Get the free Application Form for Rtgs/neft/internal Transfer

Get, Create, Make and Sign application form for rtgsneftinternal

Editing application form for rtgsneftinternal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application form for rtgsneftinternal

How to fill out application form for rtgsneftinternal

Who needs application form for rtgsneftinternal?

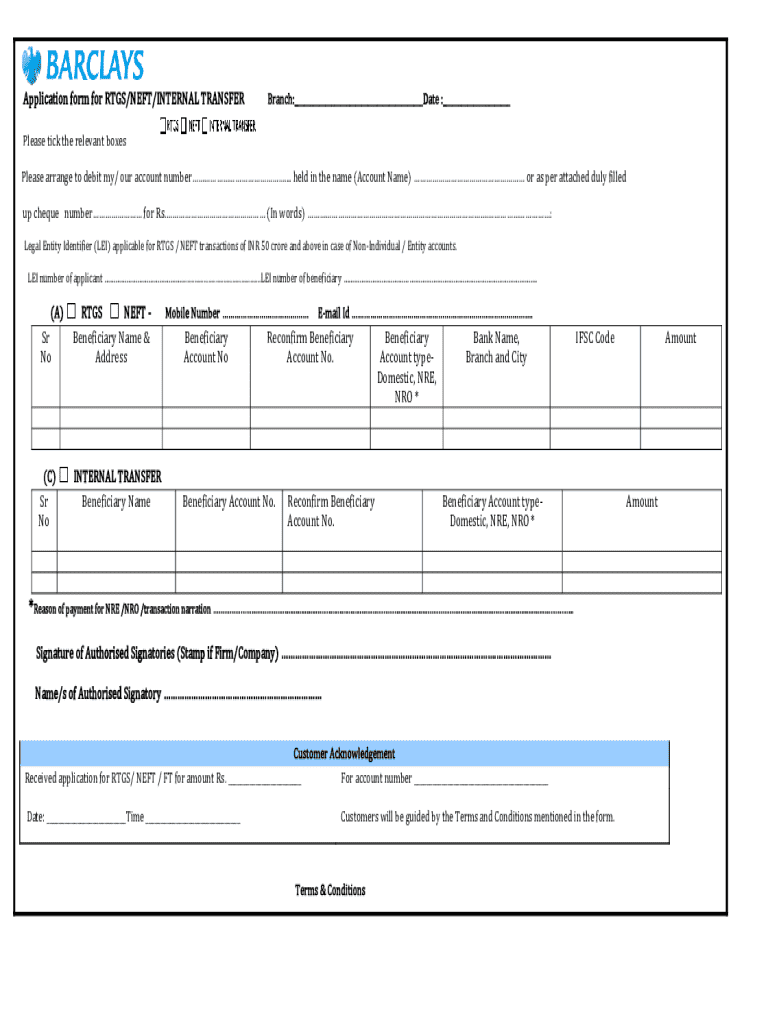

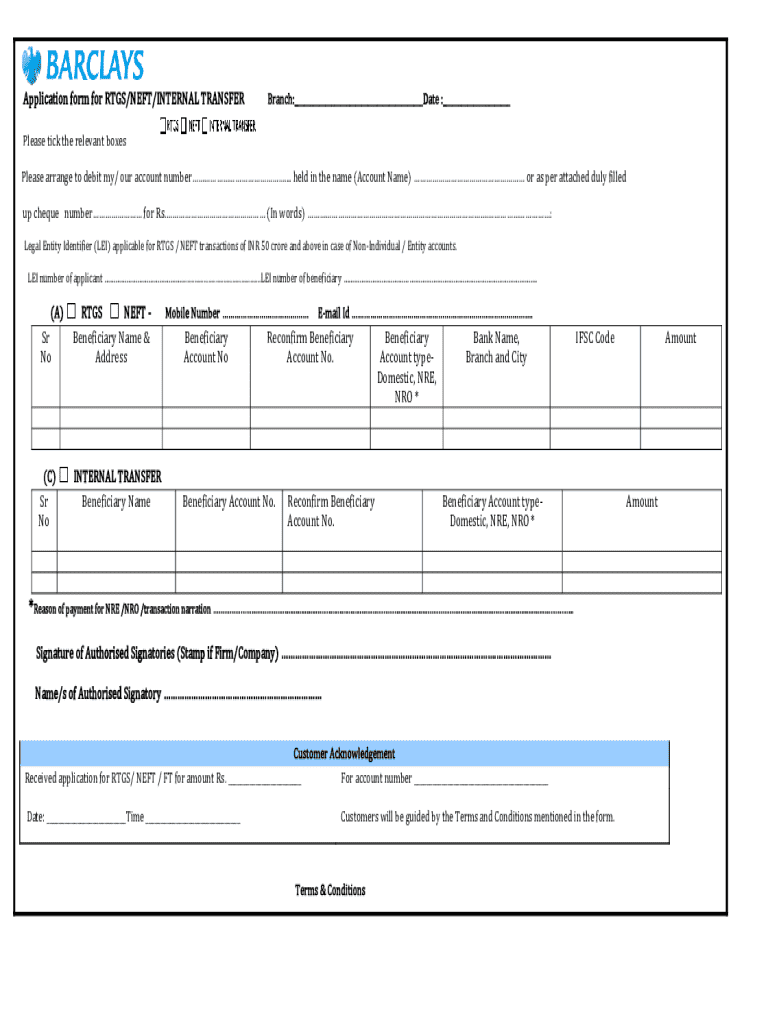

Application Form for RTGS/NEFT Internal Form: A Comprehensive Guide

Understanding RTGS and NEFT

Real Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT) are two pivotal systems used for transferring funds electronically in India. RTGS is primarily used for high-value transactions, facilitating real-time processing. On the other hand, NEFT allows for smaller transactions, processed in batches at regular intervals throughout the day.

Knowing these systems is essential for individuals and organizations alike, especially those handling finance. With an understanding of RTGS and NEFT, you can select the most appropriate method for transferring funds, ensuring efficiency and compliance.

Definition of RTGS (Real Time Gross Settlement)

RTGS is a system where the settlement of funds occurs in real time—whenever they are transferred. This means that once the funds are sent, they cannot be reversed or altered. Key features of RTGS include immediate transfer of money, settlement on gross basis, and the ability to handle high-value transactions. It is mostly used when a quick transaction is required, such as urgent bill payments, interbank transfers, or large-scale transactions.

Definition of NEFT (National Electronic Funds Transfer)

On the other hand, NEFT facilitates electronic transfer of funds in smaller amounts and operates on a deferred net settlement basis. Transactions are processed in batches, meaning there may be slight delays. NEFT is often utilized for regular payments such as utility bills, salary disbursements, and other non-urgent transactions.

Differences Between RTGS and NEFT

Importance of the RTGS/NEFT Internal Form

The RTGS/NEFT Internal Form plays a crucial role in the efficient transfer of funds within organizations. By having a structured form, organizations can streamline their payment processes, ensuring that transactions are tracked and recorded appropriately. This not only aids in efficient fund transfers but also promotes compliance with financial regulations, reducing risks associated with unauthorized or incorrect transactions.

