Get the free Volunteer Income Tax Assistance - Vita

Get, Create, Make and Sign volunteer income tax assistance

Editing volunteer income tax assistance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out volunteer income tax assistance

How to fill out volunteer income tax assistance

Who needs volunteer income tax assistance?

Your Complete Guide to the Volunteer Income Tax Assistance Form

Understanding the Volunteer Income Tax Assistance (VITA) Program

The Volunteer Income Tax Assistance (VITA) program is a vital resource designed to support individuals with limited income in preparing their taxes. Operated nationwide by the IRS, VITA volunteers are trained to offer free tax help, ensuring that individuals who may struggle with tax regulations and paperwork can access the aid they need. This program caters specifically to individuals who meet certain income thresholds, seniors, persons with disabilities, and those who speak limited English, making it a cornerstone of financial accessibility in many communities.

VITA plays an essential role in fostering economic well-being by offering complimentary services that can lead to significant tax refunds, such as the Earned Income Tax Credit (EITC). By connecting people with tax assistance, VITA not only alleviates financial burdens but also promotes financial literacy and provides a pathway for people to build their financial futures.

Preparing for Your VITA Appointment

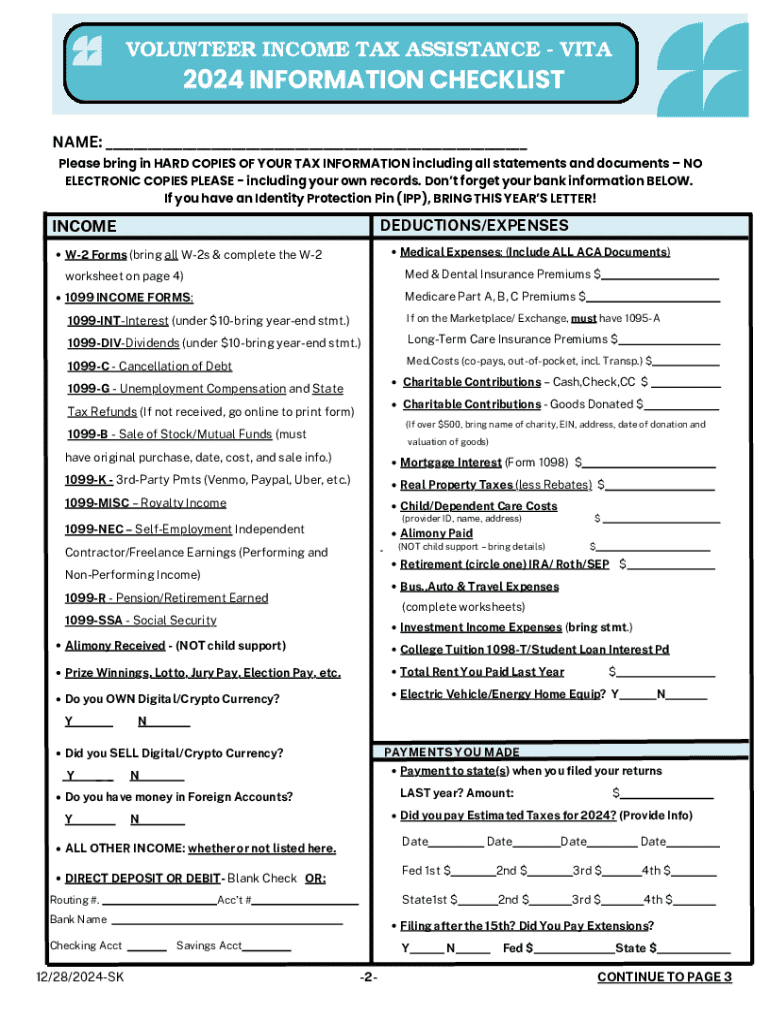

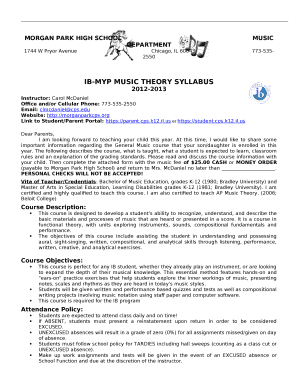

Preparation is key to making your VITA appointment as efficient and effective as possible. Before you head to your appointment, gather essential documents that will help the volunteers accurately prepare your tax return. These documents typically include identification such as Social Security cards, tax forms like W-2s and 1099s, and bank information for setting up direct deposit for your refund. Having all necessary information at hand will streamline the process.

