Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

SEC Form 4: How-to Guide

Understanding SEC Form 4

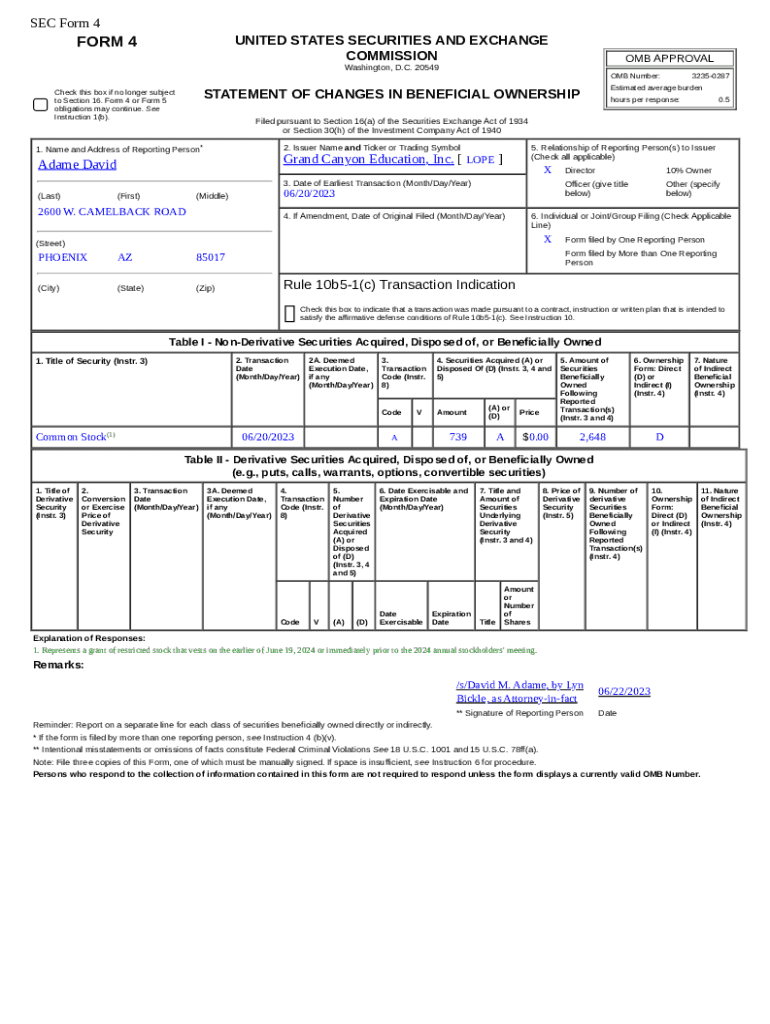

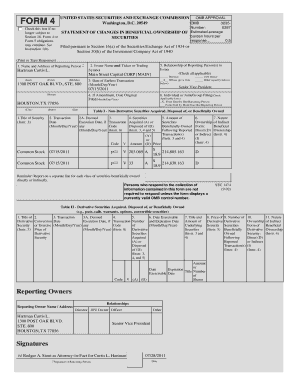

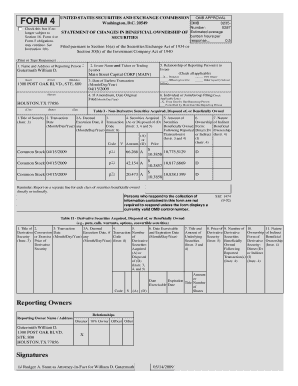

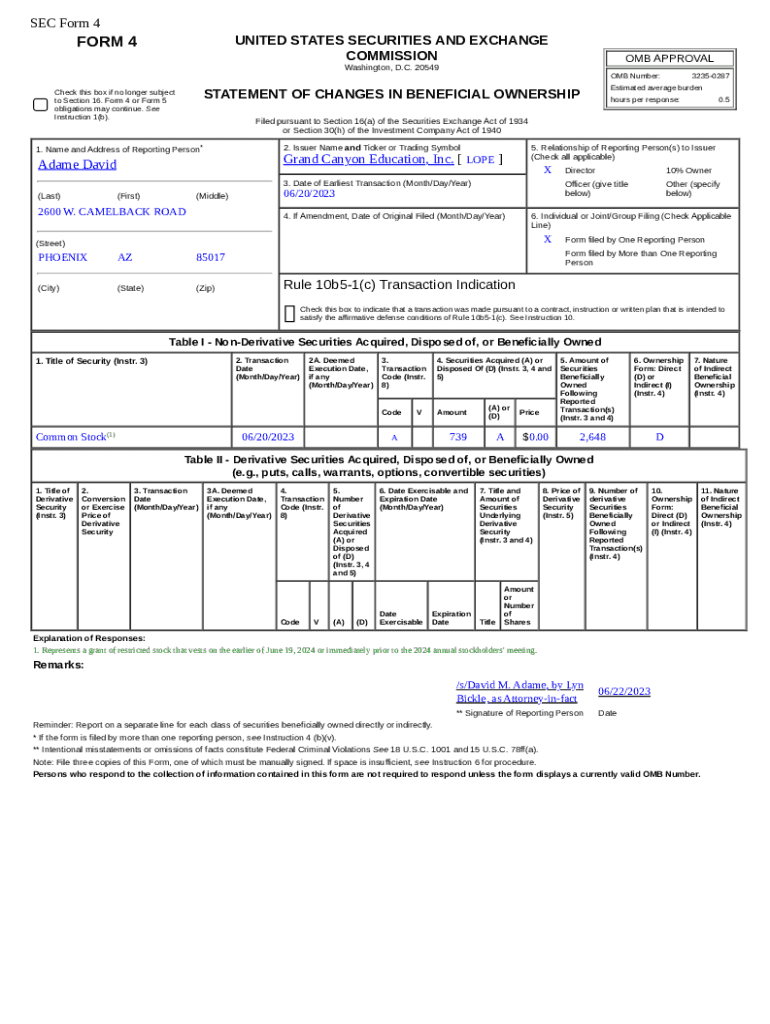

SEC Form 4 is a vital document used to report the buying and selling of securities by corporate insiders. The form is submitted to the U.S. Securities and Exchange Commission (SEC) and is primarily aimed at promoting transparency in the securities market. By requiring insiders to report their transactions, the SEC facilitates scrutiny by investors and other market participants, helping ensure the market operates fairly.