Moreover, clear documentation is indispensable in maintaining transparency and accountability in financial operations. Teams responsible for financial transactions benefit greatly from utilizing the RTGS/NEFT Internal Form, which aids in minimizing errors and facilitates audit trails.

Who should use the RTGS/NEFT Internal Form?

Employees who handle finance-related tasks within corporations are the primary users of this form. Teams engaged in processing payments will find this form essential for carrying out their duties, as it ensures that transactions are executed smoothly and consistently.

Using the RTGS/NEFT Internal Form aids financial departments in adhering to internal control policies and financial standards, making it an indispensable tool for anyone involved in managing funds.

Accessing the application form for RTGS/NEFT

Finding the RTGS/NEFT Internal Form has been made simpler with platforms like pdfFiller, which offers user-friendly navigation. To access the form, first visit the pdfFiller website, then navigate to the form templates section. Here, you can search for the RTGS/NEFT Internal Form by using keywords in the search bar.

Once you locate the form, you can access it directly, ensuring that you have the latest version for your needs. pdfFiller provides an intuitive interface designed to enhance your document management experience.

Supported Devices and Platforms

pdfFiller supports various devices and platforms, making document access incredibly convenient. Whether you prefer using a desktop, laptop, or mobile device, pdfFiller is designed for seamless compatibility with major web browsers. This flexibility allows you to work on your documents from virtually anywhere and at any time.

Filling out the RTGS/NEFT Internal Form

When filling out the RTGS/NEFT Internal Form, ensure you have all required information on hand. This usually includes the sender's and receiver's account information, transfer amount, transaction date, and purpose of the transfer. Providing accurate details is critical for successful processing.

Required information for RTGS/NEFT transfers

After compiling the information, follow these step-by-step instructions to complete the form effectively. Each field has specific requirements; ensure you fill out each section completely to avoid processing delays.

Tips on avoiding common mistakes

Common mistakes include entering incorrect account numbers, not providing sufficient details about the transfer, or failing to include signatures where necessary. To mitigate errors, review all entries before submission and use pdfFiller’s interactive tools to validate information as you fill out the form.

