Get the free About Form 7004, Application for Automatic Extension ...

Get, Create, Make and Sign about form 7004 application

How to edit about form 7004 application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out about form 7004 application

How to fill out about form 7004 application

Who needs about form 7004 application?

About Form 7004 Application Form: A Comprehensive Guide

Understanding Form 7004

Form 7004 is an application used by businesses to request an automatic extension of time to file specific business income tax returns. This application allows companies to extend their filing deadline without the need for elaborate justifications, making it a streamlined option for businesses that may need more time.

The importance of Form 7004 cannot be overstated as it grants essential leeway to businesses dealing with complex financial situations. Filing this form ensures that businesses do not rush their tax filings, which can lead to mistakes and potential financial repercussions.

Reasons for filing Form 7004

Filing Form 7004 offers several key benefits that are essential for any business. One primary reason for utilizing this form is to secure a filing extension. For businesses facing unexpected delays in their financial processes, having extra time to compile and verify data is invaluable.

Additionally, filing Form 7004 helps businesses avoid late filing penalties, which can accumulate quickly and lead to financial strain. The IRS imposes penalties for late returns, which can diminish a business's bottom line significantly.

Finally, an extension can aid in tax planning. Businesses often utilize this time for strategic financial assessments, ensuring they maximize deductions and credits based on accurate and thorough accounting practices.

