Get the free Form No. 15h - Part I & Ii

Get, Create, Make and Sign form no 15h

Editing form no 15h online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form no 15h

How to fill out form no 15h

Who needs form no 15h?

Understanding Form No 15H: A Comprehensive Guide

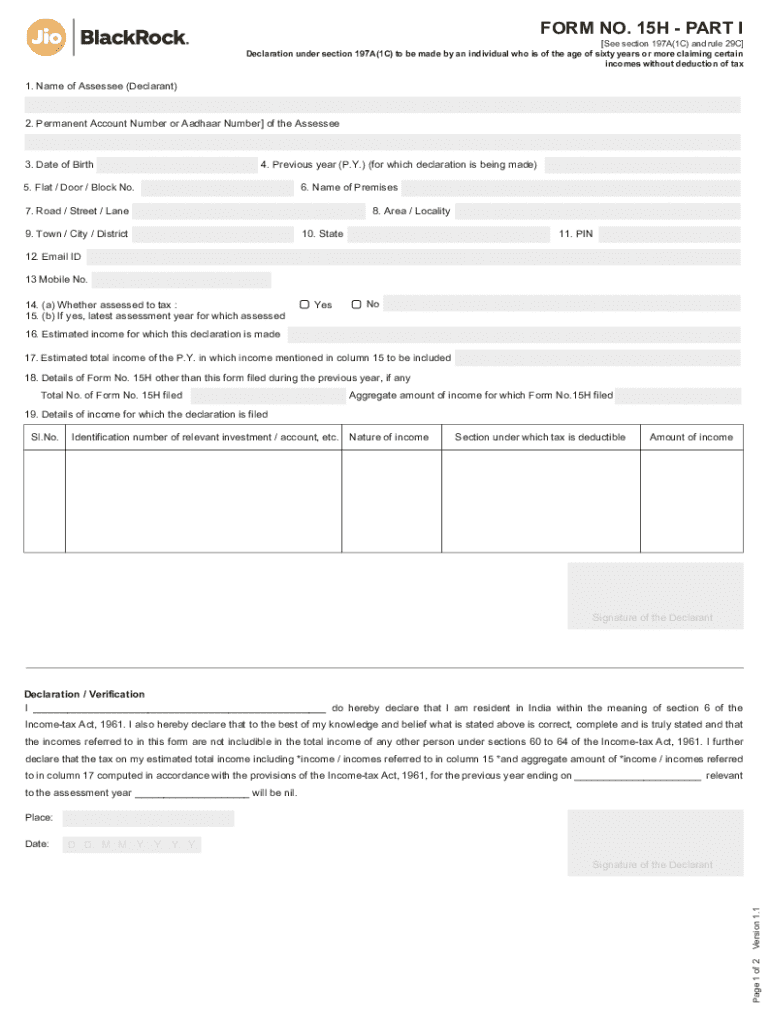

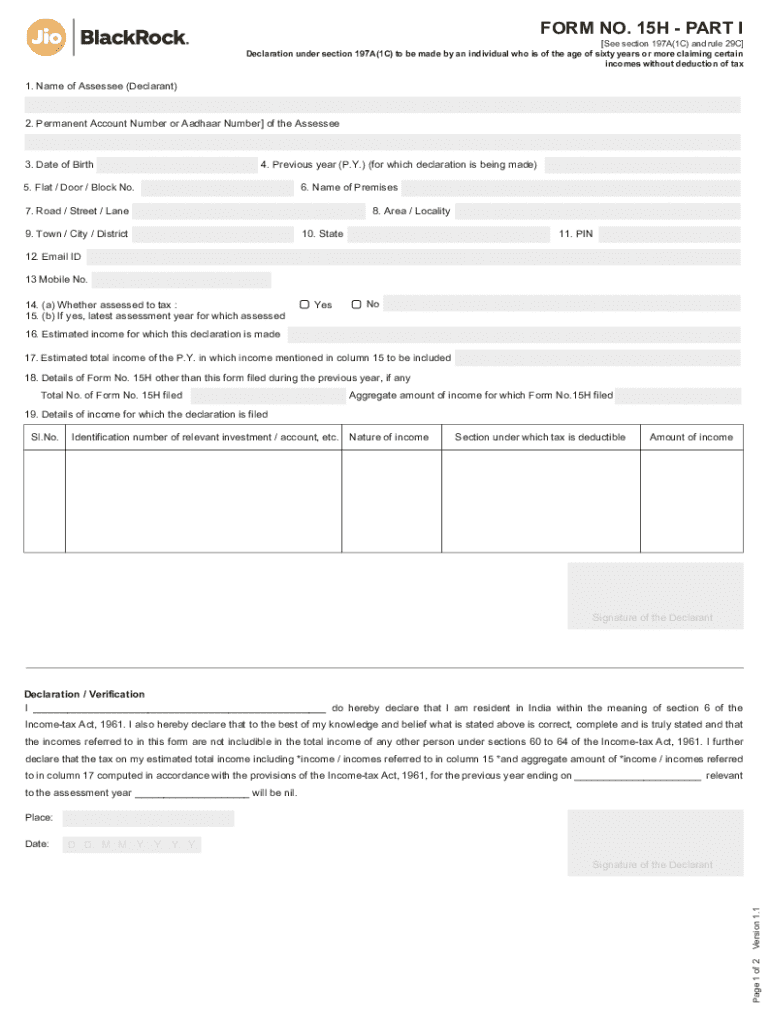

Overview of Form No 15H

Form No 15H is a tax declaration form utilized primarily by individuals to ensure that the interest income received from specific sources remains exempt from tax deductions. This form serves to tell banks or financial institutions that the account holder is eligible for non-deduction of tax at source (TDS) — effectively allowing taxpayers without taxable income to manage their finances without deductions.

