Get the free 2018 PACKAGE X - DC Office of Tax and Revenue

Get, Create, Make and Sign 2018 package x

How to edit 2018 package x online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2018 package x

How to fill out 2018 package x

Who needs 2018 package x?

2018 Package Form - How-to Guide

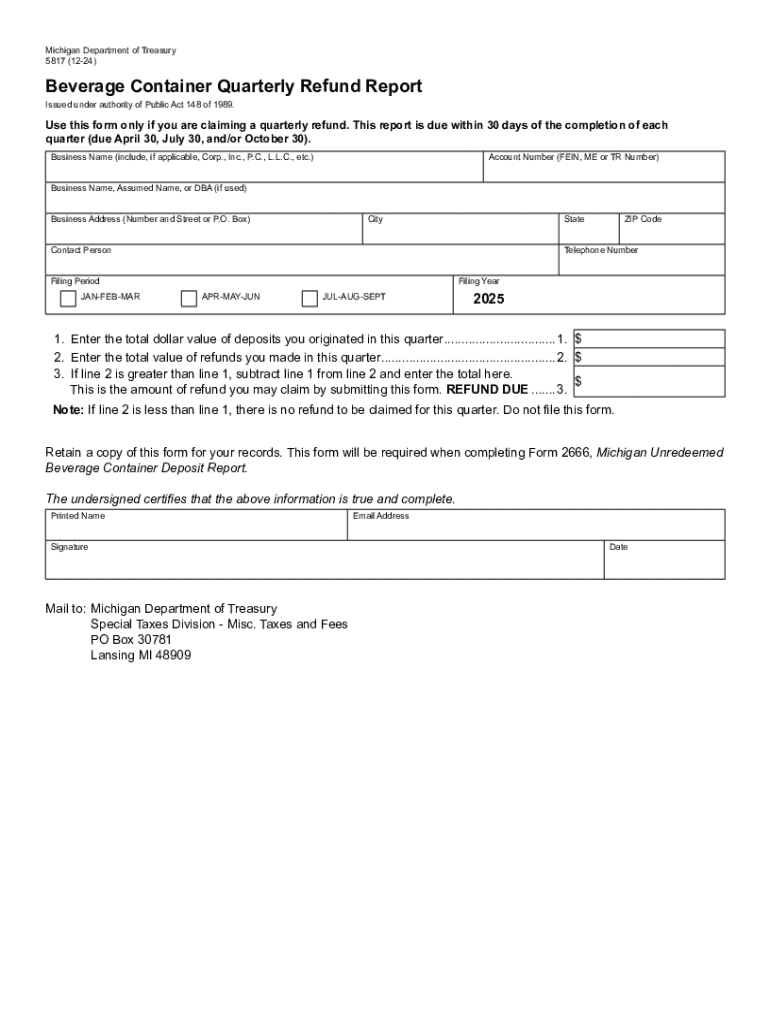

Overview of the 2018 Package Form

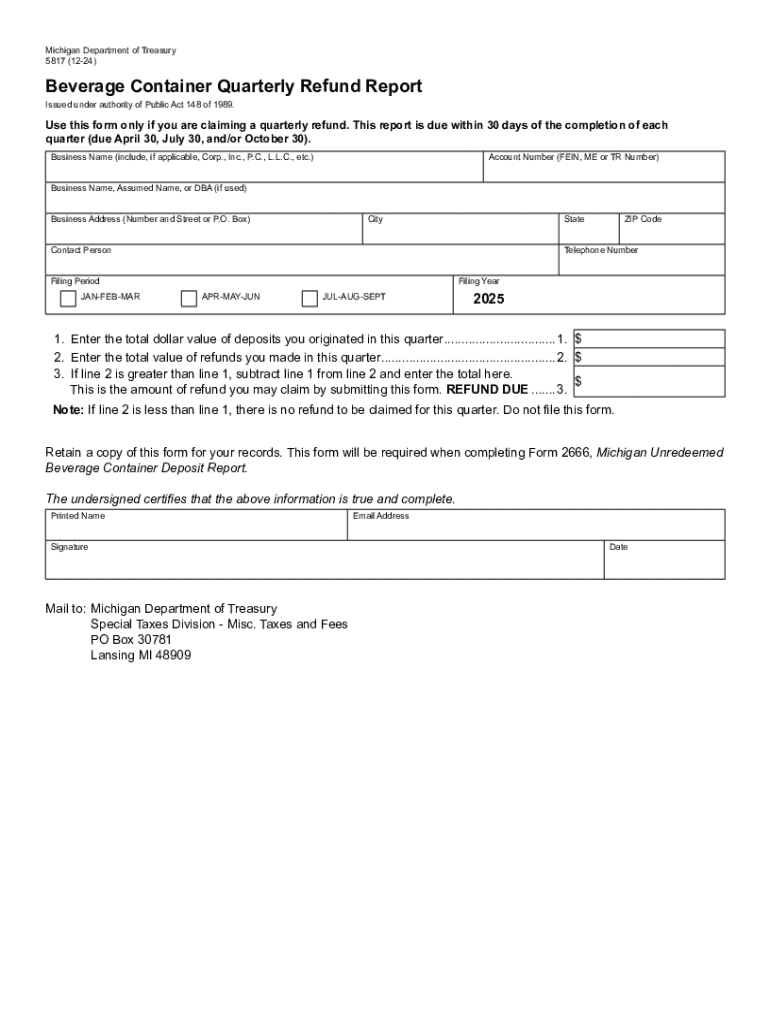

The 2018 Package X Form is a specialized document designed for specific reporting and tax-related submissions. It serves as a crucial tool for both individual taxpayers and teams managing collective submissions. Accurately completing this form is vital, as it directly impacts tax calculations, potential refunds, and compliance with the IRS regulations.

Who should use the 2018 Package Form?

The primary audience for the 2018 Package X Form includes individuals filing their own taxes and teams that manage collective submissions for groups or organizations. Individual taxpayers must understand how to report personal income, deductions, and credits accurately. On the other hand, teams may need to harmonize information across multiple filers to ensure compliance and maximize financial outcomes.

Particularly, freelancers, independent contractors, and small business owners should be aware of the requirements laid out in this form. Understanding the nuances of the 2018 Package X Form can protect individuals from tax penalties and ensure they are taking advantage of all available exemptions.

Key features of the 2018 Package Form

The 2018 Package X Form encompasses several essential sections designed to elicit specific information from the filer. Each section serves a distinct purpose, contributing to the overall tax filing process. Important fields include personal identification details, income sources, applicable deductions, and signature lines.

Step-by-step instructions to complete the 2018 Package Form

Completing the 2018 Package X Form can be efficient if you follow a structured approach. Below are the detailed steps to guide you through the process.

Managing your 2018 Package Form

Once you've completed the 2018 Package X Form, managing and storing it appropriately becomes crucial. pdfFiller offers integrated tools for saving and accessing your documents conveniently. With cloud storage, you can access your form from anywhere, enhancing flexibility and control over your paperwork.

If amendments are required post-submission, pdfFiller allows you to make changes effortlessly using a structured process. Simply open your saved document, make the necessary amendments, and re-submit as per the outlined submission options.

Common issues and solutions

During the process of completing and submitting the 2018 Package X Form, users may encounter several common issues. Addressing these promptly can ensure a smoother filing experience.

FAQ sections can often provide insight into these concerns, enabling users to troubleshoot effectively.

Related forms and templates

