Get the free Aat-20-ii

Get, Create, Make and Sign aat-20-ii

How to edit aat-20-ii online

Uncompromising security for your PDF editing and eSignature needs

How to fill out aat-20-ii

How to fill out aat-20-ii

Who needs aat-20-ii?

A Comprehensive Guide to the AAT-20- Form

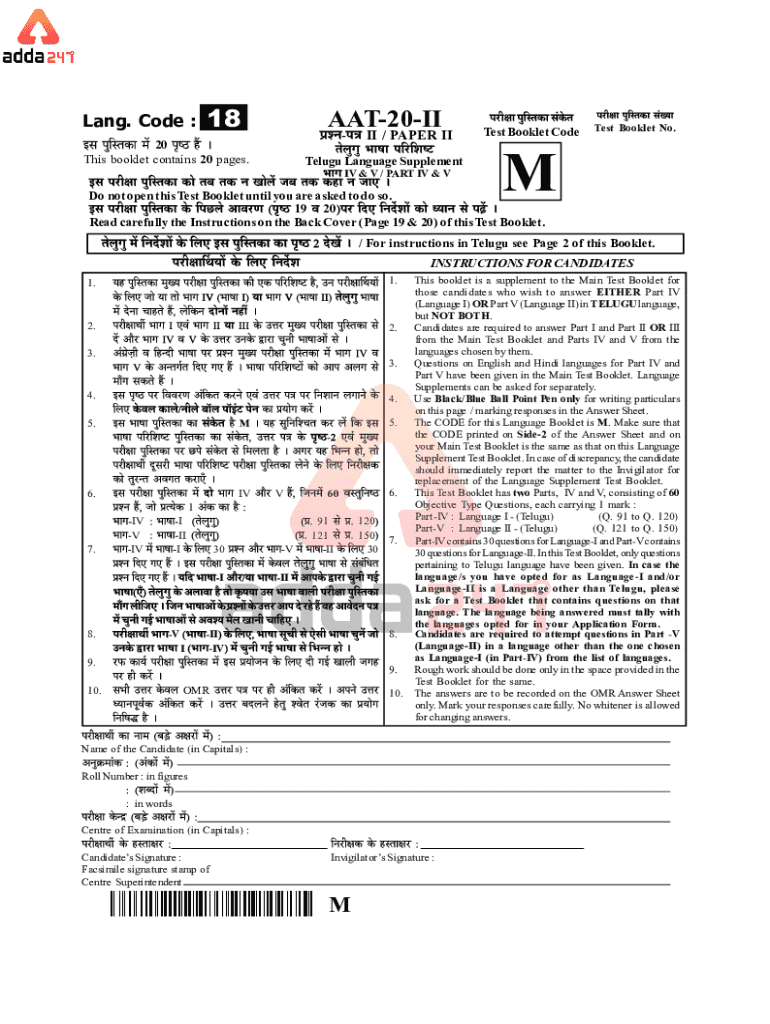

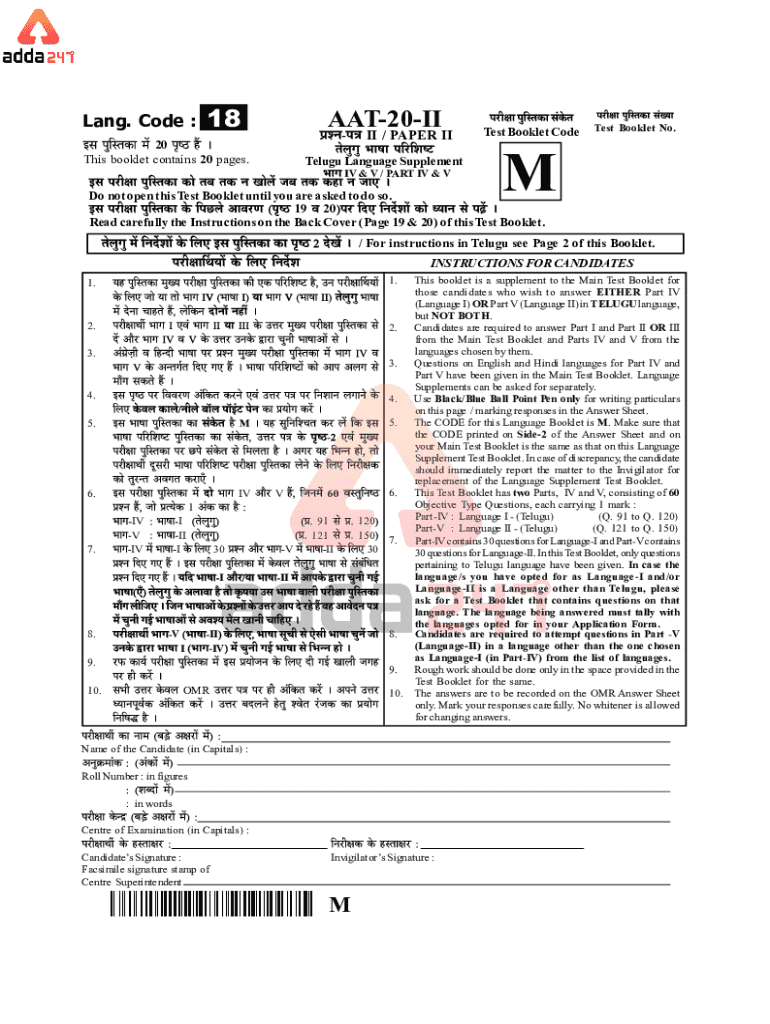

Understanding the AAT-20- form

The AAT-20-II form serves a critical role in the realm of financial reporting and compliance. Designed primarily for businesses and organizations, this form is essential for maintaining transparency in financial operations. It typically includes detailed information concerning financial statements, organizational structure, and operational metrics.