The significance of Form No 15H in tax filing is particularly pronounced for senior citizens and individuals whose total income is below the taxable limit. By submitting this form, they can avoid unnecessary tax deductions, thus ensuring they receive their entire interest amount without reductions.

Eligible taxpayers include residents of India who are not liable to pay income tax, typically characterized by low incomes or none at all. This form is particularly relevant for seniors who may rely heavily on savings accounts or fixed deposits, making them vulnerable to TDS when they shouldn’t be.

Key features of Form No 15H

Form No 15H allows for exemption from TDS on various types of income. The main categories include interest accrued from savings accounts, fixed deposits, and recurring deposits in banks and post offices. However, it’s essential to note that this exemption applies only when the total taxable income does not exceed the prescribed limit, which is determined during each fiscal year.

Step-by-step instructions for filling out Form No 15H

Filling out Form No 15H accurately is crucial. The following step-by-step guide elaborates on the procedure to help users navigate this process effectively.

Step 1: Gather required information

Before starting the form, gather necessary personal details such as name, address, and Aadhaar number. Additionally, summarize your income sources, including bank interest and other exempted incomes, as this information will need to be declared.

Step 2: Access the form

Form No 15H can easily be found on the pdfFiller platform. Finding the latest version of the form is essential to ensure compliance with current regulations.

Step 3: Fill out the form online

Using interactive tools provided on pdfFiller can streamline the process. Enter personal details in the required fields, and ensure that your income details reflect your total earnings accurately.

Step 4: Review your information

Once all fields are filled, carefully check your information against your documents. A checklist to ensure accuracy includes confirming spelling, numbers, and verification of income amounts. Common mistakes to avoid include incorrect account numbers or omitting income sources.

Step 5: Save and sign the form

After verifying the details, save your filled form using the download option. Utilize the eSignature feature on pdfFiller to electronically sign your document — a critical step for legitimacy.

Step 6: Submit your form

Finally, submit your Form No 15H to the relevant bank or financial institution. Methods of submission include direct email or paper submission. Tracking your submission allows you to maintain a record and follow up if necessary.

How to edit and manage Form No 15H

pdfFiller offers robust editing features for Form No 15H, making it easy to amend any mistakes or update information when necessary. This is particularly beneficial when changes occur in your financial situation or personal data.

Moreover, collaboration tools on pdfFiller enhance teamwork on tax-related documents. Teams can share forms, leave comments, and ensure all necessary staff are on the same page regarding submissions. The version history feature also allows you to manage changes efficiently without losing sight of previous iterations.

Frequently asked questions (FAQs) about Form No 15H

Common queries regarding Form No 15H typically revolve around eligibility requirements. Taxpayers frequently want to know if they qualify based on their income and whether they can use this form for different types of income.

Real-life examples and scenarios

Several individuals have successfully utilized Form No 15H to navigate the complexities of TDS exemption. For instance, a retired teacher receiving fixed deposit interest and a senior citizen pensioner living solely on bank interest benefits from filing this form, allowing them to receive their full entitled interest without deductions.

Testimonials reveal satisfaction among users who managed their tax filings with pdfFiller, highlighting the ease of use and the straightforward nature of filling out Form No 15H through its interface.

Additional tips for using pdfFiller with Form No 15H

To maximize efficiency with pdfFiller when utilizing Form No 15H, consider leveraging the advanced features that streamline document management. These include utilizing templates to reduce repetitive tasks and engaging in real-time collaboration for teams.

Integrating Form No 15H into your overall tax strategy promotes systematic record-keeping and timely submissions. Moreover, encouraging collaboration among team members can aid in creating a comprehensive approach to handling tax documents effectively and reducing last-minute stress.

Contact support for Form No 15H related queries

If you encounter any challenges while working with Form No 15H, the pdfFiller support team is readily available. You can access customer support through various channels, including live chat and email support, ensuring that help is just a click away.

Additionally, pdfFiller provides a set of resources, including tutorials and helpful articles, to further assist you in resolving issues or deepening your understanding of using Form No 15H effectively.

Related forms and documents

Understanding the relationships between various tax forms is crucial for comprehensive tax filing. Related forms include Form No 15G, which provides a similar exemption process for individuals whose total income does not exceed the taxable limit. Moreover, familiarity with Form No 16 can aid in understanding TDS deductions made by employers on salary incomes.

Final thoughts on effortless tax filing with pdfFiller

Utilizing pdfFiller for completing Form No 15H not only simplifies the tax filing experience but enhances overall document management. With its user-friendly interface and robust features, users can successfully manage their tax obligations while minimizing errors and maximizing efficiency.

Incorporating a comprehensive document solution like pdfFiller into your tax strategy promotes organized record management and timely submissions, ensuring stress-free tax seasons in the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form no 15h for eSignature?

Can I create an eSignature for the form no 15h in Gmail?

How do I fill out form no 15h on an Android device?

What is form no 15h?

Who is required to file form no 15h?

How to fill out form no 15h?

What is the purpose of form no 15h?

What information must be reported on form no 15h?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.