Using interactive tools on pdfFiller

pdfFiller offers multiple editing features that can be utilized while filling out the RTGS/NEFT Internal Form. You can highlight important fields, comment for clarifications, or save templates for future use. These tools make form preparation streamlined and user-friendly.

Utilizing templates enhances efficiency, allowing you to pre-fill fields or save settings that you frequently use, which speeds up the overall process and reduces chances of errors.

Reviewing and editing your application

Before finalizing your application, it is crucial to double-check all entries for accuracy. Common errors like a wrong IFSC code or an incorrect account number can lead to failed transactions. pdfFiller's features make it easy to review and edit your document, allowing for quick adjustments.

Importance of double-checking entries

Common mistakes include numerical inaccuracies and missing mandatory fields. By carefully reviewing your entries, you can ensure that the transfer occurs without a hitch. Utilize the preview feature on pdfFiller to gauge how the final document will appear once submitted.

Editing features on pdfFiller

pdfFiller also allows for seamless editing of your RTGS/NEFT Internal Form. You can change entries, add comments, or collaborate with teammates to gather feedback before final submission. The platform supports real-time collaboration, making it easier for teams to work together on financial documents.

Signing the RTGS/NEFT Internal Form

Once your application is complete and reviewed, the next step is to sign the RTGS/NEFT Internal Form. E-signatures are legally valid and increasingly adopted in finance-related documents. pdfFiller offers a straightforward method for adding electronic signatures to your documents.

eSigning your document on pdfFiller

To eSign, simply click on the signature field within pdfFiller, choose to draw, upload, or type your signature. Once signed, the document can be shared securely within your organization for approval, ensuring compliance and traceability throughout the transaction process.

Sending the form for approval

After signing, you can send the RTGS/NEFT Internal Form for approval through the pdfFiller platform. The document status can be tracked in real-time, which not only streamlines the approval process but also ensures that all parties are kept in the loop regarding the transaction.

Managing your documents after submission

Effective document management continues post-submission. pdfFiller provides options for securely storing your RTGS/NEFT Internal Form, allowing easy access when required. You can manage different versions of the document, ensuring that you always have the latest format.

Options for document storage and access

The cloud-based storage offered by pdfFiller means you can access your forms from anywhere with an internet connection. This feature is particularly beneficial for teams spread across multiple locations, as it ensures that important documents are always accessible.

Tracking transactions post-submission

Monitoring your fund transfer status is crucial. After submission, you can track the status via the banking channel used, and in case of issues, you can reach out to your financial institution for further assistance. Keeping record of your transactions helps in managing financial audits effectively.

Troubleshooting common issues

Even with a well-prepared RTGS/NEFT Internal Form, issues may arise. Common errors during filling can include incorrect details or incomplete fields. Identifying these mistakes quickly can save time and prevent transaction failures.

Resolving issues with transfer processing

If a transfer fails, consult the bank or payment service provider to understand the cause. Issues may stem from incorrect account details, insufficient funds, or regulatory flags. Having a well-documented record of submissions through pdfFiller aids in resolving these matters expediently.

Where to seek help

For additional support, pdfFiller offers robust customer service resources, including FAQs, live chat, and guides. These can help users navigate any challenges they may face while using the platform, ensuring that assistance is readily available.

Conclusion: Empowering document management

Utilizing the RTGS/NEFT Internal Form on pdfFiller is not just about completing paperwork; it’s about elevating your document management capabilities to a new level. The platform enhances the user experience with powerful editing, eSigning, and collaborative capabilities tailored to meet the demands of finance professionals.

Why choose pdfFiller for RTGS/NEFT internal forms

pdfFiller stands out as a solution for managing RTGS/NEFT Internal Forms because it combines all necessary functionalities into one easy-to-use platform. This minimizes errors and maximizes efficiency in fund transfers. Adopting digital solutions for processes like this is not only practical but essential in today’s fast-paced financial landscape.

Embracing digital solutions for efficient fund transfers

The future of electronic transfers is bright, driven by innovations and demand for speed and accuracy in financial transactions. With platforms like pdfFiller, teams can streamline their processes, reduce the risk of manual errors, and achieve operational excellence in financial management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify application form for rtgsneftinternal without leaving Google Drive?

How do I execute application form for rtgsneftinternal online?

Can I create an electronic signature for signing my application form for rtgsneftinternal in Gmail?

What is application form for rtgsneftinternal?

Who is required to file application form for rtgsneftinternal?

How to fill out application form for rtgsneftinternal?

What is the purpose of application form for rtgsneftinternal?

What information must be reported on application form for rtgsneftinternal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.