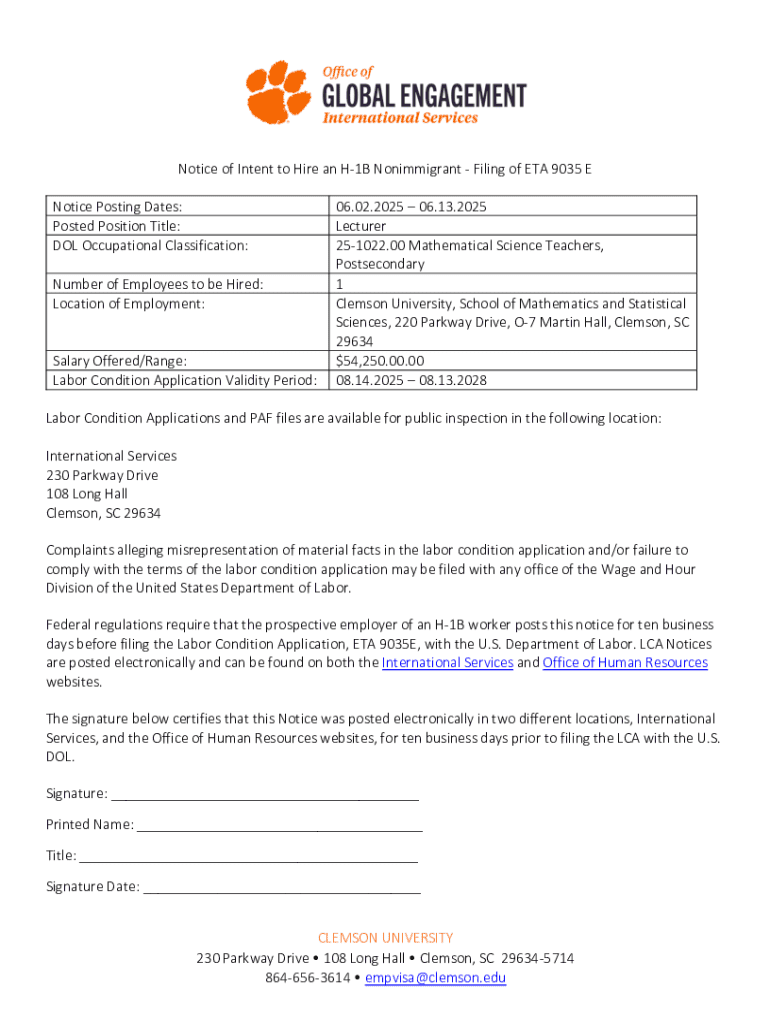

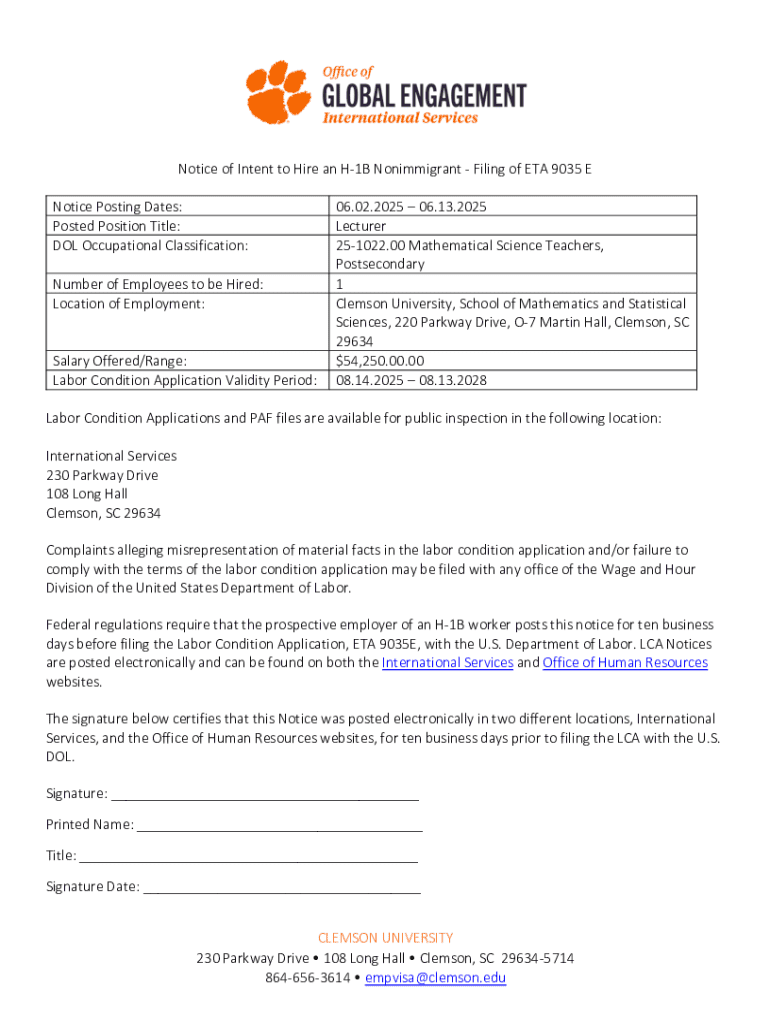

Get the free Notice of Intent to Hire an H-1b Nonimmigrant - Filing of Eta 9035 E

Get, Create, Make and Sign notice of intent to

Editing notice of intent to online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of intent to

How to fill out notice of intent to

Who needs notice of intent to?

Notice of intent to form: A comprehensive how-to guide

Understanding the notice of intent to form

A Notice of Intent to Form is a preliminary document that announces an individual or group's intention to establish a business entity. This notice serves as a formal declaration, signaling to state authorities, potential partners, and the public that the associated parties aim to create a structured organization, such as a corporation or limited liability company (LLC). By filing this notice, applicants proactively ensure transparency within the business environment, building credibility as they transition into formal operations.

The purpose of a Notice of Intent to Form extends beyond mere notification; it establishes a legal framework for the proposed business. This document is crucial in various legal and business contexts, as it helps to define the nature of the entity, outlines the intended structure, and ensures compliance with state-specific incorporation laws. Understanding its significance aids potential entrepreneurs in navigating the complexities of business formation.

When to file a notice of intent to form

Timing is critical when it comes to filing a Notice of Intent to Form. Situational factors—such as securing funding, finalizing business plans, and identifying partners—commonly trigger this filing. It is advisable for entrepreneurs to file the notice as early as possible in their planning process, as this can affect business operations. For instance, many states require this notice before you can reserve a business name or register your entity formally.

Deadlines vary from state to state, and it’s essential to familiarize oneself with local regulations to avoid any delays. Most states accept notices on a rolling basis, but there might be specific requirements tied to local events or business climates that could influence the timing. Always check for applicable deadlines to ensure timely compliance.

Who should file a notice of intent to form?

The parties that should file a Notice of Intent to Form include individual entrepreneurs, small business owners, and teams or organizations intending to establish a formal partnership or corporation. Entrepreneurs who are contemplating launching a startup should not only file this notice but also encourage their partners to do so to create a unified legal front. The act of filing ensures that all parties are aligned in their vision and prepared for the next steps in the business creation process.

Small business owners logging their first steps into the corporate world can benefit significantly by filing this notice early in their planning stages. This helps them to secure their business name and mark their territory in the market. For organizations considering partnerships, submitting a Notice of Intent to Form is an important initial step that lays the foundation for future collaborative efforts.

Step-by-step process to complete the notice of intent to form

Completing a Notice of Intent to Form begins with gathering the necessary information. Specific details are required based on the type of business structure you intend to create, whether it’s an LLC, Corporation, or another type of entity. The data may include the chosen business name, the purpose of the business, and the names and addresses of the founders or members involved. Understanding what is needed from the onset helps to expedite the filing process.

