Get the free Beneficiary Form

Get, Create, Make and Sign beneficiary form

Editing beneficiary form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary form

How to fill out beneficiary form

Who needs beneficiary form?

The Ultimate Guide to Beneficiary Forms

Understanding beneficiary forms

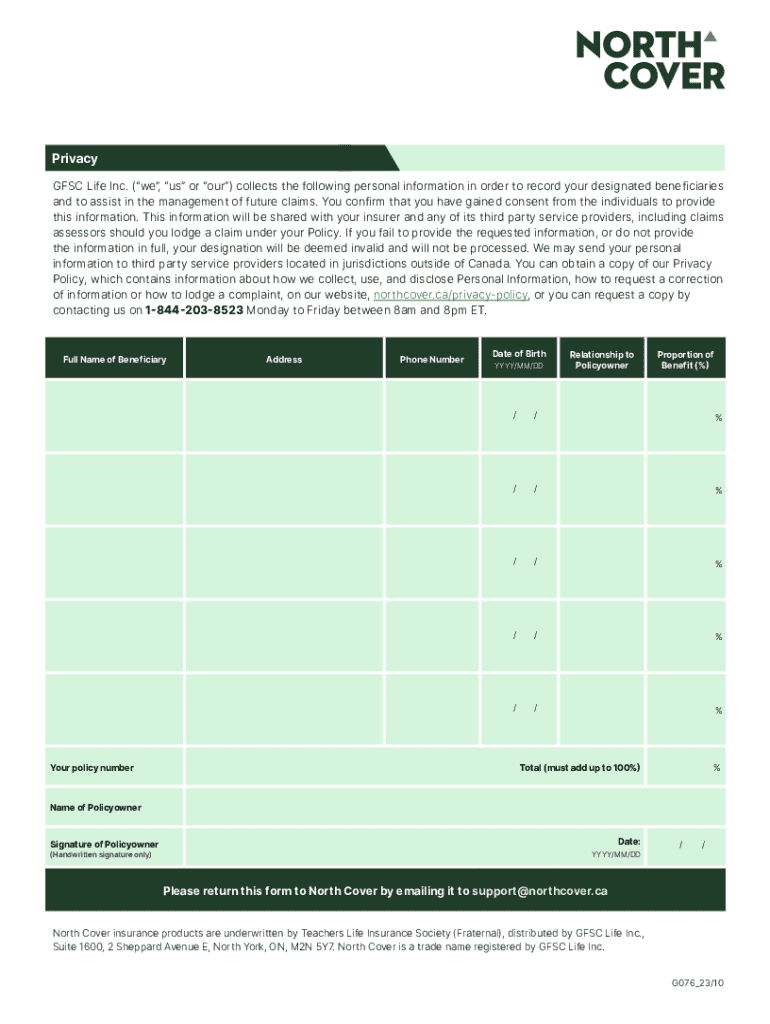

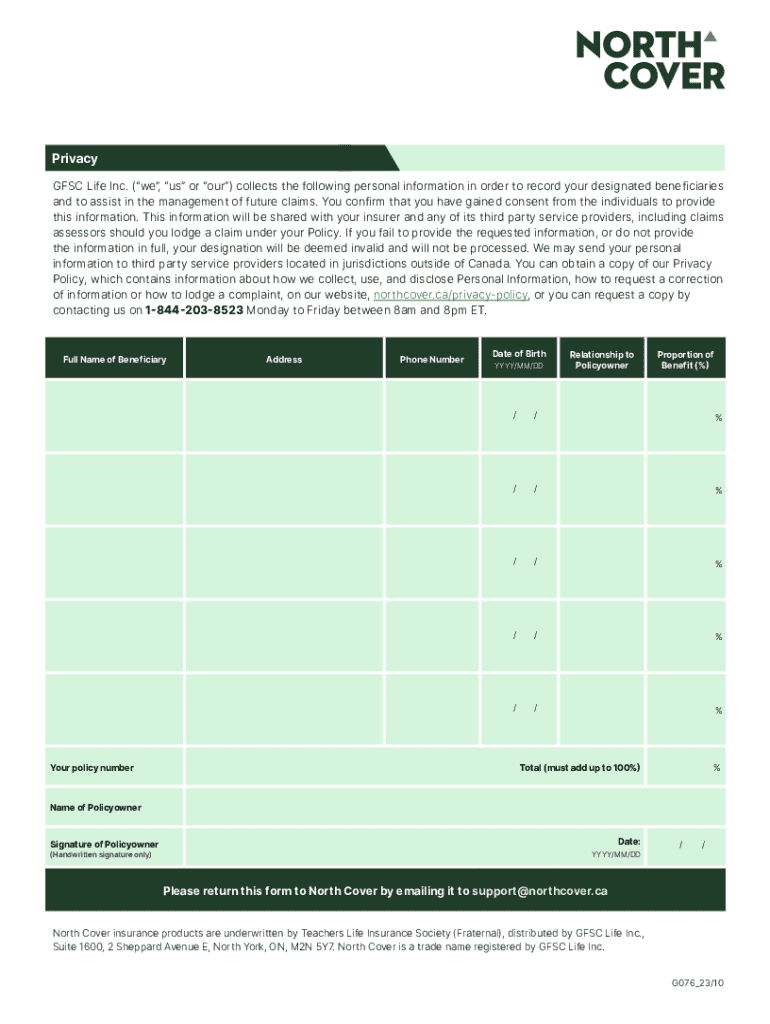

A beneficiary form is a crucial document that identifies who will receive your assets upon death. While commonly associated with life insurance policies, beneficiary forms are used for various accounts, including retirement savings plans, bank accounts, and trusts. Each of these forms serves the purpose of ensuring that your wishes regarding the distribution of assets are clearly documented, reducing the likelihood of disputes or legal complications for your heirs.

