Understanding the Implications of No Written Shareholder Agreement Form

Understanding shareholder agreements

A shareholder agreement is a vital legal document that outlines the rights, responsibilities, and obligations of shareholders in a corporation. It serves as a formal contract between shareholders that governs the operation of the company, as well as the relationship between the shareholders. The purpose of these agreements extends beyond mere documentation; they are crucial for preventing misunderstandings and establishing a clear framework for decision-making.

Significantly, shareholder agreements also protect the interests of shareholders, especially when it comes to issues like equity ownership, dividend distribution, and the transfer of shares. Common terms within these agreements often include clauses on voting rights, buy-sell agreements, and dispute resolution mechanisms that are essential for smooth business operations.

The risks associated with not having a written shareholder agreement

Operating without a written shareholder agreement can present numerous risks. Without a formalized structure in place, companies may encounter potential disputes and conflicts between shareholders, as there are no agreed-upon guidelines for resolving disagreements. This often leads to complications in decision-making processes and can result in contentious disputes, impacting overall business operations.

Moreover, the legal implications of operating without a shareholder agreement can be substantial. For instance, under the Florida Business Corporation Act, shareholders are afforded certain rights, but without a written agreement, enforcing these rights becomes more complex. Case studies reveal businesses like a small tech startup that faced litigation due to a lack of clarity regarding share allocation and dispute resolution. Such predicaments could have been avoided with a well-defined written agreement.

Essential components of a shareholder agreement

To effectively safeguard the interests of shareholders, a comprehensive shareholder agreement must include several essential components. These typically outline the roles and responsibilities of each shareholder, ensuring that everyone knows their obligations and expectations. Additionally, the procedures for buying and selling shares must also be laid out clearly, detailing how and when shares can be traded.

The decision-making process, including voting rights, is another critical aspect that should be defined. Establishing the profit distribution mechanisms allows shareholders to understand how profits will be shared, preventing future disputes. Given that every business is unique, customizing these agreements to fit specific business needs is paramount for effective governance and smooth operations.

Common misconceptions about shareholder agreements

There are prevalent misconceptions regarding shareholder agreements that can lead to unwise decisions for many businesses. One such myth is that these agreements are only necessary for large corporations. In reality, even small businesses with only a few shareholders can benefit immensely from formal agreements, as they provide clarity and protection for all parties.

Another common misconception is that verbal agreements can suffice in place of written ones. This is far from the truth; while verbal agreements may hold some weight, they are often difficult to enforce in a legal context. Finally, some individuals believe that having a few shareholders means an agreement is unnecessary. However, any number of shareholders can have diverse interests, making a written agreement essential for alignment and clarity.

Alternatives to written shareholder agreements

While written shareholder agreements are the gold standard for governing shareholder relationships, there are informal options available. These can include verbal agreements and collaborative discussions among shareholders. However, these alternatives come with significant limitations, primarily in enforceability and clarity.

Other legal documents such as operating agreements or corporate bylaws can be utilized, but they typically do not replace a shareholder agreement. Verbal contracts may provide a semblance of agreement but lack the robustness required during disputes. Relying solely on informal practices can create vulnerabilities for shareholders and the corporation itself. The pros and cons of these alternatives underscore the necessity of a formalized approach.

The importance of formalizing your shareholder agreement

Formalizing a shareholder agreement through a written document provides several legal advantages. It fundamentally strengthens each shareholder's rights, making it easier to enforce agreements in a court of law if disputes arise. Furthermore, a written agreement serves as a critical tool for dispute resolution, guiding shareholders through conflicts with clear pathways to resolution.

Additionally, having a formalized agreement fosters trust and transparency among shareholders, as it lays out expectations and obligations clearly. This trust not only fortifies relationships but also enhances the overall stability of the business. With the potential of conflict minimized, the focus can shift back to the growth and competitive success of the corporation.

Steps to create a shareholder agreement

Creating a shareholder agreement requires careful consideration and collaboration among all shareholders. The first step is assessing the necessity of a written document by evaluating the potential risks that could arise from the absence of formal guidelines. This involves gathering input from all shareholders, facilitating open discussions to ensure that everyone has a voice in the process.

