Get the free Financial Disclosure Statement (elected, Appointed, Board/commission Members)

Get, Create, Make and Sign financial disclosure statement elected

How to edit financial disclosure statement elected online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement elected

How to fill out financial disclosure statement elected

Who needs financial disclosure statement elected?

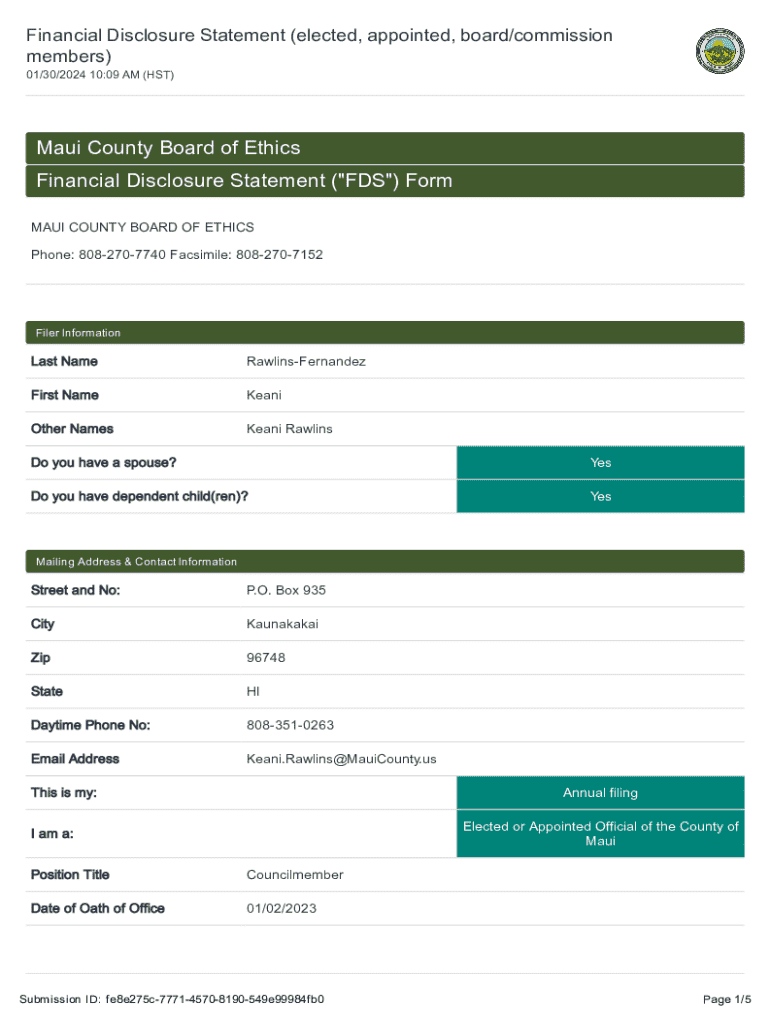

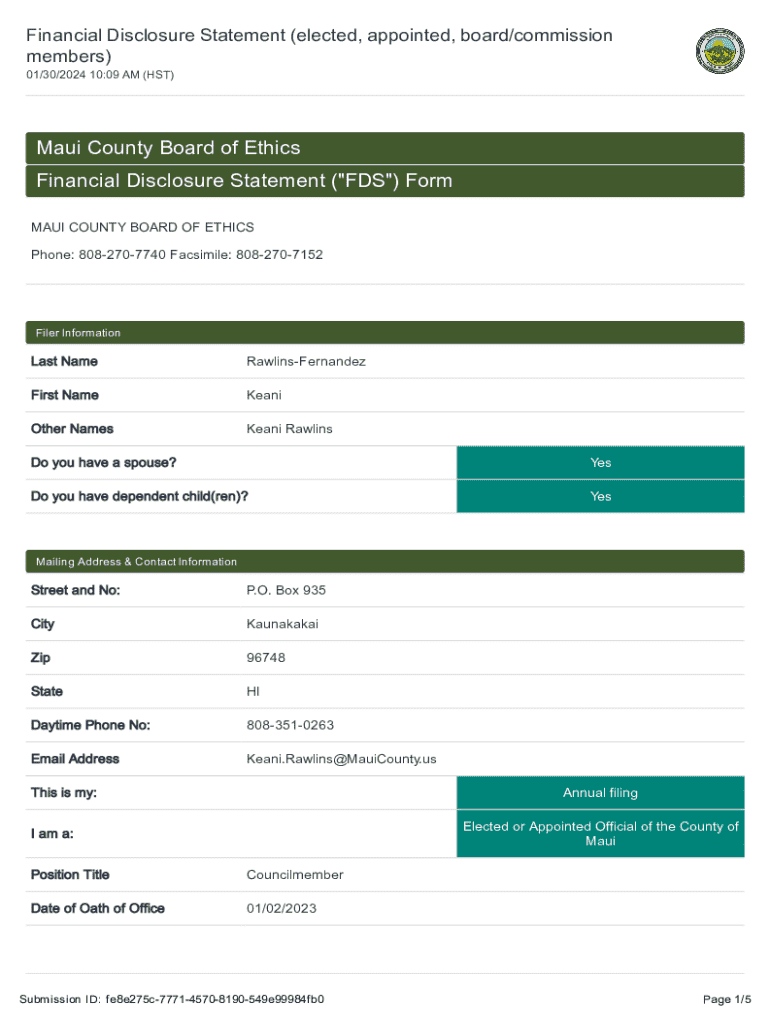

Understanding the Financial Disclosure Statement Elected Form

What is a financial disclosure statement?

A financial disclosure statement is a legal document that mandates elected officials to declare their financial interests, real estate holdings, and other relevant financial information. This declaration is crucial as it promotes transparency and integrity in governance, ensuring that elected officials act in the public’s best interests. The document is often a requirement at both state and federal levels, governed by specific laws designed to hold public officials accountable.

The primary importance of a financial disclosure statement lies in its function as a tool for fostering public trust. By disclosing their financial affairs, officials can demonstrate their commitment to ethical standards and accountability, alleviating concerns about conflicts of interest. These statements are also utilized during public audits and inquiries, ensuring that officials maintain a clear record of their financial dealings while in office.

Purpose of filing financial disclosure statements

Filing a financial disclosure statement is pivotal in upholding the values of transparency and accountability within the political landscape. These documents not only keep the ethical behavior of officials in check but also serve as an assurance to the public that their representatives are financially responsible and are operating free from undue influences. Public trust hinges on the belief that elected officials do not misuse their positions for personal gain.

Furthermore, these statements play a vital role in enhancing accountability. By providing a clear picture of an official's financial status, potential conflicts of interest can be identified and addressed proactively. When citizens are aware of their representatives’ financial interests, it fosters an environment of informed decision-making and civic engagement, crucial elements in a well-functioning democracy.

