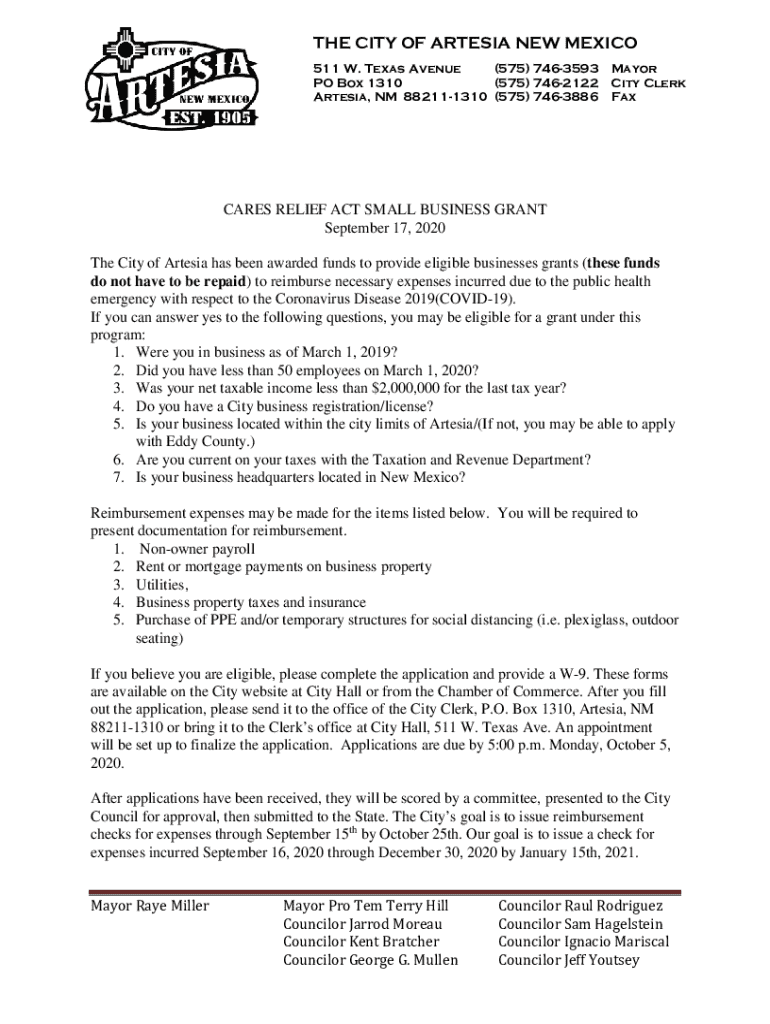

Get the free Cares Relief Act Small Business Grant

Get, Create, Make and Sign cares relief act small

How to edit cares relief act small online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cares relief act small

How to fill out cares relief act small

Who needs cares relief act small?

