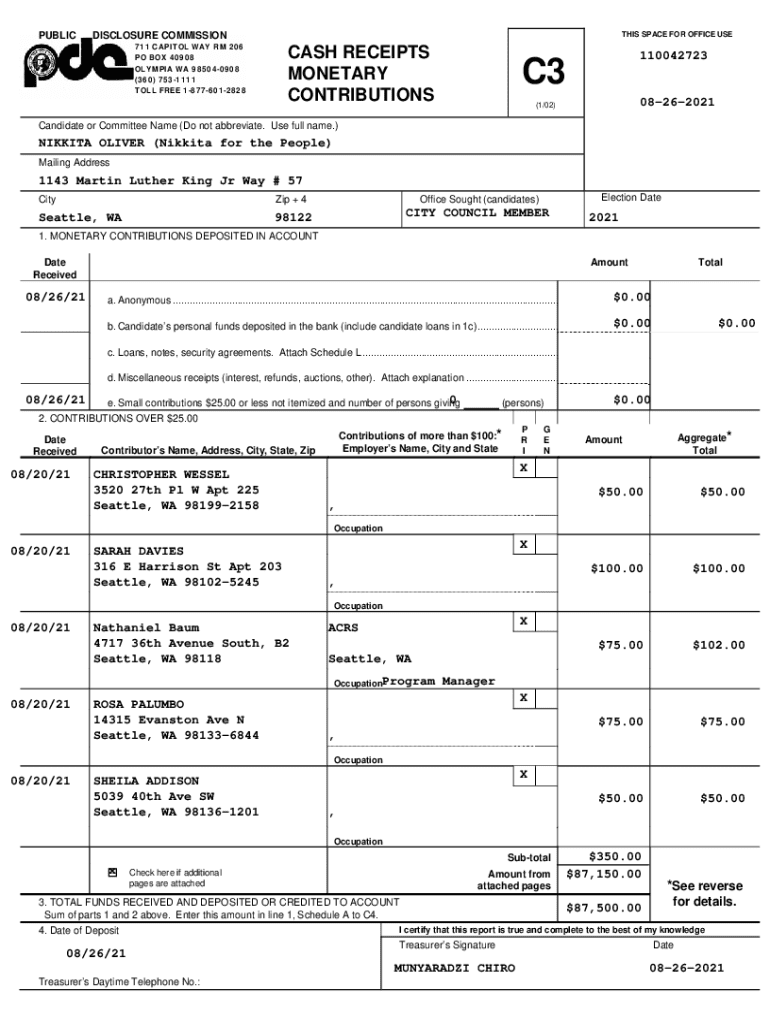

Get the free C3 Cash Receipts Monetary Contributions - web pdc wa

Get, Create, Make and Sign c3 cash receipts monetary

Editing c3 cash receipts monetary online

Uncompromising security for your PDF editing and eSignature needs

How to fill out c3 cash receipts monetary

How to fill out c3 cash receipts monetary

Who needs c3 cash receipts monetary?

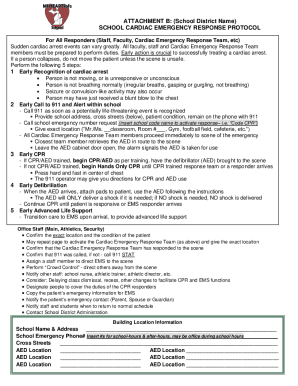

Understanding the C3 Cash Receipts Monetary Form: A Comprehensive Guide

Overview of C3 cash receipts monetary form

The C3 cash receipts monetary form is a standardized document used to officially acknowledge the receipt of funds. Its primary purpose is to provide clear and organized evidence of cash transactions, facilitating better financial management and record-keeping. By using this form, individuals and organizations can accurately track inflows of cash, ensuring that all monetary exchanges are documented suitably for accounting and auditing purposes.

This form holds significant importance in financial tracking and reporting, especially in corporate, nonprofit, and personal finance contexts. For businesses and nonprofits, it serves as a vital tool for maintaining compliance with various legal requirements, ensuring transparency in financial dealings. Common users of the C3 cash receipts monetary form include businesses processing sales or service payments, nonprofits receiving donations, and individuals documenting personal transactions.

