Get the free Land Charges Act 1972 Fee Panel Form K3

Get, Create, Make and Sign land charges act 1972

How to edit land charges act 1972 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out land charges act 1972

How to fill out land charges act 1972

Who needs land charges act 1972?

Understanding the Land Charges Act 1972 Form: A Comprehensive Guide

Overview of the Land Charges Act 1972

The Land Charges Act 1972 plays a crucial role in the regulation of land transactions in England and Wales. It serves to provide transparency regarding certain financial obligations that may affect a property. The need for a clear legal framework arose due to historical issues in property ownership and transfer, making the act essential for protecting both buyers and sellers in real estate transactions.

Historically, before the introduction of the Act, there was a lack of standardized methods for recording land charges, leading to potential disputes and legal issues. The 1972 Act imposed an obligation on property sellers to disclose any existing charges, ensuring that potential purchasers are well-informed. This legal reform paved the way for secure property transactions, ultimately benefiting the housing market by fostering trust.

Understanding land charges

Land charges refer to specific obligations or claims imposed on a property that may affect its ownership or value. These charges can arise from various sources, including loans secured against the property or legal obligations arising from previous ownership or ongoing agreements. Understanding these charges is crucial for anyone involved in property transactions.

There are two primary types of land charges: financial and non-financial. Financial charges are typically associated with loans or mortgages, where lenders have a claim over the property until the borrowed amount is repaid. Non-financial charges can include easements, restrictions, or covenants that can affect how a property can be used. Knowledge of these charges is essential during buying or selling property to avoid any legal repercussions.

