Get the free 2024 Blair County Tax Collectors

Get, Create, Make and Sign 2024 blair county tax

How to edit 2024 blair county tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 blair county tax

How to fill out 2024 blair county tax

Who needs 2024 blair county tax?

2024 Blair County Tax Form: Comprehensive Guide to Filing and Management

Overview of the 2024 Blair County Tax Form

The 2024 Blair County Tax Form is a crucial document for residents and businesses in Blair County, Pennsylvania, designed to ensure accurate reporting of income and compliance with local taxation laws. Filing accurately not only contributes to community funding but also helps you avoid potential fines and legal complications.

Key deadlines for submitting the 2024 form typically fall on April 15, aligning with federal income tax deadlines. Late submissions can result in penalties, ranging from fines to interest on unpaid taxes.

This year's form introduces several changes compared to 2023, including revised deduction limits and updated income thresholds that reflect recent legislation changes. Understanding these modifications is essential for accurate reporting.

Who needs to file the 2024 Blair County Tax Form?

The requirement to file the 2024 Blair County Tax Form applies to individuals and businesses that generate taxable income within the county. This includes full-time residents, part-time residents, and non-residents earning money in Blair County.

New residents and businesses moving to Blair County should familiarize themselves with local taxation requirements, as they may have different obligations than they encountered in their previous locations.

Key components of the 2024 Blair County Tax Form

The 2024 Blair County Tax Form consists of several key components that taxpayers need to understand to complete the form correctly. Each section is designed to gather specific information critical for tax calculation.

Common mistakes include inaccuracies in personal information that can lead to processing delays and failure to report all income, which could trigger audits.

Step-by-step instructions for completing the 2024 Blair County Tax Form

Filing your 2024 Blair County Tax Form can be a streamlined process if you follow these step-by-step instructions closely. Begin with organizing your paperwork and ensuring you have all necessary documents at hand.

Precision in each step is crucial to prevent issues such as audits or penalties from the tax office.

Utilizing pdfFiller for the 2024 Blair County Tax Form

pdfFiller offers a robust platform that can streamline the process of filing your 2024 Blair County Tax Form. This cloud-based solution enables easy access and enhanced document management, allowing users to work efficiently.

With automatic updates, users are assured they are completing the most current version of the 2024 Blair County Tax Form, which is essential for compliance.

Filing options for the 2024 Blair County Tax Form

Taxpayers have multiple options for submitting the 2024 Blair County Tax Form, catering to different preferences and needs. Whether you prefer submitting online for immediate processing or traditional mail, both methods are available.

For mail submissions, it's crucial to check and verify appropriate mailing addresses to prevent delays.

Managing your tax records post-filing

After submitting your 2024 Blair County Tax Form, maintaining accurate tax records is essential. Keeping a digital copy of your forms ensures you have a backup in case of future audits or inquiries.

By establishing a solid record management system now, you can alleviate future stress.

Frequently asked questions (FAQs) about the 2024 Blair County Tax Form

Most taxpayers have questions when approaching the filing process. Understanding common queries can help demystify the complexities of submitting the 2024 Blair County Tax Form.

Being informed helps you not only in filing but also in understanding your obligations under Pennsylvania tax laws.

Contacting the Blair County Tax Office

For any concerns regarding tax filing, the Blair County Tax Office is your go-to resource for assistance. Knowing how to reach out to them can save time and provide clarity on your tax responsibilities.

Being proactive in reaching out when in doubt can help alleviate issues during tax season.

