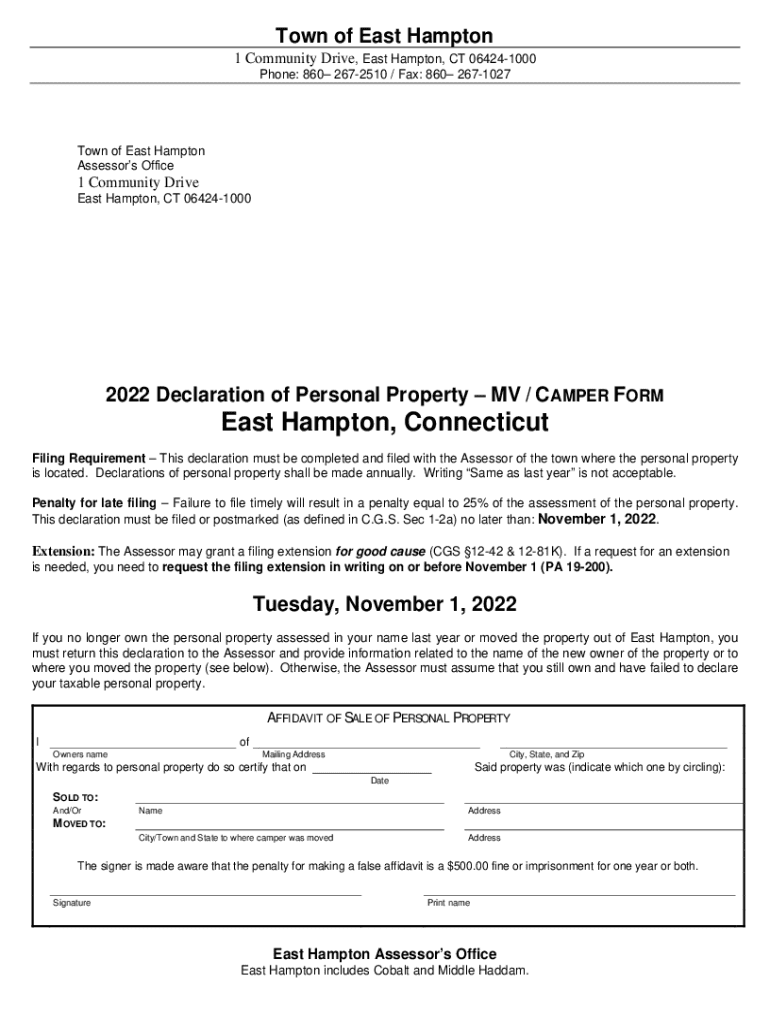

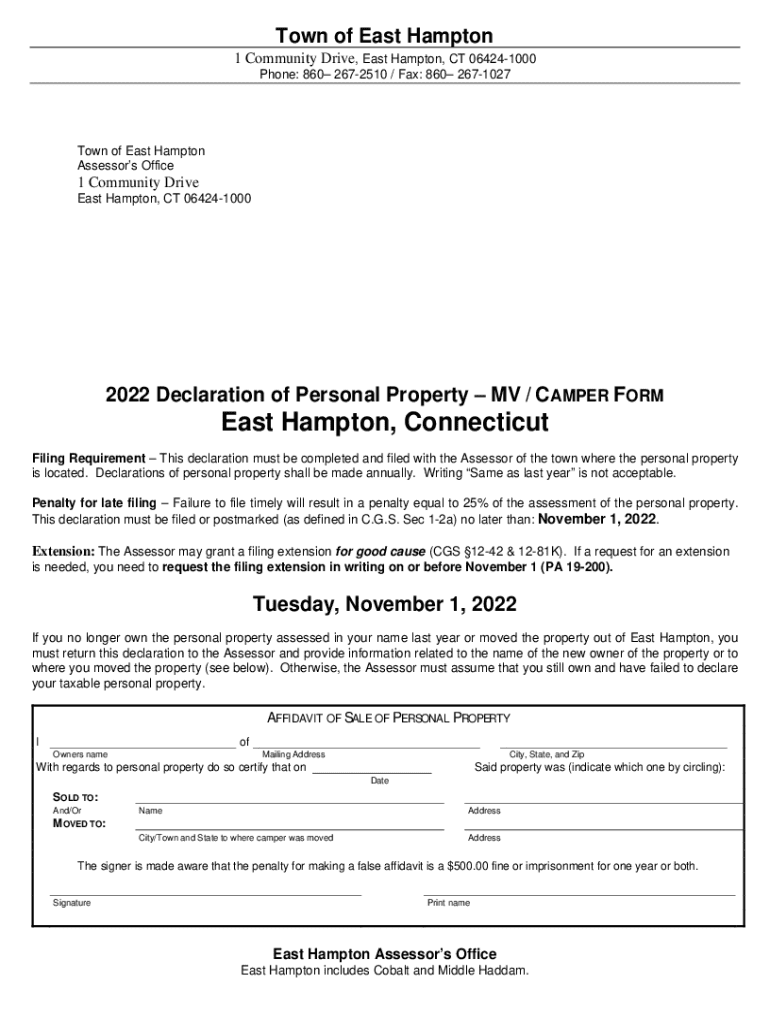

Get the free 2022 Declaration of Personal Property – Mv / Camper Form

Get, Create, Make and Sign 2022 declaration of personal

How to edit 2022 declaration of personal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2022 declaration of personal

How to fill out 2022 declaration of personal

Who needs 2022 declaration of personal?

2022 Declaration of Personal Form: A Comprehensive How-to Guide

Overview of the 2022 Declaration of Personal Form

The 2022 Declaration of Personal Form serves as a critical tool for individuals and teams looking to accurately report their financial status to governing authorities. This declaration not only informs the tax officials of your financial activities but also plays a vital role in ensuring compliance with tax laws.