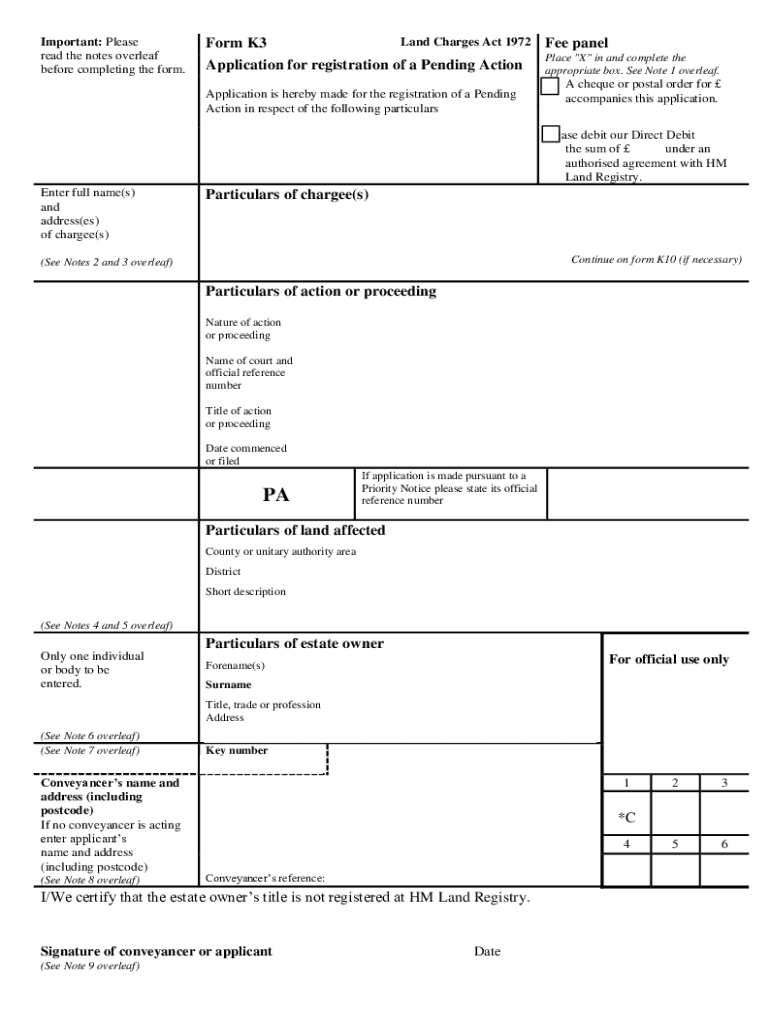

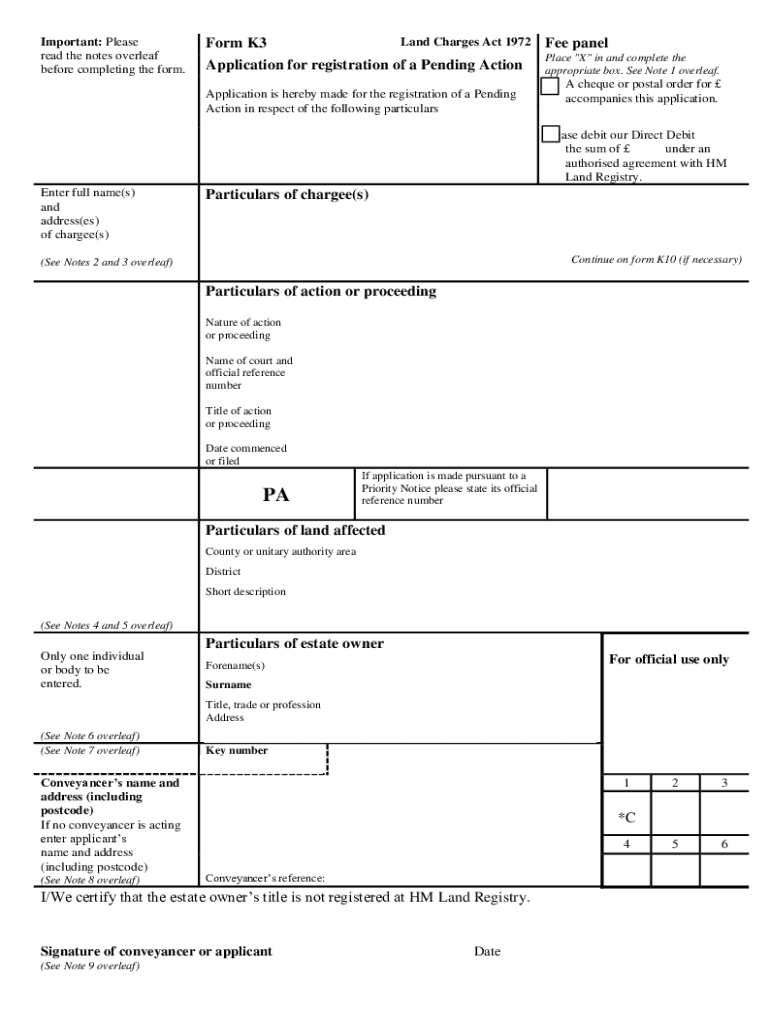

The Land Charges Act 1972 Form: What you need to know

The Land Charges Act 1972 Form is a formal document required to register charges on a property. Its purpose is to ensure that all details concerning the charges on real estate are recorded correctly, creating a public record that can be accessed by potential buyers and other interested parties.

When completing the form, essential information must be provided. This includes personal details of the applicant, relevant property information, and the specific type of land charge being registered. Accurate and thorough completion of the form is critical, as any inaccuracies may lead to legal challenges or disputes later on.

Step-by-step guide to completing the Land Charges Act 1972 form

Completing the Land Charges Act 1972 Form can seem daunting, but with careful preparation, it can be straightforward. Before you start, gather all necessary documentation and information to ensure accuracy. This includes any mortgage agreements, title deeds, and personal identification.

Begin the form by filling out Section 1, which includes the applicant's details. It's important to ensure that these are accurate to facilitate easier communication with relevant parties. In Section 2, provide a thorough description of the property, including any distinguishing features that might be applicable to the charge. Then, move on to specify the type of charge in Section 3, detailing any financial obligations or additional restrictions. Finally, check Section 4 for any additional requirements that may apply in your specific case.