The importance of transparency cannot be overstated; it fosters a level playing field for all investors. When insiders act in their own interest, it can significantly affect stock prices. Thus, disclosures made through SEC Form 4 help to inform the broader market about potential changes in a company's direction, aligning investor expectations.

The importance of SEC Form 4 filings

Filings of SEC Form 4 are critical; they help maintain the integrity of the stock market. Insiders must file this form whenever they buy or sell shares, capturing the transaction details like the date, price, and number of shares. By doing so, insiders fulfill their legal obligation to disclose their equity transactions, which can signal insider confidence or concerns to investors.

Failure to file SEC Form 4 on time can lead to severe consequences, including fines and penalties for the offending insiders. The integrity of the market hinges on this transparency because if information is obscured, it could lead to unfair trading practices and diminished investor confidence.

The Form 4 filing process

Filing SEC Form 4 can seem daunting, but breaking it down into manageable steps can streamline the process. To successfully file, insiders must first gather the necessary information, including transaction details, insider identification, and the company's background.

Once the information is consolidated, insiders can begin filling out the form. Each section of the SEC Form 4 has specific requirements, including the transaction date, the number of shares traded, the nature of ownership, and applicable transaction codes.

Common mistakes during this process include errors in reporting (like incorrect transaction codes) and missing submission deadlines. Insiders should review their filings before submitting to ensure all components are correct.

Transaction codes explained

Transaction codes are fundamental to understanding the nature of insider transactions reported on SEC Form 4. Each code corresponds to a specific action, such as buying, selling, or option expiration—providing essential context for each filing.

Some common transaction codes include 'P' for purchase, 'S' for sale, and 'A' for additional or automatic acquisition. Understanding these codes is crucial for both insiders and investors, as they help communicate the intentions behind the transactions.

Real-world scenarios show the impact of these codes, such as when a high-ranking executive sells off a large percentage of shares, which can signal financial distress to investors. Conversely, a significant purchase may indicate that the executive believes strongly in the company's future.

Analyzing insider trading data

SEC Form 4 filings provide a wealth of information for those looking to analyze insider trades. Understanding how to read and interpret these filings is essential for making informed investment decisions. They essentially serve as barometers for sentiment from those who are most aware of a company's stability.

Traders and analysts often employ various tools and platforms to track insider trading activity. This includes databases that allow for the filtering of transactions based on factors such as transaction size, code type, or date. By analyzing patterns in insider trading, investors can glean insights into the potential direction of stock prices.

Case studies reveal how certain trades have caused stock fluctuations—for instance, a drastic sell-off by insiders often leads to immediate scrutiny and can result in substantial price drops. Conversely, notable purchases generally encourage investors to adopt a bullish stance.

Leveraging technology for transparency

Efficiency in creating and managing SEC Form 4 filings can significantly impact compliance. Tools like pdfFiller facilitate this process by offering features that streamline the document creation, editing, and storage processes.

With pdfFiller, users can edit forms directly in the cloud, integrate electronic signatures, and collaborate in real-time—all of which allows for team members to work seamlessly together, enhancing the accuracy and speed of submissions.

Resources and tools for SEC Form 4 compliance

Ensuring compliance with SEC regulations requires robust tools and resources. Various interactive tools can enhance filing accuracy, allowing for efficient tracking and reporting of insider trading activities.

Financial professionals can benefit from checklists designed to ensure that all necessary components of the filing are included, helping to minimize errors during the submission process. Additionally, there's a wealth of educational resources available that provide insight into best practices in Form 4 compliance.

Best practices for managing SEC Form 4 filings

To facilitate accuracy and compliance, it's essential to establish robust internal protocols surrounding the management of SEC Form 4 filings. All teams must be aware of filing responsibilities and timelines to ensure deadlines are met.

Additionally, conducting regular reviews and updates to the filing protocols will help teams stay current with any regulatory changes enacted by the SEC. Recommended auditing practices can include regular checks of submitted forms against internal records to ensure consistency and accuracy in reporting.

Engaging with experts

Consulting with compliance specialists can provide invaluable advice for navigating the complexities of SEC Form 4 filings. By engaging with professionals, companies can better understand their responsibilities and align their filings with the latest regulatory practices.

Building a network of compliance resources also allows insiders to obtain diverse perspectives on compliance challenges, potentially uncovering pitfalls missed in self-guidance.

Related topics of interest

Exploring other SEC forms like SEC Form 3 and Form 5 offers further insight into insider trading and reporting requirements. These forms relate closely to Form 4, with Form 3 used for initial ownership reports and Form 5 for holding changes that don’t require immediate reporting.

Current trends in insider trading analysis can highlight how trading activities of insiders impact stock performance. Investors should remain vigilant regarding any reported trades, particularly in volatile markets, as these could signify shifts in company operations or strategic directions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find sec form 4?

Can I create an electronic signature for signing my sec form 4 in Gmail?

How do I fill out the sec form 4 form on my smartphone?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.