Get the free State Tax Form 126-mve

Get, Create, Make and Sign state tax form 126-mve

Editing state tax form 126-mve online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state tax form 126-mve

How to fill out state tax form 126-mve

Who needs state tax form 126-mve?

Understanding State Tax Form 126-MVE: A Comprehensive Guide

Overview of the State Tax Form 126-MVE

The State Tax Form 126-MVE serves as an essential document for individuals and businesses in navigating their state tax obligations. This form is specifically designed to gather pertinent information that helps determine tax liabilities and ensures compliance with state tax laws.

Key features of the form include a structured layout that simplifies data entry, allowing for uniform collection of information relevant to varying taxpayers. The benefits also extend to minimizing errors through guided sections and increasing efficiency during filing seasons.

Understanding how the State Tax Form 126-MVE fits into the overall tax process is crucial. This form acts as a gateway, leading taxpayers to the fulfillment of their financial responsibilities while providing a structured approach to collecting and reporting necessary financial information.

Who needs to use the State Tax Form 126-MVE?

The State Tax Form 126-MVE is not for everyone. Eligibility criteria for this form typically include residents, businesses, or teams that have generated taxable income within the state. Understanding when this form is necessary can save individuals from potential complications or penalties.

Common scenarios requiring this form include those who have received income from self-employment, rental properties, or have made significant capital gains within the tax year. It's also essential for teams within businesses to file this document yearly to ensure accurate payroll reporting.

Failing to use the State Tax Form 126-MVE when required can have serious implications. Delinquent filings can lead to penalties, increased interests on owed taxes, and jeopardize one’s ability to claim certain deductions.

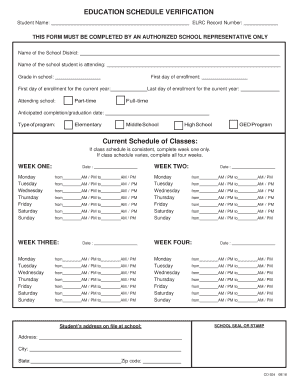

Step-by-step guide to filling out the State Tax Form 126-MVE

When preparing to fill out the State Tax Form 126-MVE, a methodical approach is crucial. Start by gathering the necessary documents, ensuring you have everything required to accurately report your finances.

Gather necessary information

List of documents required typically includes tax identification numbers, previous tax returns, income statements such as 1099s or W-2s, and receipts for deductible expenses. It's essential to have these documents organized to streamline the completion process.

Filling out the form

Each section of the State Tax Form 126-MVE should be completed with accuracy. The primary sections typically include:

After completing the form, it’s vital to review your information meticulously. Ensure all entries are correct to avoid mistakes that could lead to unnecessary complications.

Reviewing your information

Tips for double-checking your entries include verifying numbers against your documents, ensuring that names match legal documents, and confirming that no sections are left blank. Common mistakes to avoid involve accidental transpositions of digits or misunderstanding tax obligations that lead to incorrect deductions.

Editing and Modifying the State Tax Form 126-MVE

Once your form is filled, you may need to edit or modify it before final submission. Utilizing pdfFiller allows users to easily make changes on the platform, ensuring that your form remains up-to-date.

Using templates is another fantastic way to streamline the process. Instead of starting from scratch each tax season, you can refer to saved templates from past filings.

Collaborating with team members for edits can improve accuracy. Using a platform like pdfFiller facilitates seamless interaction among team members, allowing for collective input and ensuring all necessary elements are considered.

Signing and submitting the State Tax Form 126-MVE

Before submission, the State Tax Form 126-MVE needs to be signed electronically or physically. Electronic signing has become increasingly popular due to its convenience and efficiency.

eSigning the form

The benefits of eSigning include immediate assurance that your form has been signed correctly and can be tracked directly from your dashboard. The step-by-step eSigning process on pdfFiller is user-friendly and ensures compliance with state regulations.

Submission options

You have various submission methods once your form is ready. Electronic submission procedures typically involve uploading your signed document directly through the state's tax portal.

If you opt for mailing instructions, ensure including the cover letter outlining what you are submitting, copies of supporting documents, and use a secure envelope to protect your sensitive information.

Managing and storing your State Tax Form 126-MVE

Once submitted, the proper management of your State Tax Form 126-MVE is crucial. Keep in mind that maintaining organized documents can make future filings and audits much simpler.

Using pdfFiller for secure document storage makes this process even easier. Files can be categorized based on years or types for easy retrieval when needed.

Keeping records tidy and easily accessible can aid in simplifying future tax obligations and provide peace of mind.

FAQs about the State Tax Form 126-MVE

Tax-related questions are common, especially regarding the State Tax Form 126-MVE. Here are answers to some frequently asked questions that may provide clarity.

For additional support, consulting with a tax professional can provide tailored advice based on your unique tax situation.

Interactive tools for easy management of your State Tax Form 126-MVE

pdfFiller offers various interactive features designed to assist users in managing their State Tax Form 126-MVE efficiently. These features not only streamline the filling process but also enhance collaboration and ease of use.

Demonstration of form-filling tools can guide users in utilizing operable options that provide instant calculations, suggested fields, and helpful prompts.

Leveraging these tools can mitigate the challenges typically faced during tax season, enhancing user experience and accuracy.

Case studies: Success stories of using the State Tax Form 126-MVE

Examining success stories can illuminate how efficiently managing the State Tax Form 126-MVE through pdfFiller has helped others. Individuals and teams have reported significant time savings and reduced stress through better organization and preparation.

For instance, a small business utilized pdfFiller to streamline their tax submission process, reducing their filing time by over 50%. By properly managing their documents and utilizing templates, they overcame challenges in compliance that previously led to errors.

The analysis of these challenges emphasizes how effective document management with pdfFiller fosters efficiency and accuracy.

Additional tools and resources on pdfFiller

Beyond just the State Tax Form 126-MVE, pdfFiller offers a range of resources for document management. These include access to other important forms, tax templates, and learning resources tailored to improve your financial documentation skills.

Additionally, pdfFiller ensures accessibility needs are met for all users, providing tools that aid in usability for diverse needs.

Get started with pdfFiller for your State Tax Form 126-MVE

Getting started with pdfFiller is a simple process. Creating an account takes just a few minutes, and once created, you gain access to valuable features that streamline your document management.

A brief walkthrough of pdfFiller’s features reveals an intuitive interface with plenty of options for collaboration, editing, and document storage. From easily accessible templates to eSigning capabilities, everything is designed for the user experience.

Opportunities for teams to collaborate on document management make pdfFiller an excellent choice for both individuals and businesses alike.

Helpful tips for a smooth tax season

When the tax season approaches, preparation is key to avoiding pitfalls. Being well-prepared can significantly ease the stress that often accompanies filing.

These tips enhance efficiency and help minimize the risks of late filings, ensuring compliance and peace of mind during tax season.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute state tax form 126-mve online?

Can I sign the state tax form 126-mve electronically in Chrome?

How can I edit state tax form 126-mve on a smartphone?

What is state tax form 126-mve?

Who is required to file state tax form 126-mve?

How to fill out state tax form 126-mve?

What is the purpose of state tax form 126-mve?

What information must be reported on state tax form 126-mve?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.