Filling out the form accurately is the next pivotal step. Common fields in the notice typically include: - Entity name: The proposed business name. - Purpose: A brief description of what the business will do. - Principal office address: The main location of the business. - Names of owners or partners: Critical for legal identification. Ensuring each section is completed with precision can prevent unnecessary delays in processing.

It's also essential to review your notice thoroughly before submission. Accuracy and completeness are crucial; going through a checklist can be highly beneficial. Common mistakes include typos in the business name or incorrect addresses, which may lead to rejections. Verifying every detail promotes a smooth filing experience.

Filing the notice of intent to form

When it comes to submitting your Notice of Intent to Form, understanding the various methods is vital. Many states now offer electronic filing through online platforms, which can significantly speed up the process. Users can submit their documents quickly, without the delays often associated with traditional mail.

For those who prefer a physical approach, paper submissions are still possible. Ensure that you mail your notice to the relevant state or local government offices, and be aware of the specific submission requirements in your jurisdiction. Adhering to these regulations is paramount to ensuring your filing is accepted.

Response time and follow-up actions

Once a Notice of Intent to Form has been submitted, applicants must understand the typical processing times for responses from authorities. While this can vary based on location and the volume of applications being processed, generally, expect to receive a response within a few weeks to several months. Keeping track of submission dates can aid in effective follow-up.

If approval is granted, the next steps should involve formalizing your business structure, obtaining any necessary licenses, and starting operations. If the notice is rejected, you will typically receive instructions on what corrections need to be made. Responding promptly to these requests can help to maintain momentum in the business formation process.

Impact of filing a notice of intent to form

The legal implications of filing a Notice of Intent to Form are significant. While this document serves as a precursor to establishing a business entity, it does not equate to the actual formation of the business itself. Formal incorporation or registration must follow this step, solidifying the entity legally. Therefore, it's crucial to understand that the Notice is merely a declaration of intent, not the finalization of the business.

Filing this notice also impacts future business operations and compliance. It sets in motion the regulatory requirements that must be adhered to, shaping the organizational framework that will govern the new business entity. Establishing a timeline for complying with legal obligations once the notice is filed can help future-proof the operations.

Common FAQs about the notice of intent to form

Understanding common concerns regarding the Notice of Intent to Form can help ease the anxiety of first-time filers. Frequently asked questions include inquiries about the specific information required, how to correct mistakes after submission, and the implications of not filing correctly. Being prepared with these answers can streamline the process significantly.

In case issues arise during the filing process—such as missed deadlines or incorrect details—having a plan to troubleshoot can save time and stress. For example, promptly contacting the relevant authority for clarification can often provide guidance on the next steps to take.

Utilizing pdfFiller to streamline your process

When it comes to document management, pdfFiller offers a powerful suite of tools that can streamline the process of filing a Notice of Intent to Form. With its comprehensive editing capabilities, users can create and modify PDF documents in real-time, ensuring that all necessary information is included and accurate before submission.

Moreover, pdfFiller includes interactive tools like eSigning and collaboration features, making it easier for teams to work together on the notice. Accessing the required forms on pdfFiller is straightforward; simply search for 'Notice of Intent to Form,' and the platform provides a user-friendly template, ensuring everyone is on the same page while managing the documentation effortlessly.

Additional considerations

It’s important to address common misconceptions around the filing process of a Notice of Intent to Form. Many believe that this notice guarantees the entity's formation, when in fact it only signals intent. Debunking these myths prevents misunderstandings that could lead to compliance issues down the line.

When the complexities of filing seem overwhelming, seeking professional assistance can provide clarity and peace of mind. Legal professionals or consulting services can guide you through the nuances of local regulations. pdfFiller can facilitate this collaboration, providing a platform for document sharing and editing to enhance communication and streamline the filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in notice of intent to without leaving Chrome?

How do I fill out notice of intent to using my mobile device?

Can I edit notice of intent to on an Android device?

What is notice of intent to?

Who is required to file notice of intent to?

How to fill out notice of intent to?

What is the purpose of notice of intent to?

What information must be reported on notice of intent to?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.