Who must file a financial disclosure statement?

The requirement to file a financial disclosure statement typically extends to various elected officials, including mayors, governors, members of state legislatures, and certain officials appointed at various governmental levels. Federal elected officials, such as senators and representatives, are also obligated to file these statements as part of their public service duties. These filings ensure that those in positions of power are held accountable for their financial activities while serving in office.

However, there may be exceptions based on specific roles or jurisdictions. For example, some positions may be exempt due to their limited scope of authority or financial impact. It's important for individuals to check their specific state guidelines to understand their obligations accurately.

Non-compliance with financial disclosure requirements can result in significant penalties, including fines and potential legal repercussions. Late or ignored filings could lead to inquiries that damage the trust between officials and constituents, reinforcing the necessity of vigorous adherence to these regulations.

General information about the filing process

Understanding the timeline for filing is crucial for all elected officials. Generally, deadlines for filing financial disclosure statements are set annually or biannually, often aligning with the official’s reporting year. Key deadlines are usually specified by local or state governance, and failing to meet these can result in penalties. To mitigate risks associated with missing deadlines, early filing is recommended, allowing sufficient time for the review and correction of any potential discrepancies.

The type of disclosures required often includes financial assets, liabilities, income sources, and any gifts received. Officials also need to disclose any positions held in other organizations that might present a conflict of interest. A detailed understanding of what is required helps in preparing accurate and thorough disclosures, thereby easing the filing process.

