Get the free Federal Direct Plus Loan Application and Master Promissory Note

Get, Create, Make and Sign federal direct plus loan

Editing federal direct plus loan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out federal direct plus loan

How to fill out federal direct plus loan

Who needs federal direct plus loan?

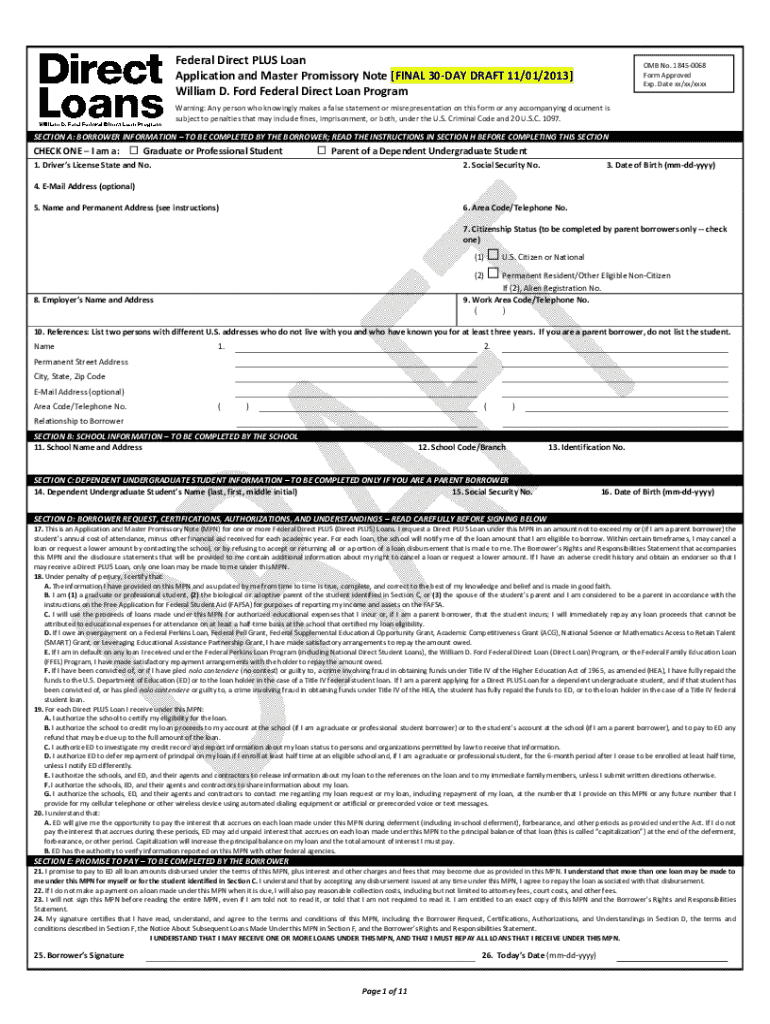

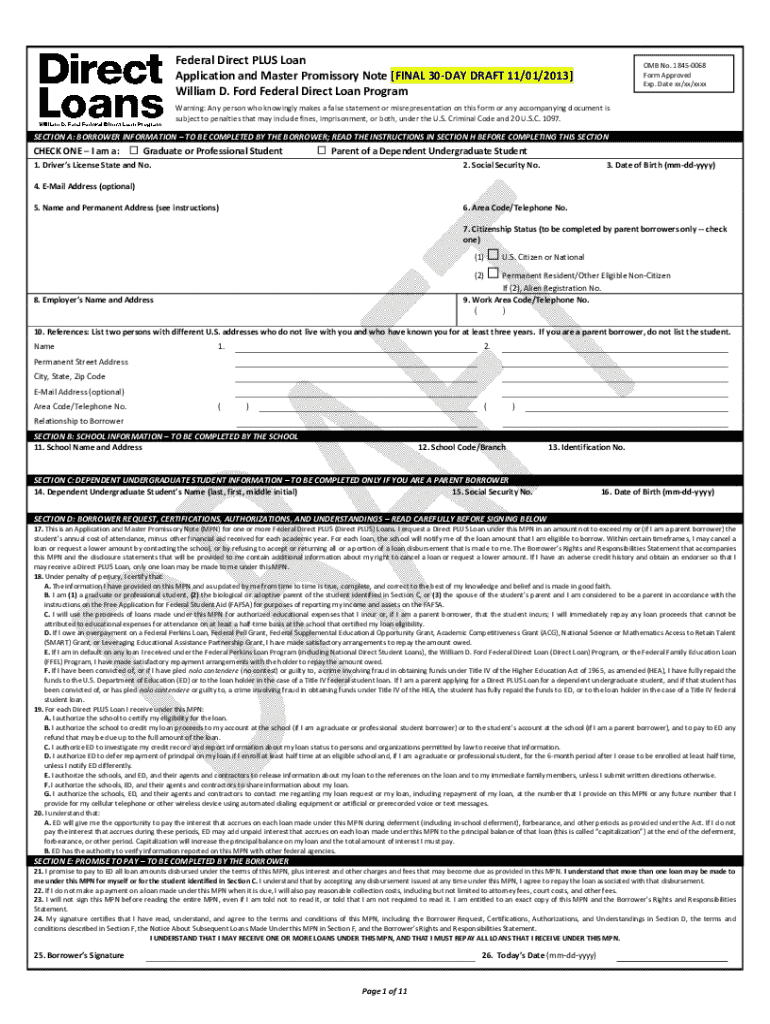

Federal Direct PLUS Loan Form: A Comprehensive How-To Guide

Understanding the Federal Direct PLUS Loan

The Federal Direct PLUS Loan is a government-backed financial aid option designed to help parents of dependent undergraduate students and graduate students cover educational expenses. This loan can bridge the gap between what federal student aid covers and the actual cost of attendance, making it an essential resource for many families.

