Get the free 2024 Ia 178

Get, Create, Make and Sign 2024 ia 178

Editing 2024 ia 178 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 ia 178

How to fill out 2024 ia 178

Who needs 2024 ia 178?

2024 IA 178 Form - How-to Guide

Understanding the 2024 IA 178 Form

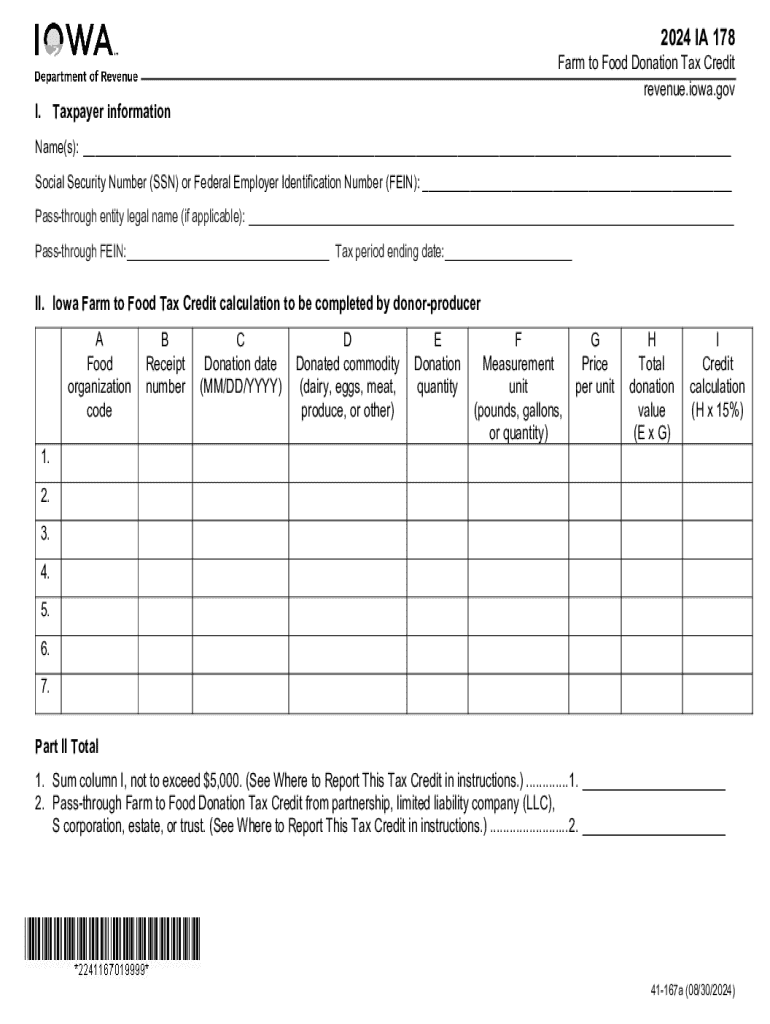

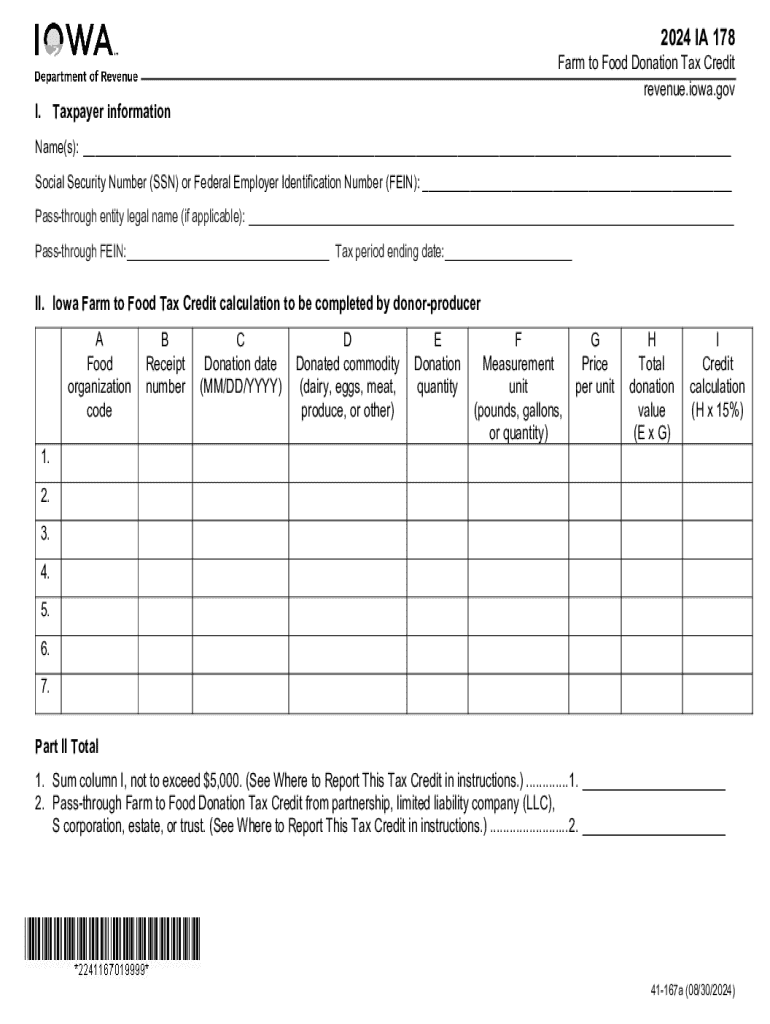

The IA 178 Form is a vital document for Iowa taxpayers seeking to claim a variety of deductions and credits on their state income tax returns. Specifically, it is used to report and calculate claims related to revenue credits and other adjustments that directly affect tax responsibilities. Filing this form accurately and timely is crucial for any individual or business wanting to maximize their eligible tax benefits.

To successfully complete the IA 178 Form, users must provide essential information such as taxpayer identification numbers, detailed records of income, and documentation supporting any claimed credits or deductions. Understanding the requirements not only expedites the filing process but ensures compliance with Iowa tax regulations.

Who needs to use the IA 178 Form?

The IA 178 Form is primarily targeted toward Iowa residents, including both individuals and business entities that generate taxable income in the state. Specific groups that may be required to file this form include self-employed individuals, small business owners, and those who have income from rental properties or various investments.

Eligibility requirements often hinge on the nature of income and specific deductions sought; hence, it’s recommended that anyone unsure of their need to file consults a tax professional or the Iowa Department of Revenue for guidance.

Accessing the 2024 IA 178 Form

Finding the 2024 IA 178 Form is straightforward, thanks to several reliable platforms. The Iowa Department of Revenue’s official website is the primary resource. Additionally, users can access a downloadable version of the IA 178 Form directly from platforms like pdfFiller, ensuring ease of access for all.