The importance of naming a beneficiary cannot be overstated. Without a designated beneficiary, your assets may have to go through probate court, a process that can be lengthy, costly, and public. Furthermore, failing to fill out a beneficiary form can lead to confusion among surviving family members, potentially resulting in disputes over your estate. By taking the time to complete this form accurately, you ensure your intentions are honored and that your beneficiaries receive what you intended to leave them.

Types of beneficiary forms

Beneficiary forms are utilized in several common scenarios where assets are involved. Understanding where these forms apply can help individuals ensure their financial affairs are properly managed.

It’s essential to note that variations exist between institutions regarding beneficiary forms. Different banks may have distinct requirements, while insurers may ask for specific identification or documentation. Always check with your institution to understand their specific process for naming beneficiaries, which may include additional forms or confirmations.

Steps to complete a beneficiary form

Completing a beneficiary form is a straightforward process, but attention to detail is critical. Here are the collective steps you should take to ensure accuracy:

Taking the time to thoroughly fill out and review your beneficiary form can save your heirs from confusion and potential conflicts down the line.

Digital options for beneficiary forms

With advancements in technology, completing beneficiary forms has become more convenient than ever, especially through platforms like pdfFiller. This online tool simplifies the process, allowing you to fill out beneficiary forms from any device with internet access.

Utilizing features like cloud storage means you can access your completed forms anytime, ensuring your beneficiary designations are always handy. With pdfFiller's interactive tools, you can seamlessly edit and modify beneficiary forms, reducing mistakes that could arise when manually filling them out.

Moreover, eSignature functionality on pdfFiller enables you to electronically sign your beneficiary forms, maintaining legal validity while eliminating the need for physical signatures. This aspect is particularly useful in situations where time is of the essence, ensuring that your records are up to date without unnecessary delays.

Managing your beneficiary information

Once you have completed and submitted your beneficiary form, the work doesn’t end there. Keeping your beneficiary designations up to date is critical and should be a regular part of your financial planning. Significant life events such as marriage, divorce, or the birth of a child may necessitate changes to who you wish to designate as a beneficiary.

Storing your completed beneficiary forms is equally important. Securely organizing both digital and physical copies can prevent misplacement or unauthorized access. A reliable option is to use services like pdfFiller that prioritize document security, enabling you to manage your documents in a centralized, secure platform.

Regular reviews of your beneficiary information can ensure that your wishes reflect your current circumstances and relationships, thus safeguarding your estate planning against unforeseen disputes or complications.

Tips for completing beneficiary forms effectively

To navigate the process of completing a beneficiary form smoothly, consider the following tips. Consulting with a financial advisor is advisable, especially if your financial situation, assets, or family dynamics are complex. These professionals can provide tailored advice to ensure your beneficiary designations align with your overall estate planning strategies.

By following these guidelines, you can rest assured that your beneficiary designations are accurate and reflective of your intentions.

Frequently asked questions (FAQ) about beneficiary forms

Understanding common questions related to beneficiary forms can provide clarity and confidence as you navigate this essential process. A prevalent concern is what happens if a beneficiary form is not completed. In such cases, assets may be distributed according to state laws, which can lead to unwanted outcomes and extended probate processes.

Addressing these FAQs ensures you remain informed about the implications and responsibilities associated with beneficiary forms.

Additional considerations

When completing your beneficiary forms, it’s crucial to differentiate between revocable and irrevocable beneficiaries. Revocable beneficiaries can be changed at any time, while irrevocable beneficiaries cannot be modified without their consent. This distinction is vital to understand, especially in contexts involving significant financial assets.

Additionally, consider the tax implications of your beneficiary designations. While beneficiaries of life insurance payouts typically do not incur federal taxes, other assets may be subject to inheritance or estate taxes depending on the overall size of the estate and specific state regulations. Consulting with a tax professional is advisable to fully understand these potential consequences.

Contact information for assistance

If challenges arise while completing your beneficiary form or you need specific instructions tailored to your situation, it’s crucial to reach out for help. Most institutions offer customer support, whether through dedicated phone lines or online chat services regarding their specific forms and processes.

Additionally, for users of pdfFiller, support resources are readily available to assist you in filling out, managing, and organizing your beneficiary forms, ensuring you have the tools needed to navigate this vital aspect of your financial planning with ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit beneficiary form from Google Drive?

How do I make changes in beneficiary form?

How do I fill out the beneficiary form form on my smartphone?

What is beneficiary form?

Who is required to file beneficiary form?

How to fill out beneficiary form?

What is the purpose of beneficiary form?

What information must be reported on beneficiary form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.