Filing the 2022 Declaration accurately is of utmost importance, as errors can lead to audits, penalties, or missed deductions and credits that you may be entitled to.

Understanding the 2022 Declaration Requirements

Before completing your 2022 Declaration of Personal Form, it's essential to understand who is eligible to file. Generally, individuals earning income above a specified threshold must file a declaration. If you're unsure whether you meet the criteria, consult the IRS guidelines or local tax authority.

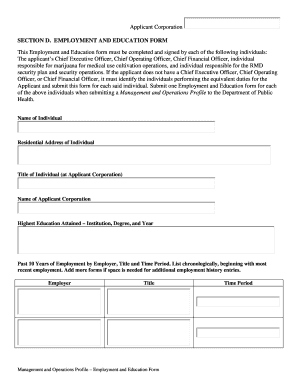

In addition to eligibility, you'll need to gather documentation. Personal identification information, including Social Security numbers for you and any dependents, is required. Income reporting is also crucial; make sure you have all W-2s, 1099s, and records of any other income sources. Finally, sit down and identify applicable deductions and credits you may claim, such as mortgage interest or educational expenses.

Preparing to fill out the 2022 Declaration

Preparation is key when filling out the 2022 Declaration of Personal Form. Start by organizing your financial documents. Create a dedicated folder—whether physical or digital—for all necessary documents. Key pieces include income statements, relevant personal identification documents, and any deduction receipts. Having these easily accessible will streamline the process.

Before you begin, ensure you have all key information at hand. You’ll need your residential address, Social Security number, and information regarding your income. pdfFiller offers numerous tools and resources designed to facilitate this process, allowing you to access templates, checklists, and guidance that make filling out the form straightforward.

Step-by-step instructions for completing the form

Accessing the 2022 Declaration of Personal Form is your first step in the filing process. You can easily find and download the form directly from pdfFiller's user-friendly platform. Alternatively, if you prefer to access it via government websites or tax software, you can do so as well.

When filling out your personal information, ensure accuracy in entering your name, address, and Social Security number. If you’re filing jointly with a partner, entering your spouse’s information is crucial. Remember to include details for any dependents as well.

Next, you’ll report your income. Use a step-by-step approach to list all your income sources, paying particular attention to W-2 and 1099 forms. Double-check for common mistakes, such as transcribing numbers incorrectly or omitting income sources.

When claiming deductions and credits, thoroughly research what you might be eligible for. Filling out these sections accurately can significantly impact your tax refund or liability. Lastly, when signing and submitting the form, pdfFiller allows you to eSign your document digitally, offering options to submit either online or through traditional mail.

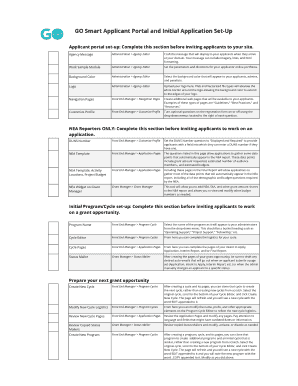

Interactive tools and resources on pdfFiller

pdfFiller offers a plethora of interactive tools to enhance your document management experience. Their editing tools allow you to make any modifications to the form seamlessly. You can also digitally sign documents with ease, which has the same legal validity as a handwritten signature. Collaboration features enable teams filing together to work smoothly on shared documents.

Tracking the status of your submission

Once you submit your 2022 Declaration, tracking its status is essential. pdfFiller provides tools to help you monitor your submission easily. If your declaration encounters delays or is rejected, promptly identify the causes and address them, which may involve submitting additional documentation or clarifications.

Frequently asked questions (FAQs)

It’s natural to have questions about the 2022 Declaration of Personal Form. Common inquiries involve eligibility, available deductions, and the deadlines for filing. Being aware of filing deadlines is crucial as late submissions can incur penalties. You can find a comprehensive FAQ section in pdfFiller or consult the IRS website for additional information.

Contact information for further assistance

If you require further assistance with your 2022 Declaration of Personal Form, pdfFiller provides a robust support system. You can contact their support team directly through their website or reach out to relevant government departments for specific queries on tax regulations.

Important deadlines for the 2022 Declaration

Awareness of important deadlines for filing the 2022 Declaration can save you from costly penalties. The typical deadline for submission is April 15, but exact dates can vary based on extensions or local holidays. It’s wise to mark key dates in your calendar, including potential deadlines for modifications or appeals.

Best practices for future filings

In preparing for future filings, consider establishing a system for managing your financial documents year-round. Maintain an organized digital or physical storage space where you keep records of receipts, income statements, and previous declarations. This level of preparation will simplify next year's filing process immensely.

Navigating changes in the 2022 tax year

Each tax year can bring changes to the rules that affect your filing. For the 2022 tax year, there are important adjustments in allowable deductions, credits, or thresholds that taxpayers should be aware of. Keeping abreast of these changes will ensure that you maximize your entitlements and avoid common pitfalls during your submission process.

Final checks before submission

Before submitting your 2022 Declaration, it's crucial to conduct a final review. Utilize a checklist approach to ensure all information is complete, accurate, and up-to-date. Pay special attention to commonly overlooked aspects such as math errors or omissions on income entries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2022 declaration of personal to be eSigned by others?

How do I complete 2022 declaration of personal online?

How do I edit 2022 declaration of personal in Chrome?

What is declaration of personal?

Who is required to file declaration of personal?

How to fill out declaration of personal?

What is the purpose of declaration of personal?

What information must be reported on declaration of personal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.