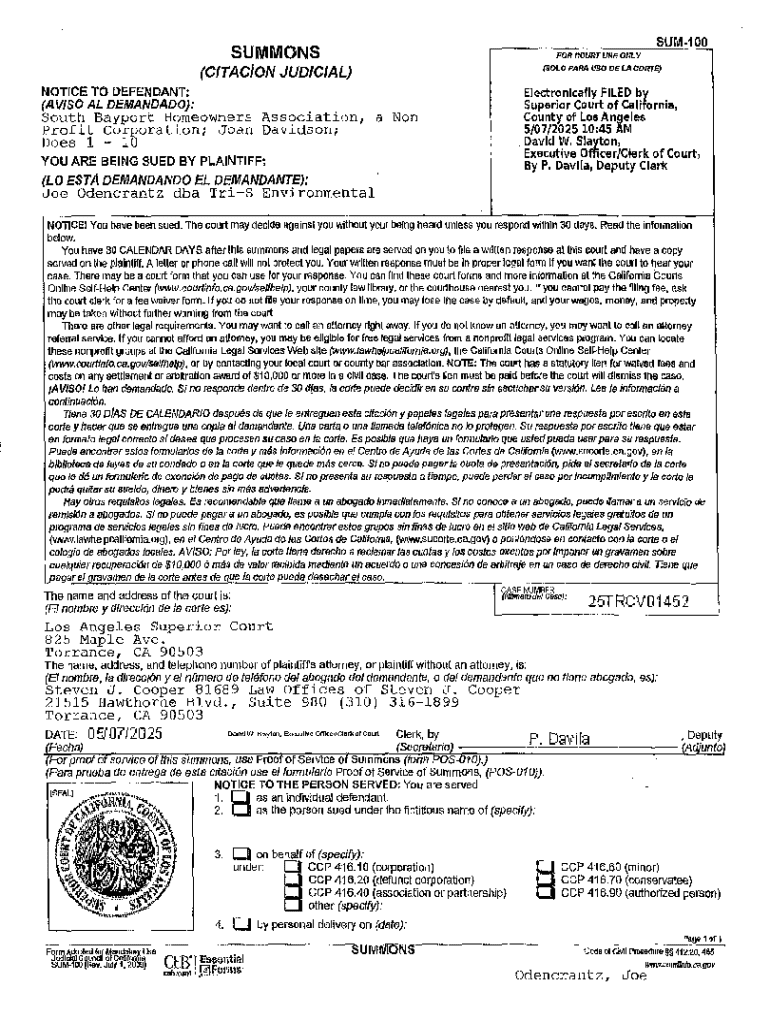

Understanding the SUM-100 Form

The SUM-100 form, or the Plaintiff's Claim and ORDER to Go to Small Claims Court, is a critical document used in California for initiating small claims proceedings. Its primary purpose is to officially notify the defendant of the claim being made against them and to outline the specifics of the dispute. This form is crucial not only for announcing the claim but also for ensuring that the defendant understands the nature of the claims, allowing for a proper response.

In the context of debt collection, the SUM-100 form becomes a vital piece of the legal framework that governs civil summons in California. By properly completing and submitting this form, a claimant can pursue the recovery of debts, thus facilitating the resolution of financial disputes without resorting to lengthy litigation.

Key components of the SUM-100 Form

Understanding the structure of the SUM-100 form is essential for both claimants and defendants. The document is divided into several sections, each serving a specific purpose. The first section typically introduces the parties involved, including their names, addresses, and contact information. It’s essential to provide accurate details here, as this information can influence the entire claim process.

Next, the form requires a comprehensive overview of the case information, which should include the nature of the dispute and the specific amounts owed. This section should also highlight any claims being made, allowing the court to understand the basis of the plaintiff's request. The clarity and completeness of these sections are fundamental to the successful navigation of the small claims process.

Completing the SUM-100 Form

Filling out the SUM-100 form accurately is essential to avoid delays in your case. Here’s a step-by-step breakdown to assist you in completing it.

Be aware of common mistakes, such as missing signatures or incorrect case information. Double-check all entries before submitting the form to ensure everything is in order.

Filing the SUM-100 Form

Once completed, the next step involves filing the SUM-100 form. Thorough understanding of this process will minimize complications. Here’s how to proceed:

After filing, it’s essential to be aware of the timeline. Courts typically notify defendants of the claim via mail, and knowing the timeline of notifications will help you manage case expectations effectively.

Responding to a SUM-100 Summons

If you are the defendant receiving a SUM-100 summons, there are important steps you must take. First, understand your options for responding, which can include filing an answer or disputing the claim.

Failing to respond could lead to a default judgment against you, making it imperative to act quickly and professionally.

Further actions and alternatives

If you find yourself embroiled in a small claims matter, consider your options beyond a basic response. Engaging in a cross-complaint can be appropriate if you believe you have claims against the plaintiff.

Each option carries specific implications, and being well-informed is critical to navigating your legal journey effectively.

Additional legal forms related to the SUM-100

In the course of your small claims proceedings, it's vital to be prepared with additional paperwork. Various other forms may complement your SUM-100 submission.

Advanced considerations in debt collection

Understanding the broader context of debt collection can enhance your strategic approach during proceedings. This includes knowledge of statutes of limitation, which dictate how long you have to pursue a claim.

Implementing these strategies will empower you to effectively manage subsequent court proceedings and increase your chances for a favorable outcome.

Documentation and record management

Efficient document management is crucial in legal proceedings. Utilizing pdfFiller’s cloud-based solutions can streamline your processes significantly. With features designed for optimal organization, you can enhance your experience with the SUM-100 form.

FAQs about the SUM-100 Form

Understanding common questions surrounding the SUM-100 form can demystify the process. Here are frequently asked questions along with expert answers.

These insights aim to equip you with the knowledge needed to navigate your small claims journey effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get sum-100?

How do I make changes in sum-100?

How do I edit sum-100 on an Android device?

What is sum-100?

Who is required to file sum-100?

How to fill out sum-100?

What is the purpose of sum-100?

What information must be reported on sum-100?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.