The form is typically available in a PDF format, which can be filled out on desktops and mobile devices, thus ensuring that users can complete their filing process from anywhere. Users should ensure their devices have PDF-reading capabilities for optimal functionality.

Filling out the IA 178 Form

Filling out the IA 178 Form can be streamlined by following a step-by-step approach. Begin with personal identification information, ensuring that all details are accurate. Next, input your income figures, and then list any credits or deductions being claimed, detailing them in accordance with the documentation you gathered.

Before you start, it’s wise to collect necessary data, including income statements and records of eligible expenses. Preparation helps mitigate errors, a common issue among filers. Watch out for frequent mistakes, such as omitting income sources or miscalculating deductions, both of which could lead to delays or audits by tax authorities.

Editing and customizing the IA 178 Form

pdfFiller offers a variety of editing tools to enhance your experience with the IA 178 Form. Users can easily modify text, add images, and even incorporate signatures directly on the platform. This functionality is particularly useful when correcting errors or personalizing the form according to specific needs.

Additionally, the use of templates can significantly expedite the process of filling out the IA 178 Form. Users can create and save customized templates for their future filing needs, allowing for quick access and easy repetitions of common submissions. This is especially beneficial for individuals or organizations that regularly file tax forms.

Signing the IA 178 Form

Upon completing the IA 178 Form, it’s essential to properly sign it. pdfFiller allows users to electronically sign documents through legally binding eSignature options. This is not only convenient but also complies with state regulations regarding electronic submissions.