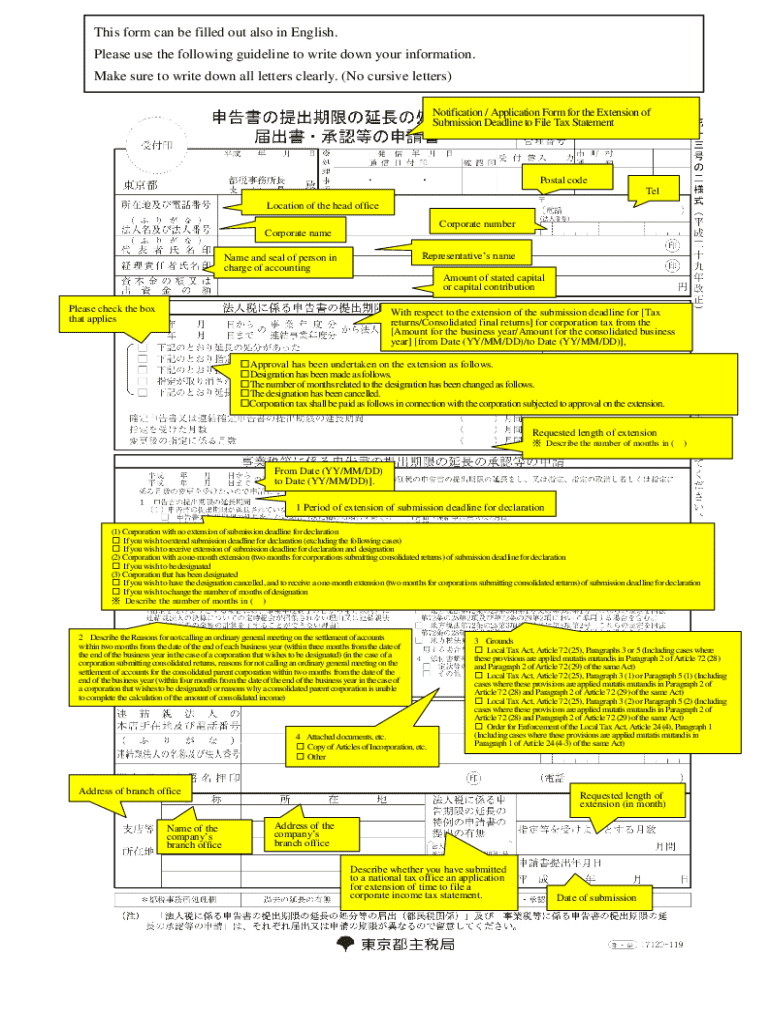

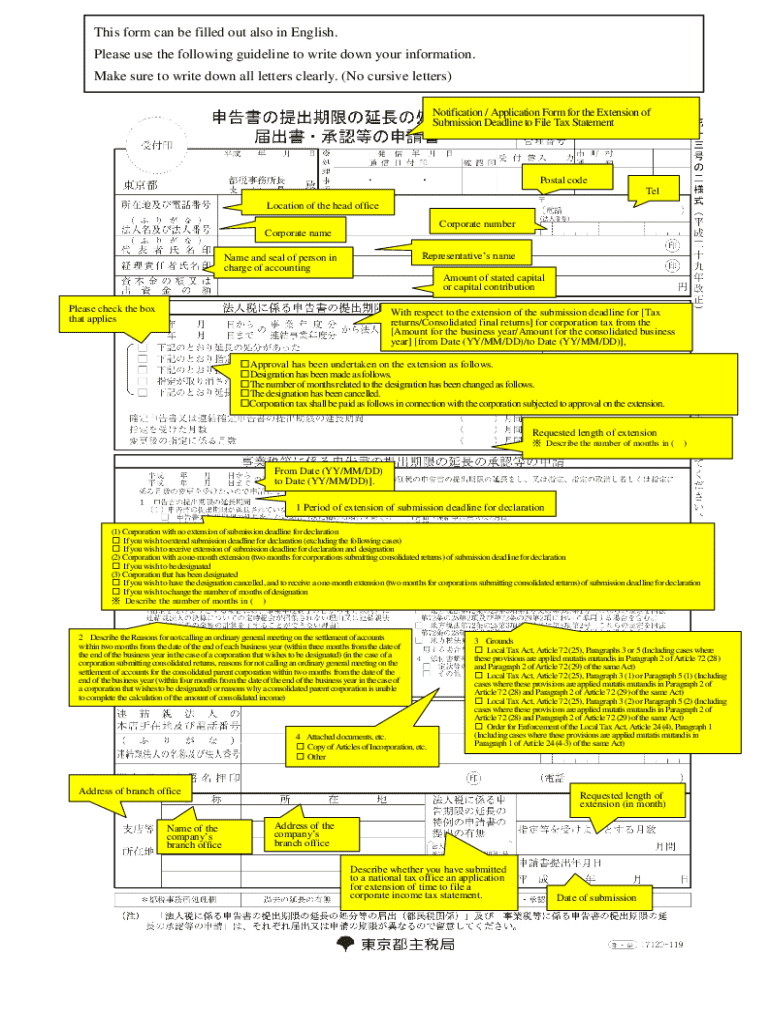

Detailed breakdown of Form 7004

Understanding the structure of Form 7004 is pivotal. The form comprises several parts, each tailored to gather specific information regarding the business entity and the nature of the filing. Part I requires filers to indicate the type of entity submitting the form, while Part II provides detailed instructions for completing various sections.

One common mistake in this section is failing to accurately identify the type of entity, which can lead to further complications in the filing process. If you select the wrong entity type, it could potentially void the extension request.

How to complete Form 7004

Completing Form 7004 can be straightforward if you approach it methodically. Start by gathering all required information. This usually includes financial data, business classification, and prior tax information. Having these documents handy streamlines the overall process and reduces errors.

Next, you will want to fill out the form carefully. Each section guides you in providing essential information accurately. After completing the form, a thorough review is essential. Many errors occur during submission simply because the form was not double-checked.

Filing process for Form 7004

Businesses have different submission options for Form 7004. Electronic filing has become increasingly popular due to its convenience and immediate confirmation of receipt. Electronic methods often reduce processing times and improve accessibility for businesses needing to file quickly.

For businesses opting for mail submissions, it is crucial to send the form to the appropriate IRS address and ensure it is correctly addressed. For those who wish to confirm that their form has been received, keeping track of delivery with tracking services can be beneficial.

Duration of filing extensions

When a business successfully files Form 7004, it typically grants a six-month extension beyond the original filing deadline. For many entities, this extended timeline can mean the difference between accurate financial reporting and unnecessary rush. It is important to understand your new deadline as it becomes crucial for compliance.

Key deadlines after a successful extension will influence your operational planning. Businesses should incorporate these dates into their accounting schedules, ensuring they don’t miss critical follow-up deadlines.

Implications of late filing

Understanding the penalties for late filing of Form 7004 is essential for business planning. If businesses do not file their extension request on time, they may incur significant penalties that vary based on the length of delay and the type of return being filed.

Long-term consequences can include interest on unpaid taxes, which will accumulate over time and can affect a business's cash flow. Ensuring timely submissions is crucial to maintaining financial stability and tax compliance.

FAQs about Form 7004

Many filers have questions when dealing with Form 7004. A frequently asked question is whether this form can be filed multiple times in a single tax year. The answer is yes; however, it should be done correctly to avoid issues with the IRS.

Another common inquiry centers around business structure changes after an extension request. If your business structure changes, it is advisable to consult with a tax professional to determine the best course of action regarding your extension and potential re-filing.

Comparative assessment

When assessing whether to use Form 7004 or other tax extension forms, it's crucial to understand the distinctions between them. Other forms may not offer the same convenience or automatically extend your deadline without justification. The streamlined nature of Form 7004 makes it an excellent choice for many types of businesses.

For example, while individual filers may use Form 4868, business owners will find Form 7004 tailored to their needs, thus simplifying the extension process considerably.

Interactive tools and resources

Utilizing digital tools can significantly enhance your experience with Form 7004. pdfFiller offers an intuitive platform where users can edit Form 7004 digitally, making the correction and completion process much more efficient. The ability to sign and share documents securely within the platform allows for seamless collaboration.

In addition to Form 7004, pdfFiller provides other templates for IRS-related forms, ensuring businesses have all necessary documents at their fingertips.

Insights from experts

Real-world insights can be beneficial, provided by professionals who have guided businesses through the filing of Form 7004. Articles and publications from tax advisors often emphasize the significance of being proactive with budget planning and financial tracking to avoid last-minute rushes and errors.

Many business owners report that timely use of Form 7004 has significantly improved their tax planning processes, providing much-needed time to assess their financial landscapes accurately.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send about form 7004 application for eSignature?

How can I get about form 7004 application?

How do I fill out the about form 7004 application form on my smartphone?

What is about form 7004 application?

Who is required to file about form 7004 application?

How to fill out about form 7004 application?

What is the purpose of about form 7004 application?

What information must be reported on about form 7004 application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.