Get the free Payroll Prior Pay Period Adjustment Sheet

Get, Create, Make and Sign payroll prior pay period

How to edit payroll prior pay period online

Uncompromising security for your PDF editing and eSignature needs

How to fill out payroll prior pay period

How to fill out payroll prior pay period

Who needs payroll prior pay period?

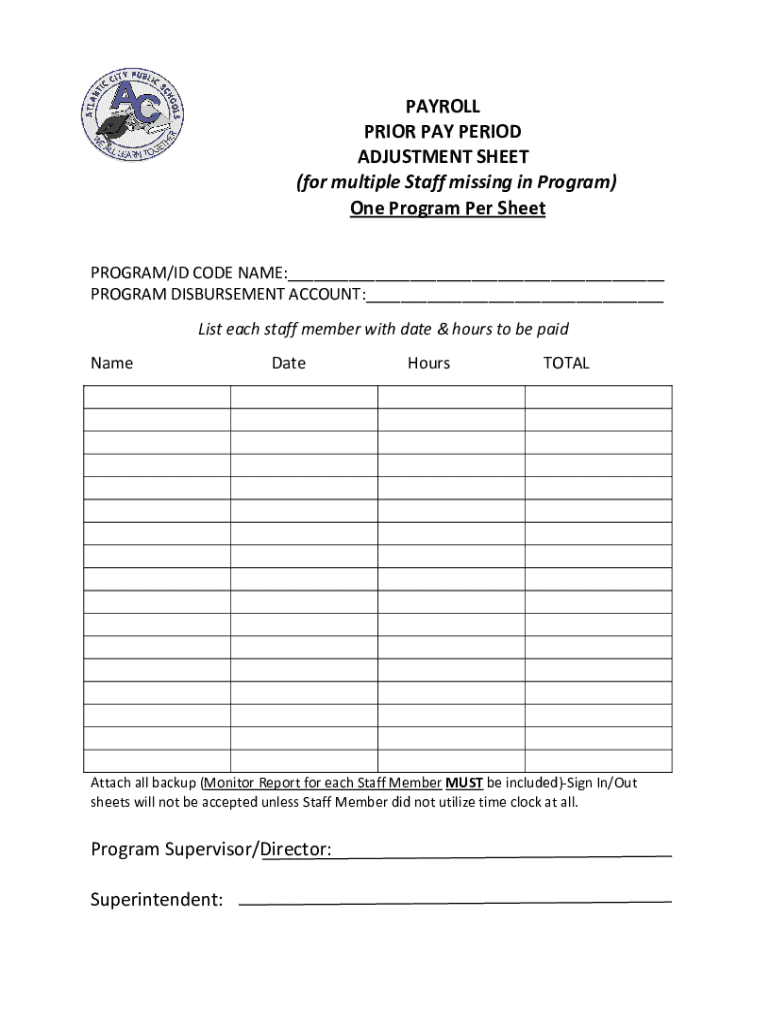

Understanding the Payroll Prior Pay Period Form

Understanding the payroll prior pay period form

The payroll prior pay period form is a crucial document used in payroll processing to ensure that adjustments to an employee's pay are accurately recorded for a pay period that has already been completed. This form is essential for situations where errors or changes in compensation need to be reconciled, ensuring employees receive the correct amount they are owed and maintaining compliance with payroll regulations.

The importance of the payroll prior pay period form extends beyond financial accuracy; it helps maintain employee trust and satisfaction by ensuring that they are compensated fairly for their work. When discrepancies arise, the timely use of this form can prevent confusion and contribute to smoother payroll operations.

Typically, this form is used in scenarios such as retroactive pay adjustments, corrections in hours worked, or situations involving bonuses that need to be allocated to previous pay periods. Understanding when to use this form is critical for payroll coordinators and HR departments.

Key components of the payroll prior pay period form

A comprehensive payroll prior pay period form includes specific sections that gather essential information to process payroll adjustments accurately. The required information typically consists of employee identification details, pay period dates, earnings, and deductions relevant to the adjustment being requested.

Key sections of the form can include gross pay calculations that detail regular earnings, overtime, bonuses, and adjustments specific to deductions such as taxes or benefits. A thorough overview of these components ensures clarity in how each figure was derived and aids in the prevention of future discrepancies.

Step-by-step instructions for completing the form

Completing the payroll prior pay period form requires careful attention to detail and a methodical approach. Prior to starting, it is advisable to gather all necessary documents, including previous pay stubs, time sheets, and any relevant communications regarding pay adjustments.

Once the form is completed, double-check calculations and ensure that all necessary employee signatures are obtained. A thorough review checklist before submission can streamline the approval process and mitigate errors down the line.

Editing and managing the form

Utilizing tools like pdfFiller can significantly enhance the efficiency of managing the payroll prior pay period form. The platform allows users to upload their forms, make necessary adjustments, and save their work securely. This makes it easier to manage multiple versions and ensure that the most current information is always available.

Managing edited forms becomes simpler with cloud storage capabilities, offering version control features that facilitate easy tracking of changes. This approach not only secures data but also enhances collaboration among payroll team members.

Interactive tools for enhancing payroll accuracy

Employing interactive tools can significantly improve the accuracy of payroll computations when using the payroll prior pay period form. For instance, utilizing calculation tools can assist payroll staff in determining gross pay and applying deductions efficiently.

Having templates that cater to different employee types ensures that adjustments reflect their specific compensation structures and reduce errors associated with misclassification.

Common challenges and solutions

Filling out the payroll prior pay period form does come with its challenges. One of the most common issues is missing information, which can lead to delays in processing and employee dissatisfaction. With a high stake in accurate payroll management, addressing these errors proactively is essential.

Troubleshooting tips include having a designated contact person for payroll queries and utilizing support from platforms like pdfFiller. Their resources can guide users through the complexities of payroll documentation, thereby minimizing friction.

Submission and approval process

Understanding the submission and approval process for the payroll prior pay period form is key to ensuring timely adjustments are made. Typically, this workflow involves routing the completed form through a series of approvals before final processing.

Tracking the status of the form and following up with approvers can also help to accelerate the process. Establishing clear communication channels among team members enhances collaboration and reduces processing times.

Insights into specific use cases

The payroll prior pay period form is not just for routine adjustments; it can address various unique circumstances. Adjustments for off-cycle payments, for instance, may require precise documentation to avoid employee dissatisfaction or compliance issues.

By recognizing these specific use cases and preparing accordingly, payroll professionals can enhance their operational efficiency and provide better service to employees.

Finalizing the payroll process

Once the payroll prior pay period form has been submitted and approved, finalizing the payroll process involves confirming that all updates have been accurately processed. This may require cross-referencing against payroll reports to ensure integrity throughout the payroll cycle.

By adhering to strict record-keeping protocols, organizations can ensure audit readiness and compliance with legal mandates surrounding employee compensation.

Benefits of using pdfFiller for payroll management

Integrating pdfFiller into your payroll management workflow simplifies how teams interact with the payroll prior pay period form. The cloud-based platform provides global accessibility, allowing users to complete, edit, and sign documents from anywhere.

Additionally, these features foster communication among both payroll teams and employees, underpinning a smoother payroll process overall and ensuring transparency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my payroll prior pay period in Gmail?

How can I edit payroll prior pay period from Google Drive?

How do I fill out the payroll prior pay period form on my smartphone?

What is payroll prior pay period?

Who is required to file payroll prior pay period?

How to fill out payroll prior pay period?

What is the purpose of payroll prior pay period?

What information must be reported on payroll prior pay period?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.