CARES Relief Act Small Form: A Comprehensive Guide

Understanding the CARES Relief Act

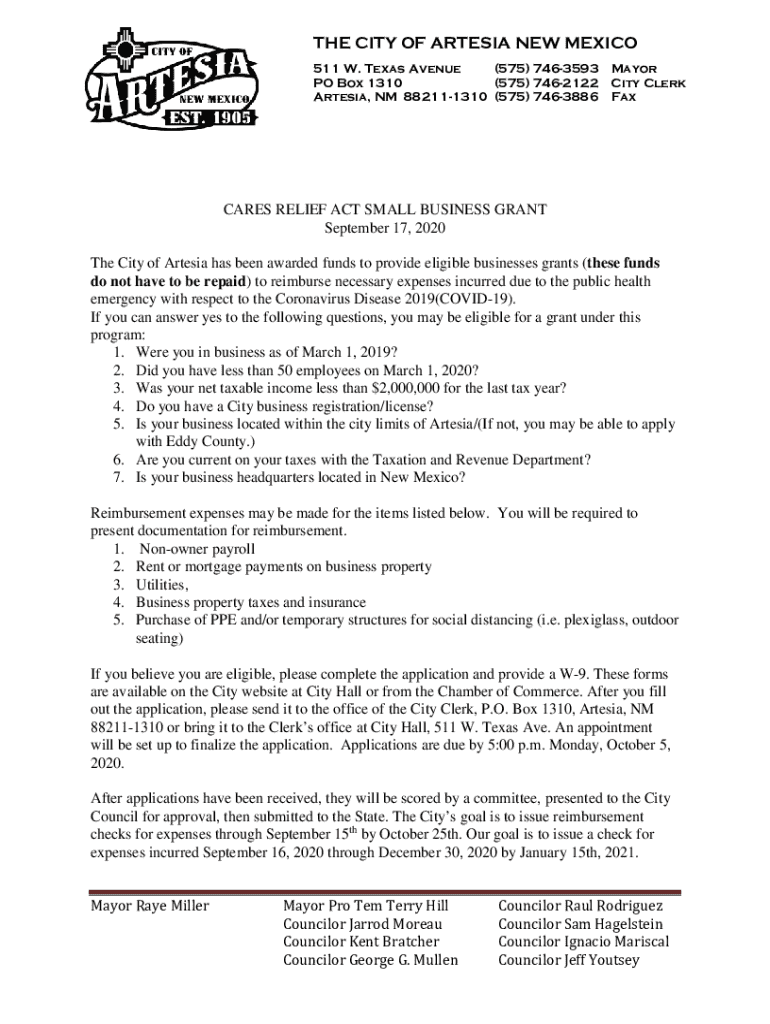

The Coronavirus Aid, Relief, and Economic Security (CARES) Act was enacted on March 27, 2020, in response to the economic fallout from the COVID-19 pandemic. It aimed to provide urgent financial support to individuals, families, and businesses affected by the crisis. The Act allocated over $2 trillion for various relief programs, including direct payments to Americans, expanded unemployment benefits, and funding for small businesses.

Among its many provisions, the CARES Act introduced critical financial assistance for small businesses through programs like the Paycheck Protection Program (PPP) and the Economic Injury Disaster Loan (EIDL). These programs were designed to help retain employees and cover essential operational costs during the pandemic's peak.

Small forms play a pivotal role in accessing these benefits, serving as the primary documents needed to apply for loans, grants, and credits. Understanding the various small forms under the CARES Act is essential for those seeking financial relief.

Types of small forms under the CARES Act

The CARES Act encompasses several small forms designed to streamline the process for obtaining financial assistance. Here’s a breakdown of key forms:

When selecting a small form to complete, consider your specific financial situation, whether you’re applying for a loan or a tax relief program, and ensure that you have all necessary documentation ready before filling out the forms.

How to fill out the CARES Act small form

Filling out the CARES Act small forms accurately is crucial to avoid delays in processing your application. Here’s a step-by-step guide to help you through the process:

Double-check all information for completeness and accuracy. Common mistakes include misspellings, incorrect numbers, and missing signatures. Taking the time to review your form thoroughly can save you significant time and stress.

Using pdfFiller for CARES Act form management

Managing your CARES Act small forms can be simplified using pdfFiller. This cloud-based platform offers numerous benefits that streamline the form creation and management process.

To use pdfFiller, simply upload your small form, fill it out online, and utilize the eSigning feature to sign electronically. Sharing your completed form with relevant parties is also straightforward through the platform.

Navigating the submission process

Successfully submitting your completed CARES Act small form is critical for ensuring you receive the relief you need. Here’s how to navigate this process effectively:

After submission, be aware of the expected timelines for processing. Processing times can vary widely, so it’s essential to track the status of your application, noting any communications from the respective agency.

Common FAQs relating to CARES Act small forms

Many individuals have questions regarding the CARES Act small forms. Here are some common inquiries:

Key considerations after form submission

Once your CARES Act small form is submitted, it's crucial to stay proactive. Continue to monitor any updates from the relevant government agencies about your application status. Being informed can help you quickly respond to any requests for additional information.

Additionally, understanding your rights and responsibilities as a recipient of CARES benefits is essential. Remember that these benefits may have future implications on your taxes. Consult with a tax professional to navigate potential impacts.

Conclusion on CARES Relief Act small forms

Navigating the world of CARES Relief Act small forms doesn't have to be overwhelming. Understanding the importance of accurate form completion cannot be understated, as it plays a vital role in accessing the financial relief to which you may be entitled. Utilizing resources, especially tools like pdfFiller, can enhance your experience with form management. Remember, if you feel lost, don’t hesitate to seek assistance to ensure you make the most of the CARES Act benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get cares relief act small?

How do I execute cares relief act small online?

How can I fill out cares relief act small on an iOS device?

What is cares relief act small?

Who is required to file cares relief act small?

How to fill out cares relief act small?

What is the purpose of cares relief act small?

What information must be reported on cares relief act small?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.