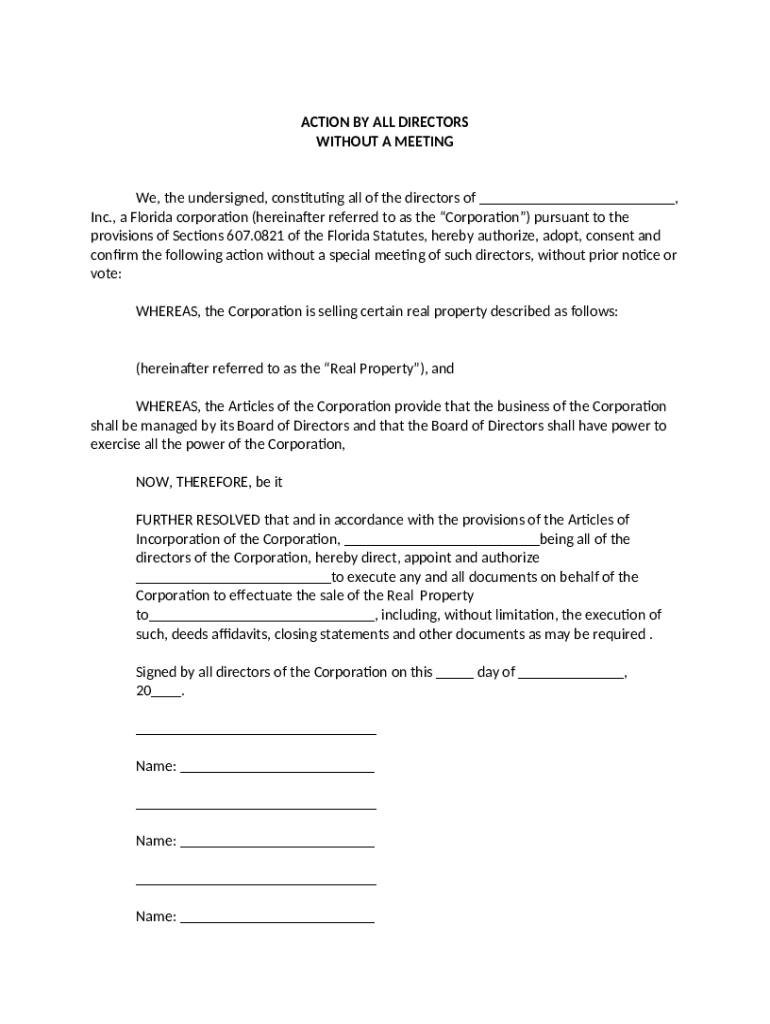

Next, draft the agreement by utilizing templates and other tools for guidance, such as those available through pdfFiller. Collaborating via platforms allows for easier document creation and real-time editing. Once drafted, it is imperative to review the agreement with legal counsel, ensuring compliance with relevant laws, such as the Florida Business Corporation Act. Finally, solidify the agreement through signatures, establishing it as a legally binding document that protects all shareholders.

Utilizing pdfFiller for shareholder agreement management

pdfFiller provides a streamlined solution for creating, editing, and managing shareholder agreements. Users can efficiently create documents through an array of templates, ensuring compliance with local laws such as the Florida Business Corporation Act. The platform enables easy collaboration, allowing multiple shareholders to access and edit the document simultaneously, fostering enhanced teamwork.

Additional features of pdfFiller include cloud storage for secure, easy access and eSignature capabilities that facilitate swift execution of documents. With interactive tools available, teams can make real-time edits, ensuring that all changes are documented and agreed upon seamlessly. By leveraging pdfFiller, businesses can efficiently manage their shareholder agreements, reducing the risk of conflicts and misunderstandings.

Frequently asked questions (FAQs)

Many potential stakeholders have common queries regarding the necessity and implications of having a written shareholder agreement. One frequent question is whether all businesses require a written shareholder agreement. While not legally mandated for all entities, it is strongly advisable to have one for the sake of clarity and mitigation of risk.

Other concerns revolve around the consequences of not having a written agreement and the enforceability of verbal agreements in court. Most often, lacking a written shareholder agreement can lead to costly disputes, while verbal agreements hold limited validity. Additionally, stakeholders often wonder how frequently these agreements should be updated, especially with changes in business structure or personnel.

Looking ahead: Regular review and updates of agreements

Maintaining the relevance and clarity of shareholder agreements is essential for effective governance. Regular reviews are not just advisable; they are necessary to adapt to changes within the business, such as new shareholders joining or existing ones leaving. Changes in the business structure, whether it be through mergers, acquisitions, or product line adjustments, can warrant significant revisions.

The best practice for periodic reviews is to schedule them in tandem with shareholder meetings, promoting transparency and open dialogue. These reviews should involve assessing the current agreement against the existing business climate, ensuring that all shareholders are aligned with the operational framework. By committing to regular evaluations, businesses can proactively prevent misunderstandings and safeguard shareholder interests.