Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form: A Complete Guide for Nonprofits

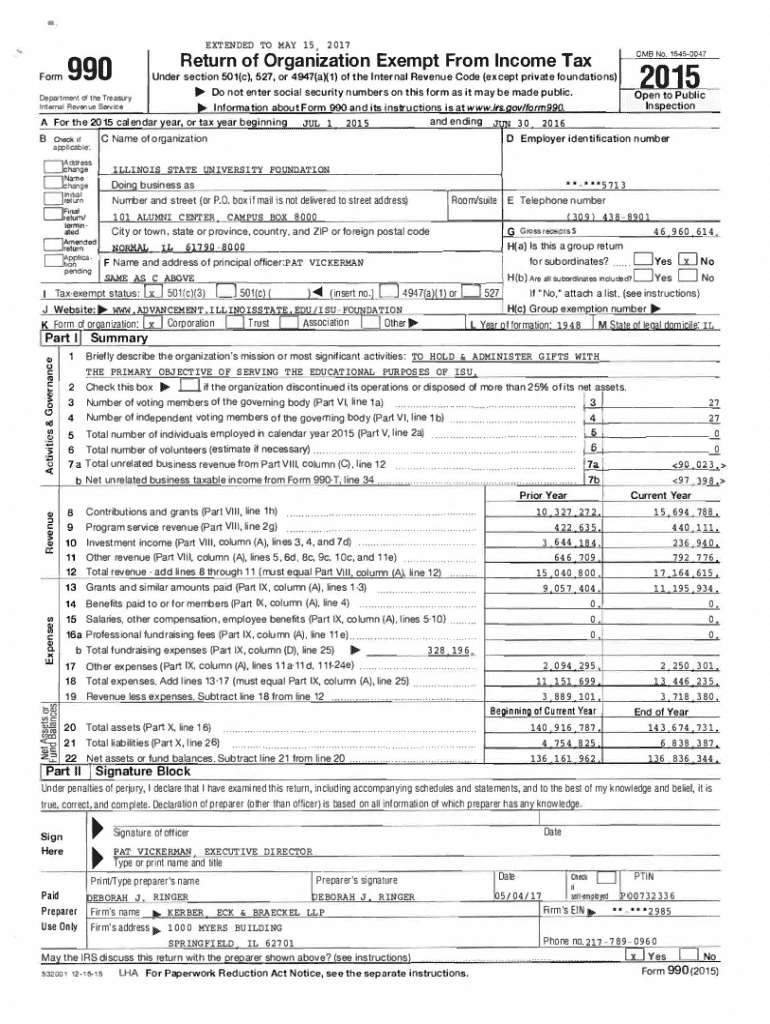

Understanding Form 990

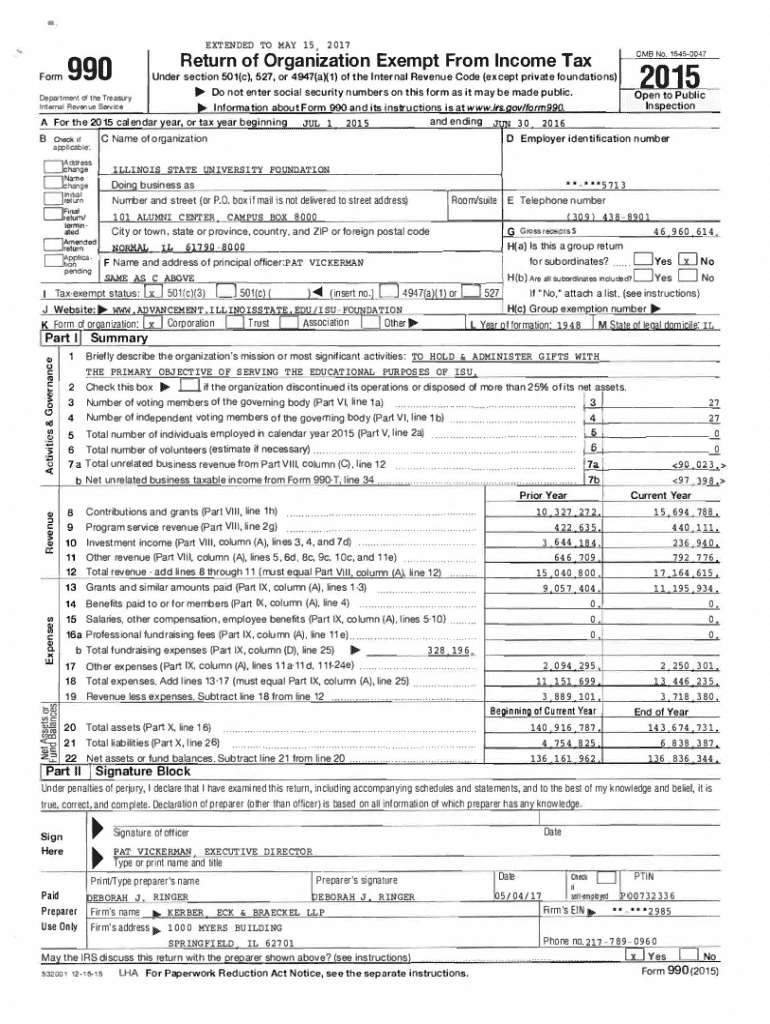

Form 990 is a vital document for nonprofit organizations in the United States, primarily serving as an annual information return. Its primary purpose is to provide the IRS and the public with details about the organization’s financial activities, governance, and compliance with IRS rules. This form aids in ensuring that nonprofits operate transparently and justly, offering insights into their mission and impact.

The importance of the Form 990 cannot be understated. It fulfills critical annual reporting requirements, ensuring nonprofits remain compliant with federal regulations. By filing this form, organizations demonstrate their commitment to transparency and accountability, which can enhance their reputation and foster trust with donors, beneficiaries, and the general public.

Navigating the Form 990

Navigating the Form 990 requires a clear understanding of its structure. The form includes several sections that delve into different aspects of the nonprofit’s operations. Each part is designed to collect specific information, and understanding these sections is crucial for accurate and comprehensive reporting.

Key terminology includes 'program service accomplishments,' which refers to the efforts made by the nonprofit to achieve its mission, and 'net assets,' which reflects the total amount of assets available minus liabilities. Familiarity with these terms is essential for filling out the form correctly.

Variants of Form 990

Nonprofits may file different variants of the Form 990 based on their size and activities. Understanding these variants is essential for compliance and accuracy.

Filing modalities

Filing the Form 990 is crucial for nonprofit organizations, and they can choose between electronic and paper filing methods. Both processes have their own requirements, and understanding them can help facilitate a smoother submission.

Electronic filing is generally more efficient and less prone to errors. Organizations can utilize platforms like pdfFiller to file their forms securely and conveniently. These online platforms often come with features to ensure efficiency in submitting and managing documents.

Common pitfalls and how to avoid them

Several common pitfalls can lead to complications when filing the Form 990. Awareness of these can significantly improve compliance and reduce the risk of penalties.

One major issue arises from incomplete information provided on the form. Nonprofits must ensure that every section is thoroughly completed and accurate, reflecting their financial situation clearly. Additionally, filing late can also result in severe consequences.

