Get the free Occupational Tax / Regulatory Fee

Get, Create, Make and Sign occupational tax regulatory fee

Editing occupational tax regulatory fee online

Uncompromising security for your PDF editing and eSignature needs

How to fill out occupational tax regulatory fee

How to fill out occupational tax regulatory fee

Who needs occupational tax regulatory fee?

Occupational Tax Regulatory Fee Form: Your Comprehensive Guide

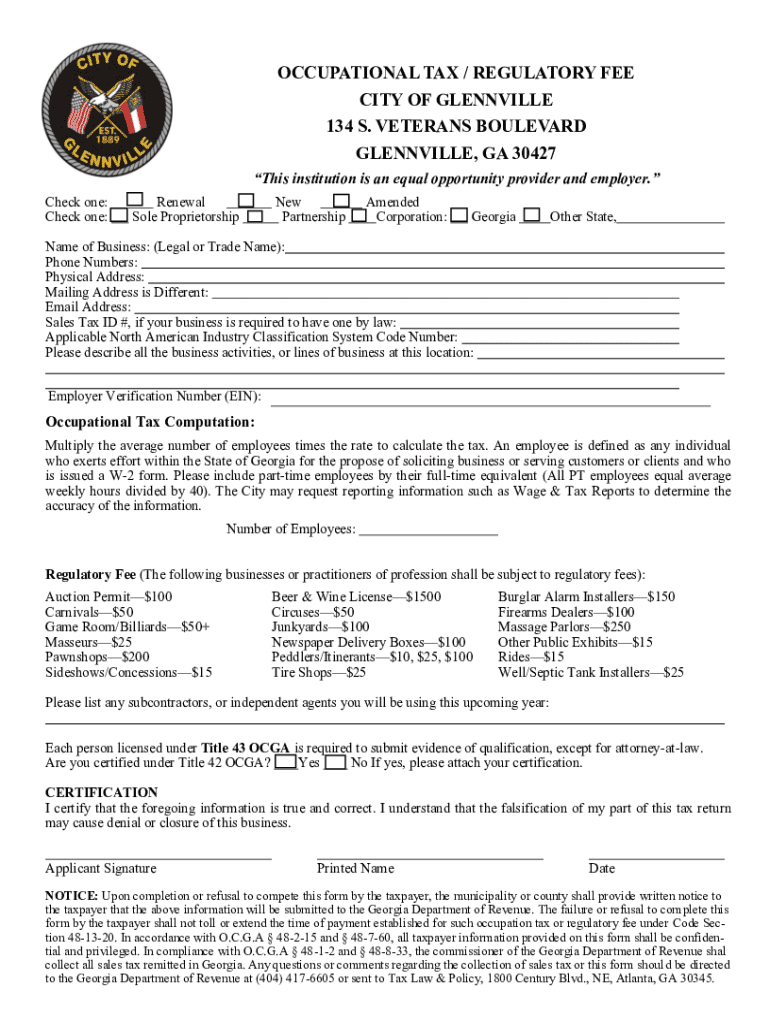

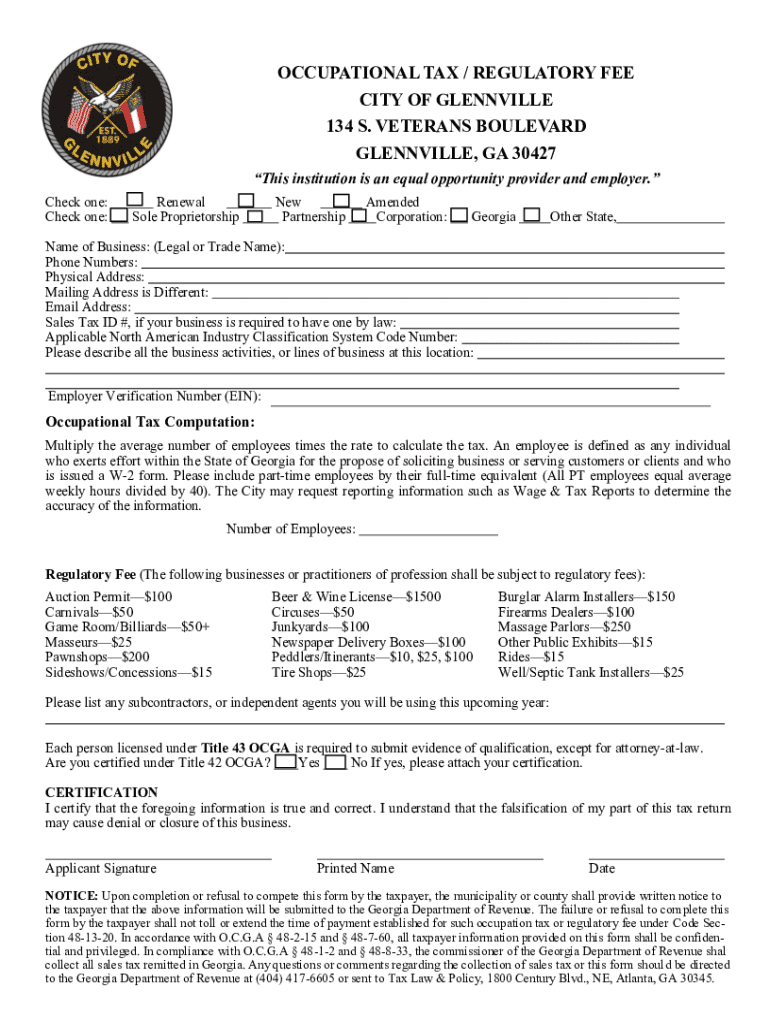

Understanding the occupational tax regulatory fee form

Occupational tax is a levy imposed on individuals or businesses that engage in specific professional activities. This fee exists to fund local services and infrastructure, ensuring that the business environment is conducive to growth and prosperity. Understanding the occupational tax regulatory fee form is essential for compliance, as it determines your tax obligations based on your business operations.

Various groups are required to fill out the occupational tax regulatory fee form, including sole proprietors, corporations, and partnerships. Not only does this form serve as a declaration of your business activities, it also informs local tax authorities of your compliance with relevant regulations.

A common misconception is that employing workers absolves businesses from filling out the form or paying the associated fee. In reality, every entity conducting business within a jurisdiction may be required to comply with these regulations irrespective of their employment structure.

Key components of the occupational tax regulatory fee form

The occupational tax regulatory fee form consists of several key components that must be accurately completed to ensure compliance. A typical form is divided into distinct sections that capture essential information pertinent to business operations.

In addition to filling out the form, you must also submit required documentation to support your claims. This could include income statements, business licenses, and any relevant records that justify your tax calculations.

Step-by-step guide to completing the occupational tax regulatory fee form

Completing the occupational tax regulatory fee form can seem daunting, but following a systematic approach can simplify the process. Here’s a step-by-step guide to ensure you fill it out correctly.

Each region may have its own submission guidelines and deadlines, so be sure to check these specifics to avoid late fees or penalties.

Common mistakes to avoid when filling out the form

Several common mistakes can lead to delays or issues with the local tax authority. Awareness of these pitfalls can help you avoid potential headaches.

Double-checking all entries and consulting with a tax professional can help mitigate these risks.

Utilizing pdfFiller for a seamless form experience

pdfFiller offers a powerful solution for handling the occupational tax regulatory fee form efficiently. By utilizing its user-friendly features, filling out this important document can be effortless.