Detailed steps for filling out the financial disclosure statement

The first step in filling out your financial disclosure statement is gathering all necessary information. This includes personal financial records, bank statements, investment documents, and any other relevant records that outline your financial situation. Having these documents organized and ready for review helps streamline the filling process, ensuring no vital information is missed unintentionally.

Once all necessary information is collected, filling out the form involves carefully entering details in specific sections. Each section typically requires a detailed report of assets, liabilities, and sources of income. Common pitfalls include underreporting or neglecting to mention certain income sources or assets, which can lead to complications later on. It's vital to read instructions carefully and ensure that all information entered is honest and accurate.

After completing the form, reviewing the submission is crucial. Consider creating a checklist to ensure all sections are filled in and that no critical information is left out. Double-checking figures and details may prevent erroneous submissions that could raise flags during audits or reviews. Be especially cautious with numerical entries to avoid inadvertent mistakes.

When it comes to submission methods, many jurisdictions offer online filing options in addition to traditional mailed formats. Online submissions can significantly reduce processing times and allow for prompt confirmation of receipt. If submitting by mail, consider using a certified mailing method to track your documents until they are officially acknowledged.

Tools for managing your financial disclosure statement

Utilizing platforms like pdfFiller can significantly enhance the ease of creating and managing your financial disclosure statement. This cloud-based solution features editing tools that simplify the filling process, allowing you to modify documents directly in your web browser. With features like auto-save and the ability to share documents securely, you can collaborate with trusted advisors or colleagues, ensuring that your submission is thorough and accurate.

Furthermore, pdfFiller supports e-signatures, providing a seamless way to legally sign your financial disclosure statement. This option is paramount for streamlining the process, making it easy to manage your filings and keep track of deadlines. Using automated reminders allows you to maintain an organized schedule for filing years in advance, ensuring that your compliance remains uninterrupted.

Frequently asked questions (FAQ)

When discrepancies are found in your financial report, the first step is to correct the mistakes promptly. Contact the relevant authorities as soon as possible to report any errors and seek guidance on the necessary amendments. Transparency in addressing such discrepancies can mitigate potential repercussions and demonstrate accountability.

If you miss the filing deadline, it's essential to act quickly. Most jurisdictions impose automatic fines for late filings, which can compound over time. Understanding the specific penalties for your area is vital. Depending on circumstances, you may have options for appealing penalties if you can demonstrate valid justifications for your delay.

You may also inquire whether extensions for filing are available as certain circumstances warrant. Approaching the engaged authority early can provide clarity on whether your request can be accommodated based on specific criteria. Formulating a clear rationale within any request is key.

Resources for further assistance

For questions and support regarding financial disclosure statements, it's crucial to identify the appropriate authorities. Different jurisdictions have designated offices or online resources where officials can seek guidance. These resources often include comprehensive help centers, dedicated to answering queries and assisting individuals with their submission processes.

Moreover, training and workshops are often available to familiarize individuals with the financial disclosure statement process. Participating in such sessions can provide valuable insights and networking opportunities. Online webinars can also be beneficial for staying updated with changing compliance requirements, ensuring that you are well-equipped to navigate the complexities of this important obligation.

Keeping your financial disclosure updated

Regularly updating your financial disclosure statement is crucial in maintaining accurate records of any changes in your financial situation. Fitness for continued public service relies on transparency; thus, amendments should be made as soon as your financial circumstances change, such as when acquiring new assets or experiencing shifts in income. Keeping abreast of these changes ensures that stakeholders are always aware of your financial position.

Incorporating best practices for ongoing management of your financial disclosures can help simplify an often tedious process. Consider utilizing tools and calendars to track important filing deadlines throughout the year. Automation tools can provide reminders for when updates or filings are due, allowing you to stay organized and avoid any administrative oversights in your financial responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send financial disclosure statement elected for eSignature?

Can I create an electronic signature for signing my financial disclosure statement elected in Gmail?

How do I edit financial disclosure statement elected straight from my smartphone?

What is financial disclosure statement elected?

Who is required to file financial disclosure statement elected?

How to fill out financial disclosure statement elected?

What is the purpose of financial disclosure statement elected?

What information must be reported on financial disclosure statement elected?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.