Public inspection regulations

Form 990 plays a role in transparency, as it must be available for public inspection. Understanding the regulations surrounding this requirement helps nonprofits manage their compliance obligations effectively.

All filed forms must be made accessible to the public, which underscores the need for accuracy. Individuals interested in reviewing these forms can do so through various means.

Utilizing Form 990 for charity evaluation

Form 990 serves as a valuable resource for potential donors and researchers interested in charitable organizations. By analyzing this information, stakeholders can gain insights into a nonprofit’s operational efficiency and impact.

Key metrics typically highlighted in Form 990 files can help assess the financial health of a nonprofit, enabling donors to make informed contributions.

Historical context of Form 990

Understanding the evolution of Form 990 provides insight into the current reporting landscape for nonprofits. Over the years, the form has undergone various changes to enhance its clarity and relevance.

Recent changes have included a greater emphasis on reporting financial details and programmatic achievements, reflecting a broader trend towards accountability in nonprofit management.

Tools for managing Form 990

Using tools like pdfFiller can greatly enhance the process of preparing, filing, and managing Form 990. These tools offer comprehensive features tailored for nonprofits, making compliance easier.

Among the interactive features that pdfFiller provides are easy editing tools and eSigning capabilities that facilitate collaboration and streamline the submission process.

Learning from sample IRS Form 990

Analyzing a sample IRS Form 990 can provide practical insights into the filing process. By breaking down each section, organizations can learn the nuances of what information to include.

Practical tips can include ensuring consistency in financial reporting and staying updated with changes to definitions or reporting requirements as stipulated by the IRS.

Frequently asked questions (FAQs)

As nonprofits navigate the complexities of filing Form 990, several common questions arise, which can clarify their responsibilities and options.

Engaging with the community

Engagement with broader nonprofit networks can provide valuable support in the Form 990 filing process. Organizations can access peer support and expert advice through various platforms.

Finding organizations that offer workshops and guidance can help nonprofits keep abreast of changes and best practices in completing Form 990.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the form 990 in Chrome?

Can I create an electronic signature for signing my form 990 in Gmail?

How do I edit form 990 on an iOS device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.