Understanding cash receipts

Cash receipts represent any cash inflow for a business or individual, and they play a crucial role in accounting. These receipts serve as proof of transactions and help maintain accurate financial records. They can also substantiate claims of income reported for tax purposes, ensuring compliance with IRS regulations.

The necessity of the C3 form

Utilizing the C3 cash receipts monetary form is essential for legal compliance in various financial contexts. Many jurisdictions necessitate formal documentation of cash transactions, especially in cases of large sums, to prevent issues such as tax evasion or financial mismanagement. Furthermore, situations such as audits, business transactions, or fundraising events underscore the requirement for proper recording through the C3 form, ensuring transparency and accountability.

The benefits of proper cash receipt documentation extend beyond mere compliance. Detailed records help organizations analyze cash flow, manage budgets effectively, and prepare for potential audits. By using the C3 form consistently, individuals and businesses can create a reliable trail of financial activity, making it easier to track and review financial health over time.

How to access the C3 cash receipts monetary form

Accessing the C3 cash receipts monetary form can be done easily online, particularly through pdfFiller. Follow this step-by-step guide to locate and download the form:

pdfFiller also offers interactive tools, including an online editor and mobile access, making it convenient for users to fill out and manage forms from anywhere.

Filling out the C3 cash receipts monetary form

Completing the C3 cash receipts monetary form requires careful attention to each section to ensure accuracy. Here’s how to fill out the form correctly:

Common mistakes to avoid when filling out the form include rushing through sections, forgetting to sign the form, or failing to double-check amounts entered. To ensure accuracy, review the completed form thoroughly before submission and keep copies for your records.

Editing and modifying the C3 form

After completing the C3 cash receipts monetary form, you may find the need to edit or modify certain entries. pdfFiller provides intuitive tools to facilitate this process. To edit the form, simply upload your filled-out document into pdfFiller’s system and choose the editing options available.

These features not only enhance user experience but streamline the modification process, making it easy to manage your documentation effectively.

eSigning the C3 cash receipts monetary form

Applying an electronic signature to your C3 cash receipts monetary form is straightforward using pdfFiller. The eSigning process enhances document security and compliance with legal requirements, eliminating unnecessary paperwork and facilitating quicker transactions.

eSigning strengthens the form’s integrity while also expediting the process of getting necessary approvals or acknowledgments.

Collaborating on the C3 form

Collaboration on the C3 cash receipts monetary form becomes efficient with pdfFiller’s sharing features. Teams working on financial documents can collaborate seamlessly, allowing for real-time editing, feedback, and version control.

This collaborative approach allows for a detailed review and ensures that all contributions are taken into account before finalizing the document.

Managing and storing C3 cash receipts

Effective management of completed C3 cash receipts is paramount for both individuals and organizations. Best practices suggest utilizing a systematic approach to organize these documents to facilitate easy retrieval and review periods.

This organized approach not only streamlines operations but also aids in future reference and audits, bolstering overall financial management.

Analyzing cash receipts data

After gathering data from cash receipts, summarizing and analyzing that information can provide impactful insights into financial health. By tracking cash inflows over time, organizations can identify trends, forecast future earnings, and make informed financial decisions.

This analytical process thus supports strategic planning and enhances financial accountability throughout the organization.

Exploring related topics

Understanding the role of cash receipts connects to broader financial processes such as income tracking and expense management. The C3 cash receipts monetary form is part of a suite of relevant documentation that also includes receipts for expenses and income summaries, playing a critical role in wider accounting practices.

Enhancing internal controls

Implementing effective internal controls when handling cash receipts is essential for preventing fraud and ensuring accurate financial reporting. Establishing procedures regarding cash receipt management can mitigate risks and enhance accountability.

Implementing these strategies builds a strong foundation for financial integrity and operational efficiency.

Frequently asked questions (FAQ)

The following answers to common questions regarding the C3 cash receipts monetary form help guide users in its proper utilization:

These clarifications can ease the process of utilizing the form and enhance user confidence in financial documentation practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the c3 cash receipts monetary in Chrome?

How do I edit c3 cash receipts monetary on an iOS device?

How can I fill out c3 cash receipts monetary on an iOS device?

What is c3 cash receipts monetary?

Who is required to file c3 cash receipts monetary?

How to fill out c3 cash receipts monetary?

What is the purpose of c3 cash receipts monetary?

What information must be reported on c3 cash receipts monetary?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.