Creating a checklist can help ensure you don’t miss any crucial paperwork. Additionally, familiarize yourself with common deductions and credits for which you may qualify, such as the EITC and the Child Tax Credit. This will help maximize your tax refund.

Navigating the Volunteer Income Tax Assistance Process

Finding a VITA location near you is straightforward. You can search using your ZIP code on the IRS website or contact local community organizations that participate in the VITA program. Many libraries, community centers, and nonprofit organizations host VITA sites, making these services accessible to a wide audience.

Understanding what to expect during your appointment can significantly reduce anxiety. Generally, the appointment lasts about an hour, depending on the complexity of your tax situation. Expect to discuss your financial situation with the volunteer, who will ask pertinent questions to gather the necessary information for filing your taxes. Be prepared for potential wait times, particularly during peak tax season.

Filling Out the Volunteer Income Tax Assistance Form

The primary form filled out during a VITA appointment is the Volunteer Income Tax Assistance form. This form requires specific personal information, including your name, address, Social Security number, and income details. Accurate completion of this form is crucial to ensure that your tax return is processed correctly and that no deductions are missed.

Common mistakes to avoid include misreporting income, which can lead to significant issues with the IRS, and overlooking deductions and credits that you qualify for. By paying close attention to the details and double-checking your entries, you can reduce the chances of errors.

eSigning and Submitting Your Tax Return

Once the VITA form is filled out and verified for accuracy, you are ready to eSign your tax return. Using pdfFiller, the eSigning process is straightforward, making it easy to submit your tax return electronically. Simply upload the filled form to pdfFiller, follow the prompts to eSign, and submit your form directly to the IRS.

Ensuring compliance and accuracy before the final submission is critical. Review all entries carefully, confirming that they reflect your financial reality. Understanding IRS submission protocols helps you avoid any potential pitfalls during the filing process.

Post-Submission Steps and Tracking Your Refund

After submitting your tax return, it's common to wonder when you can expect your refund. The IRS typically processes electronically filed returns within 21 days, though this can vary based on various factors. Being proactive and staying informed about your submission can make this waiting period less stressful.

To track your refund status, visit the IRS website and use their 'Where's My Refund?' tool. This resource allows you to input your details to check the status of your refund. Keeping a close eye on this will give you a clearer understanding of when you can expect monetary relief post-tax season.

Frequently Asked Questions about VITA

Understanding the nuances of VITA services can help alleviate concerns. Many people wonder if there is a cost associated with using VITA. Rest assured that all services provided under the VITA program are completely free of charge. Additionally, while VITA generally focuses on federal tax returns, volunteers can provide guidance for state tax returns, depending on their training and expertise.

For those with unique tax situations, such as self-employment or rental income, VITA volunteers may still offer assistance, but it's best to inquire ahead of time to ensure the volunteers are equipped to help with your specific needs. Common credits and benefits such as the EITC and Child Tax Credit are also eligible for assistance through VITA.

Additional Support and Resources

Connecting with VITA volunteers can prove invaluable beyond the tax filing process itself. If you have questions or concerns after your appointment, don’t hesitate to reach out for follow-up assistance. Many volunteers are eager to help even after the filing process is complete.

Utilizing tools like pdfFiller can significantly enhance your tax management experience. The platform allows users to effortlessly manage tax documents, eSign forms, and collaborate with others on critical documents, all from a cloud-based service that prioritizes accessibility. Features tailored for tax documents ensure that your forms are not only easy to fill out but also securely archived.

Choosing the Right Tax Assistance for You

While the VITA program is a great resource for many individuals, it’s important to know that there are alternatives available. Depending on your unique situation, you may find a paid tax preparer offers specialized services that better meet your needs, particularly if you operate a business or have complex investments. However, many individuals find that utilizing VITA not only saves money but also provides extensive support and resources that are community-centered.

By opting for VITA services, users not only benefit from cost-effective tax preparation but also receive educational support about tax issues, empowering them with knowledge for their financial future. The volunteer-driven nature of VITA strengthens community ties and ensures that financial services become accessible to all.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send volunteer income tax assistance to be eSigned by others?

How do I complete volunteer income tax assistance online?

How do I make edits in volunteer income tax assistance without leaving Chrome?

What is volunteer income tax assistance?

Who is required to file volunteer income tax assistance?

How to fill out volunteer income tax assistance?

What is the purpose of volunteer income tax assistance?

What information must be reported on volunteer income tax assistance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.