By leveraging pdfFiller’s capabilities, you can streamline the form-filling process, reducing errors and saving valuable time.

After submission: what to expect

Once you have submitted your occupational tax regulatory fee form, understanding the subsequent processes is crucial. You can expect a verification procedure during which local authorities will review your submission.

The timeframe for verification may vary, but you should be prepared to wait several weeks. During this period, keep an eye out for notifications or correspondences regarding any needed clarifications or additional documentation.

If discrepancies arise, being aware of the appeal processes can ensure you manage unexpected issues efficiently.

Frequently asked questions

Having clarity on common queries surrounding occupational tax can greatly assist in the completion of the regulatory fee form. Here are some frequently asked questions.

Accessing support

Navigating tax regulations can be complex, but support is available to assist you. Knowing when and how to contact local tax authorities can streamline your process.

Fostering connections with both professionals and the community can enhance your understanding of occupational tax requirements.

Related forms and templates

In addition to the occupational tax regulatory fee form, there are other related documents that may be pertinent to your business operations.

Staying organized with your paperwork will not only help you manage your tax obligations but also foster overall business compliance.

Keeping track of changes in occupational tax regulations

Occupational tax regulations can frequently change, making it essential to stay informed on new legislative developments. Understanding the ongoing changes will help you remain compliant and avoid potential penalties.

By utilizing these tools and resources, you are better equipped to navigate the occupational tax landscape effectively.

Advanced tips for maximizing efficiency

For businesses frequently dealing with occupational tax regulations, streamlining your processes is critical. Leveraging advanced features can significantly enhance productivity.

By adopting an organized structure and utilizing available tools, you'll streamline your experience with the occupational tax regulatory fee form, enhancing your business efficiency significantly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit occupational tax regulatory fee online?

How do I edit occupational tax regulatory fee in Chrome?

Can I edit occupational tax regulatory fee on an Android device?

What is occupational tax regulatory fee?

Who is required to file occupational tax regulatory fee?

How to fill out occupational tax regulatory fee?

What is the purpose of occupational tax regulatory fee?

What information must be reported on occupational tax regulatory fee?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.