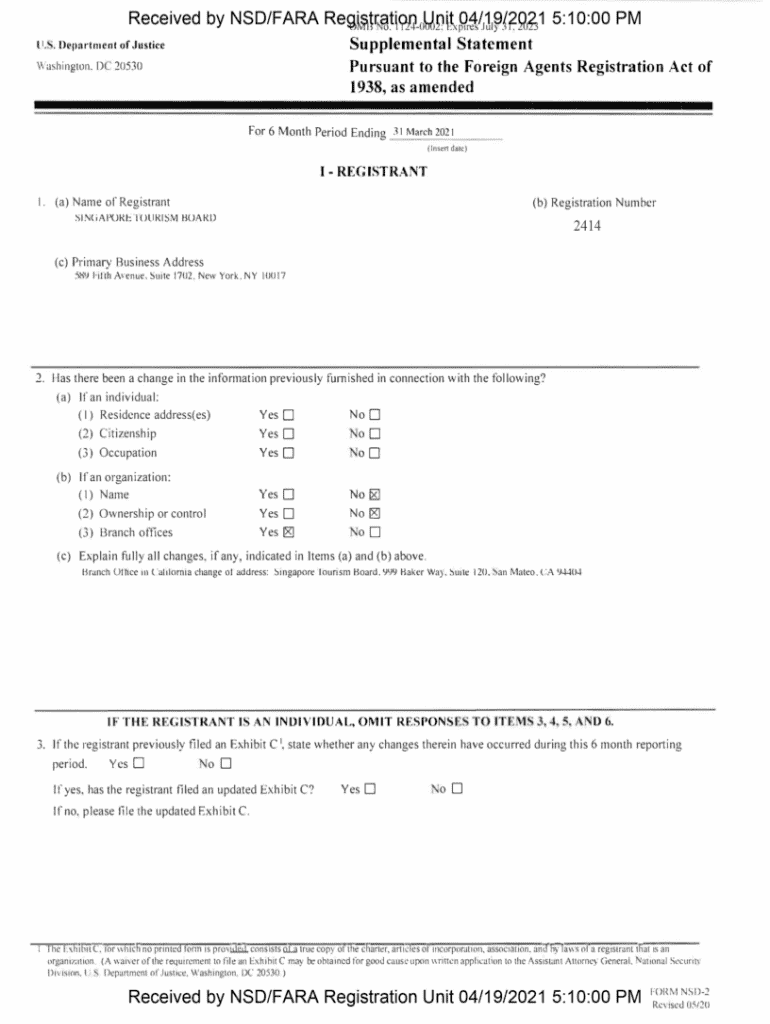

Get the free Supplemental Statement

Get, Create, Make and Sign supplemental statement

How to edit supplemental statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out supplemental statement

How to fill out supplemental statement

Who needs supplemental statement?

A comprehensive guide to the supplemental statement form

Overview of the supplemental statement form

The supplemental statement form serves a critical function in documenting financial information for businesses and individuals alike. This form is pivotal not only for tax purposes but also for maintaining accurate records for prospective stakeholders and management. Completing this form accurately is essential, as it provides a clear picture of income and expenses, crucial for decision-making and compliance with regulatory standards.

Key elements covered in the supplemental statement form include an overview of general information, detailed revenue reporting, documented expenses, defined deductions, and the final calculation of net revenue. Understanding these elements is fundamental for anyone tasked with managing their financial records.

Understanding the form structure

The supplemental statement form is structured to guide users through essential components in a logical sequence. Each section builds upon the previous one, reinforcing clarity and organization.

Detailed breakdown of form sections

The form is composed of several key sections, starting with general information before proceeding to more complex areas such as revenue and expense reporting.

Section 1: General information

In this section, you will be asked to provide basic details about your business or personal filing. Common information includes your name, tax identification number, and the reporting period.

Section 2: Revenue reporting

This section focuses on types of income to report. It can include wages, dividends, or rental income, among others. Ensuring accurate revenue reporting is crucial as it directly impacts the net income figure.

Section 3: Expenses and deductions

Common deductions allowed include business expenses, operating costs, and miscellaneous deductions. Properly documenting these expenses ensures that you maximize your deductions and minimize taxable income.

Section 4: Calculating net revenue

The final section calculates net revenue by subtracting total expenses from total revenue. This section often includes a step-by-step guide to ensure clarity for users and an example calculation to illustrate how these figures come together.

Interactive tools for form completion

pdfFiller offers a suite of interactive features that make completing the supplemental statement form easy and efficient. One can access the form online, allowing for a seamless experience from any location.

Utilizing pdfFiller’s interactive features

The platform provides tools for editing information directly on the form, including text boxes and dropdowns meant for selection. This reduces the likelihood of errors that can occur with handwritten entries. Furthermore, users can utilize e-signature options for quick and secure submission.

Step-by-step guide to filling out the supplemental statement form

Preparation is key when approaching the completion of the supplemental statement form. Begin by gathering all necessary documents, such as financial statements, tax documents, and proof of expenditures.

Detailed instructions for each section of the form

Filling in the revenue details should be done meticulously, ensuring that every potential source of income is reported. Enter expenses and deductions in the designated areas, prioritizing accuracy and thorough documentation.

Common mistakes to avoid

Common errors often include inaccuracies in reporting income and inadvertently omitting necessary documentation. Double-check figures and ensure all necessary backups are attached to avoid delays or rejection.

Submitting the form

Once the supplementary statement form is completed, the next step is submission. Users should decide between online submission via pdfFiller or traditional methods such as mailing in the completed form.

Overview of submission methods

The online submission option is often quicker and provides immediate confirmation of receipt, while traditional submission may require additional time for processing. Regardless of the method chosen, remember to check for errors before submitting to ensure a successful outcome.

It's essential to remain aware of deadlines and filing dates to avoid penalties. Setting reminders and using organizational tools available through pdfFiller can help in staying on track.

Managing your supplemental statement form

After submission, there may be instances where edits or revisions are needed. pdfFiller allows users to easily access and revise submitted forms, ensuring that data remains accurate and up-to-date.

Accessing and storing your form in pdfFiller

The platform also promotes collaboration, enabling team members to work on the document together. This feature helps streamline communication and ensures that everyone involved has the most current information.

Frequently asked questions

Users may encounter several common queries related to the supplemental statement form, particularly concerning mistakes made after submission.

By understanding and utilizing these features, users can maximize the benefits of pdfFiller for their supplemental statement forms.

Specialized considerations

It's important to note that specific requirements may vary depending on the industry. For example, financial firms may face distinct stipulations that affect their supplemental statements.

Case studies: successful completion stories from users

These case studies serve as valuable resources, showcasing how others have effectively completed their forms using pdfFiller, highlighting common best practices and lessons learned in overcoming challenges.

Staying up-to-date

Remaining informed about upcoming filing due dates and changes in regulations is vital for successful compliance. pdfFiller is proactive in providing alerts and notifications regarding any updates that may impact users.

Benefits of using a cloud-based document solution for compliance

Utilizing a cloud-based document management system like pdfFiller enables users to access their forms from anywhere, thus facilitating better organization and up-to-date compliance with current requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send supplemental statement to be eSigned by others?

How do I make changes in supplemental statement?

How do I edit supplemental statement in Chrome?

What is supplemental statement?

Who is required to file supplemental statement?

How to fill out supplemental statement?

What is the purpose of supplemental statement?

What information must be reported on supplemental statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.