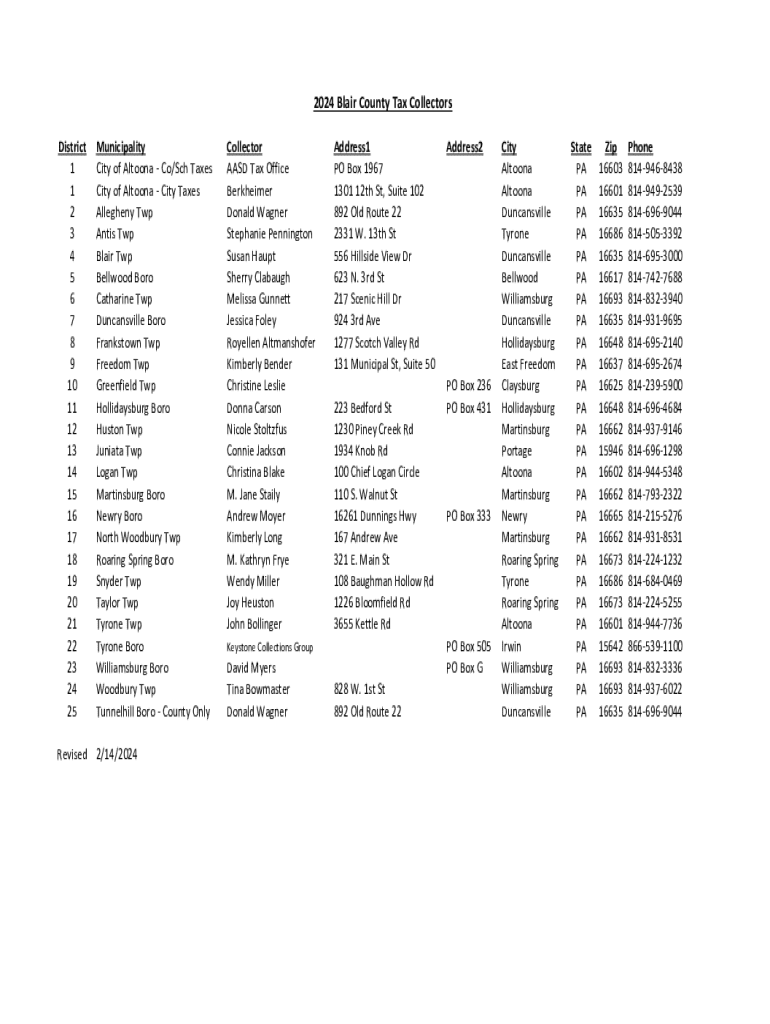

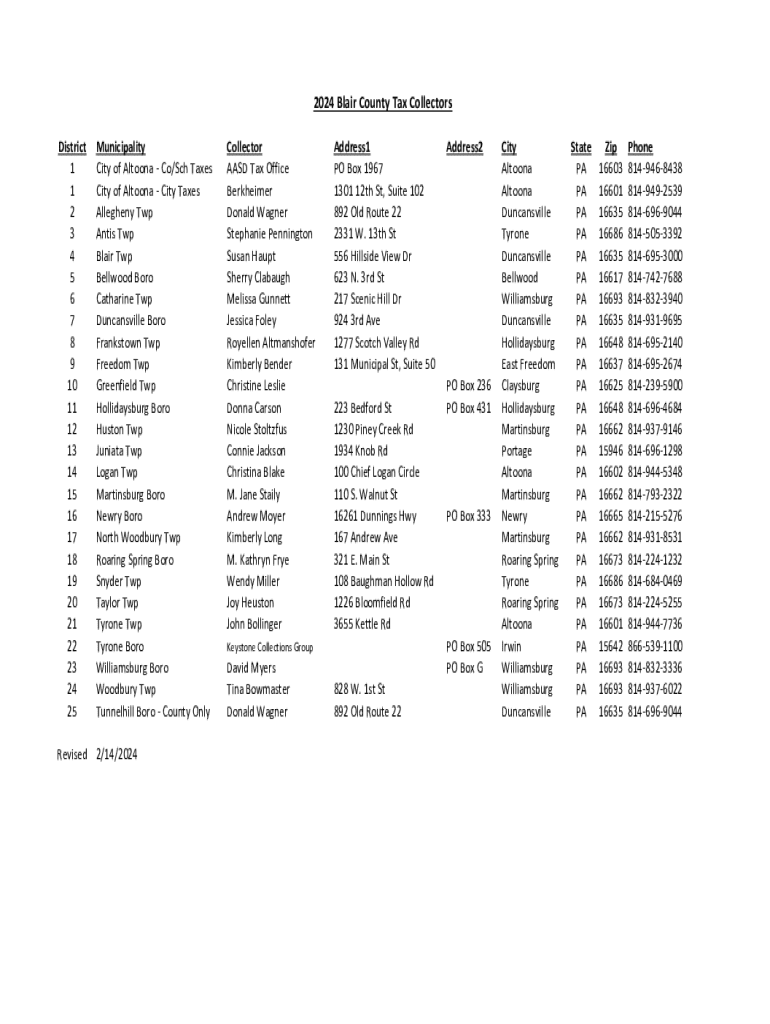

Local tax information and resources

Understanding local tax resources is key for any taxpayer in Blair County. The local income tax collectors play a vital role in facilitating tax collection and providing necessary services.

Knowledge of local tax collection practices can provide taxpayers with vital insights into their financial responsibilities.

Engage with your local tax community

Engaging with the local tax community enhances your understanding of necessary tax procedures. Keeping abreast of local tax news and changes can significantly benefit taxpayers.

Active participation helps cultivate a stronger understanding of tax responsibilities, ultimately reducing anxiety during filing periods.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2024 blair county tax online?

How do I edit 2024 blair county tax in Chrome?

How do I complete 2024 blair county tax on an iOS device?

What is Blair County tax?

Who is required to file Blair County tax?

How to fill out Blair County tax?

What is the purpose of Blair County tax?

What information must be reported on Blair County tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.