Common mistakes include leaving sections incomplete, providing incorrect personal or property data, and failing to attach necessary supporting documents. It's advisable to cross-check the entire application before submission.

Editing and managing your Land Charges Form

In today's digital age, being able to edit and manage documents effectively is paramount. pdfFiller provides users with the tools to modify the Land Charges Act 1972 Form easily. Using pdfFiller, users can access a user-friendly interface that enables quick edits, ensuring that any updates to the form are seamless.

Additionally, collaboration among team members can be greatly enhanced. Users can share the document via secure links, allowing for real-time editing and input. Moreover, documents can be saved in the cloud, which facilitates organization and retrieval whenever necessary, thus offering a convenient solution for managing legal documents.

eSigning your Land Charges Act 1972 Form

eSigning is rapidly becoming the preferred method for signing documents due to its security and efficiency. The Land Charges Act 1972 Form can be electronically signed using pdfFiller, providing a convenient solution without the need for printing or physical signing.

To eSign your document via pdfFiller, simply upload the completed form, click on the eSign option, and follow the prompts to add your signature electronically. This method not only saves time but also ensures that your documents are securely signed and stored. Importantly, eSigned documents are legally valid and recognized in courts, providing users with confidence in their legally binding agreements.

FAQs about the Land Charges Act 1972 Form

Many users have questions regarding the Land Charges Act 1972 Form, which ranges from its submission process to the consequences of mismanagement. Common queries revolve around how to correctly fill out the form and what steps to take if issues arise during submission. Having access to clear answers helps users navigate the complexities of land registration.

If you encounter issues with the form, contacting the land registry or legal advisors specializing in property law can clarify misunderstandings. Answers to frequent questions can often be found on pdfFiller's support pages, where examples and interactive guides are available.

Legal implications of not submitting the form

Failing to submit the Land Charges Act 1972 Form can lead to serious legal ramifications. Non-compliance can result in unenforceable charges, leaving property owners vulnerable to disputes. Additionally, potential buyers may back out of transactions if they have concerns about undisclosed charges.

Long-term consequences for property owners include financial liabilities, loss of property value, and complications in future transactions. Timely registration is necessary not only for protecting rights but also for maintaining the integrity of property dealings. Understanding these implications underscores the necessity of being vigilant regarding land charge registrations.

Additional tools and resources on pdfFiller

pdfFiller provides an array of tools designed to support users in managing legal documents effectively. Interactive tools are available for calculating the implications of land charges, giving users insights into how different charges may affect property values and transactions. Additionally, various templates and guided assistance are offered for related forms, simplifying the completion process.

For those who might require more hands-on help, pdfFiller’s 24/7 support features ensure that users can get assistance whenever needed. This comprehensive suite of tools is designed to streamline the document creation process and enhance user experience.

Why choose pdfFiller for your document needs

pdfFiller stands out as a robust solution for document creation and management. Users benefit from a comprehensive cloud-based platform that allows seamless editing of PDFs, eSigning, and collaboration on documents. The accessibility of pdfFiller enables users to manage their forms from any device, streamlining processes for individuals and teams alike.

Positive user testimonials highlight how pdfFiller has successfully aided many in navigating complex documentation processes. By choosing pdfFiller, users can leverage the simplicity and efficiency of their services, ensuring that vital documents, such as the Land Charges Act 1972 Form, are handled professionally and effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send land charges act 1972 for eSignature?

Can I create an electronic signature for signing my land charges act 1972 in Gmail?

How can I edit land charges act 1972 on a smartphone?

What is land charges act 1972?

Who is required to file land charges act 1972?

How to fill out land charges act 1972?

What is the purpose of land charges act 1972?

What information must be reported on land charges act 1972?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.