Get the free Isa Transfer Authority

Get, Create, Make and Sign isa transfer authority

Editing isa transfer authority online

Uncompromising security for your PDF editing and eSignature needs

How to fill out isa transfer authority

How to fill out isa transfer authority

Who needs isa transfer authority?

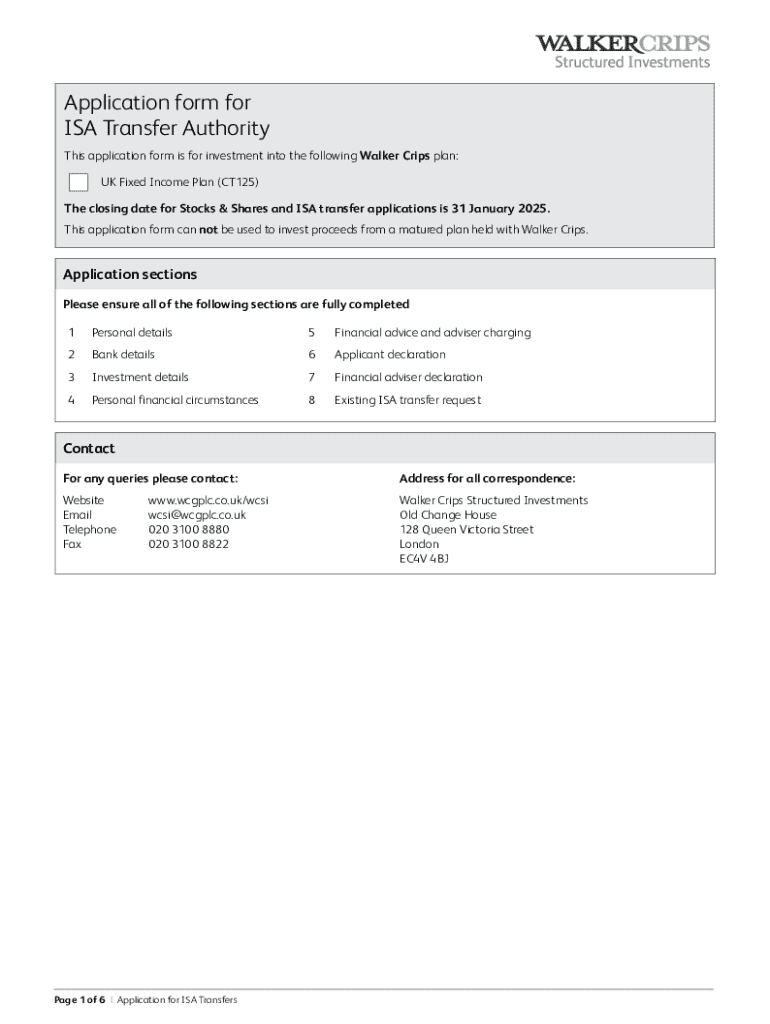

Understanding the ISA Transfer Authority Form

Understanding the ISA transfer authority form

The ISA Transfer Authority Form is an essential document that facilitates the transfer of an Individual Savings Account (ISA) from one provider to another. This form is crucial for investors looking to switch ISAs without losing the tax benefits associated with these savings accounts. By using this form, individuals ensure that their accumulated savings and investments maintain their tax exemption status, which is vital for maximizing long-term returns.

Using the ISA Transfer Authority Form streamlines the entire transfer process, allowing for a seamless transition between providers. It is vital for those seeking a better interest rate, superior account features, or different investment options. Understanding the relevance and procedure of this document can significantly impact the efficiency of managing one's savings.

Breakdown of the ISA Transfer Authority Form

The ISA Transfer Authority Form consists of several key sections that guide the account holder through the information needed to initiate a transfer. A clear understanding of the structure of this form ensures a smooth submission process.

Each section of the form plays a critical role in facilitating the transfer process. Common fields include personal identification details, the current and new ISA provider information, and specific account balance details. These components work together to grant the new provider the necessary authority to manage the transfer.

Steps to complete the ISA transfer authority form

Completing the ISA Transfer Authority Form is crucial for a successful transfer. Here’s a structured approach to effectively filling out the form.

Start by gathering necessary documents, which may include your National Insurance number, current ISA provider information, and access to your existing account. This preparation will facilitate a smoother and faster filling process.

Submitting the ISA transfer authority form

Once the form is completed, the next step is submission. You can submit the ISA Transfer Authority Form to your chosen new provider via several methods, such as online submission, mail, or in-person delivery. It is essential to track your submission to confirm that it has been received and is being processed.

The transfer timeframe varies, but generally, ISA transfers should be completed within 15 business days. After submission, expect communication from both the old and new providers. Awareness of what to expect post-submission can help mitigate any confusion or concerns during the transfer process.

After submitting the ISA transfer authority form: Key considerations

After submitting the ISA Transfer Authority Form, several follow-up actions are vital to monitor the progress of your transfer. Regular communication with both your old and new providers can prevent misunderstandings and ensure that the process is moving forward as planned.

Monitoring your new ISA account is essential during the transfer process. It's common for delays or issues to arise, particularly if documentation is missing or incorrect information is provided. Being proactive can help you resolve potential issues quickly and reduce the stress associated with ISA transfers.

Managing your ISA post-transfer

Post-transfer management of your ISA is crucial for maximizing benefits and returns. This involves setting financial goals and conducting regular reviews of your investment strategy. Utilizing tools for effective tracking can keep you informed and engaged with your investments.

Platforms like pdfFiller can provide excellent resources for managing your ISA documents effectively. Features such as document management and collaboration tools simplify the process, making it easier to adjust investment strategies as financial circumstances change.

Additional tips for a smooth ISA transfer experience

Utilizing pdfFiller's features can significantly enhance your ISA transfer experience. The platform allows users to edit and sign documents seamlessly, ensuring all forms are accurate and compliant.

Moreover, collaboration tools enable teams to work together on document preparation, ensuring that all stakeholders have input into investment strategies. Understanding the support available from pdfFiller can enhance user experience and streamline the management of ISA transfers.

Conclusion on the importance of the ISA transfer authority form

In summary, the ISA Transfer Authority Form is a fundamental component of managing and optimizing your investment strategy. A thorough understanding of this form and its implications can lead to better financial outcomes. By utilizing suitable tools from pdfFiller, you can enhance efficiency and accuracy in document management, ensuring a smoother ISA transfer process.

Encouraging all users to take charge of their financial future, it's clear that efficient document management via pdfFiller not only simplifies the ISA transfer process but also empowers individuals and teams to make informed investment decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send isa transfer authority to be eSigned by others?

How do I complete isa transfer authority online?

How do I edit isa transfer authority straight from my smartphone?

What is isa transfer authority?

Who is required to file isa transfer authority?

How to fill out isa transfer authority?

What is the purpose of isa transfer authority?

What information must be reported on isa transfer authority?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.