Individuals and teams utilize the AAT-20-II form to ensure that they align with regulatory standards, making it a vital tool in audits and financial reviews. Its structured format allows users to showcase their financial health, thereby influencing investor and stakeholder confidence.

Importance of the AAT-20- form

The AAT-20-II form is not just a bureaucratic requirement; it directly impacts compliance and reporting. The accuracy of data submitted through this form is paramount, as it can affect both the reputation of the organization and its viability. Regulatory bodies often use such forms to assess adherence to financial guidelines and standards.

Failing to submit a correctly filled AAT-20-II form can result in sanctions, fines, or even complexities in obtaining funding or partnerships. By ensuring accurate form submission, individuals and organizations not only stay compliant but also build trust with stakeholders.

Key features of pdfFiller for the AAT-20- form

pdfFiller offers an array of features that simplify the process of filling out the AAT-20-II form. The platform's cloud-based accessibility allows users to access their documents from any device, enabling greater flexibility and efficiency. This is particularly beneficial for teams that might be working remotely or across different locations.

Furthermore, pdfFiller provides seamless editing tools, allowing users to make real-time changes to their AAT-20-II forms. Users can easily utilize pre-existing templates to enhance their efficiency and save time during the data entry process.

Step-by-step guide to filling out the AAT-20- form

To fill out the AAT-20-II form effectively, you will first need to gather the required information. Essential details include financial data, personal identifiers, and organizational specifics. Ensure that you have documents such as previous financial statements or certification references at hand.

Once prepared, accessing the AAT-20-II form on pdfFiller is straightforward. Users can navigate through an intuitive dashboard to locate the form quickly. After opening the form, each section must be filled in diligently.

Post-completion, it's crucial to review the form thoroughly. Utilize pdfFiller's review features to validate data accuracy and to check for any missed entries.

Tips for editing the AAT-20- form

When it comes to editing the AAT-20-II form, pdfFiller equips users with powerful editing features. The text editing tools are designed for simplicity and effectiveness, allowing users to modify their entries or correct errors swiftly. You can also add annotations and comments where necessary, fostering clarity in communication.

Another significant feature is the collaborative editing capability of pdfFiller. Teams can work together in real-time on the AAT-20-II form, making it easier to finalize documents. Utilize sharing options to send the document to relevant stakeholders for their input or approval.

Signing and submitting the AAT-20- form

Once the AAT-20-II form is filled out accurately, the next step is to eSign it. Adding your signature digitally is a straightforward process on pdfFiller. Users can simply select the eSigning tool, choose their signature style, and insert it directly into the document.

Submission of the completed form can be conducted through various methods. Users can opt for online submissions directly through an integrated portal, or choose offline options depending on organizational needs. It’s essential to keep a copy accessible for records after submission.

Managing and storing the AAT-20- form with pdfFiller

Effective document management is crucial when dealing with the AAT-20-II form. Utilizing pdfFiller, users can categorize and store their completed forms efficiently. Strategies for organization include creating folders with intuitive names for quick retrieval.

Ensuring version control is equally important. Keeping track of different iterations of the AAT-20-II form can prevent confusion and errors, especially in collaborative environments. Additionally, pdfFiller features robust security options to protect sensitive information contained within your forms.

Frequently asked questions (FAQs)

A number of questions often arise regarding the AAT-20-II form. For instance, one common concern is about the necessary documents required for filling out the form. Typically, users should refer to organizational records and any previous submissions to ensure completeness and accuracy.

In addition, troubleshooting issues such as submission errors can also bedevil users. Most problems arise with missing information or incorrect formats; therefore, familiarity with the form’s requirements is essential. Resources and help feature on pdfFiller can provide assistance in resolving any such issues.

Advanced tips for using the AAT-20- form effectively

To further enhance the efficiency of working with the AAT-20-II form, leveraging automation via pdfFiller is invaluable. Automated features can streamline populating repetitive information, thus saving time and minimizing errors. This is particularly useful for organizations that need to fill out multiple forms with similar data.

Integrating pdfFiller with other tools can also maximize productivity. For example, utilizing document management systems alongside pdfFiller’s capabilities allows for synchronized workflows, ensuring that all team members have access to the most current version of the AAT-20-II form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my aat-20-ii directly from Gmail?

How can I modify aat-20-ii without leaving Google Drive?

Can I create an eSignature for the aat-20-ii in Gmail?

What is aat-20-ii?

Who is required to file aat-20-ii?

How to fill out aat-20-ii?

What is the purpose of aat-20-ii?

What information must be reported on aat-20-ii?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.