Furthermore, pdfFiller enables users to collaborate effectively by inviting others to review or sign the form. This feature is particularly useful in business settings, where multiple parties may need input or approval before final submission. Collaborators can be assigned different permissions, making it easier to track changes and maintain document security.

Submitting the IA 178 Form

The submission process for the IA 178 Form is straightforward but requires attention to detail. Users should follow specified submission guidelines to ensure their forms are received and processed without delay. It’s important to check deadlines carefully to avoid late submissions, which could incur penalties.

After submitting the form, it's wise to monitor the processing status. Typically, you can expect a confirmation from the tax authority regarding receipt and processing. If you have inquiries regarding your submission, there are contact options available through the Iowa Department of Revenue to address any issues efficiently.

Managing your IA 178 Form documents

Effective management of your IA 178 Form documents is crucial, and pdfFiller provides excellent resources for organization. Best practices include creating a dedicated folder for tax-related documents, labeling files clearly to enhance retrieval speeds, and regularly backing up digital forms.

pdfFiller’s storage capabilities allow users to keep track of their filled forms efficiently. You can access a history of previously submitted forms, which helps in identifying changes over time and aids in future preparation for tax filings.

Frequently asked questions (FAQs)

Many individuals have common inquiries regarding the IA 178 Form. Understanding the term 'tax credit' or clarifying what constitutes eligible income can help reduce confusion. It’s always beneficial to reference both state guidelines and instructions included with the form.

For additional assistance, pdfFiller offers support options, including customer service for specific concerns. You can also find helpful resources and webinars addressing common tax queries for enhanced understanding.

State-specific information

Filing the IA 178 Form also means adhering to Iowa's specific guidelines and regulations. All claimants should be aware of Iowa's unique requirements, such as the types of deductions available and the necessary documentation needed for verification.

For robust clarity, individuals can consult resources from the Iowa Department of Revenue for updates to guidelines or links to related state agencies. Such diligence will ensure compliance and maximize eligible claim potential.

User testimonials and success stories

Many users of pdfFiller have shared positive experiences regarding the IA 178 Form. Individuals have reported streamlined tax preparation and a decrease in filing errors since utilizing pdfFiller’s features, which include intuitive editing, signing, and storage options.

These testimonials reflect how pdfFiller has effectively improved document management and collaboration for tax-related needs, showcasing a sharing of experiences that can inspire others to leverage the platform.

Integration capabilities

pdfFiller seamlessly integrates with numerous tools and platforms, enhancing user workflow. Whether through cloud storage solutions like Google Drive and Dropbox or collaboration tools, pdfFiller’s integration capabilities streamline document access and editing.

Leveraging these cloud-based features not only elevates productivity but ensures users can operate comfortably from various devices, further simplifying the document management process in tax preparation.

Advanced features

pdfFiller’s advanced features add significant value, offering functionalities such as tagging, searching, and automation tools. Users can easily tag their documents for quick searches or automate repetitive tasks, significantly alleviating the burden of document management.

With such advanced tools at your disposal, the task of handling forms becomes less daunting and more manageable, allowing users to focus on what truly matters—accurately filing their taxes.

Accessibility features

Ensuring that everyone can utilize the IA 178 Form effectively, pdfFiller includes various accessibility options. These features cater to users with disabilities or special needs, providing alternatives that uphold usability and functionality.

Users are encouraged to explore these accessibility options to tailor their experience, ultimately fostering an inclusive environment around document management and form filling.

Final thoughts

In conclusion, leveraging pdfFiller for your IA 178 Form needs enhances the entire document handling experience. Users benefit from comprehensive editing, e-signing, and efficient management that streamline tax preparation and submission.

Exploring the myriad features of pdfFiller not only simplifies individual tasks but empowers users to conduct their tax filings with confidence, ensuring they achieve the best outcomes from their forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in 2024 ia 178?

Can I edit 2024 ia 178 on an iOS device?

How do I complete 2024 ia 178 on an Android device?

What is ia 178?

Who is required to file ia 178?

How to fill out ia 178?

What is the purpose of ia 178?

What information must be reported on ia 178?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.