Get the free Annual Statement

Get, Create, Make and Sign annual statement

Editing annual statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual statement

How to fill out annual statement

Who needs annual statement?

Your Comprehensive Guide to the Annual Statement Form

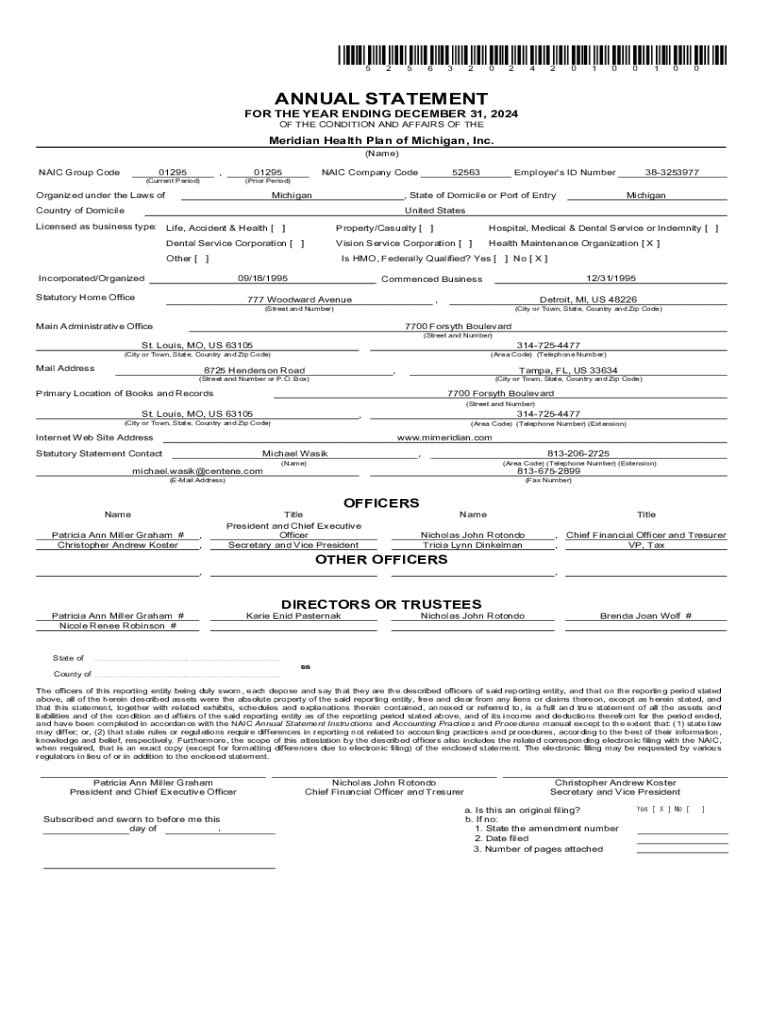

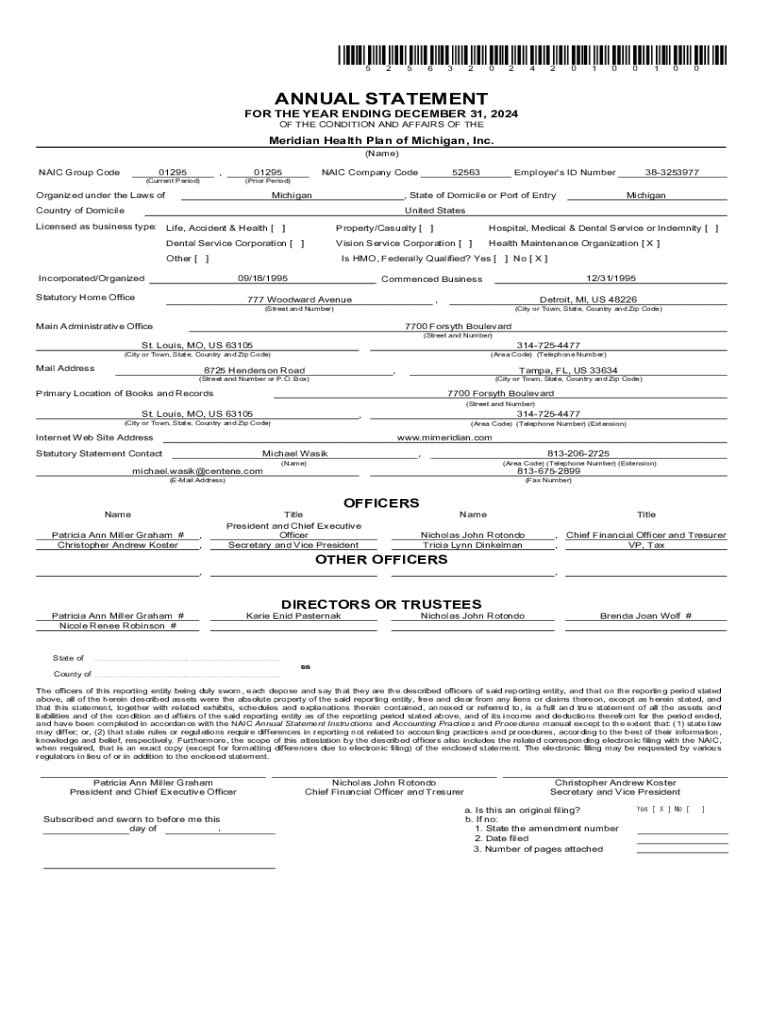

Understanding the annual statement form

An annual statement form is a critical document that serves as a summary of a company’s financial performance over the preceding year. This form not only encapsulates the financial health of the organization but also provides essential insights into compliance with regulatory requirements. Various industries rely heavily on annual statements to ensure transparency and build trust with stakeholders.

