Get the free Form F

Get, Create, Make and Sign form f

Editing form f online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form f

How to fill out form f

Who needs form f?

Form F: Your Complete How-to Guide for Efficient Filing

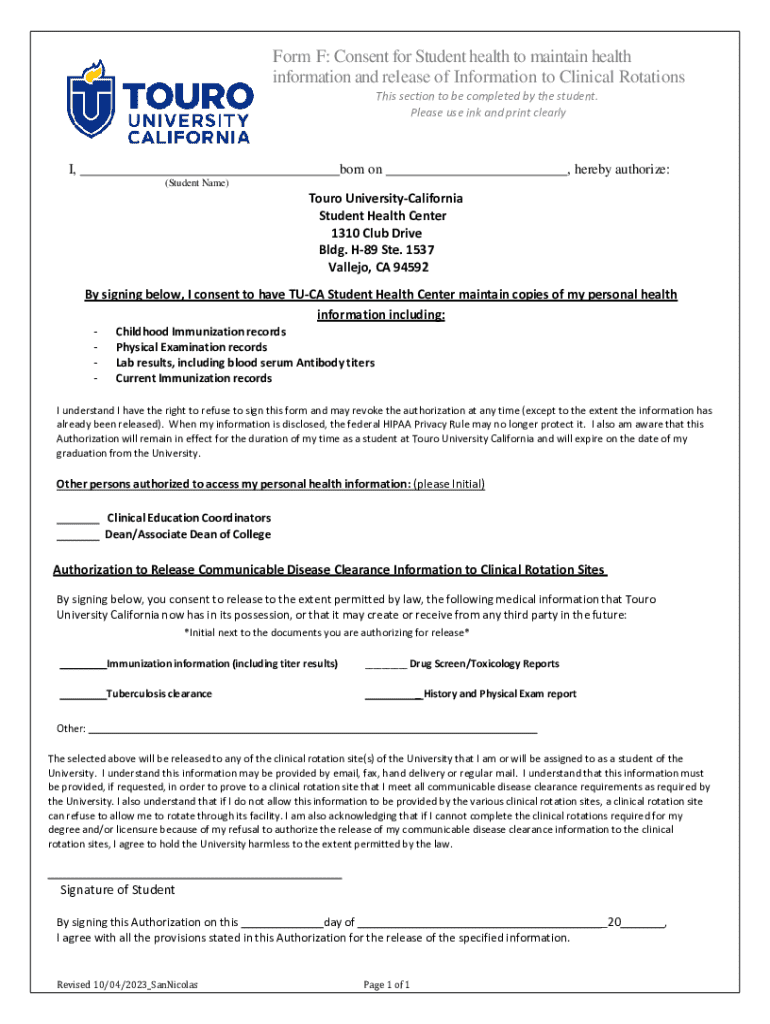

Understanding Form F: A comprehensive overview

Form F serves as a critical document widely used in various sectors, particularly in finance and tax reporting. Designed to collect essential information in an organized manner, it ensures that both individuals and organizations comply with specific regulatory requirements. The primary purpose of Form F is to provide a uniform template for reporting financial details and other vital data, thereby simplifying the review process for authorities.

Common scenarios requiring Form F include annual tax filings, financial disclosures for grants, and documentation for loan applications. These contexts underscore the legal importance of accurate filing, as discrepancies can lead to penalties or delays in processing.