Eligibility for the Federal Direct PLUS Loan differs based on the applicant's status. Parents applying for their children must pass a basic credit check, while graduate students enjoy a similar requirement. Both demographics cannot have an adverse credit history, which includes having a record of bankruptcy or defaults on federal loans.

The benefit of choosing a Federal Direct PLUS Loan includes fixed interest rates, ensuring that borrowers won't face rising costs over time. Other advantages include potential loan forgiveness opportunities through various programs and flexible repayment options like deferment and forbearance during financial hardships.

Preparing to complete the Federal Direct PLUS Loan form

Before you begin filling out the Federal Direct PLUS Loan Form, gathering all necessary documentation is crucial. Generally, borrowers must provide personal identification, their Social Security Number, and a Federal Student Aid (FSA) ID, which can be obtained through the official FAFSA website.

Familiarizing yourself with relevant loan terms is equally essential. For instance, understanding aggregate loan limits—how much you can borrow—is vital in ensuring that you do not overextend yourself financially. Additionally, being aware of the implications of credit checks will help manage expectations regarding your application status.

Accessing the Federal Direct PLUS Loan Form

To fill out the Federal Direct PLUS Loan Form, you will first need to find it. It is available on official government websites, specifically the Federal Student Aid portal, ensuring that you are accessing the most updated version. For a user-friendly experience, pdfFiller offers easy access to these forms with tools for editing and saving.

Different forms are available depending on your needs. The initial application form is designed for first-time borrowers, while a renewal form caters to those who have previously taken out a loan and are looking to borrow again.

Detailed guide to completing the Federal Direct PLUS Loan form

While completing the Federal Direct PLUS Loan Form, a section-by-section breakdown can simplify the process. Start with your personal information, entering demographic data accurately—this includes your name, address, and contact details. This information is crucial as any discrepancies can delay the processing of your loan.

Next is the school information section. It's critical to select the correct educational institution your child or you will attend, along with the degree program. This ensures the loan proceeds reach the school directly, covering applicable educational costs.

When detailing loan amounts, request only what is necessary. Review your total cost of attendance and subtract any other financial aid to come up with an accurate amount. Additionally, you'll authorize a credit check, which is essential for the approval of your loan.

Avoid common mistakes such as providing incorrect personal information or neglecting to sign the form, as these can lead to delays or rejections.

Utilizing pdfFiller for your Federal Direct PLUS Loan form

Using pdfFiller to manage your Federal Direct PLUS Loan Form can enhance your experience significantly. The platform offers cloud-based access to your documents, meaning you can edit and fill in your forms from anywhere. Furthermore, enable eSigning capabilities ensure that you can sign your documents electronically, speeding up the process.

To leverage pdfFiller effectively, start by uploading your Federal Direct PLUS Loan Form. The editing features allow for easy adjustments, letting you fill in the necessary fields seamlessly. Once completed, you can save your form securely, and if needed, eSign and share it without any hassle.

Submitting your Federal Direct PLUS Loan form

Before submitting your Federal Direct PLUS Loan Form, it’s crucial to perform a thorough review to ensure everything is complete and accurate. Double-check that all fields are filled out appropriately, as missing information can stall the process or lead to rejection.

For submission, you have options. The most efficient method is online submission through the Federal Student Aid portal. Alternatively, if required, you can mail the completed form. Make sure to follow guidelines for mailing, such as using the correct address and ensuring that the form is sent via a traceable method, like certified mail.

Post-submission steps

After submitting your Federal Direct PLUS Loan Form, you may wonder what comes next. Processing times can vary, but borrowers should generally expect a wait of about 4-6 weeks. During this period, keep an eye on your email and the Federal Student Aid portal for updates about your loan status.

Once approved, the next steps involve managing your loan. Setting up an account with your loan servicer is essential to keep track of repayment schedules and amounts. Familiarizing yourself with repayment plans, including income-driven repayment options, can aid in navigating your financial responsibilities.

Frequently asked questions (FAQs)

The Federal Direct PLUS Loan can bring up several questions, especially among new borrowers. A key concern is whether one can apply for a PLUS loan with a bad credit history. Generally, applicants must not have an adverse credit history to qualify, which includes certain financial or bankruptcy issues. If concerns arise, potential borrowers should explore options to build credit before applying.

Understanding the repayment process is also crucial. Repayments usually begin within 60 days after the loan is fully disbursed, although borrowers may have options to defer payments based on certain circumstances. Don't overlook the importance of these repayment terms, as they will directly impact your financial future.

It's essential to clarify misconceptions between PLUS loans and other federal loans, primarily aimed at dependency status and the borrower's responsibility for repayment. Unlike traditional unsubsidized loans, PLUS loans are taken out in the parent's name, often involving a more significant borrowing capacity.

Tips for managing your Federal Direct PLUS Loan

Successfully managing your Federal Direct PLUS Loan involves establishing a repayment schedule that fits your financial situation. Setting a budget that accounts for your monthly loan payments can prevent unnecessary stress and financial strain. Consider using budgeting tools and maintaining a strict payment schedule.

In addition, accessing online tools provided on platforms like pdfFiller can enhance your document organization. Keeping track of your loan documents, payment schedules, and correspondence with your loan servicer will ensure you stay on top of your financial obligations. Many tools also provide calculators to project future repayments and interest accrual.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send federal direct plus loan for eSignature?

How do I execute federal direct plus loan online?

How can I edit federal direct plus loan on a smartphone?

What is federal direct plus loan?

Who is required to file federal direct plus loan?

How to fill out federal direct plus loan?

What is the purpose of federal direct plus loan?

What information must be reported on federal direct plus loan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.