The importance of annual statements cannot be overstated. For public companies, these forms are required by law to ensure that investors have access to relevant financial information to make informed decisions. Similarly, nonprofits use annual statements to report on their fiscal health to donors and regulatory bodies, demonstrating accountability.

Preparing to complete your annual statement

Before diving into filling out the annual statement form, it’s essential to gather all necessary documents. This preparation involves collecting financial records, previous annual statements, bank statements, and other relevant information. Organizing these documents will save time and streamline the completion process.

Best practices for document organization include creating a dedicated folder on your computer or cloud storage, using clear naming conventions, and checking off items once they’re collected. This structured approach prevents last-minute scrambles for documents and ensures a smooth workflow.

Step-by-step instructions for filling out the annual statement form

Starting with basic information, accurately entering identifying details is crucial. This includes your company's name, address, and tax identification number. Double-checking initial details can help prevent errors later that could lead to compliance issues or delays in processing.

Once the basic information is in place, it’s important to focus on the financial sections. A breakdown of income, expenses, and balance sheets will reveal key insights on profitability and expenditure. Attention should be paid to major lines on the statement, as oversights in reporting can lead to challenges down the line.

Utilizing interactive tools for your annual statement

pdfFiller offers a suite of interactive tools specifically designed to enhance your annual statement form-filling experience. The platform’s online editing features allow users to edit, sign, and manage their documents with ease. Real-time collaboration is also a standout feature, allowing multiple users to work on the document simultaneously, streamlining feedback and approvals.

Utilizing templates can significantly speed up the process of filling out your form. pdfFiller provides access to customizable templates for annual statements that cater to various industries. This functionality saves time and helps ensure consistency in formatting and presentation.

Finalizing your annual statement

As you approach the end of the process, conducting a thorough review of the annual statement is essential. This step involves cross-checking all figures and data for accuracy. Common mistakes can lead to significant implications, ranging from regulatory penalties to loss of credibility.

Once satisfied with the document, signing and submitting your form is the final step. With pdfFiller, you can electronically sign your annual statement, which is not only secure but also expedites the submission process. Remember to consider your submission methods, whether online or via traditional mail, ensuring you meet all local requirements.

Common mistakes to avoid when filing your annual statement

One of the most prevalent issues in filing annual statements is inaccurate financial reporting. Misreported figures can lead to immense fiscal repercussions, including audits and fines. To navigate this, employing a checklist and double-checking calculations can aid in identifying discrepancies early.

Additionally, failing to comply with submission deadlines can result in penalties. Awareness of filing deadlines is crucial, and utilizing digital tools like pdfFiller can help track and manage filing schedules effectively, ensuring you never miss an important date.

Frequently asked questions about annual statement forms

If you happen to miss the filing deadline for your annual statement, it's essential to act quickly. Depending on your industry, there may be a grace period, or you might incur penalties. Contacting the relevant regulatory body can provide clarity on the next steps.

In cases of discrepancies in reported data, it’s critical to document any errors and amend your statement as soon as possible. This ensures compliance and maintains the integrity of your financial reporting.

Annual statements typically require filing once a year, but various factors can dictate different timelines. Keep regulatory requirements in mind and reach out to financial experts if uncertain.

Leveraging pdfFiller for ongoing document management

Once your annual statement has been filed, managing financial documents becomes crucial for ongoing compliance. Utilizing pdfFiller allows you to organize past filings effectively, ensuring they are easily accessible for audits or future reference.

Tracking revisions and updates is also streamlined with pdfFiller. The platform’s tools help maintain a clear history of changes, which is invaluable when comparing previous years’ statements or preparing for an audit.

Industry-specific insights

In the insurance sector, annual statements often have unique requirements due to the heavily regulated nature of the industry. Insurers need to disclose additional information regarding their reserves and claims, which adds a layer of complexity to the standard form.

Conversely, in the financial sector, entities like banks and investment firms focus on showcasing asset management performance, compliance with capital requirements, and risk management protocols in their annual statements. This specificity necessitates an understanding of different regulatory standards.

Nonprofits face their own distinct considerations, such as providing detailed statements regarding donations, expenditures, and how funds are utilized. Transparency in financial reporting is paramount to maintain donor trust and regulatory compliance.

Conclusion

Filing an annual statement form is more than just a requirement; it’s an opportunity to reflect on your organization’s financial health and plan for the future. Precision and compliance in this process are critical to avoid pitfalls and ensure reliable reporting.

As a comprehensive document management tool, pdfFiller empowers users to navigate the complexities of the annual statement form, from editing and signing to collaborating and organizing. Leveraging such powerful resources can transform your experience, enhancing efficiency and accuracy in your reporting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find annual statement?

How do I execute annual statement online?

Can I create an electronic signature for signing my annual statement in Gmail?

What is annual statement?

Who is required to file annual statement?

How to fill out annual statement?

What is the purpose of annual statement?

What information must be reported on annual statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.