Users who utilize the 2018 Package X Form may benefit from knowledge of other related forms. Commonly used forms often include 1040 and Schedule C for business income reporting. Understanding the distinct requirements of these forms can provide clarity in the overall tax filing landscape.

It's also beneficial to look into differences between the 2018 Package X Form and forms from previous years, as updates in tax law can impact completion strategies.

Advanced tools for document management

Leveraging pdfFiller’s advanced tools can further enhance document management for the 2018 Package X Form and other submissions. Collaboration features allow teams to work in tandem on collective submissions, ensuring everyone contributes accurately and timely.

The platform also safeguards users’ data with stringent security measures, ensuring that personal and financial information remains confidential and protected.

Helpful tips and best practices

To ensure a successful completion of the 2018 Package X Form, implementing a few proven strategies can be beneficial. Start early to give yourself ample time to gather documents, research any questions, and make necessary corrections. Utilizing pdfFiller’s editing tools can save time on formatting and enhancing the overall presentation of your document.

Find additional resources

For further assistance, consider visiting external sites that specialize in tax advice and form preparation. Additionally, resources specific to your state can provide insight into local regulations and requirements, which can be instrumental in completing the 2018 Package X Form accurately.

Engaging with communities online for shared experiences and tips can provide practical advice on filling out forms effectively.

Feedback and improvement

Feedback from users who navigate the 2018 Package X Form can enhance future iterations and tool functionalities. pdfFiller encourages users to share their experiences and report any issues encountered during the completion process.

Community resources, such as forums or discussion boards, can also facilitate the exchange of tips and solutions among users, creating a supportive environment while tackling tax-related challenges.

Interactive tools

pdfFiller provides several interactive tools, such as an FAQ chatbot that can assist users in real-time with their queries. Additionally, financial calculators related to taxes are available to help you understand potential liabilities and refunds, contributing to a smoother form-filling experience.

Language options

Understanding that users come from diverse backgrounds, pdfFiller offers translation options for the 2018 Package X Form. This commitment to accessibility ensures that valuable tax resources are available to multilingual users, promoting inclusivity in tax filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 2018 package x online?

How do I edit 2018 package x on an Android device?

How do I fill out 2018 package x on an Android device?

What is package x?

Who is required to file package x?

How to fill out package x?

What is the purpose of package x?

What information must be reported on package x?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.