Key components of Form F

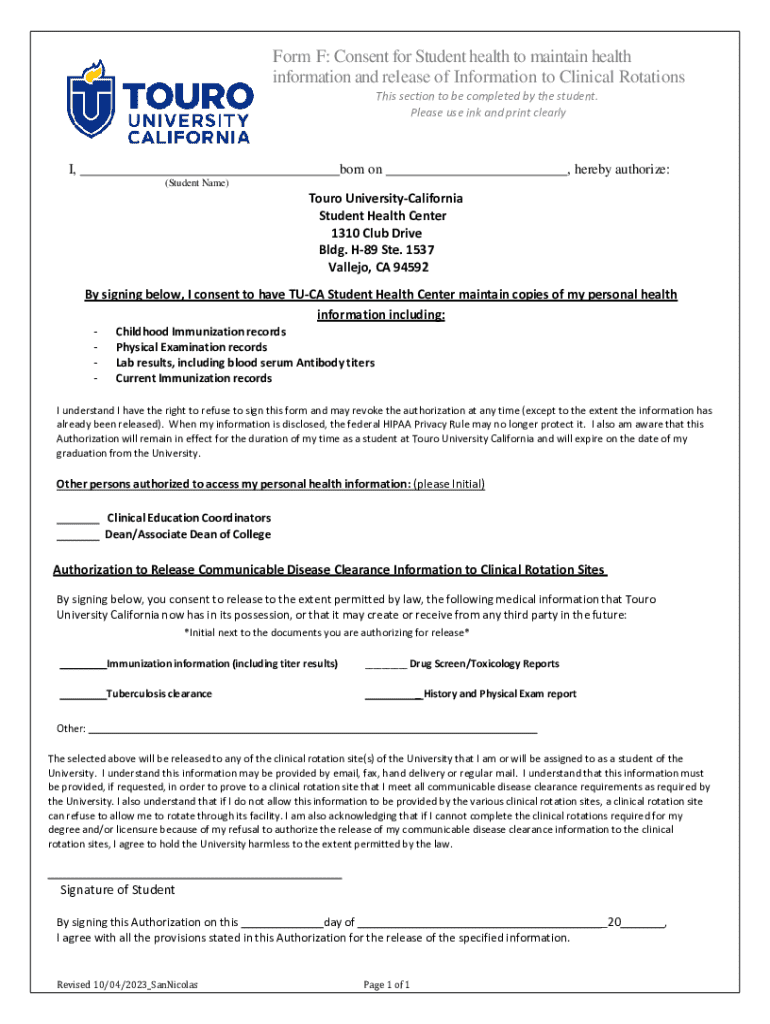

Form F is divided into distinct sections, each catering to specific requirements. Understanding these components is crucial to ensure accurate completion. The most significant sections include personal information, financial details, and declarations.

The personal information section typically includes fields like name, address, and identification numbers. Financial details encompass income sources, expenses, and any required financial disclosures. The final part is the declaration, where the individual certifies that all information is truthful and accurate, often requiring signatures from involved parties.

Step-by-step instructions for filling out Form F

Completing Form F correctly involves a systematic approach. First, gather necessary documents such as tax returns, pay stubs, and previous Form F submissions. An accurate understanding of the required information is essential to avoid pitfalls.

Once prepared, begin filling out the form. Step 1 entails entering personal information—ensure accuracy, as errors could lead to processing delays. In Step 2, input financial data, paying close attention to detail and ensuring all figures are correct. Finally, in Step 3, complete the declaration and gather signatures where necessary.

Common mistakes to avoid include omitting required fields, entering incorrect data, and failing to sign the form. Utilizing pdfFiller can simplify this process with built-in guidance and validation checks.

Editing and modifying Form F

Editing Form F becomes effortless with tools like pdfFiller, which offer user-friendly interfaces for document modifications. Whether you need to correct minor errors or update significant information, pdfFiller provides accessible editing tools that streamline the process.

To adjust existing information, simply upload the document to pdfFiller, utilize the editing features, and make necessary changes. Templates are also available for Form F, allowing you to create new submissions based on previous versions, thus enhancing efficiency.

Signing and submitting Form F

Legally, signing is a crucial aspect of submitting Form F, and electronic signatures (eSignatures) offer a convenient alternative. With pdfFiller, eSigning provides a secure way to complete the process while meeting legal compliance standards.

After completing the form and obtaining necessary signatures, consider your submission options. Submitting Form F online is often faster and more efficient, while offline methods may include mailing or hand-delivering. Ensure that your submission adheres to any specified deadlines.

Collaborating on Form F

Collaborating effectively on Form F is possible with pdfFiller's extensive sharing features. Users can share the document with team members or stakeholders, ensuring everyone involved has access to the latest version.

Additionally, pdfFiller offers the functionality to manage track changes and comments, making coordination seamless. This feature is particularly beneficial for teams working on complex submissions that require multiple inputs and reviews.

Frequently asked questions about Form F

Understanding common concerns can help streamline the filing process. A frequent question relates to errors on the form: if an error occurs, it’s typically advisable to correct it as soon as possible and, if necessary, resubmit the form. Lost or misplaced versions can often be retrieved from pdfFiller's saved documents feature.

Deadlines for Form F vary based on its purpose, such as tax filing dates or loan application deadlines, so it's crucial to remain informed. As a best practice, always double-check that all required information is present before submission to avoid setbacks.

Best practices for managing Form F and related documents

Organizing your documents is essential for efficient management of Form F and related files. Utilize folders to categorize by year or type of submission, ensuring that retrieval is simple and quick when needed. Implement version control to track changes and submissions.

For long-term storage, consider cloud solutions and secure backup systems that ensure your documents remain safe and accessible. Maintain a consistent naming convention to simplify future searches of your forms and documents.

Exploring alternative forms and templates

Form F is not the only document available for various reporting and submission needs. Familiarizing yourself with other related forms is beneficial, particularly if there are specific nuances in your situation that another form might better address. For instance, different states or jurisdictions may have unique versions or additional forms to accompany Form F.

Comparing Form F with similar documents can provide clarity on which to choose. Paying attention to the criteria and requirements of each option ensures that you select the most appropriate form for your needs.

Getting support and help with Form F

For comprehensive assistance, pdfFiller offers robust customer support services designed to address any queries or challenges users may encounter while completing Form F. Accessing these resources can significantly improve your filing experience, providing peace of mind.

Additionally, leveraging online resources and community forums can offer helpful insights from fellow users. If complexities arise in filling out Form F or if specific legal advice is needed, seeking professional assistance could also be a prudent decision. This help can clarify tricky sections of the form and ensure compliance with all regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form f directly from Gmail?

How do I make changes in form f?

Can I create an electronic signature for signing my form f in Gmail?

What is form f?

Who is required to file form f?

How to fill out form f?

What is the purpose of form f?

What information must be reported on form f?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.